Chapter 6. Fostering the digital transformation of the brazilian economy

Digital transformation is reshaping established markets and creating new ones. Successful business models make innovative use of data and data analytics to create value, enhancing the efficiency of production processes, transforming data into new services or establishing entirely new markets (OECD, 2015a). Emerging technologies that enhance the availability and usability of data, including smart sensors and the Internet of Things (IoT), are significantly expanding the scope for data-driven business models (OECD, 2017a). In many cases, data services are integrated into existing products and value chains, creating new economies of scope (OECD, 2019a).

The digital environment has significantly increased transaction efficiency and reduced marginal costs, e.g. close to zero for some digital products, for many firms. New business models, even if small by standard measures, e.g. number of employees, have often been able to scale up quickly and overcome large geographical distances (scale without mass) (OECD, 2019a). These developments can create significant challenges and uncertainties for both firms and policy makers, for example due to regulations that are unfit for new business models.

In Brazil, the transformation of business models and blurring sector boundaries are clearly visible in many areas. Digital start-ups, some valued at over USD 1 billion (unicorns), are threatening to disrupt consolidated markets like transport (e.g. Loggi, 99) or banking (e.g. Nubank, Creditas). Mercado Libre, an Argentinian online marketplace with major stakes in Brazil, recently reported that its payment service Mercado Pago Point in the country by far surpassed its merchant service business in terms of volume. MercadoCredito, the platform’s credit branch, provides sellers with access to finance (MercadoLibre, 2020). The business-to-consumer (B2C) food delivery app iFood has recently increased the scope of products, offering food supplies and market analysis to restaurant owners (B2B) (Natanson, 2019). The Chinese e-commerce giant Alibaba, as Amazon’s AWS, is now offering Alibaba Cloud services to business customers in Brazil (Bnamericas, 2019).

With its E-Digital Strategy, Brazil has developed an encompassing strategy for digital transformation, highlighting some of the core enablers of this transformation as well as providing thematic explorations into the digital transformation of both government and the economy. The strategy acknowledges the changing market environment and puts an emphasis on the emergence of a data-driven economy and new business models, including for agriculture, industry and services.

As discussed in the remainder of this chapter, promising initiatives are already under way in some of these areas. However, an effective response to the overarching challenges mentioned above will require more than sectoral policies. In particular, it will rely on predictable and co-ordinated efforts by several government entities in close co-ordination with the private sector. Policy makers need to focus on rules that are flexible enough to accommodate changing business models and sectoral boundaries. By acknowledging the need for a whole-of-government approach, Brazil’s digital strategy offers a way to tackle some of the challenges that are stifling the digital transformation of the economy.

Precision agriculture and the Internet of Things are key drivers of productivity in agribusiness

Agribusiness is one of the most important sectors of the Brazilian economy, accounting for about 21% of gross domestic product (GDP) in 2018. Besides agricultural activities (5.1%), the sector aggregate encompasses agro-industry (6.3%), agro-services (8.7%) and the input (e.g. fertiliser) producing sector (1%) (CEPEA, 2019a). The sector employs over 18 million people, or close to 20% of total employment, of which almost half (46%) are engaged in agricultural activities, followed by agro-services (32%), agro-industry (21%) and the input-producing sector (1%) (CEPEA, 2019b).

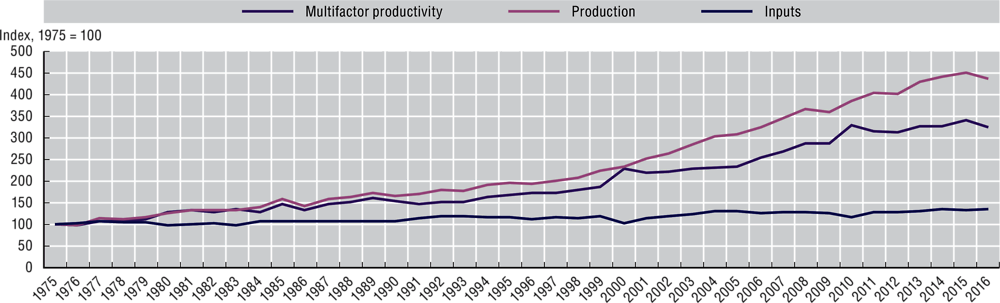

The agricultural sub-sector has registered significant increases in productivity over the last three decades. Between 1975 and 2016, multifactor productivity more than tripled, with an annual average growth rate of approximately 3.1% (Figure 6.1). As a consequence, the price that Brazilian consumers had to pay for a basic consumption bundle diminished in real terms by about 50% between 1975 and 2013 (Embrapa, 2014). Consequently, after having been a food importer for a long time, by 2016 Brazil had become the world’s third-largest agricultural exporter, behind the European Union (EU) and the United States and ahead of the People’s Republic of China (hereafter “China”). Brazil’s share in total world export value increased from 3.2% in 2000 to 5.7% in 2016 (FAO, 2018).

Much of the success of Brazil’s agricultural sector over the past decades has been driven by a robust innovation ecosystem, led by the public Brazilian Agricultural Research Corporation (Empresa Brasileira de Pesquisa Agropecuária, Embrapa). Increasingly, the ecosystem also involves scientific and technological co-operation with other countries (e.g. through Embrapa’s virtual laboratory programme, LABEX), high-quality academic institutions (e.g. the Luiz de Queiroz College of Agriculture [Escola Superior de Agricultura Luiz de Queiroz, ESALQ] in Piraciacaba, São Paulo) and private sector participation. Private sector participation includes an increasingly vibrant start-up scene, fostered by several incubators and accelerators (e.g. ESALQTec, Pulse, ScaleUp Endeavour, Wayra), many of which have been emerging in close proximity to research hubs such as ESALQ in Piraciacaba.

Advancements in precision agriculture, i.e. the application of technology to enhance the management of agricultural systems, is promising further large gains in terms of productivity and cost reductions (OECD, 2016a). According to some estimates (Brasscom, 2019), investments in IoT solutions, considered a key enabling technology in precision agriculture, totalled USD 57.5 million (BRL 210 million) in 2018 for the Brazilian agricultural sector. For the years 2019-21, IoT applications in agribusiness are expected to further grow with an average rate of 40% per year, involving additional investments of USD 330.8 million (BRL 1.3 billion).

Grupo SLC Agricola (SLC), one of the largest cotton, soybean and maize producers in Brazil, provides an example for the use of IoT applications among agricultural producers. Engaging with precision agriculture since the 1990s, SLC is now applying satellite images, sensors and drones to monitor the fields. Big data and machine learning are applied to enhance the efficient use of inputs, including fertilisers, chemicals, water or seeds and to monitor crop performance. According to the firm, the use of these technologies has reduced the use of fertilisers by up to 10% and the use of chemicals for plant protection by up to 3%. Other advantages include gasoline savings, efficiency gains in the management of processes, a better tracking of machines and the collection of vast amounts of data (MAPA, 2019a).

The government is fostering precision agriculture, but innovation would benefit from enhanced public-private co-operation

Despite the strong dynamism in Brazilian agribusiness and the increasing role of the private sector in agricultural innovation, there still remains a lot of untapped potential. In particular, the highly complex business environment and tax regulation create substantial bottlenecks for start-ups and firm innovation (see Chapter 5). This is aggravated by a lack of investment capital, management flexibility and a qualified workforce (OECD, 2015b). The poor infrastructure is further diminishing the profit margins of agricultural producers, limiting financial flexibility for innovations. For example, the cost of soybean transport in Brazil is estimated to be seven times higher than in the United States (Arias et al., 2017).

Furthermore, there is significant potential to enhance innovation synergies from better co-operation between the public, academic and private actors (OECD, 2015b). Embrapaand the different state agricultural research organisations, together with other research institutions, have been part of the National Agricultural Research System (Sistema Nacional de Pesquisa Agropecuária, SNPA) since 1992. Embrapa alone entails a network of over 40 different offices and research centres in different parts of Brazil. However, the private sector, and in particular the growing start-up scene, is currently not well integrated into the existing research system.

An important step to promote the precision agriculture ecosystem in Brazil was the creation of the Brazilian Commission of Precision Agriculture (Comissão Brasileiro de Aquapaisagismo, CBAP) through the Ministry of Agriculture, Livestock and Supply (Ministério da Agricultura, Pecuária e Abastecimento, MAPA) in 2012 (Ordinance 852). CBAP is based within the ministry and has mostly a consulting and co-ordinating function, including through the identification and articulation of relevant stakeholders. CBAP encompasses representatives from several ministries, the Brazilian Confederation of Agriculture (Confederação da Agricultura e Pecuária, CNA), Embrapa, the National Rural Apprenticeship Service (Serviço Nacional de Aprendizagem Rural, SENAR) and other institutions, including universities and major business associations.

