Chapter 3. Argentina

Support to agriculture

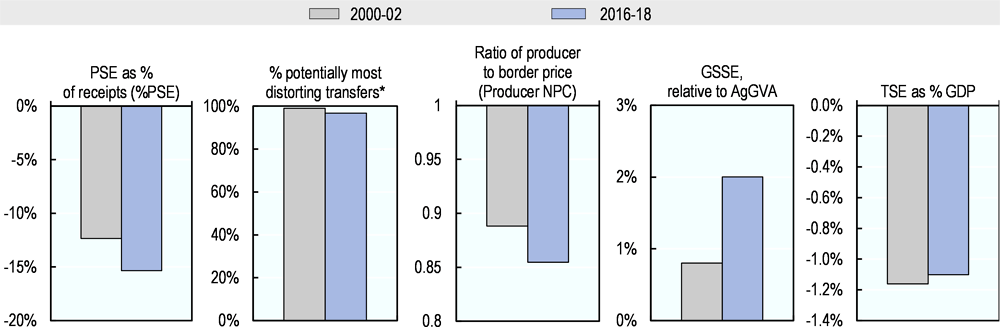

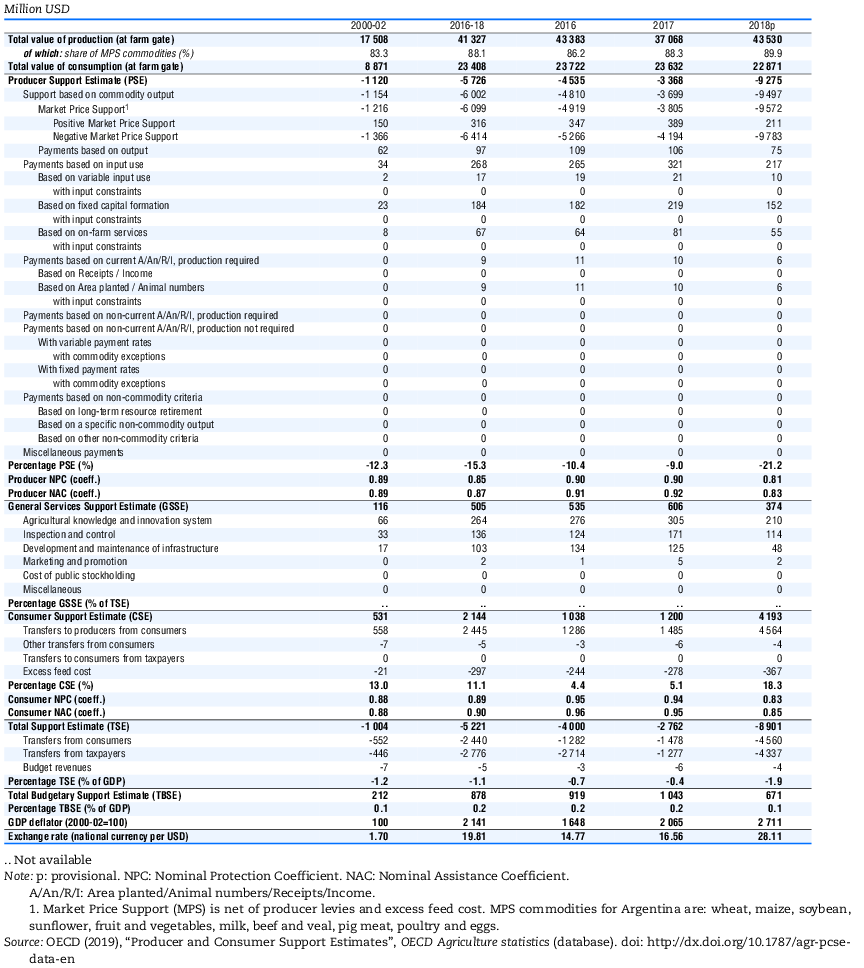

Argentina provides negative support to its agricultural sector mainly due to export taxes that depress domestic producer prices. Estimated producer support was negative at -15.3% of gross farm receipts in 2016-18. Budgetary payments to producers are limited and focused on input support, provided mainly in the form of credits at preferential rates.

Despite the tax burden, agricultural production and exports in Argentina have been growing due to a very dynamic and innovative private sector, and to public services, particularly for knowledge, research, extension and sanitary inspection. Most of Argentina’s budgetary support to the sector goes to these general services (GSSE). However, the total budgetary support to producers and the sector overall was only 0.2% of GDP, well below the absolute value of negative market price support, making the total support estimate to agriculture (TSE) also negative representing -1.1% of GDP.

