copy the linklink copied!Finland

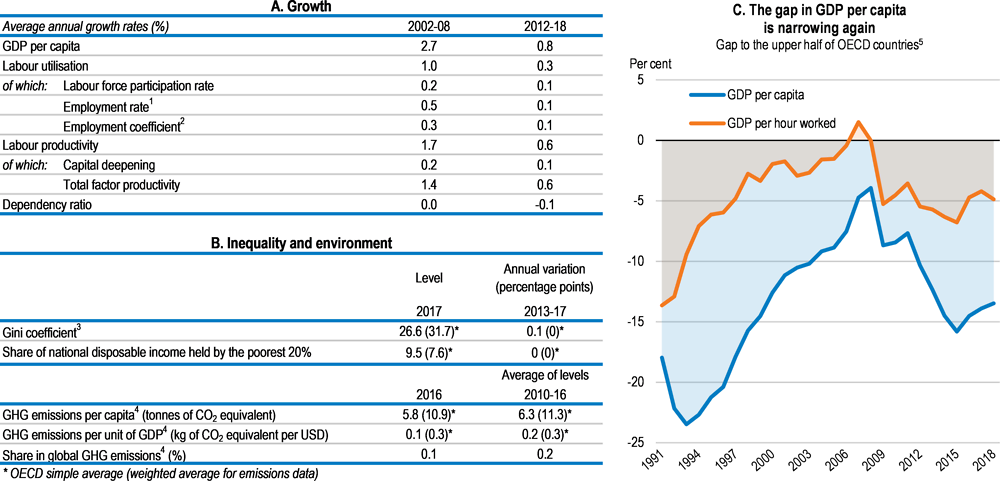

The GDP per capita gap relative to the upper half of OECD countries is narrowing anew, as growth is picking up strongly thanks to a favourable global environment and the effect of structural reforms.

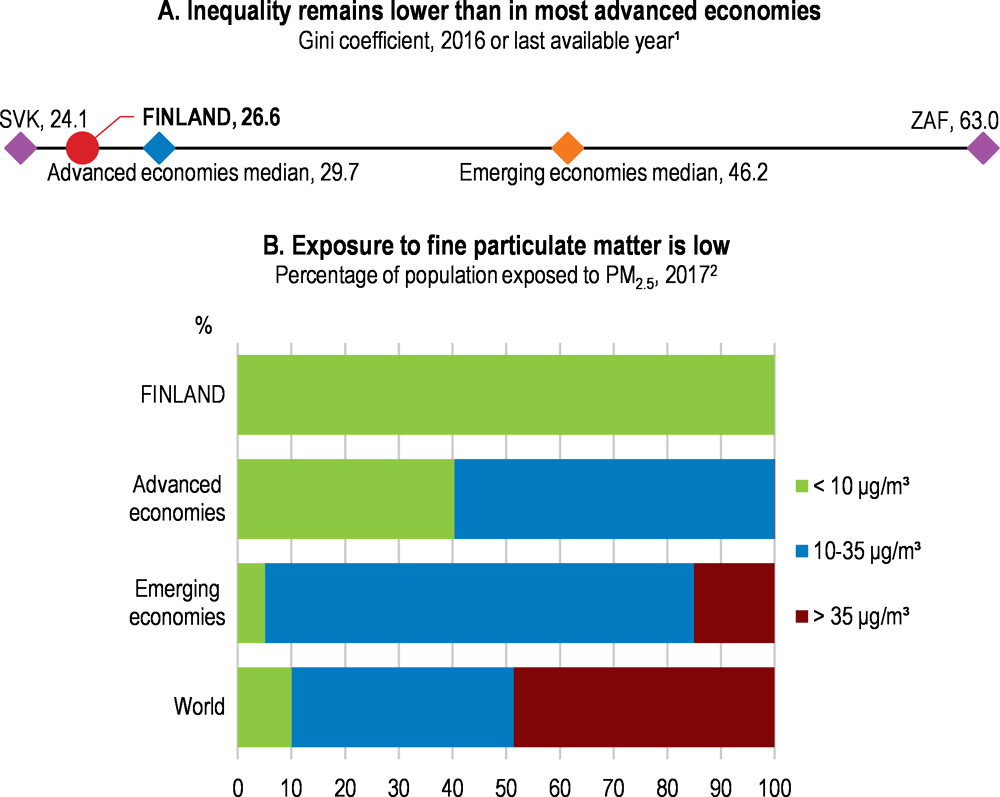

Income inequality is low by OECD standards and has been relatively stable over recent years. Greenhouse gas emissions are declining and the share of renewable energy is increasing.

The reform of unemployment benefits addressed the priority through shortening the duration of unemployment benefits and stricter conditionality. Progress on competition is substantial, with an easing of restrictions applying to large retail units from spring 2017 – making this no longer a priority – and a gradual opening to competition of new segments of the transport sector starting 2018. A health care and social services reform is underway continuing the provision of high-quality services at a reasonable cost to an ageing population.