Based on the discussions in CBAP, in 2014 MAPA published the Strategic Agenda for Precision Agriculture (2014-30), proposing several directions to promote precision agriculture in areas such as value chain governance, R&D, and sector diagnostics or regulation (MAPA, 2014). Among the proposed actions was the establishment of a permanent representation of the sector, allowing for continuous stakeholder discussions, and of a R&D network, integrating both public and private stakeholders. However, the document established neither specific timelines nor any organisational or budgetary responsibilities. It was rather considered a basis for future discussions.

The launch of Brazil’s National IoT Plan in June 2019 recently provided the ground for the establishment of a new multi-stakeholder forum. The National IoT Plan is the result of a joint initiative between the Ministry of Science, Technology, Innovations and Communications (Ministério da Ciência, Tecnologia, Inovações e Comunicações, MCTIC) and the Brazilian Development Bank (Banco Nacional de Desenvolvimento Econômico e Social, BNDES) from 2014 and features agriculture as one of four core sectors (Box 6.1). In particular, the National IoT Plan considers the application of IoT solutions in agribusiness crucial for both the efficient use of inputs and sanitary security, for example with regard to animal health or the use of antibiotics. Following the launch of the plan, a technical co-operation agreement between MAPA and the MCTIC formally established the Agro 4.0 Chamber in August 2019. In line with the strategy documents, the chamber aims at strengthening stakeholder dialogue and has a stronger focus on private sector participation than CBAP. CBAP has taken an active role in informing the work of the Agro 4.0 Chamber. However, with regard to objectives such as stakeholder co-ordination or strategy setting, a clearer distinction of responsibilities between the two bodies in the future seems warranted.

The emergence of the Internet of Things (IoT), connecting devices to the Internet and among each other, is bringing radical changes to all economic sectors. Because modern sensors generate vast amounts of data, which can be transformed into information by smart devices and fed into production decisions, the IoT carries significant potential for process innovation and energy efficiency. The resulting big data sets create further benefits, including an integration of new services and service providers into the value chain (OECD, 2017a).

To promote the deployment of the IoT in Brazil, the government created the IoT Chamber (Decree 8.234) in 2014, a multi-stakeholder forum encompassing participants from government, the private sector and academia. The IoT Chamber was tasked to elaborate a National IoT Plan, aiming to “foster the implementation of IoT as a sustainable development instrument for the Brazilian society, capable of increasing competitiveness, strengthen national production chains and promote higher quality of life” (MCTIC, 2018). The plan was initiated by the Ministry of Science, Technology, Innovations and Communications in co-operation with the Brazilian Development Bank (BNDES) and involved a public call (01/2016, BNDES/FEP) for a series of studies, including on Brazil’s IoT environment, the identification of key sectors and the formulation of policy proposals. Work on the plan began in December 2016 and entered its final stage (Phase 4) in 2018, encompassing the design of measures to support the implementation and establishment of a monitoring framework. The National IoT Plan, which builds upon several rounds of stakeholder interactions, was formalised in June 2019 through Decree 9.854. The plan now encompasses close to 30 documents that are openly accessible via a special website (BNDES, 2019a).

Four verticals (sectors) have been selected as priorities for IoT in Brazil, namely agribusiness, manufacturing, health and smart cities. The selection followed a multi-stage process involving over 160 specialists and more than 3 500 contributions obtained through different fora. Selection criteria encompassed demand factors, such as the potential impact on productivity and competitiveness or socio-environmental effects; supply factors, such as the potential to strengthen the existing IoT supply chain; and capacities, including institutional efficiency (e.g. governance structure), facilitators (e.g. ICT infrastructure) or the prospect for effective government interventions (incentivising supply or demand). The result of this process is shown as a prioritisation matrix in Figure 6.2.

The National IoT Plan foresees 75 initiatives, organised along 4 transversal thematic axes, namely: 1) infrastructure for connectivity and interoperability; 2) innovation and international market integration; 3) human capital; and 4) regulatory environment, security and privacy. Within these axes, the initiatives are distinguished by their envisaged time horizon, namely short-term actions (to be executed within one year), medium-term actions (two to three years) and long-term actions (four to five years). With this level of detail, the National IoT Plan is probably the most advanced and concrete initiative towards the digital transformation of the economy. Because of its focus on a specific technology (the IoT), the plan might seem narrow compared to advanced manufacturing plans in other countries, e.g. the People’s Republic of China, Germany or the United States. However, the increasing availability of low-cost sensors implies that the use of most production technologies, including artificial intelligence, additive manufacturing or big data analytics, will be increasingly embedded in an IoT environment (OECD, 2017a).

However, as with the E-Digital Strategy, the National IoT Plan lacks clear funding mechanisms and mostly relies on the willingness of actors in a particular resort to reassign the existing budget to new areas. This includes expenditures of particular ministries, as well as the funding instruments of institutions like BNDES or the Brazilian Agency for Innovation and Research. There is also no clearly established hierarchy between different government strategies, which in some areas can be overlapping. For example, while the recently established Brazilian Chamber for Industry 4.0 is clearly linked to the National IoT Plan and its manufacturing vertical (MCTIC, 2019), other strategies (e.g. MCTIC’s ProFuturo [MCTIC, 2017] or the Ministry of Economy’s Brazilian Agenda for Industry 4.0) are also referred to as core guiding documents.

For the National IoT Plan to be successful, it will be crucial that different national, sectoral but also regional transformation strategies are well aligned and co-ordinated. Optimally, this would involve a strong overarching governance structure, predictable budget, and a clear allocation of funds and responsibilities among the different stakeholders involved. In the short term, it will also be important to implement the monitoring framework, foreseen in the National IoT Plan but currently not realised, as soon as possible.

The National IoT Plan also iterates the call for an innovation network that better accounts for private sector activities (BNDES, 2019a). In particular, the plan details that the envisaged innovation ecosystem should involve technology-based start-ups, large firms willing to invest in innovation as well as academic research centres. It also proposes adequately equipped competence centres as a means to provide technical and financial support for research projects with high market potential. Research projects could be clustered around particular topics and should involve all three types of actors. The innovation ecosystem should further improve matchmaking between IoT suppliers and potential customers and offer a forum for stakeholders to discuss common problems, such as a lack of a skilled workforce or a lack of interoperability between devices.

An interesting example of how such a network is already emerging at the regional level is AgriHub, a regional initiative of the Federation of Agriculture and Livestock of Mato Grosso (FAMATO), the Institute of Applied Economics in Mato Grosso (Instituto Mato-Grossense de Economia Agropecuária, IMEA) and SENAR-MT). AgriHub is an innovation network connecting agricultural producers with specific needs to start-ups, mentors, researchers or investors. Interested producers can register to the AgriHub’s ALFA network, which also facilitates the testing and validation of new technologies and encourages investments in start-ups (Netto, 2017).

Brazil should not only build upon these successful regional initiatives, but also leverage existing networks such as the National Agricultural Research System and Embrapa. Embrapa itself consists of a large research network and with strong capabilities in terms of innovation, training and technical assistance. It is already actively engaged in start-up acceleration, e.g. through a recent co-operation with Venture Hub (TechStart Agro Digital), and, jointly with private sector stakeholders, has recently carried out a detailed mapping of agricultural start-ups in Brazil).1 While closely connected to MAPA, Embrapa has been a strong promoter of public-private partnerships and open innovation – two crucial instruments when it comes to fostering synergies from private-public research co-operation.

The government should also foster public access to and provision of agricultural data where appropriate. This is relevant both for the formulation of better public policies and for research purposes, but can also help farmers without own data to better benchmark and improve their performance. Both the reuse of administrative data (e.g. through pooling and aggregation) and the formulation of “open data” and other access policies (depending on the context) can be viable approaches in this regard (OECD, 2019b).

Embrapa is currently developing an API platform (AgroAPI) that opens its own agricultural data to third parties in order to foster the development of new services and applications. The platform could be leveraged for additional data, including for complementary open and administrative data.

A lack of connectivity, the high cost of sensors and regulatory uncertainty have limited the uptake of digital technologies

The first meeting of the Agro 4.0 Chamber in October 2019 focused on rural connectivity. The lack or high cost of connectivity in remote areas is explicitly discussed and acknowledged in the National IoT Plan (BNDES, 2017b). While in principle a connection via satellite is viable in most rural areas, the costs of this type of connection can be prohibitive, especially for small and medium-sized farmers.

