Canada

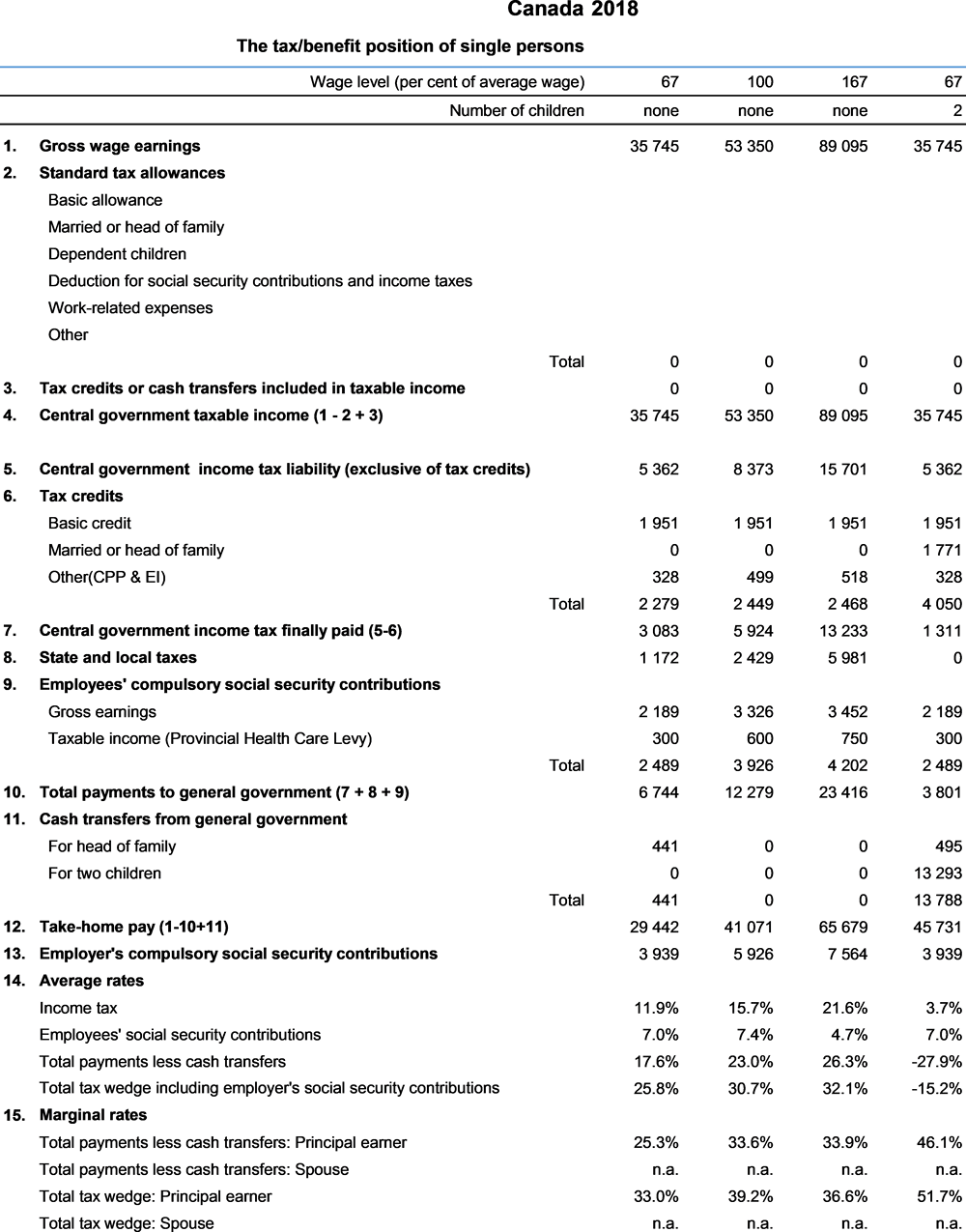

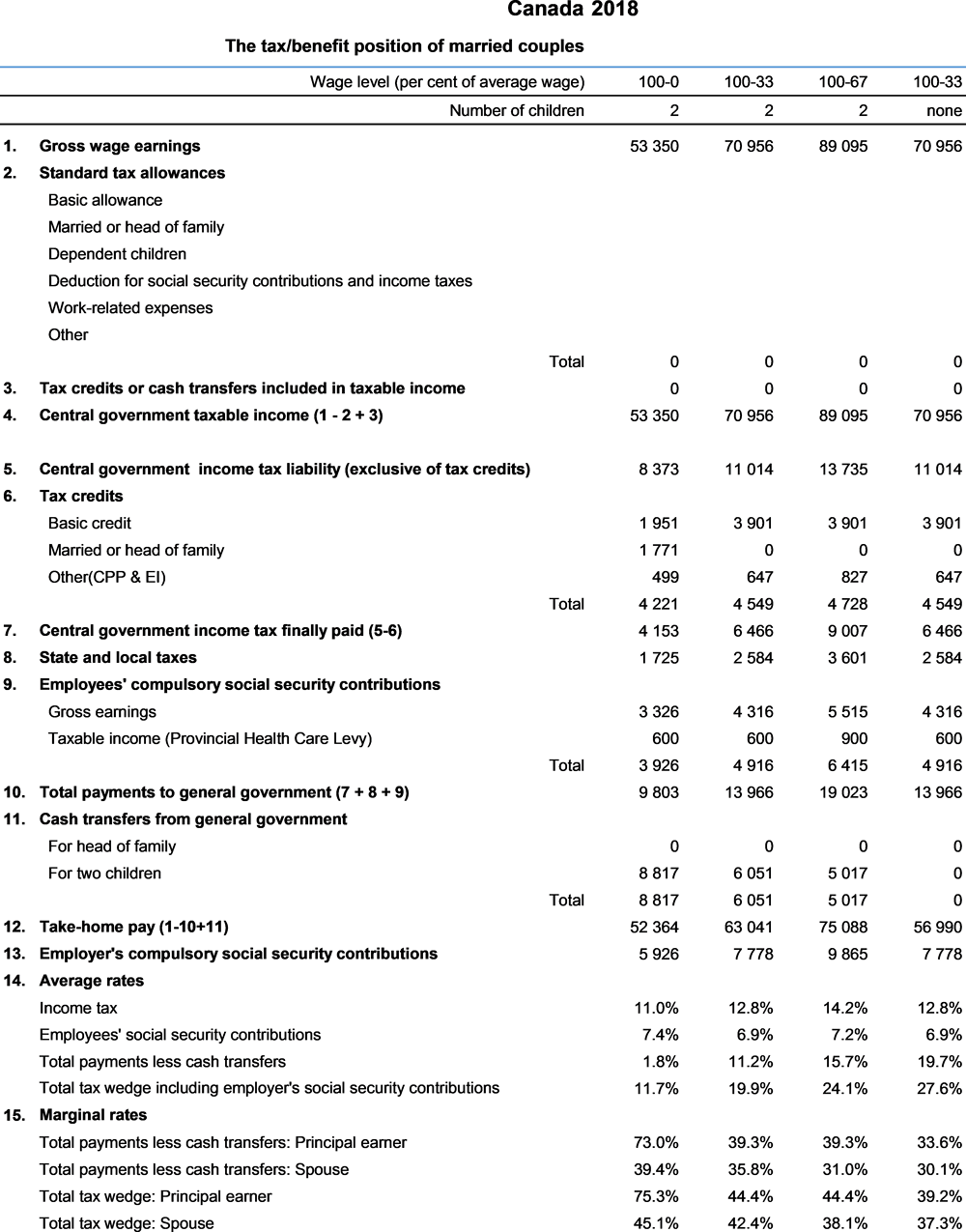

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Canadian dollar (CAD). In 2018, CAD 1.30 was equal to USD 1. In that year, the average worker earned CAD 53 350 (Secretariat estimate).

1. Personal Income Tax Systems

1.1. Central/federal government income taxes

1.1.1. Tax unit

Under the present system, tax is levied on individuals separately; certain tax reliefs depend on family circumstances.

1.1.2. Tax allowances and credits

1.1.2.1. Standard credits

-

Basic personal amount: All taxpayers qualify for a basic personal tax credit of CAD 1 771.35.

-

Credit for Spouse or Eligible Dependant: A taxpayer supporting a spouse or other eligible dependant receives a tax credit of CAD 1 771.35 which is reduced by 15 cents for each dollar of the dependant’s income.

