1. Key policy insights

Costa Rica’s social and economic progress has been remarkable. A strong commitment towards trade openness has been key to attract foreign direct investment and move up in the global value chain. The effort to provide virtually universal health and pensions has translated into well-being indicators comparable with OECD standards in several dimensions. Costa Rica has also shown a strong commitment to preserving natural resources. Challenges to retain achieved successes and to continue converging towards higher living standards are substantial. The fiscal situation remains a critical vulnerability. Reform momentum has been extraordinary, as a significant number of legal initiatives linked to OECD accession have been finalised. This includes the fiscal reform approved in December 2018, a historic step to restore fiscal sustainability. These reforms would also facilitate the recovery from the COVID-19 shock. In the short term, addressing the coronavirus outbreak is the overarching priority. Once the recovery is established, full implementation of the fiscal reform is critical to restore medium-term fiscal sustainability, ensure macroeconomic stability and set the basis for higher incomes and wider spread improvements in living standards. Putting Costa Rica on a path to stronger growth requires boosting productivity by adopting structural reforms to streamline regulations and maintaining the commitments to trade, foreign direct investment and natural resources preservation. Extending the benefits of growth to all Costa Ricans will require improving public spending efficiency, reducing informality and increasing female labour market participation.

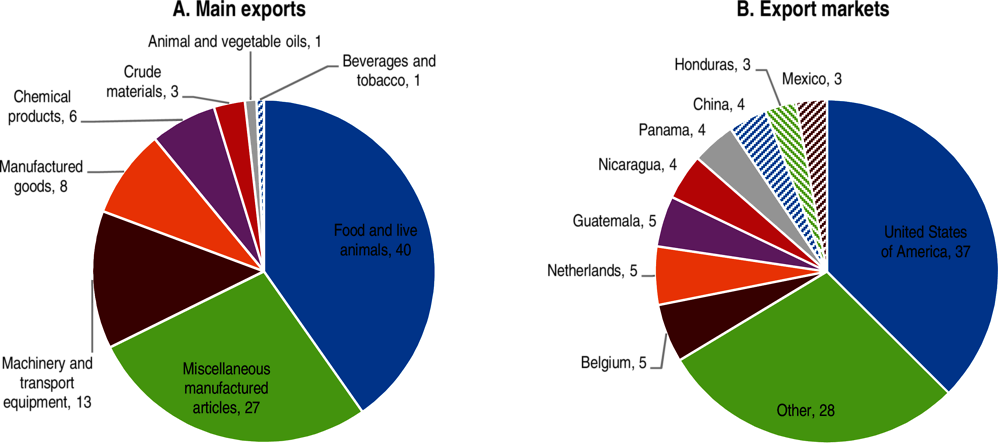

Costa Rica’s social and economic progress (centred on trade openness, well-being and a sustainable use of natural resources) has been remarkable. Over the last 30 years, growth has been steady and GDP per capita has tripled. A strong commitment towards trade openness has been key to attract foreign direct investment and move Costa Rica up in the global value chain and upgrade its exports.

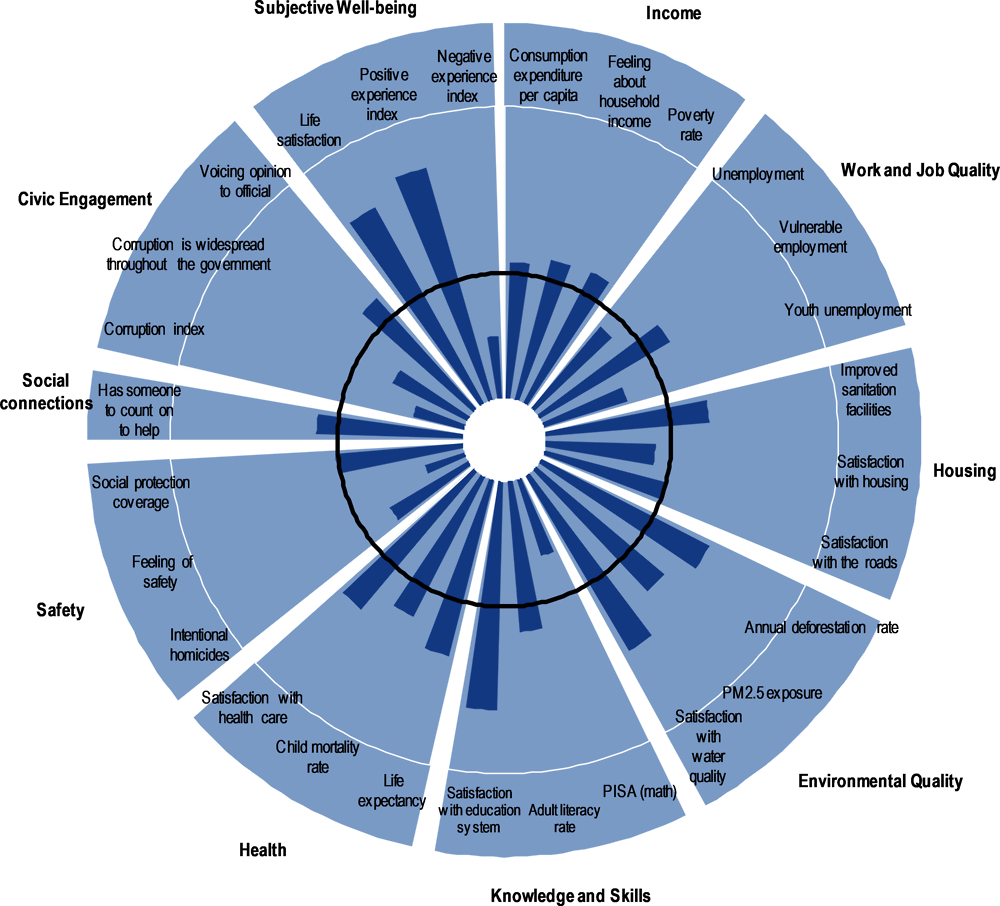

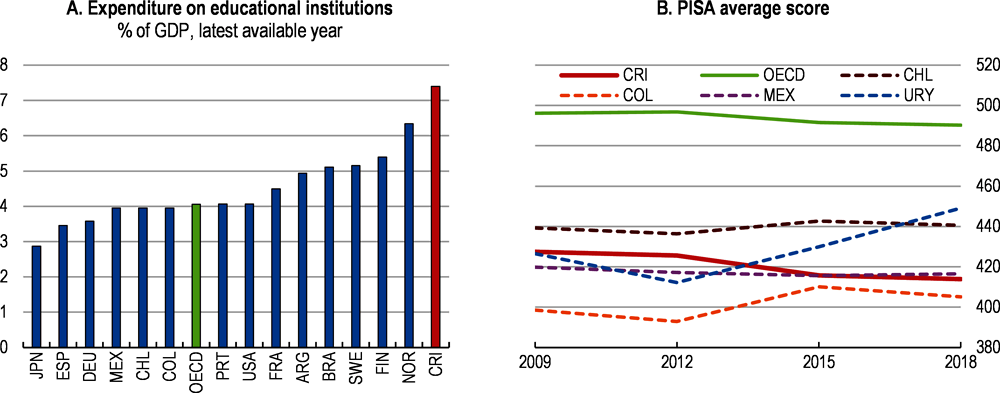

The effort to provide virtually universal health and pensions has translated into well-being indicators comparable with OECD standards in several dimensions (Figure 1.1). Costa Rica has the highest life expectancy at birth in Latin America and self-reported well-being is above the OECD average. In other dimensions, such as quality of education or female labour market participation, gaps persist (Table 1.1).

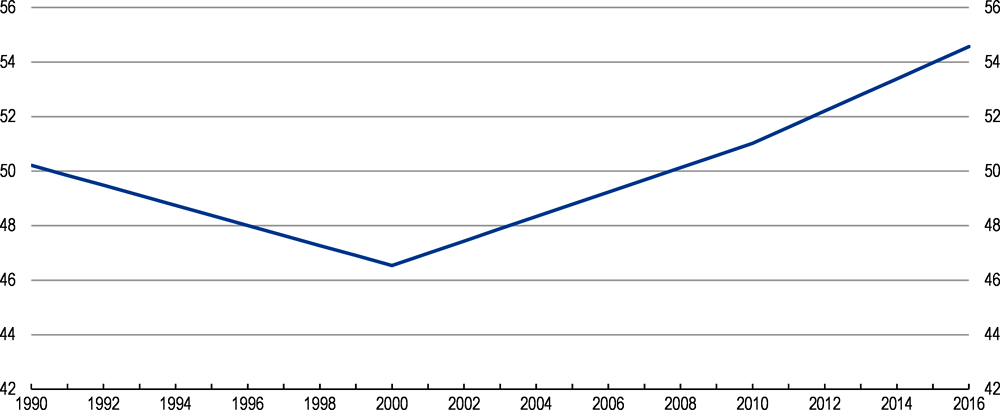

Costa Rica has also shown a strong commitment to preserving natural resources. It is one of the few countries succeeding into reversing deforestation (Figure 1.2). The area covered by forests increased from 26% in the early 1980s to more than 55% today. Costa Rica also stands out internationally as it was one of the first countries to establish the ambitious target of achieving zero net emissions of CO2 by 2050.

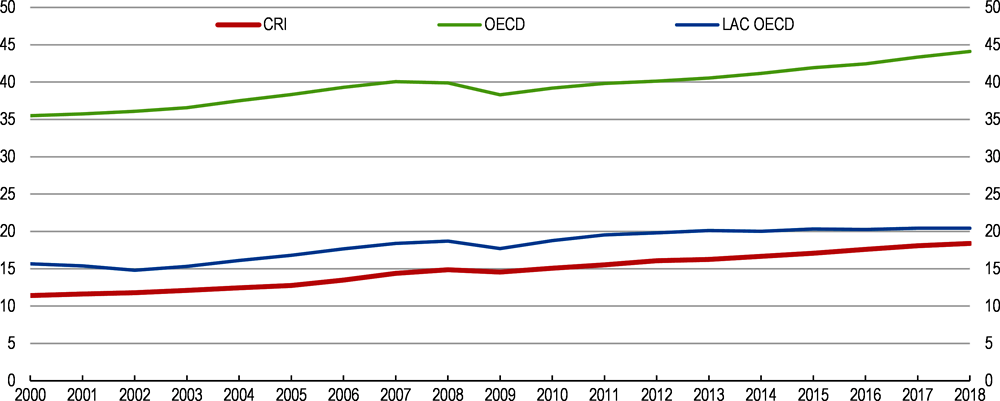

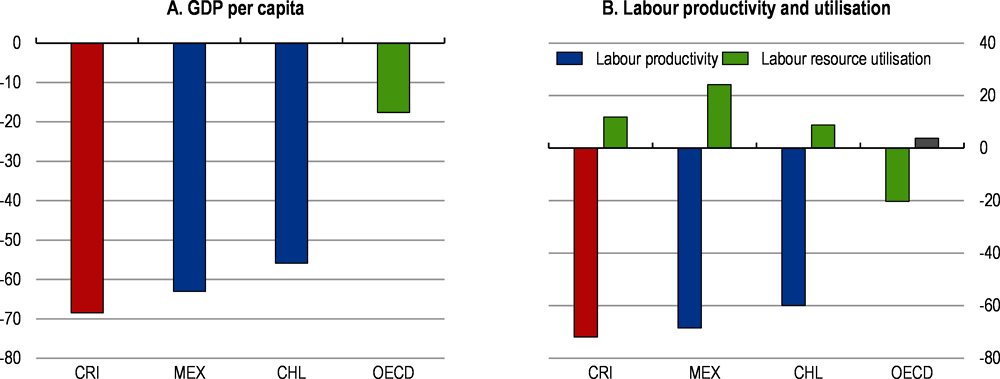

Costa Rica faces substantial challenges to retain achieved successes and to continue converging towards higher living standards, including responding to the coronavirus crisis. The fiscal situation remains a critical vulnerability. Large deficits and rapidly rising public debt threaten Costa Rica’s remarkable achievements. The fiscal reform approved in December 2018 was a historic step to restore fiscal sustainability. Boosting growth is also a key priority, as the gap in GDP per capita with advanced economies remains large (Figure 1.3). Unemployment, informality and inequality remain high (Figure 1.4). The COVID-19 pandemic has significantly impacted Costa Rica, with the global economic slowdown and the necessary containment measures hampering growth prospects and fiscal accounts.