Though supply-side data (e.g. broadband subscriptions) are mostly not available by rural and urban areas, household level surveys confirm a persistent digital divide between urban and rural areas (see also Chapters 2 and 3). In particular, in 2018, the percentage of households indicating they had access to the Internet was 70% for urban areas, compared to 44% in rural areas. While the relatively high cost of Internet access is the main reason for a lack of access in both areas, cited by 27% (urban) and 28% (rural) of individuals in households without Internet access, a lack of supply remained a significant impediment in rural areas, affecting 13% of households without Internet access. The corresponding percentage was only 3% in urban areas (CGI.br, 2018a).

MAPA also recognises that access remains one of the main challenges for the uptake of precision agriculture in Brazil and, through CBAP and the Agro 4.0 Chamber, has initiated a discussion on how to address this challenge in co-operation with the MCTIC and other public and private stakeholders (MAPA, 2019b). To map out priority areas for future investments, the government commissioned ESALQ/USP to prepare a report on the distribution of rural connectivity and clusters of productivity. Preliminary results of the study, which had not yet been published at the time of writing, indicate that less than 5% of the country’s agricultural area is currently connected to the Internet. According to the study, at least 5 600 new antennas would be required to expand access to 3G and 4G to 90% of the country. Realising only a quarter of the required investments, involving estimated expenditures of around USD 1.5 billion (BRL 6 billion), could lead to an annual gain of around USD 15.3 billion (BRL 60 billion) according to the study. The final results, which are currently being revised by the National Telecommunications Agency (Agência Nacional de Telecomunicações, Anatel), will inform the National Connectivity Policy for Brazilian Agriculture, which the Ministry of Agriculture currently is developing in partnership with the Ministry of Science and Technology (MAPA, 2019c).

More widespread application of digital technologies in agriculture, including IoT, is further limited by the high cost of IoT deployment and sensors. The cost of sensors and the lack of connectivity are considered major barriers even by the largest and most advanced agricultural producers (MAPA, 2019a). Estimates suggest that in 2015, only 10% of the 45 000 tractors and harvesters in Brazil were connected, implying significant growth potential (Febratel, 2016).

Partly responsible for the high deployment cost of IoT is taxation (BNDES, 2017c). In particular, under the FISTEL tax regime, two different taxes are currently applied to the installation (TFI) and operation (TFF, applicable yearly) of telecommunication equipment, including machine-to-machine (M2M) SIM cards, sensors or base stations. Taxes imposed on M2M SIM cards have been reduced over time, but currently remain as high as USD 2.40 (TFI) and USD 0.80 (TFF) per M2M device (OECD, 2020d). In September 2019, the Constitution, Justice and Citizenship Commission of the House of Representatives approved Bill 7656 of 2017, reducing the TFI and TFF imposed on M2M SIM cards to zero. The bill is currently awaiting approval by the Senate and once approved is likely to foster IoT adoption.

The National IoT Plan further highlights two areas in the regulatory environment that might have contributed to limited uptake of digital technologies in agriculture, namely drone regulation and data governance. Until recently, drone regulation in Brazil involved three different agencies (the National Telecommunications Agency, the National Brazilian Agency for Civil Aviation and the Department of Airspace Control) and to comply with regulations was therefore relatively cumbersome (BNDES, 2017c). In particular, there was no clear distinction between professional use and use for leisure purposes. New regulation introduced in 2017 by the National Brazilian Agency for Civil Aviation, now explicitly allows the use of drones in the agricultural sector for production purposes (Regulation RBAC-E 94). This has brought more legal certainty to drone operators and established a first regulatory environment for professional use cases. It also clarified that previous regulation, developed in the context of urban use scenarios and limiting the autonomous operation of drones in agriculture, did not apply when the pilot can remotely intervene at any time.

As the use of drones in agriculture is constantly evolving, it will be important to ensure that drone regulation keeps up with emerging applications. This requires continuous and close interaction with the private sector, including representatives of at least two dozen Brazilian start-ups currently working to advance the technology (Jardim, 2018). The National Brazilian Agency for Civil Aviation has already signalled that it considered regulation RBAC-E 94 to be dynamic, in the sense that amendments and exceptions according to need are to be expected (BNDES, 2017c). Existing examples of co-operation between the public and the private sector, including the Drone Technology Development Program for Precision Agriculture (Embrapa and Qualcomm) initiated in 2016, could provide important insights to regulators. While the National IoT Plan proposed CBAP as a forum for co-ordination between the government and the private sector in this area, the Agro 4.0 Chamber seems preferable if it implies a better integration of the private sector. The government further should expand training programmes on the use of drones, incorporating discussions of the relevant regulation. The regional branch of SENAR in Mato Grosso, for example, has been offering free courses on the use of drones in agriculture since September 2016, including on regulations (SENAR, 2016).

Precision agriculture is also raising issues about access and control rights for the vast amount of data generated by IoT sensors and other digital applications. As in OECD countries, a lack of clarity with regard to data governance has contributed to distrust among Brazilian farmers with regard to technology providers. A major concern for Brazilian farmers is, for example, that strategic data (e.g. on harvest) could be used by other parties to influence commodity prices (BNDES, 2017c). The Brazilian Association of Agriculture and Livestock therefore calls for an efficient normative environment for Brazil that establishes transparency and fosters confidence among rural producers interested in engaging with new technologies.

OECD countries are increasingly recognising the potentially stifling effects that mistrust and market failures arising from asymmetric information, a misalignment of incentives or a lack of clarity about control rights for agricultural data are creating for the uptake of digital technologies in agriculture. To inform the debate in OECD countries, the OECD is currently mapping out different regulatory approaches to data governance in the agricultural sector, with a detailed discussion of concepts like data ownership and practical approaches to data governance in agriculture. Brazil should closely follow these ongoing discussions, identifying concerns of particular relevance for Brazil and actively fostering stakeholder discussions that ensure the proper representation of all interests (OECD, forthcoming b).

Brazil should leverage multi-stakeholder fora, such as CBAP or the Agro 4.0 Chamber, to foster the development of a Brazilian framework for agricultural data governance. In the light of the large number of Brazilian smallholders, it will be particularly important to ensure that emerging regulation prevents the creation of new divides and inequalities. Recent discussions at the OECD in this regard highlight the need to foster digital literacy and transparent language in contracts for digital services (OECD, forthcoming b).

A discussion on data regulation in the context of agribusiness should also consider topics like liabilities, data standards and lock-in effects, cross-border data flow regulation, or access and use of data by public entities. The Brazilian Seed and Seedling Association (Associação Brasileira de Sementes e Mudas, ABRASEM) has further highlighted a possible interaction of data usage in precision agriculture with the regulation on personal data protection, which is particularly relevant in the context of combined or combinable data sets.

In Brazil, the lack of shared data standards is already creating difficulties for large agricultural producers that are trying integrate different technological solutions and combine equipment from different providers (Netto, 2018). With an increasing use of connected machines, the issue of data portability and open data standards is likely to become more important, including from a competition perspective (e.g. locked-in effects). As a regulator, the government can set or play an important role in the development of interoperability standards.

Mobile applications can improve technical assistance for small agriculture producers

Small family farmers still account for a significant share of Brazil’s agricultural landscape. According to the latest Agriculture Census, in 2017, about 77% of all rural properties in Brazil were owned by family farmers, who account for 67% of Brazilians employed in the sector but only 23% of all Brazilian agricultural production. About 50% of agricultural holdings are smaller than 10 hectares, jointly accounting for only 2.3% of the total farming area (IGBE, 2019).

Technical assistance, including through public or private extension services, is a crucial element to promote technology adoption among small producers and to increase their productivity (OECD, 2015b; Ribeiro Vieira Filho, 2017). Agricultural extension and advisory services facilitate the access to knowledge, information and technologies for farmers, their organisations and other market actors; facilitate their interaction with partners in research, education, agribusiness and other relevant institutions; and assist them to develop their own technical, organisational, and management skills and practices (Christoplos, 2010). In 2017, about 20% of all farmers received technical assistance, slightly down from 22% in 2006. However, among smallholders with less than 2 hectares, only 2% are receiving technical assistance on a regular basis (Buainain and Garcia, 2018).