-

Social security contributions: Taxpayers are entitled to claim 15% of their contributions to the Canada or Quebec Pension Plans (to a maximum credit of CAD 2 593.80 for the Canada Pension Plan and to a maximum credit of CAD 2 829.60 for the Quebec Pension Plan) and their Employment Insurance premiums (to a maximum credit of CAD 858.22 outside Quebec; the Employment Insurance premium rate is lower for Quebec residents, who also pay into the Quebec Parental Insurance Plan; the maximum combined credit for a Quebec resident is CAD 1 077.62.

-

Working Income Tax Benefit (WITB): The WITB provides a non-wastable tax credit equal to 25% of each dollar of earned income in excess of CAD 3 000 to a maximum credit of CAD 1 059 for single individuals without dependents and CAD 1 922 for families (couples and single parents). The credit is reduced by 15% of net family income in excess of CAD 12 016 for single individuals and CAD 16 593 for families. This is the default national design; provinces may choose to propose jurisdiction-specific changes to this design, subject to certain principles.

-

Canada Employment Tax Credit: A tax credit of up to CAD 179.25 on employment income.

1.1.2.2. Main non standard tax reliefs applicable to an average worker:

A number of non standard tax reliefs are available to the average worker in Canada. The main ones are:

-

Medical expenses credit: Taxpayers are entitled to a 15% tax credit for an amount of eligible medical expenses that exceeds the lesser of 3% of net income or CAD 2 302.

-

Charitable donations credit: The credit is 15% on the first CAD 200 of eligible charitable donations and 29% on eligible donations in excess of CAD 200, with the exception of donors with taxable income exceeding CAD 205 842, who may claim a 33% tax credit on the portion of total annual donations over CAD 200 made from taxable income greater than CAD 205 842. Eligible donations are those made to registered charities, to a maximum of 75% of net income.

-

Registered pension plan contributions: Employees who are members of a registered pension plan are entitled to deduct their contributions to the plan. Employee contributions required to fund the actuarial benefit liabilities under a defined benefit registered pension plan are permitted (annual benefit accruals are limited to a maximum of 2 per cent of earnings up to a dollar amount of CAD 2 944). Employee contributions to a defined contribution registered pension plan are limited to 18% of earned income up to a maximum of CAD 26 500.

-

Registered retirement savings plan (RRSP) premiums: Individuals can deduct their contributions to an RRSP up to a limit of 18% of the previous year’s earned income, to a maximum of CAD 26 230 a year, unless they are also accruing benefits under a registered pension plan or a deferred profit sharing plan. Members of those other plans are limited to RRSP contributions of 18% of the previous year’s earned income to a maximum of CAD 26 230, minus a pension adjustment amount based on pension benefits accrued in the previous year.

-

Union and professional dues: Individuals with annual dues paid to a trade union or an association of public servants or paying dues required to maintain a professional status recognised by statute are allowed to deduct such fees in computing taxable income.

-

Moving expenses: Eligible moving expenses are deductible from income if the taxpayer moves at least 40 kilometres closer to a new place of employment.

-

Childcare expenses: A portion of childcare expenses is deductible if incurred for the purpose of earning business or employment income, studying or taking an occupational training course or carrying on research for which a grant is received. The lower income spouse must generally claim the deduction. The amount of the deduction is limited to the least of:

-

1. the expenses incurred for the care of a child;

-

2. two thirds of the taxpayer’s earned income; and

-

3. CAD 8 000 for each child who is under age seven, and CAD 5 000 per child between seven and sixteen years of age (or older if has a mental or physical impairment, but not eligible for the Disability Tax Credit). The amount for a child who is eligible for Disability Tax Credit is CAD 11 000.

-

1.1.3. Tax schedule

1.2. State and local income taxes

1.2.1. General description

All provinces and territories levy their own personal income taxes. All, with the exception of Quebec, have a tax collection agreement with the federal government, and thus use the federal definition of taxable income. They are free to determine their own tax brackets, rates and credits. Quebec collects its own personal income tax and is free to determine all of the tax parameters, including taxable income. In practice, its definition of taxable income is broadly similar to the federal definition.

1.2.2. Tax regime selected for this study

The calculation of provincial tax for the average worker study assumes the worker lives in Ontario, the most populous of the 10 provinces and 3 territories. The main features of the Ontario tax system relevant to this report are summarised below:

Tax Schedule

Surtax

Wastable tax credits

-

A basic tax credit of CAD 522.88.

