China

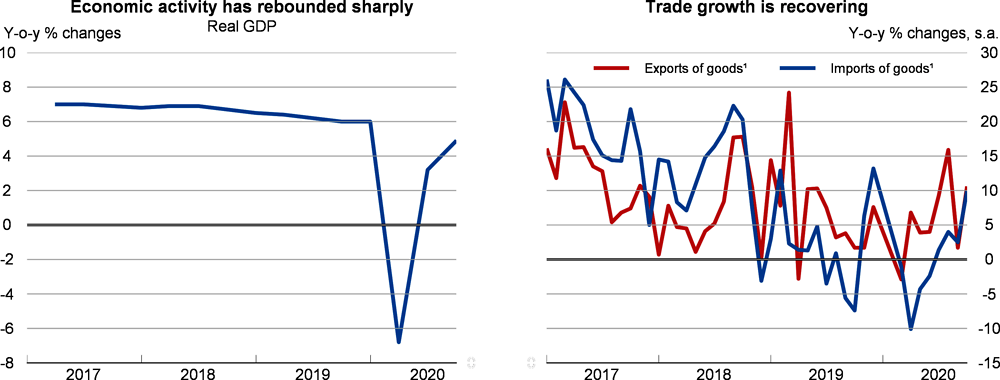

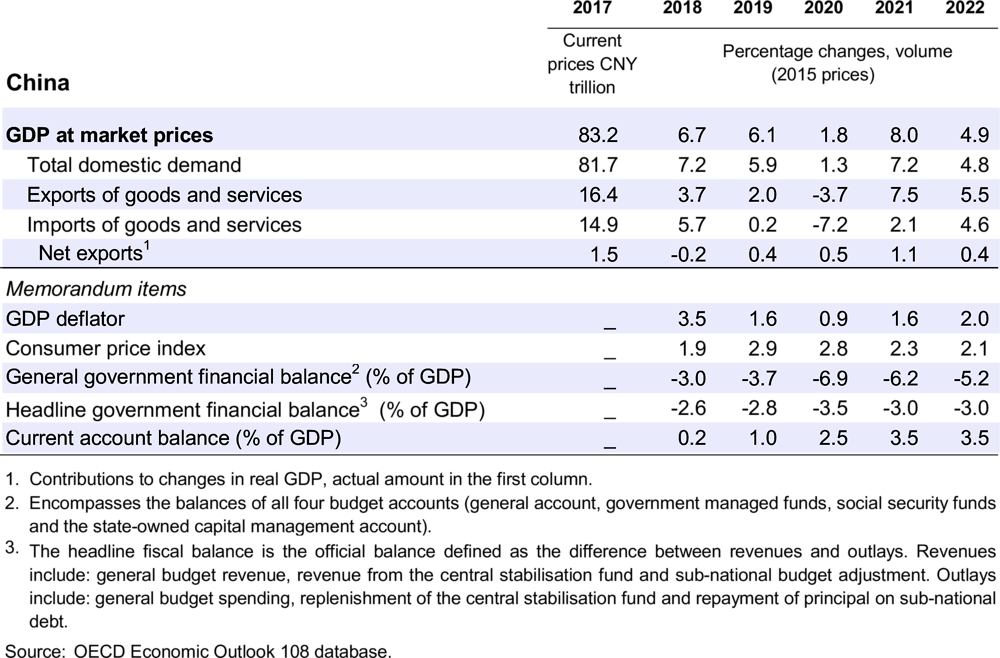

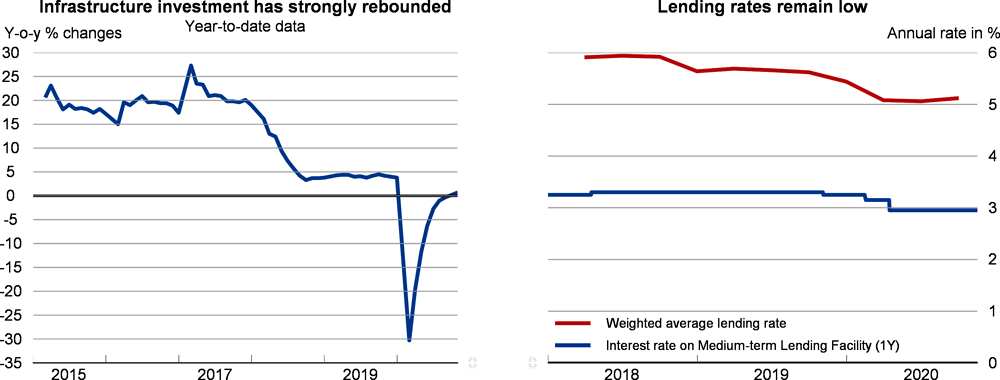

Following the steepest quarterly dive and subsequent surge on record in the first and second quarters of 2020, respectively, and then stabilisation in the third quarter, activity is projected to return to its past trajectory, with growth of about 8% in 2021 and 4.9% in 2022. New COVID-19 cases have reappeared sporadically, but the coronavirus outbreak seems largely under control in most of the country. Investment, in particular debt- and stimulus-fuelled infrastructure investment, has boosted growth in 2020. Real estate investment has also remained strong. Exports have boomed on the back of pent-up demand for masks and other COVID-19-related materials and equipment as well as teleworking-related goods. Consumption is still to recover from the hit caused by the outbreak. Even though sales of luxury goods are booming and box office revenues have reached new highs, the lack of a recovery in employment and falling household incomes mean that prospects for a full consumption recovery are not bright. Inflation is easing, despite elevated pork prices.