Currently a large number of institutions are involved in the provision of extension services, including Embrapa (WebAgritec), state-level extension agencies and a variety of agricultural research institutions. This has sometimes led to a duplication of efforts and an inefficient distribution of funds between research activities and extension services (Arias et al., 2017). To strengthen co-ordination on extension services, in 2014, the federal government created the Agency for Technical Assistance and Rural Extension (Agência Nacional de Assistência Técnica e Extensão Rural, ANATER). However, according to stakeholders, it is too early to assess how far the agency has been effective in reducing the heterogeneity of approaches in a still highly decentralised system of state-level extension services. A clarification of roles and enhanced co-operation mechanisms will therefore remain highly relevant to ensure greater efficiency in the provision of technical assistance and extension services.

The coverage and effectiveness of extension services could be greatly improved through better use of mobile applications. Smartphones can be a game changer in terms of adoption capacity, especially among smallholders and farmers in remote areas (Trendov, Varas and Zeng, 2019). Smartphones not only provide access to digital extension services, including from abroad (Jouanjean, 2019), but also to a large variety of additional information (e.g. on plant diseases), digital tools or services (e.g. accounting and planning software) that can be important enablers of higher productivity, sustainability and resilience. Embrapa has been using WhatsApp to reach farmers in remote areas and has developed apps that provide information on particular grains as well as training on the organisation of financial information.

However, especially for many small holders, the lack of digital skills and the limited use of digital tools will remain an important obstacle for uptake and needs to be addressed. Recent survey evidence from the Brazilian Micro and Small Business Support Services (Serviço Brasileiro de Apoio às Micro e Pequenas Empresas, SEBRAE) confirms that the use of even the most basic digital tools among Brazilian farmers remains low. While the percentage of rural producers using a cell phone reached almost 96% across different states, only 46% used their cell phone to access the Internet. A majority of rural producers does not engage in basic accounting activities (e.g. revenues, expenses or inventory) at all or only with pencil and paper (between 54% in Minas Gerais and 93% in Acre). Most farmers, however, reported that they would use digital technologies to manage their rural business if they had better access to digital tools (between 50% in Acre and 74% in Santa Catarina) (SEBRAE, 2017a). Providing access to affordable digital devices and local Internet access points, e.g. in partnership with co-operatives, potentially combined with local training on the use of basic digital tools, could be an effective strategy to increase productivity among poor Brazilian farmers. Examples from other countries also show that a lack of Internet access does not necessarily inhibit the use of digital extension services. For example, the mobile app “Kurima Mari” provides farmers in Zimbabwe with a self-help toolkit and library that can be used offline. The app has been adopted by the federal government and is scaled up to the national level (Welthungerhilfe, 2018).

Digital technologies also provide opportunities for new forms of communication and co-operation among agricultural producers (Trendov, Varas and Zeng, 2019). The small size of agricultural holdings can be an important impediment to adoption of digital technologies because it limits the cost-reducing benefits of many scale-dependent tools in precision agriculture (Buainain and Garcia, 2018). Social media and online networks, facilitating the creation of producer networks and other co-ordination mechanisms, can effectively help to overcome these impediments. The online platform “Uller”, a Brazilian peer-sharing solution for agricultural machinery, is an interesting example in this regard and the government should foster the creation and use of similar solutions (Be Brasil, 2018).

Digital technologies could be fostered to enhance sustainability of livestock production

Agriculture, forestry and land use are responsible for close to a quarter of total greenhouse gas (GHG) emissions worldwide. By reducing the rate of deforestation, Brazil has managed to reduce overall emissions from agriculture, forestry and land use over the past years, achieving more environmentally friendly production along with significant productivity growth (OECD/FAO, 2019). However, recent data from Brazil’s National Institute for Space Research suggest that deforestation in Brazil’s portion of the Amazon rainforest is on the rise again. In particular, deforestation between August 2018 and July 2019 was around 30% higher than in the previous period (INPE, 2019).

Fostering the development of a competitive, sustainable and resilient agro-food sector is a high priority for OECD countries. As emissions have recently been rising rather than declining, Brazil will have to step up policy efforts to meet the pledges made in the Paris Agreement for 2025, cutting GHG emissions by around a third of 2018 emissions (OECD, forthcoming b). While countering illegal deforestation remains a priority in this regard, digital technologies can also be a powerful instrument, making farming more efficient (e.g. by combining data analysis with precision agricultural machinery) and helping policy makers to raise efficiency and expand the choice of policy options (OECD, 2019b).

One of the areas where Brazil has the most potential to reduce GHGs, apart from rainforest deforestation, is beef production, one of the main sources of emissions in Latin America and the Caribbean. In Brazil, direct emissions from agriculture have been increasing almost exclusively due to an expansion of beef herds (OECD/FAO, 2019). Brazil should therefore consider stronger incentives to move resources from livestock and cattle production towards crops or other forms of agriculture with lower emissions, for example by invoking corrective taxes that account for the external effects of cattle on global climate (OECD, forthcoming b). However, for the remaining livestock production, it will be crucial to focus on reducing the emission footprint.

Integrated Crop-Livestock-Forest (ICLF) systems have been proposed as a promising way for Brazil to reduce GHG emissions and overcome the outcome of decades of monoculture, including soil erosion, loss of fertility, watercourse silting, and soil and water pollution (Embrapa, 2018). These systems integrate different forms of agricultural activity, including cattle farming, within one geographic location (through combination, rotation or succession) and can thus optimise the biological cycles of plants and animals, inputs and residues, reducing environmental pressure and GHGs, and allowing for a year-round land use and higher productivity. ICLF systems are therefore a core component of the Brazilian ABC Plan, a low-carbon agriculture plan co-ordinated by the Ministry of Agriculture, Livestock and Food Supply, that has been providing low-interest credit since 2010 for farmers that adopt climate-smart agriculture techniques. ICLF was also enshrined in Law 12.805 in 2013 as a national policy (Embrapa, 2019; Arias et al., 2017). According to the latest available data from MAPA, over a period of five years, over 34 000 contracts were signed under the ABC Plan, representing a value of over USD 4.3 billion (BRL 17 billion) and covering over 9 million hectares of land (MAPA, 2018).

However, some studies have found that adoption rates of climate-smart agriculture practices have been moderate to low in many Latin American countries, in particular among small family farmers. Among the barriers to adoption are a lack of understanding of the technologies promoted, a lack of farm management skills, insufficient training and technical assistance for farmers, as well as high upfront costs for technology adoption (Arias et al., 2017). Additionally, the workload in mixed farming systems tends to be significantly higher, and livestock management in particular requires demanding management and observation skills, including with regard to the location and well-being of individual animals (Moraine et al., 2014).

The digital transformation can significantly ease many of these constraints, potentially providing a significant boost to ICLF and other climate-smart agriculture techniques. ICLF information management systems, based on IoT, autonomous data processing and intelligent automation, are therefore currently being developed and assessed in several countries (see, for example, EC [2015]). In Brazil, a related project has recently been selected as one of 15 pilot projects supported by BNDES with USD 7.6 million (BRL 30 million) in the wake of the National IoT Plan (BNDES, 2019b). The pilot focuses on the management of pests and machinery, monitoring of animal welfare in milk cattle, and use of IoT systems for crop-livestock-forest integration and will be realised and co-financed by the informatics arm of Embrapa. Other selected pilots for the rural sector involve complementary areas such as precision cattle breeding techniques, integrated data platforms for better monitoring and management of natural resources, inputs, and machinery and solutions aimed at smallholder farmers.

The Brazilian government should further support the development and testing of digital technologies for ICLF, for example by extending and upscaling the IoT pilot programme. Targeted policies to foster the uptake of new technologies could be used to scale up successful pilot projects, leveraging previous investments. This could involve, for example, the provision of technical assistance services to smaller producers or tax incentives for large producers. Additionally, credit extended by public banks to rural producers could be conditioned on compliance with sustainability goals and environmental laws (OECD, forthcoming b). In the absence of commercial credits for sustainable solutions, specific credit lines, e.g. for family farmers, can also provide fruitful ways forward (Buainain and Garcia, 2018; OECD/FAO, 2019). While earmarked credits have been a major channel to provide subsidies in Brazil, including for the agricultural sector, sustainability-related credits represent only a very small fraction of available rural credits (The World Bank, 2018a).

Brazil could also consider more targeted support for innovation in precision livestock technology, as this area of agricultural activities has high growth potential and is already attracting a lot of international attention (Hyland, 2017). For example, the German manufacturer Siemens recently opened its first technology innovation centre focused entirely on livestock in São Paulo. According to Siemens, this “Meat Competence Centre” is intended to become a global hub for new technology services aimed at improving meat production processes with innovative uses of tracking and automation (ZDNet, 2018). Another German manufacturer, Bosch, is also highly active in Brazil, and has recently turned a large Brazilian farm in Goiás into the first connected agriculture project relying on Bosch’s Precision Livestock Farming system, which uses radio-frequency identification and IoT to help farmers manage large herds and keep track of animal weight gains.