Responding successfully to these substantial challenges will hinge on buttressing the fiscal framework and implementing reforms to foster inclusive growth. Despite a complex political environment, there has been a significant cross-party consensus in Congress on the reform agenda linked to the OECD accession process. Reform momentum in the last 18 months has been extraordinary, as a significant number of legal initiatives linked to OECD accession have been finalised (Box 1.1). Full implementation of this wide-ranging effort to improve legal frameworks and bring them closer to best standards will be key to boost growth and well-being. OECD estimates suggest that GDP per capita could rise by 15% in 10 years (Table 1.2). The largest benefits stem from improving the competition framework. Maintaining the reform momentum and undertaking additional key reforms, as identified in this Economic Survey, could increase GDP per capita by an additional 13 percentage points (Table 1.3). Reforms would also contribute to reduce income inequality significantly (Table 1.4). These reforms would also facilitate the recovery from the COVID-19 shock and improve resilience to possible future shocks. Communicating clearly that the reforms would help to share the benefits of growth more widely among Costa Ricans would help to overcome political economy barriers to their implementation. The special OECD committee in the Legislative Assembly, key to facilitate recent reforms, can play a fundamental role to maintain the reform momentum.

Against this background, the main messages of the Survey are:

In the short term, addressing the coronavirus outbreak is the overarching priority. Additional health spending and providing temporary cash and liquidity support to households and firms help to mitigate the economic and social impact of the pandemic and long-term damages.

Full and timely implementation of the fiscal reform is critical to restore medium-term fiscal sustainability, ensure macroeconomic stability and set the basis for higher incomes and wider spread improvements in living standards.

Extending the benefits of growth to all Costa Ricans will require improving public spending efficiency to maximise the impact of key policies such as education, reducing informality and increasing female labour market participation.

Putting Costa Rica on a path to stronger growth requires boosting productivity by adopting structural reforms to streamline regulations and maintaining the commitments to trade, foreign direct investment and natural resources preservation.

Fiscal reform law: Introduces a fiscal rule, creates a VAT and two new income brackets in the personal income tax scheme and reduces earmarking (Box 1.4).

Central Bank Organic Law: Strengthens the independence of the Central Bank (Table 1.8).

Amendment to Free Trade Zone Regime Law: Eliminates restriction of local sales in services, to adhere with OECD’s Action Plan to Prevent Base Erosion and Profit Shifting.

National Statistics System Law: The regulatory framework was updated to achieve best international practices in the production of statistics.

Liability of legal persons for committing domestic and foreign bribery: The law establishes the criminal liability of legal persons on domestic and transnational briberies, and other crimes related to corruption.

Law to remove Minister of Environment from the Board of the Costa Rican Petroleum Refinery: Strengthen the corporate governance of the state-owned enterprise.

Branching of Foreign Banks: This law proposes to allow foreign banks to choose how to establish in Costa Rica (either through a subsidiary or a branch) with equal rights and obligations.

Strengthening of the Competition Authorities: Strengthens the country’s competition framework, grants more independence and resources to one of the competition authorities (COPROCOM) and reduces the scope of exemptions from competition law (chapter 2).

Amendment to the Securities Market Regulatory Law: The law enables the exchange of information between the financial authorities and with supervisory bodies of other countries, the access of the General Superintendence of Securities (SUGEVAL) to the information on beneficial ownership, strengthens accounting regulations and creates a legal protection regime for the officials that execute the supervision work.

Consolidated supervision: This law aims to strengthen the legal capacities of the supervisor by allowing the issuance of prudential regulation and enabling monitoring risk exposures of the entities and companies that together create a Costa Rican financial group, regardless of the territory of activity.

Deposit insurance and resolution regime: Establishes a deposit insurance scheme covering all banks, and sets out a comprehensive resolution regime.

The economy is contracting due to the coronavirus outbreak

The COVID-19 is having a significant impact on Costa Rica, although the hit is less severe than in other countries in the region. The authorities have taken timely and well-targeted measures. Prompt containment measures helped to flatten the infection curve, while well-targeted economic measures are helping to mitigate the economic and social impact of the crisis (Box 1.2). The propagation of the virus started in early March and accelerated in April. Following a slowdown in early May, the number of cases have sharply increased since late May. The authorities announced in mid-May an exit strategy that aims to gradually phase out confinement measures, depending on the evolution of the pandemic. Looking forward, boosting testing and tracing capabilities and preparing the health system for increases in healthcare demand are important priorities.

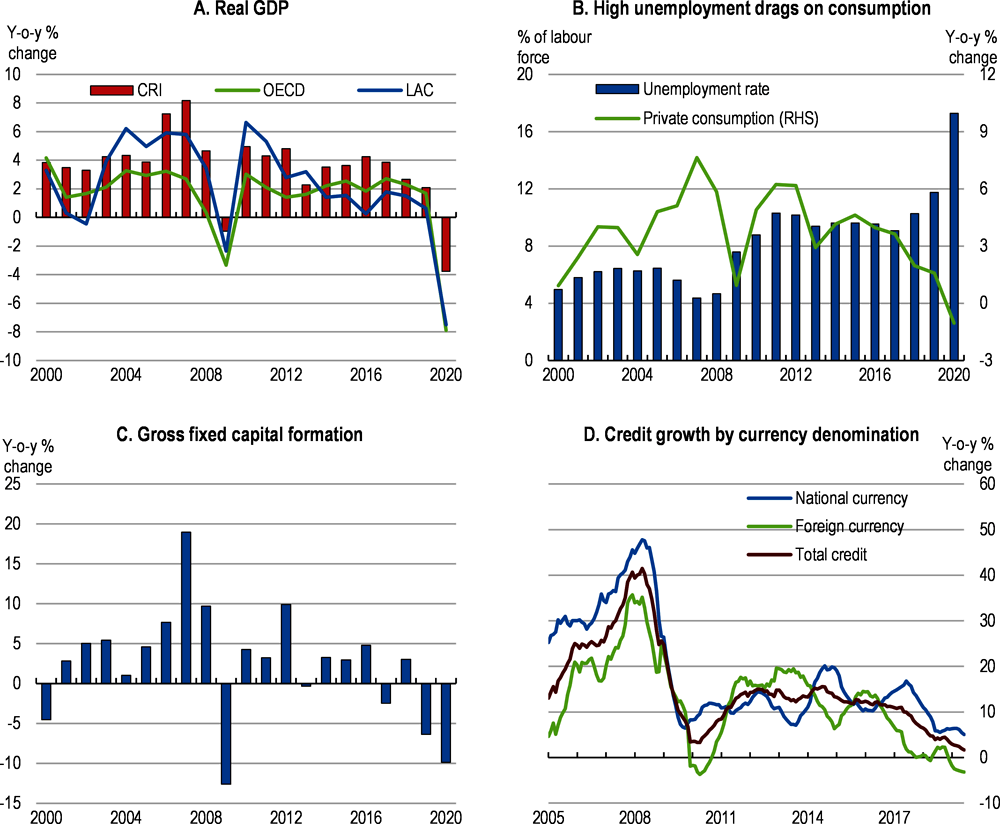

Prior to the pandemic, macroeconomic conditions were stable and the economy was expected to grow slightly above 2% in 2020. The global economic downturn triggered by the pandemic, coupled with the necessary containment measures, are taking a significant toll on the economy (Figure 1.5).The estimated initial output loss from the confinement measures in the first half of the year could reach 22%. Tourism exports have collapsed, following border closures and travel restrictions in source countries. Conversely, services in the information and telecommunications sector remain relatively dynamic. The unemployment rate is increasing, eroding consumer confidence. Around 7 100 companies, employing more than 8% of all workers, have applied to the temporary work scheme introduced by the government, which allows distressed firms to proportionally reduce working hours and salaries. Prior to the COVID-19 shock, business confidence, hampered by uncertainty surrounding the fiscal situation, and credit growth were subdued. Investment has further weakened, hit by disruptions in global value chains.

Containment measures

A state of national emergency was declared on Monday 16th March.

Recreational areas, schools and universities have been closed (conditional cash transfers are maintained).

As of 18 March only Costa Ricans and residents in Costa Rica can enter the country but will be placed in quarantine for two weeks. Restrictions on foreign residents are imposed when leaving the country.

Teleworking has been strongly encouraged and private vehicle traffic restricted.

Individuals at risk are asked to implement social distance measures.

Restaurants, bars and cinemas should operate at 50% of capacity.

Easter week activities have been cancelled.

A four-stage exit strategy was announced in mid-May to gradually phase out confinement measures until August, assuming that the pandemic will subside by then.

Economic measures

The following measures have been implemented:

The Central Bank reduced the monetary policy rate by 150 basis points to 0.75%.

Temporary adjustments to prudential regulations to create space for the reprofiling of credit repayments. In particular, it becomes possible to renegotiate twice in a 24-month period the agreed conditions of loans, without these being considered a special operation and having negative effects on the risk rating of debtors.

Temporary reduction of countercyclical provisions by banks.

Change in minimum reserve requirement regulations to provide greater flexibility to financial intermediaries to manage their liquidity.

Three-month moratorium on the payment of Value Added Tax, Income Tax and customs duties, all for formally constituted companies.

Collection of social security contributions for the time actually worked, in addition to deferring the payment of social security contributions.

Public banks will be asked to reschedule loan repayments, including a possible moratorium on the payment of principal and / or interest for three extendable months, particularly for the most affected sectors.

A preferential rate for occupational risk insurance for companies with less than 30 workers.

Authorizing a new insurance product for tourists coming to Costa Rica.

Four month moratorium by the Costa Rican Tourism institution to companies owing taxes to the institution.

Direct cash transfer programme (Bono Proteger), targeted at those who lost their job or faced reduced working hours, including those in the informal sector.

Short-term jobs retention scheme, allowing to reduce worker hours (by up to 50%) for companies that report annualised income losses between 60% and 75%. The scheme was applied during the second quarter of 2020 and can be extended for three more months.

Provision of delivery of food and home care for 15 thousand senior citizens.

Costa Rica’s current account deficit has remained comfortably financed by foreign direct investment (Figure 1.6). Total external debt has increased (Figure 1.7), reaching 49% of GDP and is expected to continue rising over the medium term owing to planned external public debt issuances. This suggests that Costa Rica’s exposure to global financial conditions, capital flow reversals and exchange risks is increasing. International reserves, on the other hand, had increased to 14% of GDP, covering 8 months of imports prior to the COVID-19 shock. The fall in tourism receipts and other exports triggered by the shock, together with an expected deceleration of direct investment inflows, will imply a significant balance of payments financing gap, which is estimated to reach 2.5% of GDP (IMF, 2020[4]). The authorities have promptly reacted and secured financial assistance from the IMF and other multilateral organisations to fill this gap, which allows also to keep reserves at adequate levels.

As a small open economy, Costa Rica is highly exposed to the global economic effects of the coronavirus. The main transmission channels are trade and tourism. The Costa Rican economy is hampered by logistics delays in obtaining supplies, less foreign demand for goods and services and a drop in tourism. The fall in tourism will particularly impact Costa Rica, as the direct contribution of tourism to GDP amounts to 6%. Domestic demand will also weaken, as containment measures implemented in Costa Rica impact consumption and investment. Mitigating and upside factors are the significant fall in oil prices and the diversification of the economy. The impact on the growth outlook will depend on the degree of the spread of the virus in Costa Rica and the severity of the global economy recession.

In a scenario of the pandemic subsiding after the first outbreak, Costa Rica would experience a recession in 2020 (Table 1.5), as would the global economy. A gradual resumption of tourism and other exports would support a gradual recovery in 2021, although they would remain below pre-pandemic levels for some time.

In a scenario of a second outbreak of the virus in the last part of the year, containment measures would need to be reintroduced and the impact on domestic demand would be more protracted. Tourism firms would continue to operate below capacity and the rebound in 2021 would be softer. Additional spending needs, such as in health, may arise. Accessing financial support by international financial organisations could help to provide needed support to those more affected and facilitate an orderly recovery.