Main policy changes

Following a large depreciation of the peso, the Argentinian economy plunged into recession in 2018 and the government sought support from the International Monetary Fund (IMF). In order to achieve primary balance budget in 2019, the authorities announced a substantial fiscal consolidation. A temporary tax on all exports was established (until 31 December 2020), reversing the progressive elimination of all export taxes (other than soya) initiated in 2015. The tax will apply to all exports, not only specific agricultural products, with a rate of up to 12%. This new tax adds to the product-specific export tax rate on soybeans, which was reduced from 26% to 18%.

Among the fiscal expenditure measures, the government decided to reduce and restructure the number of its departments, and the Ministry of Agroindustry became a Secretariat of Government under the Ministry of Production and Labour. Two important strategic plans were established in 2018: the 2018-30 National Irrigation Plan to promote the integration of irrigation projects throughout the national territory, and the National Plan of Soil to promote the conservation, restoration and sustainable management of agricultural soils.

Several measures of the Secretariat of Agroindustry, together with other government departments, focused on the promotion of good sustainable agricultural practices, including on the application of plant protection products, minimum environmental protection requirements for the management of empty containers of agrochemicals and the prohibition of certain agrochemicals.

Assessment and recommendations

-

Export taxes create distortions and uncertainty and their reduction since 2015 was a movement in the right direction. However, in response to the macroeconomic situation in September 2018, a new tax was established on all exports. Even if less distortive, this new tax should be phased out as foreseen in the current government plan, integrating the sector into a reformed economy wide tax system, enhancing policy certainty with alternative sources of fiscal revenue. In the current environment, it will be crucial to find the right balance between the long-term objective of phasing out export taxes and the short term need to raise fiscal revenues.

-

Agricultural policy could be better anchored in broad legislation, such as a specific framework law and an economy-wide reform of the tax system. Historically, Argentinian policies have been unpredictable and systematically biased against agriculture. The government should keep its long-term direction of gradually reversing this bias, moving towards a more neutral, stable, predictable and targeted policy package.

-

Recent measures to promote and improve good and sustainable agricultural practices head in the right direction. Moving forward, in particular on pesticide use reduction, crop rotation and forest conservation, will require improving monitoring and information systems for better policy design, such as on location-specific negative externalities and hotspots from pesticide use. An independent evaluation of the Native Forest Law should analyse its effectiveness in stemming deforestation and provide guidance on how to strengthen its enforcement and contribution to climate change mitigation.

-

In order to deliver the research, extension and other public goods required for future agricultural innovations, the Argentinian agricultural innovation system needs to develop systematic monitoring of efforts and results in R&D and innovation, and to define and implement strategic priorities. In this context, the role of the National Institute of Agricultural Technology (INTA) in delivering knowledge requires an in-depth evaluation of its different lines of action: research, extension and rural development. Public policies on innovation should focus on the provision of public goods in areas where the private sector has difficulties to deliver, such as related to sustainability and less developed value chains, or for regional economies outside the Pampas region.

-

The Special Tobacco Fund (FET), with a budget similar to that of INTA, should be reformed. The output payments to tobacco producers should be phased out and resources used to finance a programme for the development of poor tobacco producing areas through investment on human and physical capital. The reform should include a monitoring and evaluation system of all the initiatives implemented by the provinces.