The success of BovControl, a Brazilian start-up founded in São Paulo in 2013, illustrates that Brazilian innovators do not need to hide behind these large internationals. The firm’s technology is now applied in farms across the globe, creating an “Internet of cows” through its cloud-based livestock managing system, which helps farmers keep track of their herds. Farmers start with feeding basic data on each cow into the app (including birth data, medication, vaccinations and weight). Further data collection can then be automated through integration with other technologies, including smart collars, collecting data on temperature or location, or Bluetooth-connected weight scales. The app then uses the available data to help farmers manage their herds, including through push notifications for pending vaccination, birthdate predictions, or by enhancing inventory and tracking capabilities. In 2017, the company was listed among Forbes list of the 25 Most Innovative Ag-Tech Startups (Sorvino, 2017).

Enhance synergies between public and private sector research activities by fostering a national innovation network and testbed environment for agribusiness. Leverage existing networks, e.g. the National Agricultural Research System and ALFA network, and promote the participation of start-ups.

Use national innovation networks, e.g. competence centres, to create matchmaking opportunities for technology providers and agricultural businesses as well as a forum for stakeholders to discuss solutions to shared challenges.

Enhance rural connectivity by finalising and implementing the National Connectivity Policy for Brazilian Agriculture. Prioritise regions with high productivity or where investments are likely to have high social returns.

Ensure that drone regulation remains up to date by fostering a continuous and close co-ordination between the regulator and the private sector, e.g. through the Agro 4.0 Chamber. Expand training programmes on the use of drones and their regulation.

Follow international discussions on best practices in agricultural data governance. Leverage multi-stakeholder institutions, like the Brazilian Commission of Precision Agriculture or the Agro 4.0 Chamber, to develop an inclusive framework for agricultural data governance in Brazil.

Enhance data portability among different technologies and equipment, by promoting shared or open data standards. Foster public access to and provision of agricultural data where appropriate, e.g. through the reuse of administrative data or open data policies.

Promote technical assistance and extension services, e.g. through mobile applications, with a focus on smallholders and farmers in remote areas. Enhance the effectiveness of extension services by improving co-ordination between different providers.

Foster the use of basic digital technologies among poor farmers and smallholders, by enhancing access to affordable digital devices and providing tailored consultation and trainings, e.g. through telecentres and co-operation with local co-operatives.

Raise awareness about the potential for peer-sharing and other digital solutions for the agricultural sector, for example through extension services and information campaigns.

Further support the development of digital solutions for climate-smart agriculture, by scaling-up initiatives like the IoT pilot programme.

Foster digital uptake through technical assistance, tax incentives for larger producers or earmarked credit lines for smallholders.

Ensure alignment between the National IoT Plan and the Strategic Agenda for Precision Agriculture. Ensure clarity about the different roles and responsibilities of the National IoT Chamber, the Agro 4.0 Chamber and the Brazilian Commission of Precision Agriculture.

Implement the monitoring framework as foreseen in the National IoT Plan.

Industry 4.0 is a government priority, but the sector is far from the technological frontier

Unlike the agricultural sector, Brazil’s manufacturing sector has contributed negatively to growth in recent years. In terms of size, the share of the sector in GDP diminished from 12.7% in 2010 to 10.8% in 2015. The sector’s contribution to total manufacturing output from developing and emerging industrial economies has further continuously declined, from 14.9% in 1990 to 4.1% in 2016 (UNIDO, 2017).

Over the same period, Brazil lost ground in UNIDO’s Competitive Industrial Performance ranking (falling from 26th to 35th), an index that captures countries’ capacity to produce and export manufactured goods, the extent of technological deepening and upgrading, and their impact on world markets. In contrast, Brazil’s regional peer Mexico climbed up the ranking from 31st to 20th. Moreover, the share of medium-high and high-tech value added in total manufacturing decreased from 36.6% to 35.2% (UNIDO, 2019).

As in several OECD countries, concerns about the sluggish performance of the manufacturing sector have put policies for Industry 4.0 high on the agenda of Brazilian policy makers (Planes-Satorra and Paunov, 2019). E-Digital calls for measures to raise readiness for IoT and increase digital adoption to regain competitiveness in the industrial sector. The manufacturing sector also features prominently as one of the four core verticals of the National IoT Plan and has been the at the centre of previous government initiatives, including the MCTIC’s ProFuturo plan (MCTIC, 2017) and the Ministry of Economy’s Agenda Brasileira para a Indústria 4.0.

The sector, however, is still far from the technological frontier. According to the World Economic Forum’s Readiness for the Future of Production Index, which considers both the structure of production (e.g. complexity and scale) and drivers of production (e.g. technology, human capital or investment), Brazil displays one of the lowest levels of readiness among all G20 countries, together with Argentina and South Africa (WEF, 2018).

According to a recent survey (CNI, 2018), 73% of manufacturing firms in Brazil with 250 employees and more have used at least one digital technology, including digital automation process control sensors (46%), digital automation without sensors (30%), or integrated engineering systems for product development and product manufacturing (37%). However, more advanced manufacturing technologies have only been used by a small minority, including additive manufacturing and collaborative robots (cobots; 13%), or intelligent management systems (9%), e.g. M2M, Digital Twin or artificial intelligence (AI).2 Additionally, while 81% of large companies foresaw investments of some kind in 2018, only 48% planned to invest in technology.

While comparable data on the use of these technologies in manufacturing are rare, available estimates of the dissemination of robots and M2M SIM card subscriptions seem to confirm the relatively low use of advanced technologies in Brazilian manufacturing. For example, the number of M2M SIM card connections per 100 inhabitants, a proxy for IoT deployment, was 10.6 in Brazil in 2019, less than half the OECD average of 22. While M2M deployment was higher than in regional peers like Mexico (2) or Chile (2.8), industrial leaders including France (29.6) or the United States (37.3) had significantly higher subscription rates (see Chapter 2).

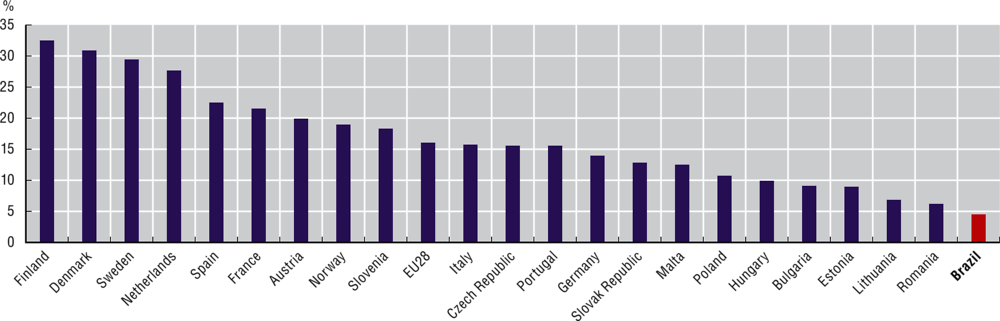

Furthermore, the percentage of Brazilian manufacturing firms using industrial robots remained lower than in any European country with available data. In particular, in 2019, only around 4.5% of Brazilian manufacturers were using industrial robots. The corresponding percentage was 16% on average in EU countries (2018) (Figure 6.3). And while in 2014 Brazil had only 6 114 industrial robots in use, leading economies like Germany, Korea, Japan and the United States employed over 100 000 operational industrial robots each (OECD, 2017b).

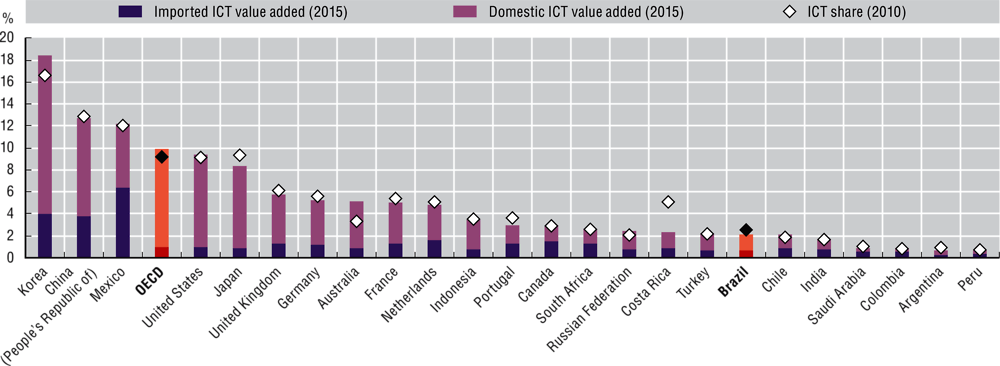

A different proxy for digital intensity and specialisation of Brazilian industry is the share of ICT value added embedded in manufacturing exports.3 ICTs may enter the production of manufacturing output in the form of installed computers and software for example, or as IT services that are required to manage and control digitised processes at the firm or plant level. This share is low in Brazil (2.2%), compared not only to major industrialised economies, such as Germany (5.3%) or the United States (9.4%), but also to other emerging economies, in particular Mexico (12.2%) and China (12.7%) (Figure 6.4).