The main downside risk to these projections is a failure or delay in implementing the fiscal reform and lowering the headline budget deficit once the economy recovers, which would curb investor confidence and put pressure on fiscal and financial stability. A weaker-than-expected global recovery is also a downside risk to the exports outlook. Spillovers from financial volatility in emerging economies also present risks. On the upside, the positive effects of the already implemented structural reforms on investment and growth might turn out larger than anticipated. The economy may also face additional unpredictable shocks, whose effects are difficult to factor into the projections (Table 1.6).

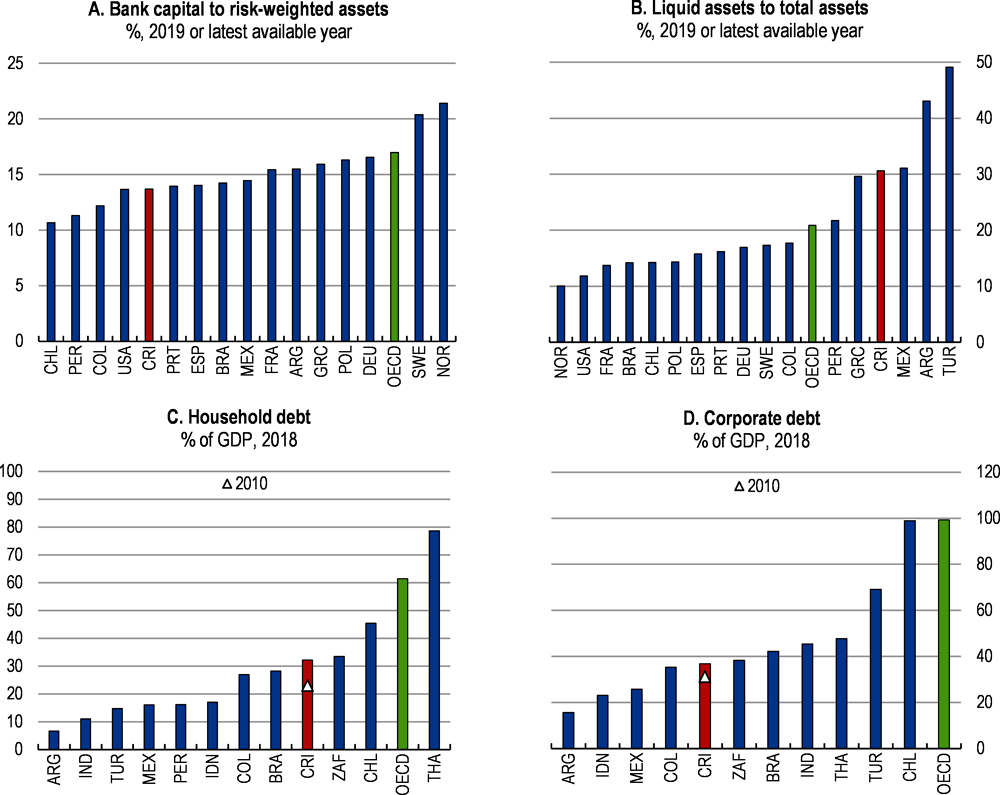

Enhancing financial resilience

The authorities have appropriately put in place an array of regulatory actions (Box 1.2) with the aim of easing credit and liquidity conditions for households and firms and avoiding that the economic disruptions associated with the pandemic hamper financial stability. The authorities consider banks to be liquid and well capitalised according to standard metrics (Figure 1.8). Asset quality has been resilient through 2019 (Fitch, 2019[5]). Weaker economic activity has translated into increasing non-performing loans, reaching 3% at end-2018, a low rate in international perspective. The ongoing recession will likely trigger additional increases in non-performing loans, in particular in the most affected sectors. Latest stress tests, run by the IMF prior to the pandemic outbreak, suggest that banks would remain well capitalised even under the adverse scenario of a combined shock consisting of a large increase in non-performing loans, an increase in interest rates and a significant foreign exchange depreciation. Household and corporate indebtedness levels have increased but remain comparable to other countries in the region. The increase in household borrowing has been particularly sharp in the last decade, with borrowing in local currency growing by 8% of GDP and borrowing in dollars by 3% (IMF, 2019[6]). Actual indebtedness is likely to be larger, as loans by non-supervised creditors are not included in official statistics. To reduce excessive household leverage, the government launched in October 2019 a debt exchange programme (Crédito de Salvamento) for highly indebted workers, which requires state-owned banks to extend loan maturities and to lower interest rates (chapter 3). This initiative is likely to hamper state-owned banks’ performance and already low profitability and should be carefully monitored and evaluated, as it can trigger additional contingent liabilities. Introducing a personal bankruptcy scheme, as done by many OECD countries, would be a better solution to provide relief and fresh start opportunities. Strengthening the credit registry office and financial education can help to contain excessive borrowing in the first place.

The Costa Rican banking sector remains highly concentrated (OECD, 2018[7]). Three public banks control around 60% of assets, while the rest is controlled by nine foreign private banks and two domestic private banks. Credit cooperatives account for around 10% of the assets of the financial sector. Bank profitability remains low (OECD, 2018[7]); (IMF, 2019[6]). A number of distortions and regulatory asymmetries hamper both public and private banks, as described in previous OECD Economic Surveys (OECD, 2018[7]).

A key distortion concerns deposit insurance. So far, only deposits in state-owned banks enjoy a guarantee. In line with previous recommendations (Table 1.7), and also in line with practice in almost all OECD countries, a bill introducing a deposit insurance scheme, covering both state-owned and private banks, was approved by the Legislative Assembly on February 2020. The scheme would guarantee deposits up to USD 10 000 (covering 96% of deposits, according to Central Bank estimates) and would streamline bank resolution processes. According to the bill, both state-owned and private banks will contribute to the insurance fund. Contributions by public and private banks would go initially to different compartments, but the bill allows eventual changes in its design without the need of additional legislative change. This is important as pooling eventually the compartments would boost risk-sharing and financial stability (Schoenmaker, 2018[8]).

Even with the deposit insurance covering public banks, Costa Rica continues to be subject to large and systemic risks of “doom loop”, as state-owned banks have large asset exposures to the sovereign debt market and to state-owned enterprises and the existing state bank blanket guarantee covers not only deposits but all financial instruments, with the exception of subordinated debt. Internationally, blanket guarantees to the banking system tend to be triggered at times of systemic financial crisis but are not in place permanently, as they entail sizeable contingent liabilities, diminish the monitoring incentives for investors and encourage increased risk-taking by banks (so-called moral hazard). Once the deposit insurance scheme is in place, Costa Rica should also plan to phase out the existing blanket guarantee.

Beyond the deposit insurance, other key distortions are the obligation for private banks to lend 17% of their deposits to a development credit fund managed by state banks and mandatory contributions imposed on state-owned enterprises, which amount to 63% of state-owned earnings. Conversely, public banks benefit from the obligation for public institutions to deposit their local currency funds in state-owned banks. All these asymmetrical regulations fragment the Costa Rican banking market, hamper public and private banks’ efficiency, limit competition and translate into interest rate spreads higher than in OECD countries (Figure 1.9). Gradually phasing out these asymmetries would ultimately help Costa Rican firms and households to access more credit and at better terms.

Financial dollarisation has fallen but remains high (Figure 1.10). Both credit and deposits dollarisation are around 40%. According to authorities’ estimates, two-thirds of the dollarised debt in Costa Rica is unhedged. In June 2018, provisions for granting foreign exchange loans to non-dollar earners were reduced (IMF, 2019[6]). This measure should be undone to avoid building up even higher vulnerabilities in the form of unhedged foreign exchange lending positions. The Central Bank recently introduced a lower reserve requirement for liabilities in local currency, which has the potential to reduce dollarisation over time.

Past bank failures, including in two state-owned banks, argue for close supervision. In line with OECD recommendations, supervision has been recently strengthened. The supervisor, SUGEF, got stronger sanctioning powers and its supervisory perimeter was extended. According to the Central Bank and the financial supervisor, stress tests indicate that the banking system is sufficiently well capitalised to absorb sizable shocks. Individual stress tests are not published, contrary to practices in most OECD countries (Box 1.3) and recommendations in the 2016 and 2018 OECD economic Surveys (Table 1.7). This limits the effectiveness and usefulness of the exercise, especially when individual banks have private knowledge of their capital adequacy (Goldstein and Leitner, 2018[9]). A quicker implementation of the roadmap to move to Basel III, as recommended in previous Economic Surveys and, in line with other countries in the region, would buttress financial stability further.

Disclosing stress test results is optimal from a welfare point of view when there is bank opaqueness (Goldstein and Leitner, 2018[10]). Recent experience shows that markets have been unable to anticipate stress tests results due to the existence of private knowledge by banks (Petrella and Resti, 2013[11]). Taking that into account, 24 OECD member countries disclose individual bank stress test results. In Europe, stress tests are assessed and disclosed simultaneously by the European Central Bank and the European Banking Association. Supervisory authorities or central banks in 8 other member countries, such as Chile and Mexico, report detailed stress test results at the aggregate level. In some country cases, some disaggregation is introduced, dividing the system into clusters of different regions or bank sizes (e.g. Japan). Two countries (Switzerland and Turkey) only summarise aggregate results and two do not disclose.

Sources: European Central Bank, European Banking Authority and country sources including financial supervisory institutions and central banks.

Macroeconomic policies have improved but the fiscal framework should be reinforced

Both prompt monetary and fiscal measures have been put in place, aiming at supporting credit, liquidity, providing needed resources in the health system and supporting those hit by the pandemic (Box 1.2). Prior the COVID-19 outbreak, Costa Rica had taken significant steps to improve its macroeconomic framework by strengthening the independence of the Central Bank and improving its fiscal framework (Table 1.8). Looking ahead, Costa Rica would benefit from fully complying with the fiscal commitments established, and from taking additional measures to buttress the fiscal framework. Experiences in other countries in the region, as Mexico (OECD, 2019[12]), Chile (OECD, 2018[13]) or Colombia (OECD, 2019[14]), attest that keeping sound macroeconomic policies over time is fundamental to build up reputation and boost trust, protecting the country in case of financial turbulences and, ultimately, translating into better financing conditions in global markets.

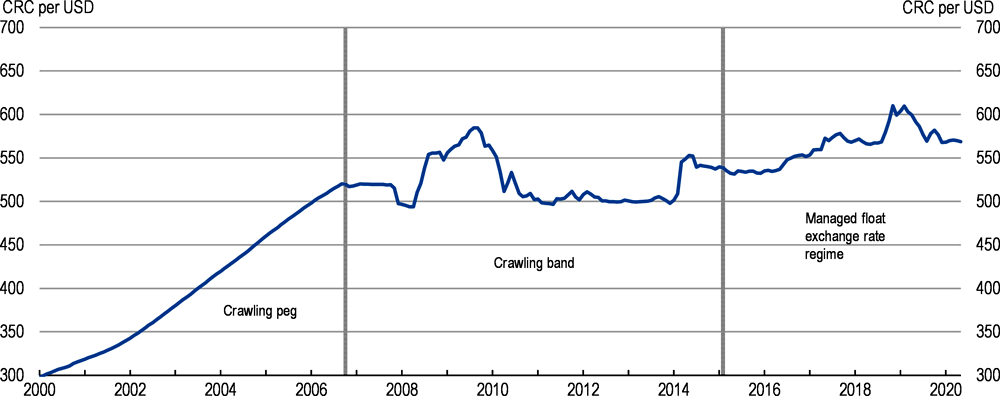

Monetary policy has improved

Costa Rica has improved its inflation targeting framework, in line with previous Economic Surveys recommendations (Table 1.8); OECD, (2018[7]). The Central Bank has also shown a stronger commitment towards exchange rate flexibility (IMF, 2019[6]); (Figure 1.11). Exchange rate interventions have become more limited and aimed at addressing episodes of large exchange rate volatility. The Central Bank has recently started to announce the yearly calendar of monetary policy meetings in advance, in line with practices in most OECD countries. The Central Bank has joined the Central Banks and Supervisors Network for Greening the Financial System, aiming at enhancing environment and climate risk management in the financial sector and mobilising finance to support the transition toward a sustainable economy.