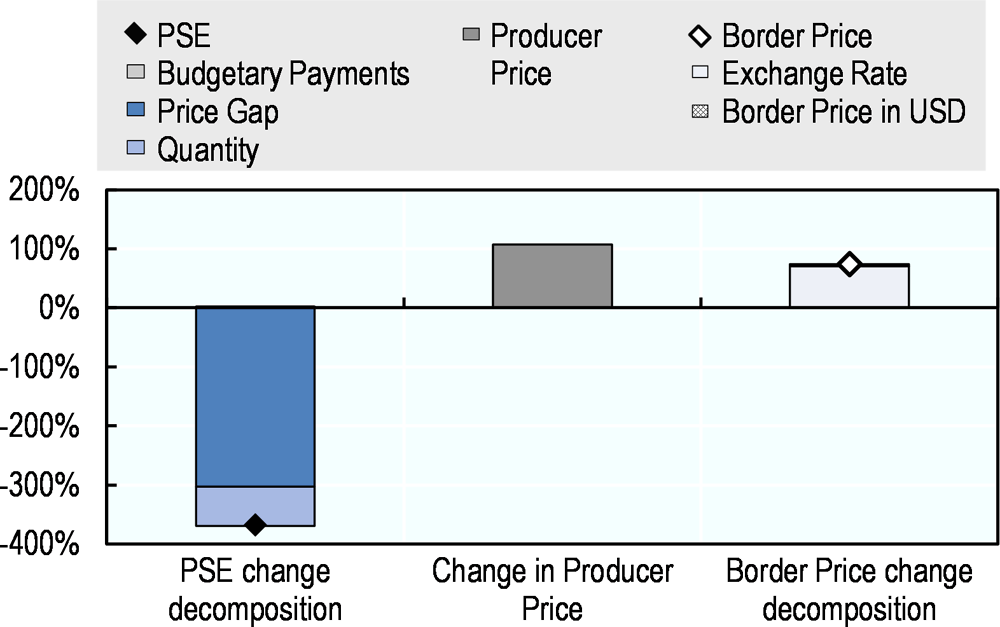

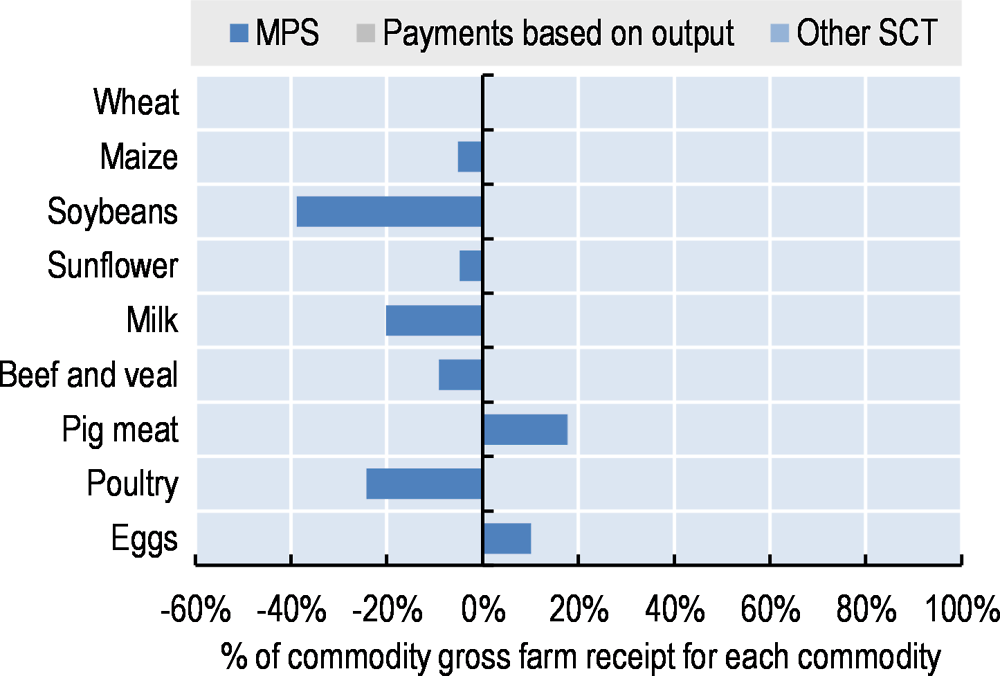

Support to producers (%PSE) has remained negative in the last two decades at -12.3% of gross farm receipts in 2000-02 and -15.3% in 2016-18, with the most extreme negative levels occurring in 2008, reaching -51%. Negative MPS amounted to –16.9% of gross farm receipts, while the share of positive MPS and budgetary farm support remained small. As a result, 97% of the policy transfers was most distorting in 2016-18. The ratio of producer to border prices (NPC) is as low as 0.85, that is, producers prices are on average 15% below world market prices. The support to general services (GSSE) relative to agricultural value added has increased from 0.8% in 2000-02 to 2%, not enough to avoid a negative Total Support Estimates (TSE) corresponding to 1.1% of GDP in 2016-18. The %PSE changed from -9.0% in 2017 to -21.2% in 2018 due to an increase in the size of the negative price gap, mainly driven by the strong depreciation of the currency. The negative support to producers is dominated by soybeans, its main export commodity, and transfers from soybean producers to consumers and taxpayers corresponded to 38% of the commodity gross farm receipts.