Over the same period, the share of imported ICT value added in total ICT value added significantly increased, from 18.3% to 29.6%, comparable to China (29.7%) but significantly above the United States (10.4%). Manufacturing firms in Brazil therefore seem to be increasingly reliant on foreign ICT value added, illustrating the crucial importance of affordable access to foreign technology.

Enhancing access to foreign intermediates is crucial to boost industrial transformation

High adoption costs are one of the main barriers to technology adoption for Brazil’s manufacturing sector (see Chapter 3). According to a survey by the Brazilian National Confederation of Industry among SMEs and large manufacturing firms, high costs are the most frequent barrier to technological adoption (reported by two-thirds of firms). Other barriers, like a lack of skilled workers (30%), inadequate infrastructure (26%) or difficulties to integrate new technologies and software (20%) were mentioned less frequently (CNI, 2016).

The high cost of technology adoption is partly the result of high import tariffs on foreign ICT goods (Figure 6.5). Companies purchasing intermediate or capital goods are paying markedly higher prices than in other countries (OECD, forthcoming a). Additionally, innovation schemes like the Informatics Law or the Semiconductor Technological Development Support Program (Programa de Apoio ao Desenvolvimento Tecnológico da Indústria de Semicondutores, PADIS) indirectly raised the relative price of imported technology (e.g. semiconductors), effectively tilting the technology choice of domestic firms towards potentially inferior domestic products.

The government has recently revised the Informatics Law and PADIS, following a World Trade Organization ruling that found the schemes to cause taxation in excess and a less favourable treatment of imported goods (see Chapter 5). It has also taken several steps to reduce import tariffs on selected ICT and capital goods under the ex-tarifario mechanism, which allows individual Mercosur members to reduce such duties temporarily in the absence of domestic equivalents. In particular, in February 2018, the government extended a temporary exemption from import duties on capital goods and ICT equipment until the end of 2019 (Camex Resolutions 14/2018 and 15/2018). On 12 September 2019, the government issued two ordinances (No. 2.023 and 2.024) lifting any import duty on 532 goods. These include 498 capital goods (e.g. machines for the production of medicines, medical equipment for exams and surgeries, cranes, tractors, or industrial robots) and 34 ICT goods (e.g. LED and photolithographic printing systems or data-processing machines for radar surveillance and airspace control).

The basket of goods exempted from import tariffs, however, is still limited. With only 34 ICT goods falling under the new regime, tariffs still apply to other, potentially crucial components. Brazil should therefore actively promote the entry of Mercosur countries into the WTO Information Technology Agreement, which would create a credible schedule for the reduction of tariffs on an increasing number of ICT goods. One estimate suggests that access to the ITA could increase GDP growth in Brazil by 0.08 percentage points in the first year alone. The increase in tax revenues from higher growth, including in the ICT sector, would exceed the loss in import tariffs from the fourth year onwards (Ezell and Foote, 2019).

Beyond ICT and capital goods, access to services at a competitive price has become crucial. Evidence from other BRIICS countries (Brazil, Russian Federation, India, Indonesia, China and South Africa), and in particular India, suggests that services reforms in markets such as banking, telecommunications, insurance or transport can have significant effects on the productivity of manufacturing firms (Arnold et al., 2015). These effects are likely to be significantly larger in the digital age, where the services content of manufacturing is steadily increasing (De Backer, Desnoyers-James and Moussiegt, 2015).

For example, digital transformation allows for the outsourcing of services previously performed in-house. In some cases, it also fosters the replacement of capital goods with services, e.g. when physical servers are replaced with cloud services. Additionally, manufacturing goods are increasingly bundled with services and emerging technologies, including additive manufacturing, are increasingly blurring the line between manufactured goods and services. Indeed, business services accounted for 36% of the valued added in all manufacturing goods exported by Brazil in 2015. About 19% of these services were imported, up from 14.4% in 2010.4 Access to competitively priced services, therefore, is becoming increasingly important for manufacturing firms in Brazil. In this context, it would be important to reduce the cost burden currently associated with the import of services, for instance by reducing the special tax CIDE (Contribuição de Intervenção no Domínio Econômico), which is levied on several services imports, including administrative and technical assistance services provided by non-residents.

The increasing importance of “servitised” business models in manufacturing has been explicitly recognised in the National IoT Plan as well as in the National Industry Federation’s (Confederação Nacional da Indústria, CNI) Industry 2027 initiative (IEL, 2018; BNDES, 2017d). The National IoT Plan, in particular, also highlights the additional challenges that arise with regard to emerging business models and bundles of goods and services. The Brazilian tax code treats goods and services taxation in two separate systems, namely the federal IPI for industrialised goods and the municipality level ISS on services (see Chapters 2 and 3). This can lead to ambiguities and uncertainties in cases where the boundaries between goods and services are blurring. To avoid these ambiguities from becoming a barrier to emerging business models, the government should consider harmonising the consumption tax schemes for goods and services, e.g. by consolidating consumption taxes at the state and federal levels into one value-added tax.

To promote innovation, the government should foster competition and support small and medium-sized enterprises

The relatively high level of tariff protection is one of the reasons for competition from abroad being relatively low in the manufacturing sector (OECD, 2015c). Another is the low level of domestic competition, which limits the redistribution of resources from large incumbents to potentially innovative market entrants (OECD, forthcoming b). In particular, the complex business environment and tax system, as well as limited access to credit, keep the relatively large number of small firms in the sector from growing into mid-sized competitors. For example, despite significant progress over recent years, the time required to comply with taxes for a benchmark company in Brazil was about 1 501 hours in 2018, longer than anywhere else in the world (PwC, 2019). Simplified procedures (Simples Nacional) are available for small firms, but growing larger implies that tax requirements can turn into additional compliance costs that may slow down growth. Additionally, the highly concentrated financial market structure implies that SMEs were facing average interest rates around 25% in 2017, about 16 percentage points higher than large firms (see below).

The limited growth potential for smaller firms, including innovative ones, has led to a rigid industry structure with a “missing middle” in the firm size distribution, involving a large number of small firms and a limited number of large incumbents with low investment incentives (OECD, 2017c; forthcoming b). The phenomenon is more severe in Brazil than in many other countries and particularly pronounced for the manufacturing sector, implying that resources remain trapped in low-productivity firms with limited incentives to invest in innovation and technological upgrading (OECD, 2018a). The fact that in 2016 over one in four manufacturing firms, close to 30% for large firms, had difficulties defining the return on adopting digital technologies (CNI, 2016) is a likely reflection of this environment.

Enhancing market openness would raise competitive pressure and could foster innovation, including among large incumbents. Experience from trade liberalisations in the 1990s suggests that Brazilian regions more exposed to liberalisation have seen a higher rate of resource reallocations from incumbents to new market entrants than other regions (Grundke et al., forthcoming). Additionally, easing access to finance for SMEs and simplifying the complex tax structure could help innovative firms to grow and transform the structure of the sector. Importantly, and as explained above, Brazil’s manufacturing sector would also benefit from more competition in upstream services sectors, whose meagre long-term performance has been suggested as one of the reasons for low productivity in the manufacturing sector (Arbache, 2018; OECD, 2018a).

SEBRAE is running a programme that specifically aims to support productivity in upstream SMEs to foster innovation in large firms: the National Productive Chain programme (Programa Nacional de Encadeamento Productivo). In particular, the programme connects technological demand in large firms with solutions from innovative SMEs and provides consultation and training to help SMEs close potential performance gaps. According to SEBRAE, more than 65 000 SMEs had benefited from the programme by 2017, providing solutions to large firms in sectors like automobile, aviation or ICTs (SEBRAE, 2017b). SEBRAE has also created the programme Nexos, which offers fiscal incentives to large companies (e.g. Informatics Law or the Good Law) when they innovate with the help of innovative start-ups (see Chapter 5).