Headline inflation remained within the official target range of 2-4% during 2018 (Figure 1.12), and started to decelerate in 2019, falling below the 2% target floor, as the economy weakened. In response, the Central Bank gradually, and appropriately, reduced the policy interest rate during 2019. The new value-added tax, introduced in July 2019, induced a pick-up in inflation, which is expected to be transitory. The central bank has cut interest rates by 150 basis points as response to the coronavirus outbreak. Going forward, monetary policy should be ready to ease further to support the economy during the coronavirus outbreak and support liquidity conditions as required.

Recent improvements in the inflation targeting framework are hampered by a weak transmission of changes in policy rates to real economy financing conditions. The authorities estimate that the pass-through from policy interest rate to market rates is of around 70%. The transmission of monetary policy is hampered by the lack of competition in the banking sector and by the high financial dollarisation. International experience shows that large currency mismatches can cause monetary policy to be more attentive to exchange rate fluctuations and hinder countercyclical monetary policy (Mimir and Sunel, 2019[15]). In this sense, policy efforts to de-dollarise the financial system, for example by tightening prudential regulation for unhedged borrowers, would allow for a more floating exchange rate without building up unhedged currency risks. In turn, increasing exchange rate flexibility would favour that economic agents internalise exchange rate fluctuations, helping to curb dollarisation.

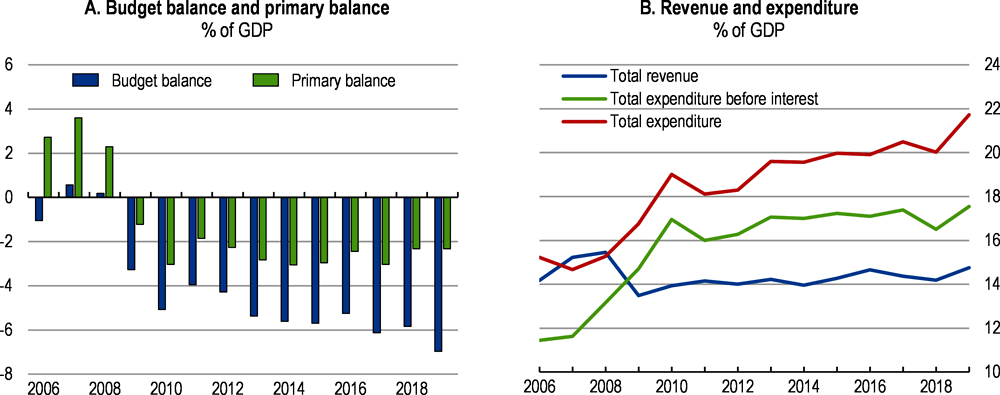

The fiscal deficit and the public debt were high and increasing even before the COVID-19 shock

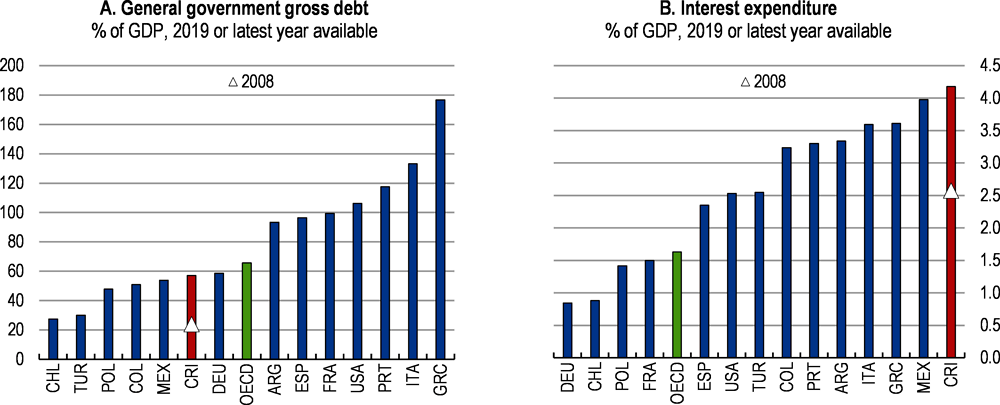

Costa Rica’s fiscal situation deteriorated significantly in the last decade, with the overall balance moving from a 0.6% surplus in 2007 to a 7% deficit in 2019 (Figure 1.13). In tandem, public debt has more than doubled, jumping from 28% in GDP in 2008 to almost 60% of GDP in 2019. The Costa Rican government has taken fundamental steps to address the growing fiscal imbalances. A historic fiscal reform law (Box 1.4) was approved in December 2018, after two decades in the works, and under a complex social situation, including a three-month public sector strike. A critical element in the reform is the introduction of a fiscal rule that ties down gradually the growth of current spending.

The main elements on the revenue side are:

The sales tax is transformed into a value-added tax, covering previously untaxed services. The standard rate is 13%. There are three reduced rates:

4% on airfares and private healthcare services (if paid by credit or debit card, healthcare is exempted).

2% on private education, medicines and insurance premiums.

1% on basic domestic essentials.

Two new personal income tax brackets for top earners, at 20% and 25%.

Capital gains starts to be taxed at 15%.

A tax amnesty, finished three months after the approval of the law.

On the spending side, the fiscal reform focuses on public employment in central government and decentralised institutions:

Establish limits for public wages.

Establish that some incentives will be defined in fixed nominal terms rather than as proportion of the salary.

Strengthen the eligibility criteria for some incentives for public workers.

The Planning Ministry becomes the steering body for public employment issues.

The law also reduced the scope of mandated spending. When central government debt exceeds 50% of GDP, the Ministry of Finance is entitled to reallocate spending from specific legal destinations, taking into account revenues and the level of budgetary execution and the fiscal balance of beneficiary entities.

The reform also introduced a fiscal rule limiting the growth of nominal spending depending on the level of public debt, as follows:

When the debt at the end of the previous fiscal year is under 30% of GDP or the current expenditure-to-GDP ratio is below 17%, the annual growth of current expenditure should not exceed the average nominal GDP growth in the past four years.

When the debt at the end of the previous fiscal year is between 30% and 45% of GDP, the annual growth of current expenditure should not exceed 85% of the average nominal GDP growth in the past four years,

When the debt at the end of the previous fiscal year is between 45% and 60% of GDP, the annual growth of current expenditure should not exceed 75% of the average nominal GDP growth in the past four years.

When the debt at the end of the previous fiscal year is above 60% of GDP, the annual growth of total expenditure should not exceed 65% of the average nominal GDP growth in the past four years.

The law establishes that the spending of all non-financial entities of the public sector are subject to the rule. This includes the central government, all deconcentrated bodies, the legislature, the judiciary, local governments or non-financial public companies. Exceptions are the Costa Rican Social Security Fund (CCSS), concerning the resources of the contributory pension regime (IVM regime) and the non-contributory regime, the Costa Rican Refinery of Oil (Recope), concerning the oil bill and state-owned enterprises, concerning the part of their activities subject to competition.

The Finance Ministry is in charge of ensuring that the formulation of the budget for central government and deconcentrated bodies is compliant with the fiscal rule. For the central government, the General Comptroller will verify during the budget approval phase that the budget is in line with the law. Once the fiscal year is over, the General Comptroller will also verify if the fiscal rule has been met. The independent fiscal council will also make an assessment on this. A final report on compliance will be delivered to the General Comptroller Office in April of the following year and published on the website of the Ministry of Finance. The General Comptroller Office will verify that the budget of state-owned enterprises is in accordance with the law.

The government estimates that the total fiscal impact of the fiscal reform is 4% of GDP (Table 1.9). Measures on the spending side account for around 65% of the fiscal adjustment. This would limit reform’s impact on growth, as spending adjustments tend to have a lower impact on growth, particularly in Costa Rica (World Bank, 2019[16]). A significant part of the adjustment implies reducing public workers salary bonuses, which will reduce income inequality, as these workers are in the highest percentiles of the income distribution in Costa Rica. By reducing the need of domestic savings to finance the public deficit, the reform will also have a positive effect on private investment, as it will reduce crowding-out effects.

The main elements of the reform have already entered into effect. As of July 2019, the existing sales tax has been transformed into a value-added tax and Budget 2020 is the first budget subject to the fiscal rule. Preliminary data for 2019 show that revenues increased by 0.6 percentage points in 2019, thanks to the new VAT and one-offs, such as the tax amnesty (Table 1.10). However, these exceptional revenues were not sufficient to offset increases in the interest bill, capital spending and transfers. The latter were expected to remain constant, according to Budget 2020, but finally increased by 0.3 percentage points. Hence, the headline deficit widened to 7% of GDP in 2019, from 5.8% in 2018. This is the highest deficit in the last 30 years, and 0.6 percentage points higher than anticipated by the government when Budget 2020 was published. The primary deficit also increased, contrary to expectations in Budget 2020, due to higher than foreseen capital spending. The authorities announced on 10 February a complementary fiscal package. The package included a set of measures to reduce public debt, such as the sale of two state-owned enterprises, one of them being the overseas subsidiary of a public bank, and financial surpluses of decentralized public entities. This is expected to reduce public debt by 2% of GDP. It also includes additional measures to boost revenues and reduce spending, such as modernising tax collection, removing tax exemptions and merging public agencies.

The deficit will continue to increase in 2020, pushed by fiscal measures taken to mitigate the impact of the pandemic and lower revenues due to the recession. Looking forward, the government expects the headline deficit will decline gradually as of 2021, as the gradual adjustment in primary current spending implied by the fiscal rule more than offsets increases in interest and capital spending, and revenues increase significantly as of 2021. The authorities expect that the primary deficit will get to zero in 2022. Assets sales would also contribute significantly to reduce the stock of debt up to 2023. Measures underlying the increase in revenues, the containment in spending and the reduction of public debt are subject to uncertainty about its size, composition and time horizon, as most of these measures require approval by the Legislative Assembly.

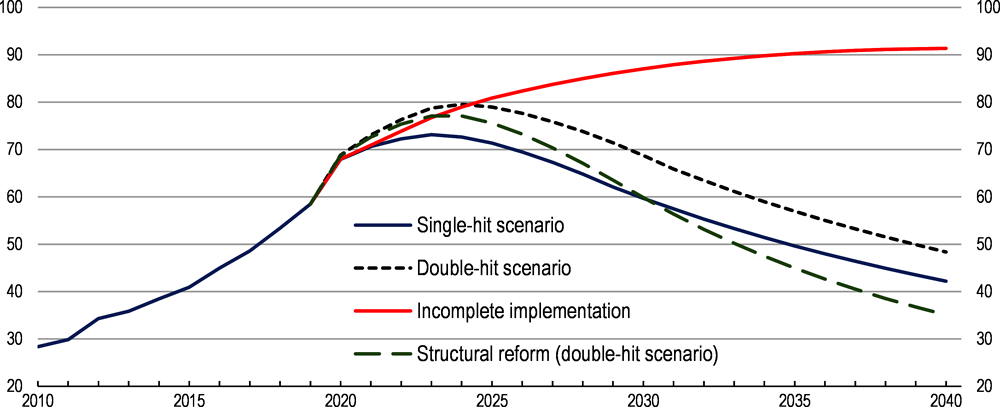

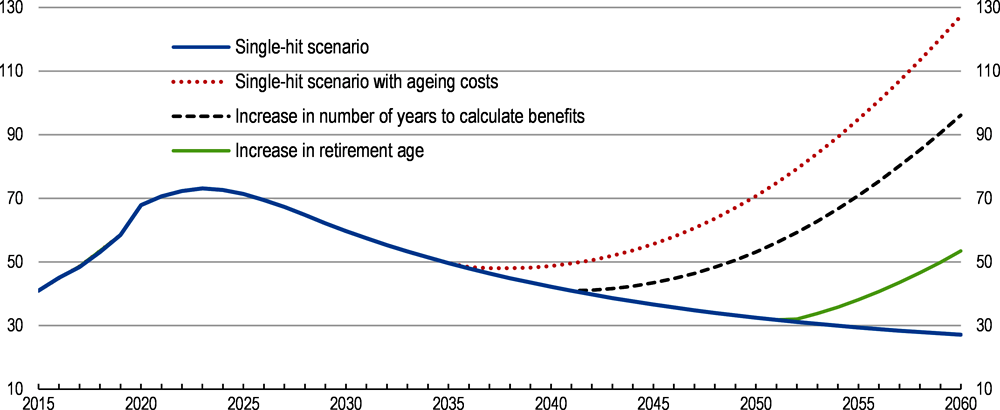

The government’s fiscal plans seek to strike a delicate balance between the critical need to improve debt sustainability in an environment of weak economic growth and the need to preserve spending in key social areas. Debt simulations suggest that current government plans would halt the increase in public debt, which would peak at around 73% of GDP in 2023 if the pandemic remains under control after the first outbreak (Figure 1.4). If there is a second wave, debt would peak at around 80% of GDP in 2024. These simulations assume that the Finance Ministry’s fiscal plan up to 2025 is met and that there is full compliance with the fiscal rule thereafter. However, the trajectory is very sensitive to the implementation of the fiscal reform. In a scenario with spending growing above the limits established by the fiscal rule, the debt ratio will continue to rise without bounds. An ambitious reform scenario, boosting potential output as described in Table 1.2 and Table 1.3, would put debt below 50% earlier, even in the double-hit scenario.