-

A maximum credit of CAD 444 for a dependant spouse or eligible dependant that is withdrawn as the income of the spouse or eligible dependant exceeds CAD 879 and is completely withdrawn when the income of the spouse is at least CAD 9 700.

-

5.05% of contributions made to the Canada Pension Plan and of Employment Insurance premiums.

Tax Reduction

An earner is entitled to claim a tax reduction where the initial entitlement is equal to CAD 239 plus CAD 442 for each dependent child under the age of 19. Where someone has a spouse, only the spouse with the higher net income can claim the dependent child tax reduction. If this amount is greater or equal to the liable provincial tax, then no tax is due. If the amount is less than the liable tax, then the actual tax reduction is equal to twice the initial entitlement amount less the liable tax (if this calculation is zero or negative, the reduction is equal to zero).

2. Compulsory Social Security Contributions to Schemes Operated Within the Government Sector

2.1. Employees’ contributions

2.1.1. Pensions

Generally, all employees are eligible for coverage under the Canada Pension Plan (Québec Pension Plan in the province of Québec). For 2018, all employees are required to contribute to the Canada Pension Plan at a rate of 4.95% of income up to a maximum contribution of CAD 2 593.80 (the contribution rate is 5.400% of income for the Québec Pension Plan up to a maximum contribution of CAD 2 829.60). Income subject to contributions is earnings (wages and salaries) less a CAD 3 500 basic exemption. The maximum contribution of CAD 2 593.80 is reached at an earnings level of CAD 55 900 i.e. (CAD 55 900 - CAD 3 500) x 0.0495 = CAD 2 593.80. For employees, each contribution to the CPP or QPP gives rise to a tax credit equal to 15% of the contributed amount. Employers are also required to contribute to the Canada Pension Plan on behalf of their employees at the same rate and can deduct their contributions from taxable income (refer § 2.2.1).

Self employed persons must also contribute to the Canada Pension Plan (Québec Pension Plan in the province of Québec) on their own behalf. However, the self-employed are required to contribute at the combined employer/employee rate of 9.90% of earnings up to a maximum of CAD 5 187.60 (10.80% of earnings up to a maximum of CAD 5 659.20 in Quebec). The self-employed can deduct the employer portion of their contribution from income, equal to 50% of the total contribution or CAD 2 593.80 (2 829.60 in Quebec). The remaining 50%, representing the employee portion, is then claimed as a tax credit at 15%.

2.1.2. Sickness

There is no national sickness benefit plan administered by the federal government. However, all provinces have provincially administered health care insurance plans. Three provinces, Quebec, Ontario, and British Columbia, levy health premiums on individuals separately from the personal income tax to help finance their health programmes.

In the case of Ontario, the premium is determined based on taxable income. Individuals who earn up to CAD 20 000 are exempt. The premium is phased in with a number of different rates to a maximum of CAD 900 for taxable income levels greater than CAD 200 600. The following table provides further details on the structure that is applicable in 2018.

2.1.3. Unemployment

In general, all employees are eligible for Employment Insurance. Eligibility to receive benefits is determined by insurable hours worked (with a minimum entry threshold of 420 to 700 hours, depending on region and the unemployment rate at the time the claim for benefits starts). For 2018, employees outside Quebec are required to contribute at the rate of 1.66% of insurable earnings. Insurable earnings are earnings (wages and salaries) up to a maximum of CAD 51 700 per year. The maximum employee contribution is therefore CAD 858.22 per year. Employment insurance contributions give rise to a tax credit equal to 15% of the amount contributed. Employers are also required to contribute to the plan. (See Section 2.23)

Quebec residents contribute to Employment Insurance at a rate of 1.30%; the same earnings ceiling applies. They also contribute to the Quebec Parental Insurance Plan at a rate of 0.548% of insurable earnings; maximum insurance earnings for 2018 are CAD 74 000. For a Quebec resident, the maximum employee contribution (Employment Insurance plus Quebec Parental Insurance Plan) is CAD 1 077.62.

2.1.4. Work injury

See section 2.2.4.

2.2. Employers’ contributions

2.2.1. Pensions

Employers are required to contribute to the Canada Pension Plan on behalf of their employees an amount equal to their employees' contributions. Thus, employers also contribute at the rate of 4.95% of earnings (less the CAD 3 500 earnings exemption) to a maximum of CAD 2 593.80. For the Quebec Pension Plan, the contribution rate is 5.40% of earnings, to a maximum of CAD 2 829.60.