A more recent project with a clear focus on the role of start-ups for industry innovation is the National Connection Start-up Industry Program operated by the Brazilian Industrial Development Agency (Agência para o Desenvolvimento da Indústria, ABDI). The programme was launched in 2017 and aims at connecting start-up solutions to industry needs. In its first edition, ten industry leaders (BRF, Embraer, Natura, 3M, Embraco, Ericsson, Libbs, Botorantim Cimentos, Caterpillar and Dow) established relationships with 27 start-ups to co-develop 32 innovative solutions. The project has already led to ten implementations and is currently in its second edition.

The government is actively fostering Industry 4.0, but a multitude of initiatives require stronger co-ordination

In 2015, the Ministry of Economics, Foreign Trade and Services (MDIC, now part of the the Ministry of Economy) and the MCTIC initiated a first structured dialogue about advanced manufacturing in Brazil. Several workshops were organised, involving hundreds of experts from the private sector and large stakeholder organisations, such as the ABDI, BNDES and the CNI, among many others. The effort was seen as the potential kick-off for a National Strategy for Advanced Manufacturing that would provide the basis for multi-stakeholder co-operation in the coming years (MDIC-MCTIC, 2016). In 2017, the MDIC established a working group (GTI 4.0) to advance the national agenda while the MCTIC focused on an R&D plan for the industry (MCTIC, 2017).

Since then, an increasing number of initiatives specifically geared to promote advanced manufacturing in Brazil has emerged. This includes programmes focused on uptake of technologies, such as the BNDES and FINEP programmes discussed in Chapter 3 (e.g. FINAME Industry 4.0, Inovacred 4.0), as well as initiatives with a focus on innovation, such as the aforementioned ABDI National Connection Start-up Industry Program, research grants for advanced manufacturing from the National Council for Scientific and Technological Development (Conselho Nacional de Desenvolvimento Científico e Tecnológico, CNPq), or the Industry 4.0 IoT pilots implemented within the CNI/SENAI and EMBRAPII network.5 Additionally, the Ministry of the Economy, together with the ABDI, has recently launched an Industry 4.0 testbed programme. Testbeds for Industry 4.0, signed in May 2019, is a USD 2.5 million (BRL 10 million) technical co-operation agreement, which scales-up a previous testbed programme by the ABDI from around 100 beneficiary companies to 1 000 companies. Several of EMBRAPII’s units, distributed across 14 states and the Federal District, will be made available to validate Industry 4.0 technologies in a controlled environment. Both technology users as well as suppliers, including start-ups, will be able to benefit from the programme.

With this increasing number of sometimes rather small initiatives, and the multitude of actors involved, co-ordination across government agencies and industry stakeholders is becoming increasingly important. Recognising the need for better co-ordination, in April 2019 the Brazilian government (ME and MCTIC) launched the Industry 4.0 Chamber (Câmara Brasileira da Indústria 4.0). The chamber is the first formal platform to co-ordinate the development and implementation of an industrial transformation roadmap and involves over 30 private, public and academic entities. The creation of an industry-specific chamber fulfils one of the core actions foreseen in the National IoT Plan for the industry vertical (Box 6.1). The chamber consists of a Superior Council, an Executive Secretariat and four working groups, focused on research, technology and innovation, human capital, production chains as well as regulation, technical normalisation and infrastructure. The Superior Council, consisting of the MCTIC, the Ministry of Economy, CNI, the Brazilian Agency for Innovation and Research, the National Council for Scientific and Technological Development, BNDES, the ABDI, SEBRAE and EMBRAPII, met for the first time in May 2019 to initiate the work of the chamber.

In September 2019, the MCTIC and the Ministry of Economy published the Industry 4.0 Chamber Action Plan 2019-2022 which draws on previous documents and strategies from public and private actors to propose strategic actions in each of the four focus areas. The proposed actions partly build upon existing initiatives, such as the dissemination of Industry 4.0 online learning tools via SENAI in the area of human resources or the integration of Industry 4.0 into the Brasil Mais Produtivo programme (see Chapter 3). Among other things, the action plan also highlights the need to support micro, small and medium-sized enterprises in the adoption of advanced manufacturing technologies, proposes the use of test beds and multi-stakeholder open laboratories, and pledges to promote regulatory changes in areas such as data protection, labour legislation or the taxation of IoT devices. Responsible for the implementation are all stakeholders pertaining to a particular working group, which according to the plan will meet on a regular basis.

With regard to the multitude of available programmes, Action 2.3 of the innovation pillar explicitly foresees the collection and classification of existing funding instruments with focus on innovation in Industry 4.0 (e.g. from the Brazilian Agency for Innovation and Research, BNDES, the National Council for Scientific and Technological Development, EMBRAPII, SENAI or the State Research Foundation [Fundações de Amparo à Pesquisa, FAP]), by type of activity or maturity of the target company for example. These instruments will be considered to become part of the so-called “Basket 4.0” of instruments. A second step (Action 2.4) would then ensure that the selected instruments are adequate for the targeted firms in terms of cost, duration and financing conditions. With regard to technology adoption, the action plan foresees the further strengthening of the available funds (e.g. Inovacred 4.0 or FINEP IoT), and the creation of new financial sources (Action 2.2).

However, the absence of an overall budget plan, and the reliance on existing funding mechanisms in many cases, implies that a successful implementation of the envisaged actions stands and falls with the political will and financial capacities of the different institutions, and their disposition to co-operate. A strengthening of the overarching governance mechanism for digital transformation will be crucial in this regard.

The Industry 4.0 strategy should include energy efficiency among its objectives

The design of the Industry 4.0 Chamber as a forum for strategic planning follows similar initiatives in countries like Austria and Germany. However, it currently does not involve a focus on particular industries or technologies like the Made in China 2025 initiative or Japan’s Robot Strategy (Planes-Satorra and Paunov, 2019) do. Nevertheless, the plan does highlight a need to identify industry segments and technologies with a high potential for Brazil. This can be of crucial importance to avoid the different initiatives from being spread out too thinly and to concentrate on certain crucial areas. The AMP 2.0 report, elaborated in the context of the US Advanced Manufacturing Partnership, can provide some guidance on the selection of relevant technology areas. The four criteria relate to: 1) industry or market pull, i.e. strong demand by industry or consumers; 2) cross-cutting impact across multiple industry sectors; 3) importance to national security and competitiveness; and 4) leveraging strength and competencies, including with regard to the available workforce and infrastructure (PCAST, 2014).

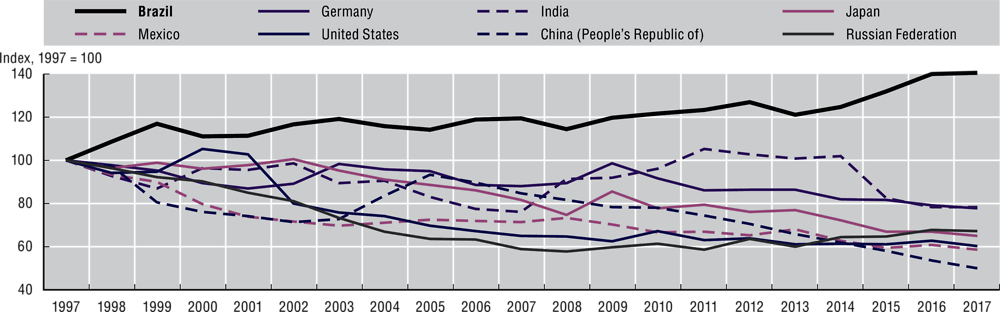

One area that might benefit from closer attention in Brazil’s Industry 4.0 strategy is energy efficiency. Brazil is the only major industrial economy that registered a substantial increase in energy intensity, defined as energy consumption per unit of manufacturing value added, over the period 1997 to 2017 (Figure 6.6).

The use of digital technologies and energy management systems, for example in the context of motor-driven systems, could help Brazil boost energy efficiency and increase productivity in manufacturing (IEA, 2018). However, while the E-Digital Strategy (MCTIC, 2018) explicitly acknowledges the potential of Industry 4.0 and IoT to increase energy efficiency, associated with energy savings of 10-20% (MGI, 2015), neither the National IoT Plan nor the Industry 4.0 Action Plan establish concrete goals or actions in this regard.