These debt simulations suggest that Costa Rica’s fiscal situation remains challenging, making Costa Rica vulnerable to possible shocks, such as a further tightening of global financial conditions or additional volatility in emerging markets. Costa Rica’s room to increase capital spending remains also constrained. The implementation of the other planned revenue and expenditure measures, along with the asset sales, would be fundamental to put the debt on a declining path. Continuing with the ongoing reform agenda is also critical to improve the fiscal situation in the uncertain and complex current environment.

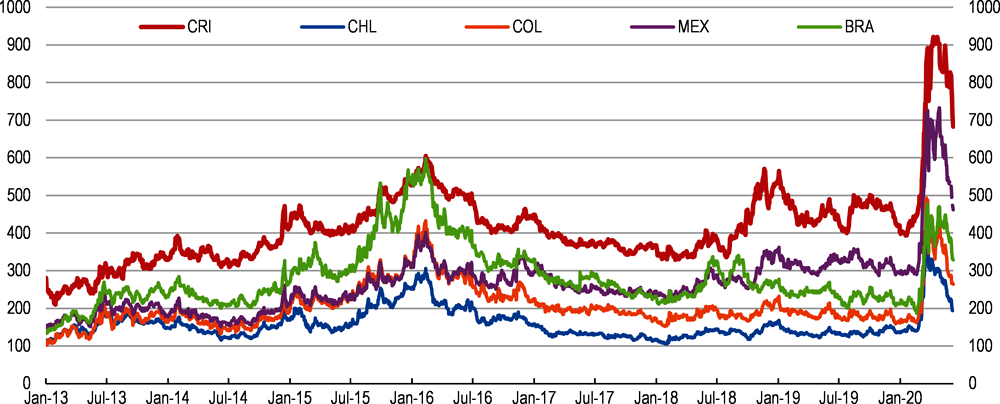

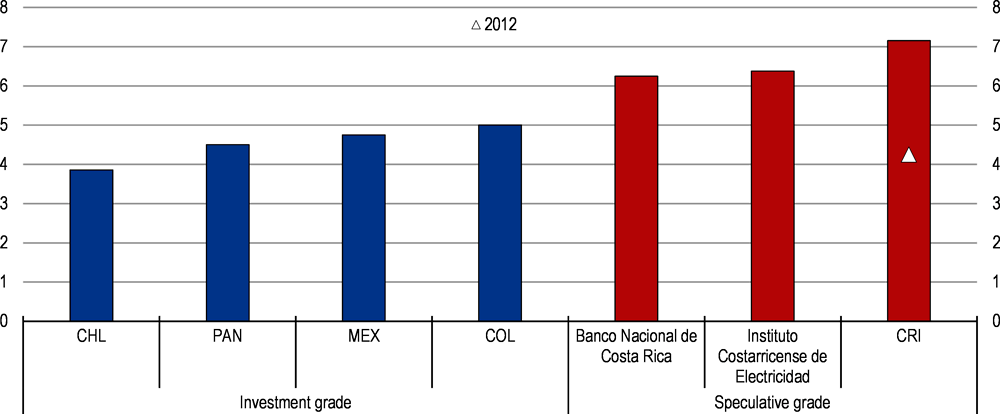

Debt simulations also highlight that full compliance with the fiscal rule, is critical. The authorities have appropriately and temporarily activated the emergency escape clause in the fiscal rule for health-related institutions. Maintaining income support payments as long as confinement measures weigh on jobs and household earnings would help to mitigate the social impact of the pandemic. However, it is vital to ensure that the fiscal responses to the COVID-19 shock are temporary and well targeted. Once the recovery is underway, it will remain particularly critical that the growth of nominal spending is put on a steady declining path, as advocated by the fiscal rule. Implementation of the fiscal rule has met significant opposition and legal challenges from different segments of the public sector, such as municipalities, the judiciary and the university sector. There have also been different understandings on whether fiscal rule calculations should be based on budgeted spending or on executed spending (CGR, 2019[17]). It is fundamental that all existing uncertainties concerning how to apply the rule and its scope are resolved univocally as soon as possible, and without creating exceptions, which would undermine the fiscal rule’s credibility and feeling of ownership among public sector institutions and citizens. Costa Rica could also consider enshrining the fiscal rule in the Constitution, as done by several OECD countries, as this can foster compliance and provide a useful counterweight to other items which appear in the Constitution and have fiscal implications, such as mandated spending in some areas. Sovereign risk premia in Costa Rica continue to be higher than in other Latin American countries (Figure 1.15). International experience shows that it is only through continuous and unequivocal compliance with the rule that trust in public finances increases, boosting confidence and ultimately reducing sovereign risk premia and financing costs. As in other Latin American countries, risk premia increased by around 500 basis points last March. If they remain at the current level, meeting sizeable financing needs in 2021, which will reach 15% of GDP, would be challenging. Costa Rica has initiated talks with multilateral financing institutions to access their lending facilities, which would supplement the multilateral financing already secured for 2020.

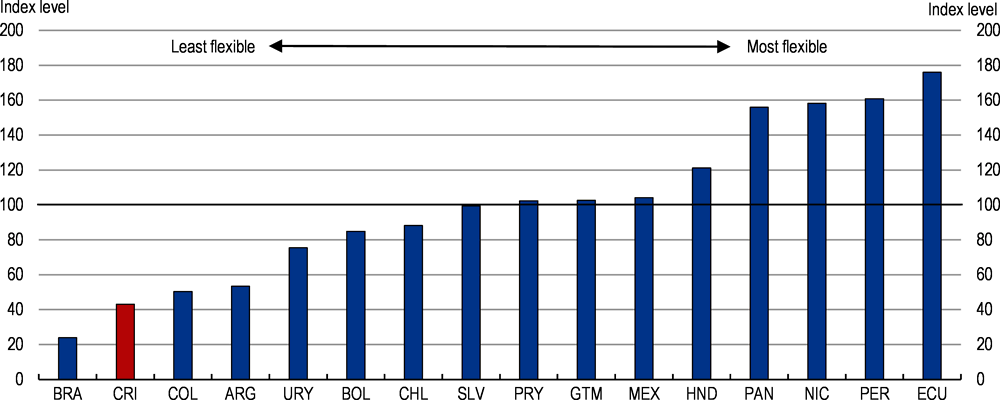

The fiscal reform has removed significant revenue-earmarking provisions introduced over the years. The Finance Ministry can now reallocate spending away from legally mandated destinations when public debt exceeds 50% of GDP, with the exception of areas mandated by the Constitution, such as public education and the judiciary. Following recommendations in previous Economic Surveys, the fiscal reform expanded the definition of the public education sector by including early education centres and vocational education, which should mitigate their effect in the budget. In 2020, total spending in education, including teachers pensions, will amount to 9% (MFPMP, 2019[18]), already above the 8% mandated by the constitution. Overall, the government’s ability to allocate budget spending to changing needs remains limited (Figure 1.16). In addition to remaining earmarking, current transfers that are not earmarked cannot be reduced below the nominal level of the previous fiscal year, and the growing interest rate bill also increasingly restrains the government’s ability to manage spending. Further efforts to increase spending flexibility are warranted. Allowing that all spending categories can be adjusted when the public debt exceeds 50% of GDP, would help the authorities to respond more swiftly to current and future fiscal challenges.

The need to meet the fiscal rule, together with the need to reduce inequality and boost growth, makes improving the efficiency of public spending a fundamental and social challenge. Public spending is on an increasing trend since 2008, but these increases have not been matched by an improvement in performance or outcomes.

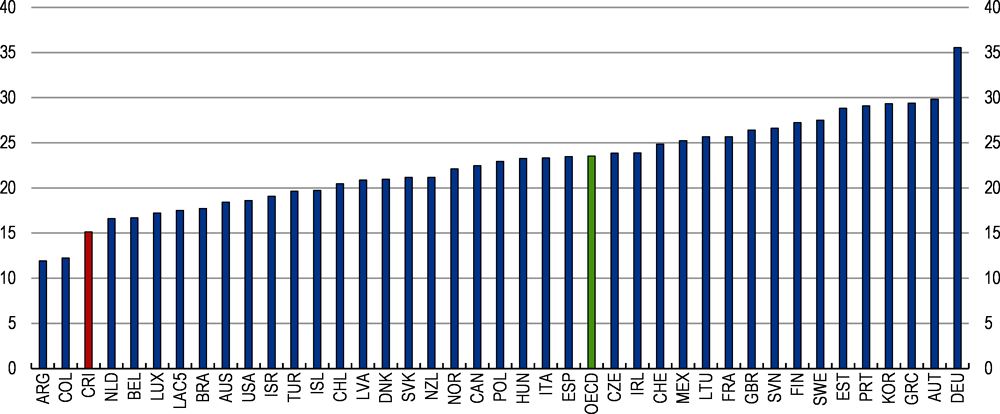

A first priority area for reform is public sector employment, as compensation of government employees accounts for more than half of total revenues (Figure 1.17), the largest share in OECD countries and more than double the OECD average. Public salaries are also almost 50% higher than in the private sector, after controlling for employees’ characteristics (World Bank, 2019[16]).

High public sector remuneration comes from a highly fragmented compensation scheme. This is the result of a combination of numerous allowances and incentives, which vary from one employee to the next, and a multiplicity of interrelated collective agreements and legislations, which tie increases in the salary of one group to another (OECD, 2015[19]). For instance, the base salary of employees on the Civil Service regime can be complemented by more than 20 different incentives, including seniority pay and bonuses (OECD, 2017[20]).

Deconcentrated entities, such as the Costa Rican Department of Social Security, enjoy a high degree of autonomy over their pay policy and have the largest share of additional pay benefits in compensation, amounting to 46%. There are also large differences in additional pay components within the same institutional category. In total there are up to 260 additional pay benefits across all institutions, according to General Comptroller’s inventory. This results in large differences within the same job category, which can reach more than 600% in some cases (OECD, 2017[20]).

This makes public employee remuneration overly complex, opaque, and extremely difficult to control. It has also made the largest contribution to income inequality (González Pandiella and Gabriel, 2017[3]) and hampers staff morale and public sector performance. Measures included in the fiscal reform are a first step to rationalise the remuneration of public employment. The government has expressed strong commitment to a more comprehensive public sector reform and a reform bill is under the discussion in the legislative assembly. Introducing a single salary scheme, with equal pay scales for the same functions across the public sector, would improve transparency. Streamlining incentives and bonuses and making them performance-based would provide a more equitable remuneration scheme. It would also facilitate management and control over the wage bill, while maintaining competitive remuneration schemes, as exemplified by the Central Bank and the General Comptroller, who implemented a single salary scheme in 1998 and 2007 respectively. Full implementation of the recently approved decree on general performance, which establishes clearer guidelines for performance evaluation, would set the basis for a fairer and more efficient remuneration scheme.