The employment rate is much lower than in the other Nordic countries, calling for measures on a wide front. The welfare system needs to be reformed, to enhance work incentives, while continuing to protect the vulnerable. Reforming parental leave and the home-care allowance would encourage women's labour market participation, with a positive impact on output and gender equality. Further reforms to spur competition, notably in transport and construction, would lift productivity. The tax structure should become more growth and environmentally friendly.

Finland: Going for Growth 2019 priorities

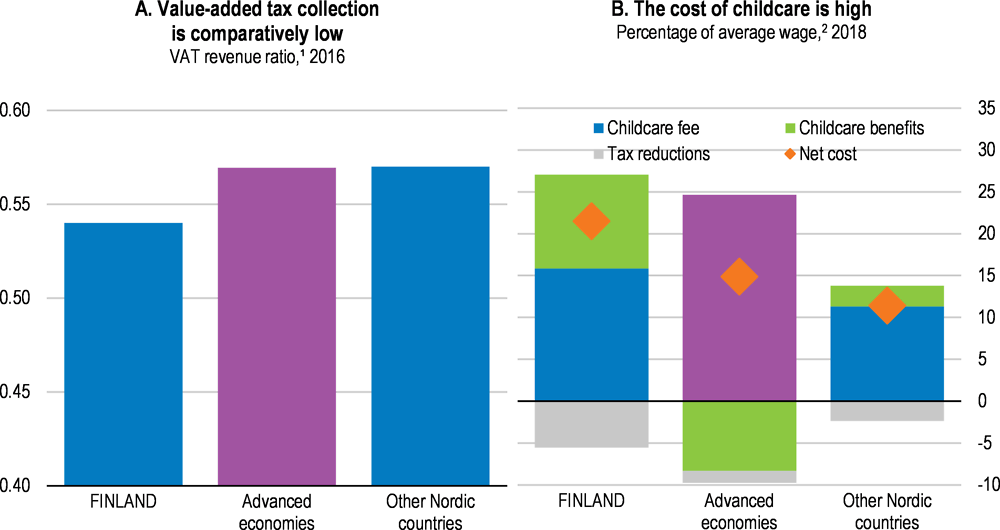

Reduce barriers to female labour force participation. The homecare allowance and the childcare fee structure reduce the attractiveness of work for parents, notably second earners in couples with children aged one to six.

-

Actions taken: The childcare fee was lowered slightly in 2017. A reform of parental leave to encourage better sharing between parents was discussed, but did not gather enough political support.

-

Recommendations: Reduce the combined duration of parental leave and the homecare allowance to foster participation in childcare and incentivise full-time employment. Calculate childcare fees on individual rather than household incomes.

Enhance competition in transport and construction. Streamlining regulations in transport and construction would encourage innovation and lift productivity.

-

Actions taken: Taxi fares are deregulated from mid-2018. A new Act on Transport Services approved by Parliament in 2017 will gradually open new segments of the transport market to competition and facilitate interactions between different modes of transportation. Rail passenger transport will be opened to competition in the early 2020s.

-

Recommendations: Implement the reforms planned in transport. Streamline regulations in the construction and building materials industries.

Improve the efficiency of public services in municipalities. Public services need to be produced more efficiently, to ensure adequate provision in the face of stretched public finances and rising demand as population ages.

-

Actions taken: A reform of health, social services, and regional government set to enter into force in January 2021. This will shift most responsibilities for service provision from municipalities to new autonomous regions, creating opportunities for economies of scale and more equal access to services.

-

Recommendations: Ensure that the reform achieves economies of scale and a better balance between primary and specialised care, while reinforcing equality in access to health care and social services. Encourage more competition where the population base and the nature of services make it viable.

Improve the efficiency of the tax system to support green and inclusive growth. The tax wedge on labour remains high, reduced value added tax (VAT) rates lower tax revenue and many environmentally harmful subsidies remain.

-

Actions taken: Tax and social contribution cuts related to the Competitiveness Pact signed by the social partners reduce the tax wedge somewhat from 2017. Energy and CO2 taxes, excise duties and property tax rates have increased further. Mortgage interest deductibility is being reduced in steps.

-

Recommendations: Further reduce the tax burden on labour, increase recurrent taxes on immovable property and environmentally-related taxes, broaden the consumption tax base and phase out reduced VAT rates, continue to phase out mortgage interest deductibility and phase out environmentally harmful subsidies.

1Reform the welfare system to increase work incentives. The combination of different working-age benefits, childcare costs and income taxation creates complexity, reduces work incentives and holds back employment.

-

Recommendations: Harmonise working-age benefits and coordinate their tapering against earnings. Simplify administrative procedures to reduce uncertainty about the amount and timing of cash receipts when beneficiaries’ circumstances change.

Note

← 1. New policy priorities identified in Going for Growth 2019 (with respect to Going for Growth 2017). No action can be reported for new priorities.

Metadata, Legal and Rights

https://doi.org/10.1787/aec5b059-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.