Some initiatives with a focus on energy efficiency already underway would, however, likely benefit from an explicit incorporation into the advanced manufacturing strategy. Energy efficiency practices are part of the SME training programmes offered through Brasil Mais Produtivo (see Chapter 3). Awareness-raising and training programmes can also play an important role. In the study “Industry 2027”, the CNI proposes that entrepreneurial training and business assistance services for small enterprises should cover environmental sustainability and energy efficiency. Corresponding activities could be executed within the SENAI network of technology and innovation institutes in partnership with SEBRAE (IEL, 2018).

Enhance access to foreign technology with a long-term commitment to reduce tariffs on ICT and capital goods.

Enhance access to imported services by reducing the special tax CIDE.

Reduce uncertainty about taxation of goods and services arising from new business models enabled by digitalisation, e.g. by introducing a single tax scheme for both products (GST).

Foster competition through market openness and improve the business environment, e.g. by simplifying the tax system and increasing SMEs’ access to finance, to promote innovation.

Scale-up programmes connecting manufacturing firms to innovative start-ups, SMEs and service providers.

Strengthen governance and co-ordination mechanisms to ensure that Industry 4.0 policies, including those that promote digital uptake in SMEs, are well aligned and have sufficient scale.

Include energy efficiency among the objectives of the Industry 4.0 strategy.

Concentration in the financial market is limiting access to credit for small and medium-sized enterprises

Beginning with the privatisation of state banks in the 1990s, the Brazilian banking system went through a period of consolidation and increasing market concentration, with larger banks acquiring smaller ones or competing them out of the market

Around 85% of financial assets are held by financial conglomerates, often headed by large banks with subsidiaries in investment banking, securities brokerage, asset management and the insurance market. The three state-owned banks account for about 40% of the total banking sector’s assets, providing 55% of bank credits. About half of all credits are earmarked by regulation for specific purposes, mainly for mortgages, investments or agriculture. Earmarked credits usually involve subsidised interest rates and longer maturities compared to the free market and are contributing to the segmentation of the credit market. In particular, the credit market for SMEs is dominated by large banks, providing mostly short-term financing, while long-term credits are almost exclusively provided by public-commercial banks (Banco do Brasil and Caixa Econômica Federal) and BNDES (IMF, 2018).

Market concentration in the banking sector, as well as restrictive monetary policies to curtail inflation, have led to some of the highest interest rates in the world. Borrowing costs are particularly high for SMEs, which were facing an average interest rate of 25.1% in 2017, about 16 percentage points higher than large firms (Figure 6.7). The interest rate spread has increased over time, implying tightening credit conditions for SMEs in relative terms (OECD, 2019d).

The government has put in place several programmes to enhance access to credit for SMEs, including a micro-credit programme, quotas to finance loans to low-income individuals and micro-entrepreneurs, and an increase in the number of access points for financial services. New regulation in 2016 has further improved legal protection for angel investors in the case of company closure (OECD, 2018b). The government’s focus is increasingly turning towards the emerging Fintech sector, which could significantly enhance competition in the market.

Brazilian Fintech is on the rise, but small compared to the traditional banking sector

Digitalisation is transforming the way in which the financial sector operates. While there is no precise definition of the term “Fintech”, it broadly captures this development, enabled by emerging digital technologies and new business models (OECD, 2018c). Importantly, the characteristics of firms in the sector have been changing over time. Early start-ups have turned into professionally managed companies and several traditional incumbents have entered the market (EY, 2019a). Besides established banks, insurers and stockbrokers, this includes an increasing number of non-classical financial service providers (e.g. retailers, online platforms), which have begun to complement their portfolio with financial solutions (e.g. eWallets). In line with this horizontal expansion, adoption of Fintech solutions among consumers is constantly increasing.

Survey data from Australia, Canada, Hong Kong (China), Singapore, the United Kingdom and the United States, for which time series data are available, illustrate the dynamics in the sector, suggesting that Fintech adoption by consumers, defined as the use of two or more different Fintech services to capture regular users, rose from 16% in 2015 to 60% in 2019. The variety of instruments used is also growing, with significant increases in areas such as insurance products (EY, 2019a). The most recent data, covering 27 000 consumers in 27 economies, suggest that money transfers and payments remain the most frequently used instruments, with uptake reaching 75% in 2019. Across all 27 economies, Fintech adoption averaged 64% in 2019, reaching 87% in China and India. For Brazil, use among consumers currently matches the global average (64%), and was on par or above the uptake in many advanced countries, such as Germany (64%), the United States (46%) and France (35%). However, the uptake remained below other Latin American countries, such as Colombia (76%), Peru (75%), Mexico (72%) and Argentina (67%), implying substantial growth potential.

With regard to the supply of financial innovations, in particular mobile payment solutions, Brazil is currently ahead of other Latin American countries (AMI, 2019). In June 2019, 604 Fintechs and related companies were active in Brazil, up from 454 in August 2018 (Fintechlab, 2019). In 2018, Brazil accounted for about 33% of all Fintechs in Latin America (IDB, IDB Invest and Finnovista, 2018). Three of these companies are currently valued at over USD 1 billion: Nubank and Stone, both founded in 2013, and PagSegure, founded in 2006. The payment segment is the largest among Fintechs in Brazil (29% of Fintechs), followed by lending (18%) and financial management services (17%).

In areas like payments or banking, where Fintechs have been particularly active, the sizeable unbanked population is likely to sustain dynamism in the market. In 2017, the share of individuals (aged 15 and older) with access to a financial institution account in Brazil was 70%, above the Latin American average (55%), but well below the OECD average (95%). Among young people (15-24 years old), where digital affinity, and thus the potential for Fintech solutions, is the highest, access to a financial account remained at 47%, compared to 84% in OECD countries (Demirgüç-Kunt et al., 2018).

By enhancing competition and enabling digital access to financial accounts, Fintech solutions have a high potential to foster financial inclusion in the forthcoming years. Indeed, the main reasons reported by individuals in Brazil for not having a financial account are insufficient money to justify the use of an account (58%) and too expensive financial services (57%). Importantly, geographic distance to financial institutions in 2017 remained an obstacle for almost every third of the unbanked (32%) (Demirgüç-Kunt et al., 2018).

Recent regulatory changes are fostering the growth of new financial services

While financial regulation in Brazil is considered rather conservative by some stakeholders (Capgemini and BNP Paribas, 2018), regulators have undertaken several important changes over recent years, which have fostered the growth of Fintech companies and are slowly beginning to increase competition in the market.

New payment institutions are reshuffling the credit card market

A major step forward for the payments market was Law 12.865 of 2013 (“Payments Act”), which defined “payment institutions” and introduced a new regulatory framework, encompassing interoperability between different payment schemes, freedom of choice for consumers, and the provision of non-discriminatory access to infrastructure and services. The new framework, which aimed to level the playing field for new business models and increase innovation in the market, followed a previous ruling by Brazil’s anti-trust regulator (CADE) in 2010 that opened access for competitors to the major credit card systems Visa and Mastercard (OECD, 2019e).

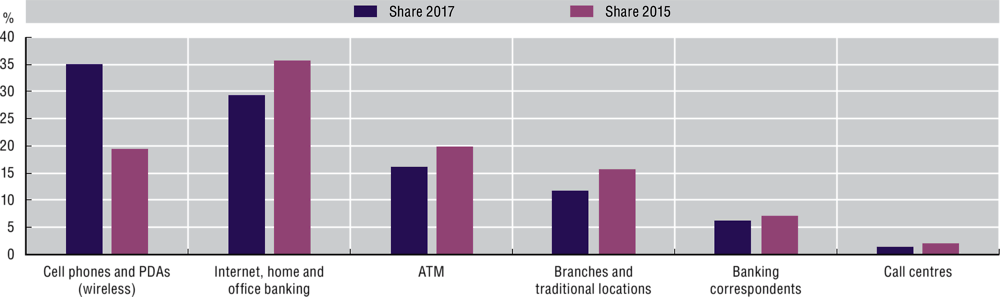

Since then, new payment institutions have begun issuing post-paid payment instruments (e.g. credit cards) and are reshuffling the cards in the concentrated market. Nubank, currently valued at over USD 4 billion and considered the largest digital bank outside of Asia in number of customers, is a good example of this dynamism. Founded in 2013, the branchless retail bank Nubank launched NuCard in 2014, a credit card with zero commissions, and has since attracted over 8 million customers in Brazil. The Fintech company is now among the five largest credit card issuers in Brazil and has received significant international investments, including from Tencent. It has added a debit card to its portfolio and in 2018 acquired a finance license, allowing it to offer a mixed current, savings and payment account (NuConta) and loans to private customers.