A second priority area to improve efficiency constitutes public sector reform. Costa Rica’s public administration is highly fragmented into a large number of decentralised bodies and public corporations, with more than 100 new public sector institutions created since the 1990s (OECD, 2017[20]). This high fragmentation is combined with limited coordination, steering and accountability, resulting in duplications, unclear assignment of responsibilities and lack of leadership in some policy areas (OECD, 2018[7]).

A thorough review of the public sector is needed to boost public sector efficiency and central government’s ability to reallocate funds to priority areas. Previous studies already identified that a large number of public institutions are non-functional (OECD, 2018[7]). The authorities are in the process of delineating a strategy to reduce duplications and boost public sector efficiency, which will result in a law to be submitted to the Legislative Assembly. Efforts to identify responsibilities of each government body and to eliminate duplications and non-functional bodies would set the basis for a more efficient public sector. First steps in this direction have been taken, including the decision to close one agency and restructure another one. Developing clearer steering and control mechanisms is also needed to increase accountability towards central government and citizens.

A third priority to improve spending efficiency is public procurement. The share of public spending subject to public procurement in Costa Rica is low (Figure 1.18). Boosting public procurement can generate significant fiscal savings (World Bank, 2019[16]); (OECD, 2020[21]). E-procurement and centralised purchasing are valuable tools to boost public spending efficiency. E-procurement decreases the administrative burden for both contracting the authorities and tenderers and improves access by firms to procurement opportunities. Costa Rica implemented the electronic public procurement system (SICOP) and its use became mandatory in 2016. However, SICOP’s uptake is still relatively limited, as about 20% of public entities are not yet using it as of May 2019 (Radiográfica Costarricense, 2019[22]), suggesting that there is room to boost public sector efficiency by continuing the uptake of e-procurement.

Centralised purchasing has been a major driver of the performance of public procurement systems in many OECD countries, such as Finland (OECD, 2019[23]) or Korea (OECD, 2016[24]). Indeed, the benefits of centralised purchasing activities – such as better prices through economies of scale, lower transition costs and improved capacity and expertise are widely acknowledged. In Costa Rica, the Ministry of Finance is responsible for centralising public procurement, but only for the central administration, which represents less than 10% of the total procurement volume of the country. Indeed, the public sector demand for specific goods, works, and services is dispersed across a large number of government agencies. This results in a myriad of bidding processes to purchase similar items. A more strategic approach to procurement, bringing purchases by government agencies into the centralised public procurement procedures, could unlock significant savings. It is particularly important to bring procurement by autonomous institutions, such as the Costa Rican Department of Social Security (Caja Costarricense de Seguro Social, CCSS) and the largest university (Universidad Nacional) (CGR, 2019[25]) into the centralised system.

There is room to make additional savings by increasing competition for government contracts. Open and competitive procedures have ceased to be the rule and direct contracting is the most frequently used procedure (World Bank, 2019[16]). This is due to provisions in the regulatory framework on exemptions (bodies that are out of the scope of the public procurement regulatory framework), exceptions to competitive tendering, and the threshold system in place (OECD, 2019[26]). In Costa Rica public entities excessively resort to exemptions granted in law to allow public entities greater flexibility to contract with other public entities without a public bidding process. Furthermore, they also use various exceptions to ordinary procedures. In 2017, the use of exceptions to ordinary procedures accounted for nearly 50% of the total procurement volume and 80% of the total number of procedures. The most used exception to open and competitive tendering was the one related to “procurement volume below threshold”. In Costa Rica, thresholds depend on: i) the procurement category; ii) the budget allocated to each entity (ten different categories); and iii) the scope of the law. Therefore, the higher is the budget received by an entity, the higher is the threshold for open tender (OECD, 2019[26]). Some SOEs have their own specific exemptions, making for an uneven treatment not just between the private and public sectors but also between SOEs (OECD, 2020[21]). This is all preventing the private sector from competing on a fair footing for public procurement, implying also excessive costs to the state and poor service delivery. The authorities are currently undertaking a full reform of the procurement law, streamlining the threshold system and reducing scope for exceptions. This holds the promise of a medium-term solution but, in the short term, the exemptions granted to public entities should also be phased out.

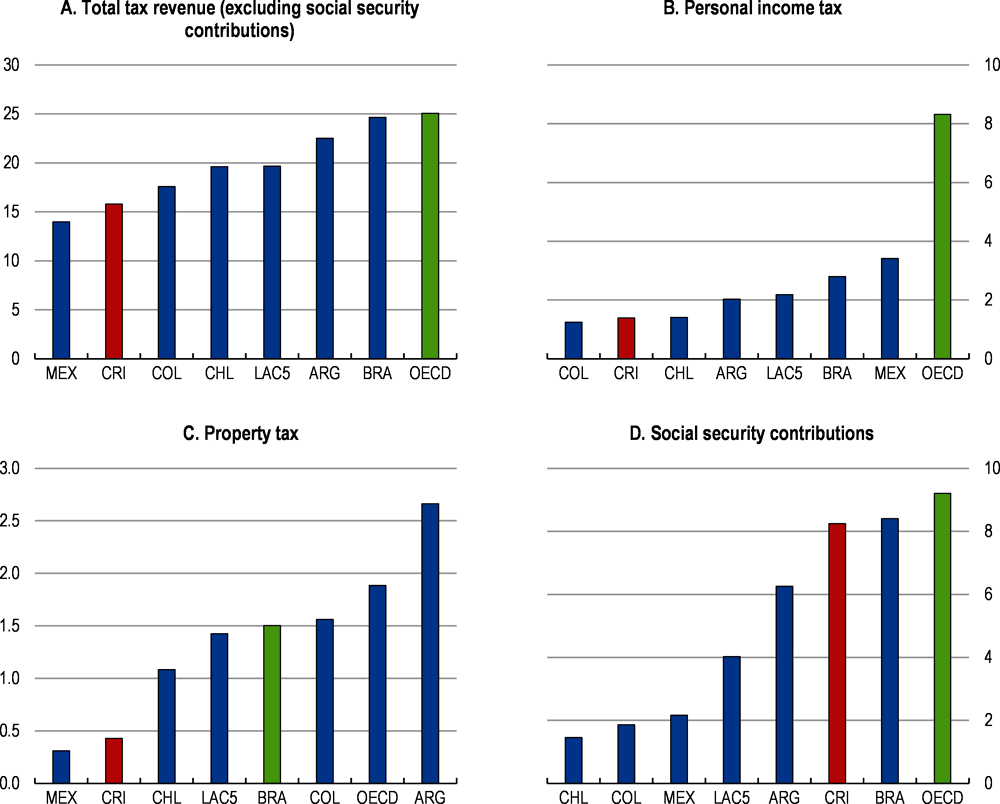

Broadening tax bases and improving the tax mix

The fiscal reform was a step forward for increasing tax revenues as well as improving efficiency and equity. The political economy of increasing taxes again is challenging, but Costa Rica has ample room to broaden tax bases without increasing rates. This room should be used in case the fiscal reform fails to deliver the planned increase in revenues, which is key to close fiscal unbalances. Tax changes increasing revenue and reducing income inequality should be prioritised. This includes starting to tax the income of cooperatives, which remain exempt despite some of them enjoying monopolistic conditions in key markets and benefiting from trade protection. Eliminating tax exemptions that benefit high-income households should also be prioritised. This includes taxing the additional salary paid at the end of the year (the so-called 13th salary), currently exempted from the personal income tax despite benefiting particularly affluent taxpayers. There is also room to optimise reduced VAT rates, in particular concerning their impact on equity. Taxing the spending on private education and health at reduced VAT rates is particularly regressive, as it benefits disproportionately high-income households.

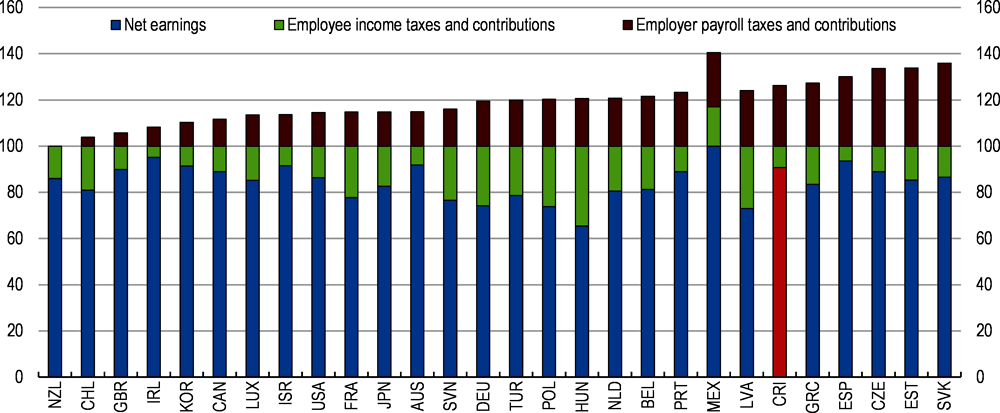

Moreover, there is room to improve the tax mix, as the current tax structure relies excessively on social security contributions (Figure 1.19). These account for one third of total revenues. Employer’s social security contributions are relatively high (Figure 1.20); (OECD, 2017[27]), which discourages formality. Conversely, Costa Rica raises relatively little revenue from property taxes. Gradually shifting taxation away from social security contributions to property tax would help to reduce informality and inequality. Colombia’s recent efforts to improve and update the cadastre, which are expected to yield 0.3% of GDP of additional revenue, exemplifies that this can be an important source of additional revenue in Latin American countries. Establishing different property tax rates can be useful to ensure progressivity, as exemplified by several OECD countries such as Ireland. These tax changes would help to raise additional revenue (Table 1.11) in an efficient and progressive manner, which could help to close the fiscal unbalance. Costa Rica is also strengthening the fight against tax evasion. Electronic invoicing became mandatory in 2019, which can help to increase revenues, as exemplified by experience in neighbouring countries such as Chile.

Improving debt management

The interest rate bill is increasing fast (Figure 1.21), reaching more than 4% of GDP at the end of 2019. This makes improving debt management, a long-standing OECD recommendation, a fundamental priority to reduce risks and contain the cost of debt servicing. Debt management has suffered from institutional fragmentation, as different departments are in charge of local and external debt, which creates overlaps and inefficiencies (OECD, 2018[7]). The government relies heavily on local investors, making Costa Rica one of the emerging economies with the lowest share of foreign investors. Expanding the foreign investor base would help decrease funding costs. Reducing the reliance on the small local capital market would also reduce existing upwards pressure on interest rates. The authorities are issuing Eurobonds, which may ease financing pressures in the short term and provide some savings, relative to placing the debt in local markets to local investors. However, they also bring foreign currency risks, and the savings are likely to be limited. During last November’s issuance, Costa Rica paid a higher interest than in its previous placement in 2012 (Figure 1.22), despite the environment of ample liquidity and global search for yield existing at that time.

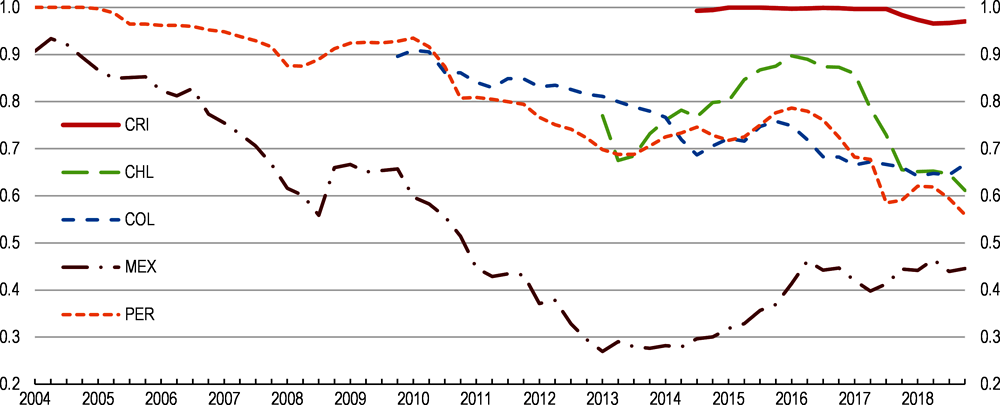

Issuing debt in foreign currency may help to reduce interest costs in the short term, but it also increases currency risks, as exemplified by Argentina. Almost all Costa Rican external government debt is already denominated in foreign currency. Other countries in Latin America have been increasingly able to attract international investors to local currency-denominated debt (Figure 1.23); (Ottonello and Perez, 2019[28]), reducing both the interest burden and currency risks. The global search for yield and improved commitments to price stability in emerging market economies can explain the appetite for domestic currency public debt in the last decade (Engel and Park, 2019[29]). Costa Rica, given ongoing improvements in its monetary and fiscal frameworks, has the potential to follow suit and start attracting foreign investors to debt denominated in colones. To that end, communication with markets should be improved. Experiences in other countries show that having all debt functions in a single unit or agency, the so-called debt management office, improves communication with investors, credit rating agencies, lenders, international financial institutions, and market regulators, which also require transparency through sound and timely reporting. By reducing information asymmetries, debt management offices can increase demand, reduce issuance costs, and promote sounder bases for credit ratings.