2.2.2. Sickness

There is no national sickness benefit plan administered by the federal government. However, all provinces have provincially administered health care insurance plans. Three provinces levy a special tax on employer payrolls to finance health services (Québec and Ontario) or health services and education (Manitoba). These payroll taxes are deductible from the employer’s income subject to tax. In the case of the province of Ontario, employers pay a Employer Health Tax on the value of their payroll, tax rates varying from 0.98% on Ontario payroll less than CAD 200 000, up to 1.95% for payroll that exceeds CAD 400 000. Certain employers are eligible for a higher exemption of CAD 450 000.

2.2.3. Unemployment

Employers are required to contribute to the employment insurance scheme. The general employer contribution is 1.4 times the employee contribution, that is, 2.28% of insurable earnings (outside Quebec). Premiums are adjusted for employers who provide sick pay superior to payments provided under the employment insurance regime. All employment insurance contributions are deductible from the employer’s income subject to tax.

2.2.4. Work injury

There is no national work injury benefit plan administered by the federal government. However, employers are required to contribute to a provincial workers’ compensation plan which pays benefits to workers (or their families in case of death) for work related illness or injury. The employer contribution rates, which vary by industry and province, are related to industry experience of work related illness and injury. Premiums are deductible from the employer’s income subject to tax. In the case of Ontario, employers broadly corresponding to industry Sectors B-N inclusive pay, on average, 2.28% of the wages paid to each employee to a maximum of CAD 90 300.

3. Universal Cash Transfers

3.1. Transfers related to marital status

None.

3.2. Transfers for dependent children

3.2.1. Federal

Children’s benefits are provided through the Canada Child Benefit (CCB). In the autumn of 2017, the Government announced that the CCB benefit amounts and income thresholds will be indexed to inflation starting with payments in July 2018. Entitlement to the CCB for the July 2019 to June 2020 benefit year is based on 2018 adjusted family net income. The CCB provides a maximum benefit of CAD 6 606 per child under age six and CAD 5 574 per child for those aged six through seventeen. On the portion of adjusted family net income between CAD 30 968 and CAD 67 097, the benefit is phased out at a rate of 7% for a one-child family, 13.5% for a two-child family, 19% for a three-child family and 23% for larger families. Where adjusted family net income exceeds CAD 67 097, remaining benefits are phased out at rates of 3.2% for a one-child family, 5.7% for a two-child family, 8% for a three-child family and 9.5% for larger families, on the portion of income above CAD 67 097.

The Goods and Services Tax Credit provides a relief of CAD 289 for each adult 19 years of age or older and CAD 152 for each dependent child under the age of 19. Single tax filers without children and with an employment income higher than CAD 9 366 receive an additional CAD 152 that is phased in at a rate of 2%. Single tax filers with children receive an additional CAD 152 that is not subject to phase-in. The credit received for the first dependent child of a single parent is also increased from CAD 152 to CAD 289. The total amount is reduced at a rate of five percent of net family income over CAD 37 604. The amount is paid directly to families.1

3.2.2. Provincial

For each child under eighteen, qualifying families can receive up to CAD 1 427 from the Ontario Child Benefit (OCB). The benefit is withdrawn at a rate of 8% of family income that exceeds CAD 21 780.

Ontario has a Sales Tax Credit that provides a relief of up to CAD 306 for each adult and each child. It is reduced by 4% of adjusted family net income over CAD 23 549 for single people and over CAD 29 436 for families. The amount is paid directly to families.

4. Main changes in the Tax/Benefit system since 2009

5. Memorandum Items

5.1. Identification of an Average Worker

The earnings data refer to production workers in the industries B to N. To obtain the annual average wage figure, the average weekly earnings for the year for employees (including overtime) are multiplied by 52.

5.2. Employer contributions to private health and pension schemes

These do exist but no information is available on the amounts involved.

2018 Tax equations

The equations for the Canadian system are mostly repeated for each individual of a married couple. However, the spouse credit is relevant only to the calculation for the principal earner and the non-wastable credits are calculated only once. This is shown by the Range indicator in the table below.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. In addition, the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.

Note

← 1. The payments that relate to income from the 2018 tax year are payable between July 2019 and June 2020. The amounts shown in this Report assume indexation of 2.1% for the 2018 tax year (and 2019-20 benefit year); the actual indexation parameter will be announced in December 2018.