Contextual information

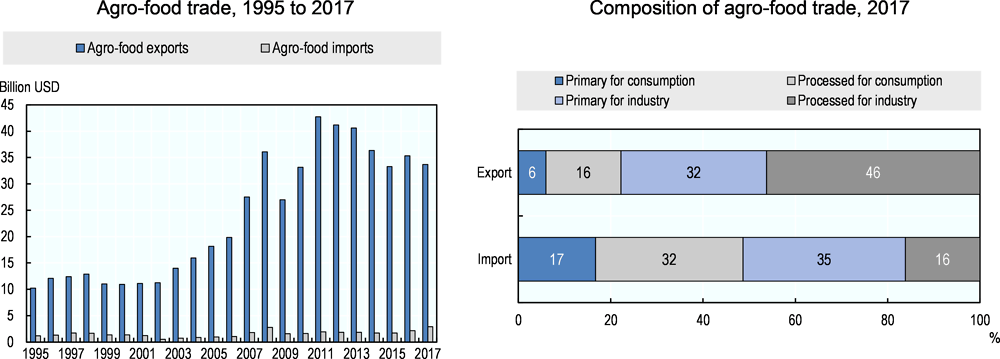

Well-endowed with human capital and natural resources, Argentina is a high income country with a per capita GDP over USD 20 000. Agriculture contributes to more than 5% of GDP, but only 0.5% of employment, reflecting the high degree of mechanisation of the production of crops in the Pampas region. The country is one of the world’s largest agricultural exporters, and agro-food exports have been significantly growing in the last decades, representing 48.7% of total exports in 1995, and 57.7% in 2017, almost eight times the average share across all countries in the report. In contrast, agro-food imports represent only 4.3% of total imports.

Argentina has abundant agricultural land representing 5% of the total agricultural area of all countries covered in this report, although a big share constitutes pasture land. The share of livestock in the total value of production has increased from 38% in 1995 to 46% in 2017.

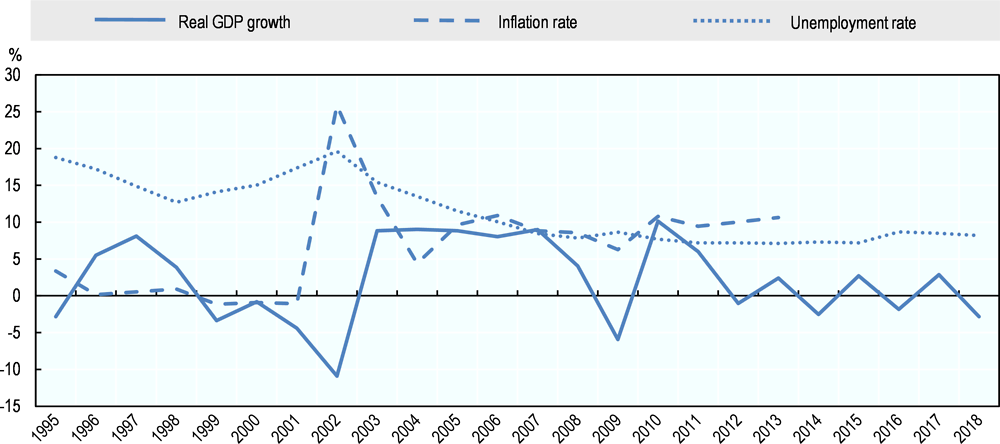

After seven consecutive months of positive growth, the Argentinian economy began to stall when the peso came under pressure in April 2018. Over a period of four months the value of the peso vis-à-vis the USD was halved, plunging the economy into recession in 2018. The national statistical institute INDEC was reformed in 2016 and the quality of statistics has significantly improved, including on inflation whose series was discontinued after the IMF found Argentina in breach of its minimum reporting requirements in 2011.

The agro-food surplus was above USD 30 billion in 2017. Almost four-fifths of agro-food exports were inputs used in downstream industries abroad, whereas the much smaller bundle of agro-food imports was more equally shared between intermediary and final products.