Debt servicing costs would also decrease by accessing financing by multilateral financial institutions, which tends to be accompanied with technical assistance. Costa Rica is expecting to access significant multilateral funding in 2020, with four credit lines amounting to more than 2% of GDP helping to cover a significant part of financing needs at below-market interest rates.

Looking forward, Costa Rica has unrealised potential to tap new areas of finance, such as green bonds. Green bonds imply a commitment to exclusively use the funds raised to finance or re-finance green projects, assets or business activities and are increasingly used by both advanced and emerging economies (Box 1.5). Long-standing commitments with natural resources preservation, ecotourism and clean energies place Costa Rica in an advantageous situation to access international green finance opportunities. Costa Rica’s ambitious decarbonisation targets also require deep economic transformation, entailing large-scale investment. Green bonds, whose spreads tend to be low relative to conventional bonds (Daubanes, Rochet and Steffen, 2019[30]), would help Costa Rica to meet these targets and, at the same time, access international finance at more convenient terms. A successful issuance of green bonds by a Costa Rican state-owned bank in 2016 illustrates that this is a viable source of financing for the sovereign.

Sovereign green bond instruments started being launched four years ago and are increasingly used by several advanced and emerging economies, as they enable a direct mobilisation of capital investment towards green and sustainable activities. Poland, France, Belgium, Lithuania, Ireland, Netherlands and South Korea have successfully raised international capital to finance green investment at relatively low rates. Sovereign green bonds represent also an interesting opportunity for emerging economies. Chile was the pioneer among Latin American countries and issued its first sovereign green bond in 2019, with the aim of financing infrastructure for electrified public transport (trains and buses), solar projects, renewable energy or water management. Chile attracted an interest rate of 3.53%, the lowest interest that Chile has ever paid for an instrument of similar term, and a spread of 95 basis points over the US Treasury rate. Investor demand was high; 13 times the offer. Mexico has also announced its intention to place its first green bond during 2020. Germany, Spain and Peru are also seeking to raise green financing throughout 2020.

Continuing to buttress the fiscal framework

To reinforce its commitment towards fiscal prudence and macroeconomic stability, Costa Rica is setting up an independent fiscal council and planning to introduce a full-fledged medium-term expenditure framework. The planned fiscal council will be composed of three council members, will have no staff and relies on the Ministry of Finance’s staff for technical analysis. The three board members were appointed on 17th March. The council held its first session at the beginning of April and will convene every four months. Creating the council is a valuable first step to improve fiscal surveillance and getting closer to OECD standards (Box 1.6). However, the current configuration of the council limits its effective independence and its potential benefits. To strengthen the independence of the council, Costa Rica could consider setting up the council under the auspices of the Central Bank, who would provide the required technical analysis, instead of the Ministry of Finance. This has proved an effective arrangement to provide stronger independence to the council in some OECD countries such as Estonia.

Multi-year expenditure frameworks have proven to be an effective tool to control public expenditure and ensure support to government strategic priorities, as illustrated by experiences in OECD countries, such as the Netherlands or Sweden in the 1990s. Today, almost all OECD Members have established a multi-year framework (OECD, 2018[7]). Costa Rica, building on its recently improved medium-term framework, should also proceed with plans to establish a fully-fledged multi-year expenditure framework.

Additional efforts to continue recording and reporting contingent liabilities are also warranted. Progress has been achieved in reporting explicit contingent liabilities, such as related to loans taken by public sector agencies with a state guarantee. Improving the recording of implicit contingent liabilities is the next priority. This includes contingent liabilities derived from pension schemes, natural disasters and those related to Public-Private Partnerships, state-owned enterprises, the financial sector and municipalities (CGR, 2019[31]).

Chile has been gradually strengthening its fiscal framework over the last decades. This has contributed to sustain economic growth and keep public debt relatively low. A fiscal rule helped to shield public spending from the copper boom, generating savings crucial when the country faced negative shocks, such as the global financial crisis. A key additional step forward to boost the fiscal framework was the creation of an autonomous fiscal council in 2019. The council is composed of five members nominated by the President and approved by the Senate. The new council has own resources and the mandate of the members do not coincide with the government term to foster independence. It is tasked, among other things, with conducting analyses, evaluating the calculation of the structural revenues, monitoring the compliance with the structural balance targets, proposing mitigating measures, and evaluating and proposing changes to the fiscal rule. The institutional framework of the council is in line with OECD good practices for effective independent fiscal institutions design and operation.

Social indicators have improved but Costa Rica remains a very unequal country

Virtually universal health care, pensions and primary education have led to remarkable social outcomes, such as relatively long life expectancy (above 80 years) and low infant mortality. However, inequality remains very high and poverty has remained largely unchanged at around 20% (according to the national definition) over the last 25 years (Figure 1.24). The poor and vulnerable will be particularly impacted by the pandemic. The authorities have reacted promptly to mitigate the impact, putting in place new social programmes, such as Bono Proteger (Box 1.7).

In April 2020, the government announced the Bono Proteger programme, which entails direct cash transfers for three months to individuals who lost their job or faced reduced working hours due to the pandemic. For workers who lost their jobs, the disbursement is CRC 125 000 (USD 217). For employees whose working hours were reduced by 50% as per the new retention scheme defined by Law No. 9832, the payment is also reduced by half. The total budget of the programme is CRC 296 billion (around 0.8% of 2020 GDP). Three-fourths of this budget has already been approved by the legislature.

The programme is well targeted, as being economically affected by the COVID-19 is a requirement, and inclusive, as informal sector workers also can receive the transfer. Public sector workers, pensioners of any regime, citizens under 15 years old, persons deprived of liberty and families that currently receive other cash transfers from the State are excluded from the programme. Applicants should fill out an on-line form, sign an affidavit as a statement of good faith and provide a valid domestic or foreign document of identity and an IBAN attached to a colones denominated bank account in the domestic financial system. Those who do not have a bank account can request one using the same application form. As of early June, 533 000 applicants have received the transfer.

Source: Ministry of Labour and Social Security.

Spending on social policies has increased over the years, but the higher expenditure has not translated into better public services. On the contrary, the quality of some public services has deteriorated over the last decade. For example, poor access to primary care has led to congestion in hospital emergency rooms; the coverage of social assistance is still relatively low (Estado de la Nación, 2019[32]); (World Bank, 2019[16]) and students’ performance in international evaluations, like PISA, has deteriorated since 2009. In light of the fiscal situation, to make growth more inclusive, it is critical that social spending leads to tangible improvements and solving existing inefficiencies. Making growth more inclusive will rely on improving opportunities for all Costa Ricans in education and work, improving their chances to find sustainable income generation opportunities. There is also a need to safeguard the sustainability of the pension and health systems. Closing existing gaps in financial inclusion would also help to make growth more inclusive (chapter 3).

Improving the targeting of social policies

The government has made important efforts to improve the delivery of social policies. Puente al Desarrollo, a strategy to fight extreme poverty, was launched in 2015, helping to stop the increasing trend in extreme poverty observed since 2007. A key remaining challenge is to reduce fragmentation, improve coordination and targeting. Costa Rica has made progress in improving coordination in some key areas, such as early childhood education and care (Table 1.12), but there is ample room to reduce fragmentation in several other areas.

With poverty largely unchanged over the last 25 years, despite increasing social programmes, improving the targeting of social programmes is a priority. 24 per cent of beneficiaries of social programmes aiming at reducing poverty are high and middle-income households (OECD, 2016[33]). The institute for social assistance, IMAS, has made remarkable progress in integrating all registries from social programmes into a common database, SINIRUBE. This database holds the promise of maximising the impact of social policies in Costa Rica. It enables better targeting, thorough evaluation of social programmes and eliminating overlaps. It can also help to increase the coverage, as it enables to identify potential eligible beneficiaries not yet covered by the programmes. The tool has started to be used to improve the targeting of some social programmes, such as scholarships or non-contributory pensions. The government has recently disbursed additional cash transfers to about 24 000 families that are registered within SINIRUBE to mitigate the impact of COVID-19 on poverty. Using it also to improve the delivery of the largest social programmes, such as Avancemos, the conditional cash transfer scheme, or a housing subsidy, would be a key step forward. The latter, offers the largest potential for savings that could be reallocated to other social programmes, as almost half of recipients of the housing subsidy are high and middle-income households (OECD, 2016[33]). The recently launched Bono Proteger is an excellent example of a well-targeted programme, as it is focused on providing direct support to those experiencing income losses during the pandemic.

Making education policies more conducive to growth and equity

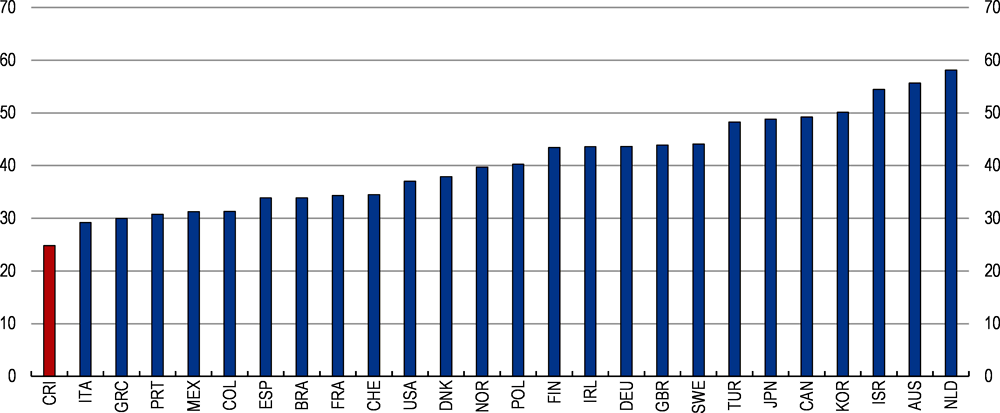

Education outcomes in Costa Rica remain low, despite spending more than in OECD countries (Figure 1.25). Costa Rica has achieved almost full enrolment in primary education but lags behind in key education outcomes. Half of Costa Rica’s population aged 25-34 has completed upper secondary education, far from the OECD average (85%) and other Latin American countries, such as Chile (85%), Colombia (70%), Argentina (72%) or Brazil (66%). According to PISA 2019 tests, students in Costa Rica perform 76 points lower than OECD students, equivalent to two years of schooling. Firms also face increasing difficulties in hiring workers with the appropriate skills. Ensuring that all Costa Ricans have access to high quality education and training and that the education system delivers the skills the labour market needs, is critical to establish a more inclusive and productive economy.

Education policies are becoming more targeted, with a special unit providing additional support to disadvantaged schools and students (UPRE). The Education Ministry, in collaboration with the Finance Ministry, is also preparing the move to a performance-based planning system. There has been also progress in increasing enrolment in early childhood education and care, although increasing quality is a pending challenge, as there is a significant delay in implementing standards designed by the Education Ministry (Estado de la Educación, 2019[34]). Increasing standards is fundamental, as starting strong in education is key to decrease inequalities. Retaining students in secondary education remain also a pending key challenge, as nearly one third of 15 year olds have dropped out of school. Evaluations of Avancemos, a conditional cash transfer programme, suggest it has helped to retain students. The special unit aimed at providing support to disadvantaged students also helped to increase retention rates in disadvantaged prioritised schools. Given the still high drop-out rate, further policy efforts are warranted, including widening the scope of the unit. Measures to encourage more capable teachers to work in the schools with highest needs have proved useful to curb drop-out rates in several OECD countries, such as Finland.

Digitalisation, globalisation, demographic shifts and other changes in work organisation are constantly reshaping skills needs. Despite the significant educational efforts made by Costa Rica and the relatively high level of unemployment, employers face difficulties in filling vacancies (Manpower, 2019[35]), particularly in technical and scientific fields (Monge-Gonzalez et al., 2015[36]). The mismatch between the demand and supply for skills is translating into people acquiring obsolete skills and persistent skill shortages and mismatches. This is costly for individuals, firms and the society in terms of lower employability, wages, productivity and accordingly, growth. The authorities are planning to run regular students’ performance tests, which should help detect learning gaps early on. It would be particularly important that gaps in digital skills are also assessed and addressed. The authorities have also recently approved a dual vocational training law. Dual schemes have proved valuable to reduce skill mismatches in several OECD countries, such as Germany, Austria or Switzerland.

Updating curricula regularly is therefore fundamental. The Ministry of Education has made good progress in adapting and improving curricula in primary and secondary education, but there are significant delays in implementing the new curricula in classrooms (Estado de la Educación, 2019[34]). Experience in some OECD countries, such as Norway or the Netherlands, suggests that developing guidance materials can help teachers to bring the new curricula to the classrooms. Continuing to provide teachers with additional training would also help. The planned new teachers evaluations is key, as they help to detect in which areas training and teacher’s professional development should be prioritised.

A particular concern is the excessive inertia in Costa Rican universities, which remain heavily biased towards social science and humanities, producing few science, technology, engineering and mathematics (STEM) graduates (Figure 1.26). Only 15% of graduates follow STEM, the same share as in 2005 (Estado de la Educación, 2019[34]). Reducing skill mismatches requires both supply and demand side actions. On the supply side, there is a need to improve the governance of the universities to make them more accountable, performance-based and responsive to Costa Rica’s skills needs. This requires a change in the funding model, as the existing one creates incentives to increase places in fields that are less expensive to deliver, such as the humanities and social sciences, to the detriment of those that are more costly to provide such as engineering, which requires investment in expensive equipment. Recent increases in the university budgets have been mostly channelled to increasing the salaries and number of the administrative staff, which is large in relation to the number of academic staff (Delgado Benavides, 2018[37]). Introducing better incentives into the universities’ funding formula, by linking funding to responding to labour market needs, would help to ensure a better alignment of curricula with skills demand, as illustrated by Ireland, who introduced this type of scheme in 2018. Students should also be informed early on in their educational life, about employment options, wages and labour market prospects by degree and university.

The demographic bonus is ending

Costa Rica has been so far reaping the benefits of a significant demographic dividend but trends are shifting. Improvements in health and economic development have led to a steep increase in life expectancy and a decline in fertility rates (Figure 1.27). The share of the population over age 65 will triple over the next 50 years, from 10% in 2020 to 30% in 2070, according to United Nations projections. Consequently, the demographic bonus will end soon (Figure 1.28). This demographic trend can have a significant impact on economic growth and fiscal sustainability, by putting additional pressure on public pension and health care systems. Promoting women’s labour force participation, fostering formalisation and gradually reforming the pension and healthcare systems can help to moderate the impact of ageing on economic growth and fiscal sustainability, while preserving equitable access to health services and adequate pension benefits.

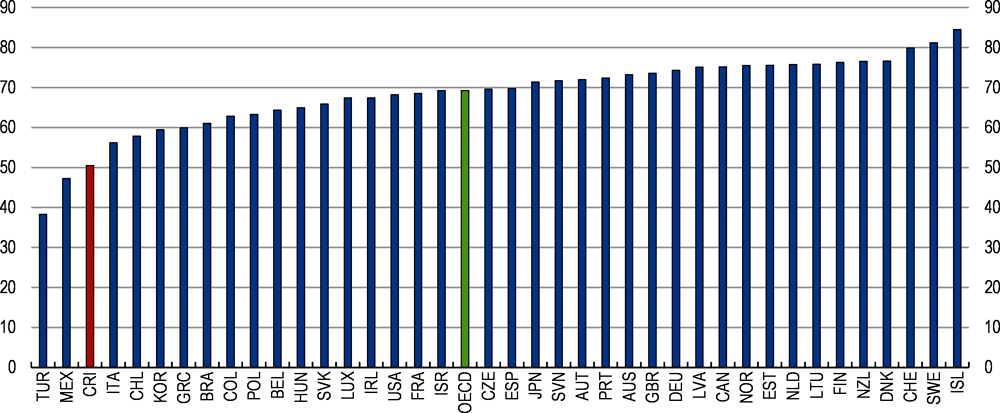

Boosting female labour market participation

Female labour force participation continues to lag the OECD average and other Latin American countries (Figure 1.29). Women taking on family care responsibilities face difficulties to complete education or continue to be in the labour force. Around half of all working-age women in inactivity report family caring responsibilities as the main cause for not looking for or taking up a job. Migrant women particularly struggle to get a foothold in the formal labour market, and tend to be trapped in informal jobs. The low female labour market participation, together with the higher informality rate, hampers women’s access to pension entitlements. More than a third of inactive elderly women do not receive a pension of their own – more than twice as many as inactive elderly men (OECD, 2017[27]).

Recent progress in extending the coverage of early childhood education and care for 5 year old children and the introduction of flexible working arrangements help but further policy action is needed. Access to early childhood education should also be expanded for children under the age of 4. Promoting more flexible working time arrangements and introducing paid paternity leave entitlements for fathers would also help. OECD countries have on average 8 weeks of paid leave reserved for fathers. There is no leave entitlement for fathers in Costa Rica, except for public sector workers, who are entitled to one week of leave. Introducing a paid leave entitlement reserved to fathers, as done in most OECD countries would help to reduce hiring discrimination against women in the workplace and change gender perceptions and attitudes towards family care.

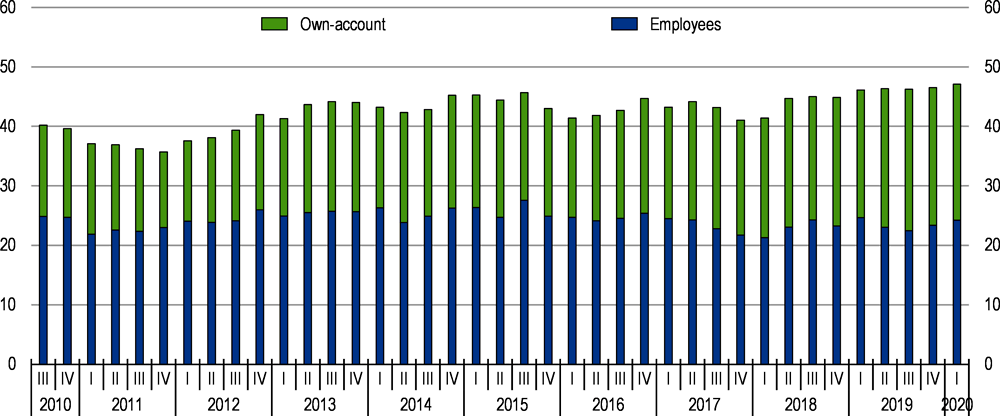

Reducing informality

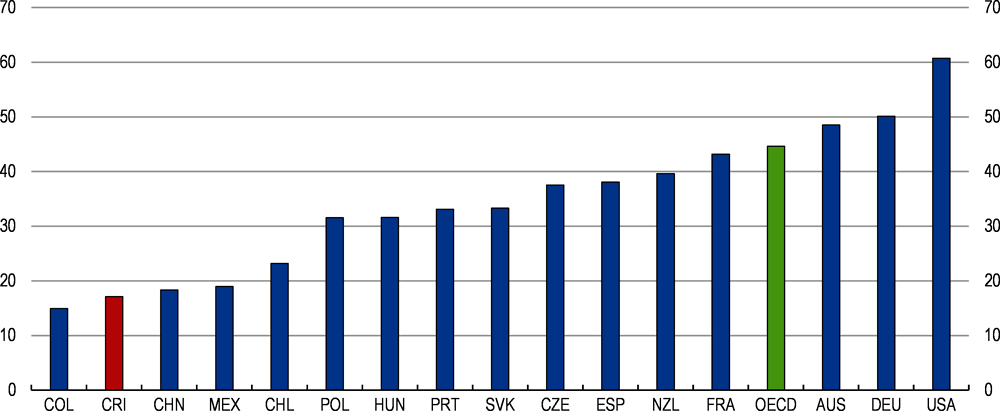

At more than 45% of workers (Figure 1.30), informality is high and is likely to increase further after the COVID-19 shock. It particularly affects women and low-skilled workers. Migrants, people with disabilities and indigenous populations face also particular difficulties to access the formal labour market (OECD, 2017[27]). Informal workers will be particularly impacted by the pandemic. The authorities’ response, including them as beneficiaries of the new cash transfer mechanism, will help to mitigate the impact and is a valuable first step to help these workers transition towards government support programmes which could help them access formal employment. There is no silver bullet to reduce informality. A comprehensive strategy is required, as recommended in previous OECD Economic Surveys (OECD, 2016[33]); (OECD, 2018[7]). Such a strategy should cover multiple policy areas, including labour and business regulations, taxes or skills. The authorities set up a number of roundtables to hold discussions with all relevant stakeholders about how to boost formalisation.

On the tax side, the authorities are stepping up efforts to reduce informality and have recently introduced lower employer and employee’s social security contributions for informal companies that become formal. The reduced contribution rates are temporary (4 years) and targeted at small firms (1 to 5 workers) in order to contain tax revenue losses. Experience in other Latin America countries, notably Colombia (OECD, 2019[14]), shows that reducing social security contributions can help to lower informality. The authorities have also launched an ambitious initiative to overhaul the employment services agency, moving to a single-window scheme and introducing profiling mechanisms. This is a welcome initiative, as employment services have so far remained under-developed and fragmented (OECD, 2017[27]). These new procedures, once fully implemented, would help to connect people to jobs and could have a material impact to curb informality, as they will help workers get the support and skills needed to access formal jobs.

Adapting regulations to facilitate compliance is another way to encourage job formalisation. Following previous OECD recommendations, the number of minimum wages has been reduced from 26 to 16, through social dialogue with employers and trade unions, with additional plans to reduce this number to 11. This is still a high number, suggesting that there is further room to make the minimum-wage system more job-friendly. There is also room to reduce regulatory barriers for the formalisation of firms (chapter 2), notably by reducing the cost and administrative burden to register firms.

Improving the sustainability of the pension system

Population ageing will imply significant pressures for the pension and health care systems, whose financing is heavily dependent on employment-linked contributions and is also hampered by increasing labour market informality. Recent efforts to improve efficiency in the health system are paying off and waiting times for surgical operations and the number of pending cases have declined. Policy efforts are also needed to improve the sustainability of the pension system.

The pension system in Costa Rica stands out in the region for its high coverage, making the pension system a key pillar for inclusiveness. The Costa Rican pension system comprises four pillars: 1) a contributory defined benefit scheme; 2) a non-contributory regime paying a minimum pension (below the poverty line), which is financed from the government budget; 3) a compulsory contributory defined-contribution scheme; and 4) a voluntary defined contribution scheme. In addition, there are special regimes for some public employees, such as those in the judiciary.

The contributory system does not generate enough resources to be sustainable in the medium term. Given the current demographic trends, a recent actuarial study shows that the system will run operational deficits in about 10 years and the reserves will be depleted in 15 to 20 years (Carranza and Jiménez, 2019[38]). Public expenditures on pensions are projected to reach 9% of GDP by 2050, placing Costa Rica close to the OECD average (Figure 1.31). The gap between pension expenditures and revenues will have to be financed by the reserve fund as of 2030 and, once the reserve fund is depleted in 2037, by the central government budget.