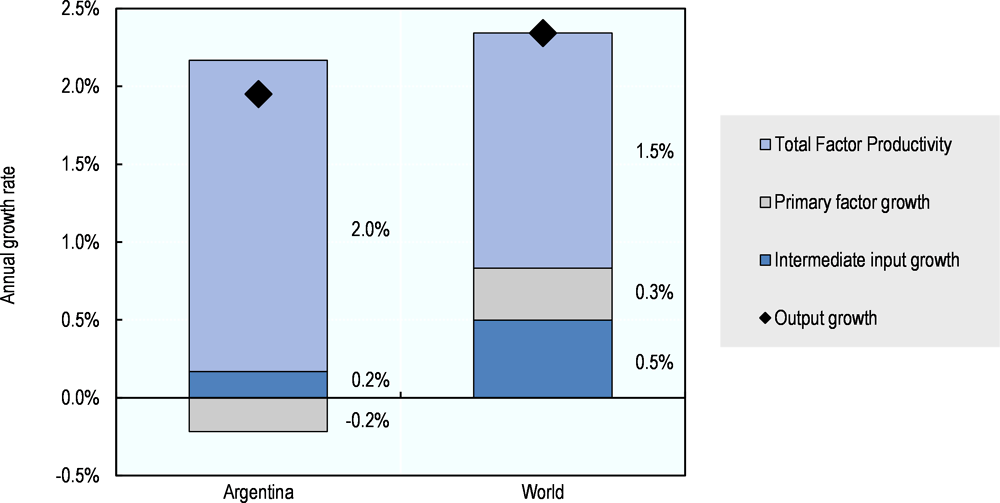

Argentinian agricultural production has increased at an annual rate of 2% between 2006 and 2015, slightly below the world average. This growth was due to increases in Total Factor Productivity (TFP), that is, innovations and technical improvements in the way resources are used in production. Limited growth in the use of additional intermediate inputs was compensated by equal-sized reductions in the use of primary factors. The contribution of TFP to production growth is well above the world average.

Agricultural nutrient balances in Argentina are below the OECD average. The shares of agriculture in energy use and in GHG emissions are, with 6.4% and 30.6% respectively, well above the OECD average, related to the importance of the sector in GDP and the large numbers of ruminants.

Description of policy developments

Main policy instruments

In addition to the Secretariat (former Ministry) of Agroindustry, other government agencies also implement policy measure providing support to agriculture in Argentina, such as the Ministry of Finance that designs and implements export taxes. In contrast to most other countries covered by this report, producers of main agricultural products in Argentina are implicitly taxed through negative price support. Export restrictions have had and continue to have a major impact in depressing producers’ prices below the international references and creating negative transfers to producers. The government made efforts to reduce export taxes since 2015 until September 2018, but, particularly after the introduction of the new tax on all exports oriented to raising fiscal revenue, they are still the major component of policy transfers from the agricultural sector. Argentina provides only few payments to farmers. Highly distorting measures are limited to the mentioned export taxes and specific output payments to tobacco producers. The recent review of Agricultural Policies in Argentina (OECD, 2019[2]) provides additional policy details.

Budgetary programmes are concentrated on financing the provision of general services such as the agricultural knowledge and innovation system or inspection control services, which represent the majority of budgetary support in Argentina. Research and development and extension services are mainly provided by the National Institute for Agricultural Technology INTA, while animal and plant health and input control services are provided mainly by the plant and animal health agency SENASA.

The Special Tobacco Fund (Fondo Especial del Tabaco - FET) provides a supplementary payment to market prices as part of a broader policy arrangement. Created in 1972, the FET (Decree Law 19.800) provides this additional revenue to tobacco producers located in the northern provinces of Jujuy, Salta, Misiones, Tucuman, Corrientes, Chaco and Catamarca. These provinces are dominated by small producers with economic and social difficulties and, apart from the support from the FET, they also benefit from the ambitious regional development programme Belgrano. The fund is financed by a tax of 7% on tobacco consumption, and is directly managed by the Secretariat of Agroindustry, but separated from the regular budget. The federal government transfers 80% of the funds to the tobacco producing provinces proportionally to their share in national production. Historically, the provinces used them to supplement prices to producers. However, after the signature of the WTO agreement in 1994, Argentina committed to reduce this support as part of its Aggregate Measurement of Support (AMS) commitment, constraining FET output payments expenditure to about 20% of the provincial funds, with the rest being spent on programmes to support producers’ fixed and working capital, to provide technical assistance, to invest in local infrastructure and even to provide social and health assistance.

Argentina provides very limited input subsidies, mostly in the form of implicit interest rate subsidies through preferential credit provided by a set of programmes under FINAGRO. These credits are targeted to a range of products to finance investment and working capital. A new fund, FONDAGRO, was created in 2017 to finance investment in the sector at preferential interest rates, but its current scope is limited.

There are almost no other direct payments to producers in Argentina. Limited amounts are provided as disaster assistance in response to extreme weather events, mainly droughts. There are no national direct payments for agri-environmental services, and few at provincial level. Among these, since 2017, area payments have been provided in the province of Cordoba subject to the application of good agricultural practices applied by farmers on a voluntary basis.

The Agricultural Provincial Services Programme (PROSAP), financed by the Inter-American Development Bank (IADB) and managed by the Secretariat of Agroindustry, invests mainly in large agricultural irrigation infrastructure.

Argentina submitted its Intended Nationally Determined Contributions (INDCs) under the Paris Agreement on Climate Change in October 2015. Argentina’s goal is to reduce GHG emissions by 15% in 2030 with respect to projected emissions for that year. Among the main measures affecting the agricultural sector in response to the commitments made in the Argentine INDCs are the Native Forest Law (Law 26.331), the improvement of soils through practices such as no-tillage and the substitution of fossil fuels by biofuels.

Argentina is a large exporter of biodiesel produced from soya and has an active biofuel policy. The Biofuel Law 26.093, approved in 2006, established compulsory blend mandates since 2010, starting at 5% but then progressively increased to 10% for diesel and 12% for gasoline. The Law also assures the purchase of biofuels at a calculated price up to the end-term of the Law in 2021. Biofuel production can also benefit from some fiscal measures. First, exports of biofuels have historically been taxed less than the export of crops, in particular soybeans. Second, the Law establishes that domestic consumption of biofuels benefits from a VAT rebate under certain conditions.

Domestic policy developments in 2018-19

In early September 2018, the government put in place several policy measures in response to the economic turmoil triggered by a large depreciation of the peso. After seven consecutive quarters of positive growth, the economy began to stall as the Argentinian peso came under pressure in April 2018. Over a period of four months, the value of the currency vis-à-vis the US dollar (USD) was reduced to half, risk premiums and credit default swap (CDS) spreads spiked and inflation rose sharply. These events plunged the economy back into recession during 2018 and the prospects of a significant deterioration in access to foreign financing led the government to seek support from the IMF.

The authorities front-loaded fiscal adjustment plans and committed to a primary budget balance as early as 2019, with primary surpluses thereafter. This implied a substantial fiscal consolidation relative to previous plans, based on both revenue and expenditure measures. Among the fiscal revenue measures announced by the government, a temporary tax on all exports was established, reverting the elimination of all export taxes other than those for the soybean complex (see sections on Trade Policy Development). Among the fiscal expenditure measures, the government decided to reduce and restructure the number of its departments. The Ministry of Agroindustry was dismantled and integrated as a Secretariat of Government under the Ministry of Production and Labour. Current expenditures were also cut, for instance through an accelerated phasing out schedule for economy-wide subsides on energy and public transport.

Since its reform in 2016, the National Statistics Institute INDEC has been investing on improving the quality and methods of Argentina’s statistics. In 2018, INDEC conducted a new National Agricultural Census (CNA), the first reliable census since 2002. This major investment on agricultural statistics will improve a systemic lack of national information on farm structures. The 2018 CNA has collected information on the basic characteristics of all the crops, livestock, forestry and bio-industry activities, covering the entire country. It is estimated that nearly 190 million hectares and more than 300 000 farms are covered. The final results are expected to be available in June 2019.

Several government measures in 2018 targeted the improvement of farming practices. The Joint Resolution 5/2018 of the State Secretariats of Agroindustry and Health incorporates good agricultural practices for the production of fruits and vegetables in the Argentine Food Code (CAA). Following a broad discussion within the framework of the National Food Commission (CONAL), the implementation and compliance deadline was set at two years for fruits and three years for horticulture. To facilitate this implementation, Resolution 174/2018 created the National Program of Good Sustainable Agricultural Practices for fruit and vegetable products to “promote the quality and safety” of these foods.

The Joint Resolution 1/2018 creates the Inter-ministerial Working Group on the Application of Plant Protection Products, with representatives from different government agencies such as agro-industry, environment, health, science and technology, INTA, SENASA and the federal councils on environment and agriculture. The application of plant protection products is to be performed according to good agricultural practices and subject to proper monitoring and control systems, following the guiding principles already prepared by the working group. Additionally, the Regulatory Decree 134/2018 for Law No. 27,279 establishes minimum environmental protection requirements for the management of empty containers of plant protection products, based on their toxicity. It establishes mandatory technical parameters to be applied in the provinces in the management of containers at the different stages. Both agriculture and environmental authorities will work together in enforcing this decree.

The regulatory and inspection agency SENASA enacted several resolutions to prohibit the use of certain agrochemicals. Resolution 263/2018 prohibits the manufacture, import and fractionation of the active substances carbofuran, carbosulfan, diazinon, aldicarb and dicofol, and their formulated products. With Resolution 149/2018, SENASA prohibits the import, marketing and use of the active ingredients dichlorvos (DDVP) and trichlorfon and their formulated products for use in grains and tobacco, in the stages of production, post-harvest, transport, handling, packaging and storage.

A Joint Resolution by several Ministries created - within the frameworks of the National Insurance Authority - the Program of Environmental Sustainability and Insurance, in order to promote the investments from insurance companies on reforestation. These investments are promoted by Law No. 25,080 (as amended by Law No. 27,487 of 2018) with tax advantages and non-refundable financial support available for reforestation projects. The Government is working on an amendment of this law before it expires at the end of 2019.

The resolution 108/2018 establishes the 2018-30 National Irrigation Plan (NIP), intended as the framework to promote the integration of irrigation projects throughout the national territory. The plan has joined several regional cooperation initiatives to ensure that it is implemented in line with updated knowledge and experience. In particular, the NIP joined the project NEXO promoted by the United Nations Economic Commission for Latin America and the Caribbean (ECLAC) and the German Agency for International Cooperation, and is committed to an interdisciplinary approach. The NIP engages experts from the water, energy and agri-food sectors and representatives from the Secretariat for Infrastructure and Water Policy, the National Water Institute and the Ministry of Energy. The Plan also joined the technical co-operation project “Platform for efficient water management in agriculture 2030-50”, a network led by Chile, Argentina and Spain that is part of the international co-operation mechanism FONTAGRO.

The Resolution 232/2018 created the National Plan of Soil to “promote the conservation, restoration and sustainable management of agricultural soils, maximizing productivity and ensuring the maintenance of its ecosystem services, in a global context of climate change”. The Secretariat of Agroindustry is working together with the Secretariat for the Environment and Sustainable Development and the provincial governments through the Agricultural and Livestock Federal Councils, and with the private sector through agreements with farmers’ organisations like the Argentinian association of no-till producers (AAPRESID), and the Consortium of regional agriculture experimentation (CREA). The National Observatory of agricultural soils was created by Resolution 169/2017, to monitor soil health and provide information for public policy design at all levels. A national Carbon map is already under development by taking samples of soils and making analysis on the ground.

Trade policy developments in 2018-19

Since 2015, the Government has enacted several tax reforms. The reform of export taxes was decided through separate successive decrees implying the elimination of agricultural export taxes except for soybeans, which were subject to a gradual reduction, initially planned for 2018 and 2019 (Decrees 133/2015, 1343/2016 and 486/2018). These measures were part of the effort to diminish distortions while at the same time meeting tight fiscal deficit objectives.

However, in response to recent macroeconomic developments, the government put in place exceptional revenue measures in September 2018. These included the establishment of a temporary export tax of up to 12% applied to all exported goods and services, including all agriculture products (Decree 793/2018). The tax cannot exceed a maximum of ARS 4 per USD of export value of primary agricultural goods and ARS 3 per USD of exports for other products. For soybeans, the new tax is added on top of the tax specifically applied to this commodity, whose rate was reduced from 26% to 18% in the same decree. These export taxes have been introduced as a temporary emergency revenue collection measure, with a sunset clause of 31 December 2020. On the other hand, the strong ARS devaluation of 50% vis-à-vis USD has significantly increased the capacity of exporters to compete in global markets and generated additional gains to agricultural exporters.

Further progress was achieved in the negotiations of the free trade agreement between the European Union and Mercosur members (Argentina, Brazil, Paraguay and Uruguay), which started 20 years ago. By the end of 2018, the parties had agreed on 12 of the 15 chapters in the negotiating text of the agreement.

References

[1] OECD (2019), “Producer and Consumer Support Estimates”, OECD Agriculture statistics (database), https://doi.org/10.1787/agr-pcse-data-en.

[2] OECD (2019), Agricultural Policies in Argentina, OECD Food and Agricultural Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264311695-en.