Monetary stimulus, which was needed during the outbreak, is now being withdrawn as the recovery is gaining momentum. Shadow banking has also picked up following a few years of decline. Increasing corporate defaults have sharpened risk pricing. Fiscal policy will remain supportive, with a number of tax cuts and extensions of social benefits promoting consumption amid weak consumer confidence. However, more ambitious structural reforms in the area of social protection, and a more equitable provision of public services, are needed for consumption to rebound. Infrastructure investment will remain robust, mainly benefitting state-owned enterprises as entry restrictions are being relaxed only slowly.

The COVID-19 pandemic has retreated

China has implemented strict sanitary and non-sanitary measures to regain control of the outbreak. Even though clusters of COVID-19 cases have reappeared sporadically in various parts of the country, and are likely to continue doing so, the proven tracing, testing and isolation system prevents them from posing a major risk to economic activities. Hundreds of millions of people have been tested by the nearly 4 000 testing institutions countrywide. The coronavirus pandemic appears to have been brought under control in most of the country, but there is an unknown number of asymptomatic carriers of the virus and citizens returning from abroad also bring it back, so quarantines and hygienic measures have continued.

The sharp drop in economic activity was followed by a rapid rebound

As of early autumn, almost all activities had restarted and exceeded pre-pandemic levels in seasonally adjusted terms. Industrial production has also risen and capacity utilisation is increasing. Similarly, services have been growing, though unevenly: finance and IT services continue to perform very well, while catering and accommodation value added is shrinking. An upturn in infrastructure investment has helped growth to resume and is lifting the output of a number of midstream manufacturing industries and imports of raw materials such as iron or copper. Tourism services imports, however, have been suspended by COVID-19-related immigration measures around the world. Exports are driven not only by COVID-19-related goods, but also by goods required for teleworking, such as IT equipment and home appliances. Consumption is lagging behind as employment is slow to recover and incomes fell in urban areas in the first three quarters of the year compared with the same period a year before.

Fiscal policy continues to support growth, while monetary policy has become more neutral

Monetary policy supported the economy by lowering the costs of financing but, as the recovery gained momentum, it has turned more neutral, leaving the benchmark interest rate unchanged for over half a year. This was needed to avoid further stimulus to the already hot real estate market. Smaller banks, hit harder by the outbreak, continue to face relatively high interest rates in the interbank market. In addition to the support provided earlier in the year, such as lower reserve requirements and lower loan-loss provisioning coverage ratios, they can now use part of the special treasury bonds - introduced to support economic recovery - to replenish their capital. Shadow banking has picked up after shrinking for several years, helping private businesses obtain funding. Recent defaults of wealth management products will sharpen risk perception. Corporate debt, mainly accumulated by state-owned enterprises, jumped by 10 percentage points in the first quarter of 2020, the latest data available. Deleveraging should restart once the recovery is on a stable path.

Fiscal policy has continued to support the recovery. Special and general local bonds, as well as special treasury bonds, are financing an infrastructure investment drive, with local government investment vehicles still playing an important role. Local governments may be pushed to reduce spending on important public goods including health, education and social assistance, as the burden of COVID-19-related spending and the costs of the summer floods are high. While physical investment, in particular in certain types of infrastructure such as suburban rail, is crucial for an inclusive recovery, soft investment in education, health and social security should also be stepped up. Once the recovery is fully established, potential revenue sources to finance new social spending include a progressive income tax and a recurring tax on the ownership of real estate. In addition, increasing submission of state-owned enterprise profits and dividends to the budget could become a more important source of finance. Active involvement of local government investment vehicles in the infrastructure drive will likely push up corporate debt and, potentially, contingent liabilities at the local government level.

Growth has rebounded, but is not inclusive and unlikely to be sustainable

The return of investment as the main source of growth implies an interruption of multiple rebalancing processes that were putting the economy on a more inclusive and sustainable path prior to the outbreak. These processes include a shift from investment to consumption, from industry to services and moving people from rural to urban areas. Consumption will not recover fully without more robust employment creation, the reversal of falling urban household incomes and stronger social security. Equally, the transition to a services-based economy will not make major progress without strong consumer demand. The fastest growing services, such as finance and IT, do not create as many jobs as the shrinking ones, such as catering and accommodation. A third process, urbanisation, has also stalled as the number of new migrants fell in the first three quarters of the year. These important processes should be restarted to avoid a further build-up of imbalances in the economy.

Moratoria on debt repayment for borrowers heavily hit by the crisis will limit bankruptcies this year, though defaults on bond issues have slightly increased. Allowing more indebted, unviable state-owned enterprises and other public entities to go bankrupt would sharpen risk perception. The lowering of the loan-loss coverage ratio for small banks also increases their vulnerability to serial bankruptcies of smaller firms. Bankruptcies would spur unemployment, both in urban areas and among migrants. Continuing lockdowns in other countries could disrupt value chains, hitting China’s parts and components producers and assemblers, although their reliance on imported inputs is decreasing. A faster-than-expected recovery from the virus crisis in Asian countries would boost not only exports, as these are the fastest growing markets, but also employment, as export-driven firms account for nearly a quarter of total employment. A prolonged trade conflict would likely entice further protectionist measures and take a toll on global trade and growth. The new regional trade agreement (Regional Comprehensive Economic Partnership), in contrast, will boost trade and provide better access to third markets.

More support to individuals and small firms hit by the outbreak is needed for a robust recovery

The COVID-19 crisis should be used as an opportunity to initiate reforms to reduce the out-of-pocket share of health costs and strengthen social protection to reduce precautionary saving and encourage consumer spending. Abandoning growth targets for good would help avoid incentives to pursue growth at any price and hence make growth more sustainable. Acceleration of the reform of the household registration system to grant access to public services to all would also work in that direction. Rebalancing from investment to consumption will continue only with those structural reforms. The private sector needs to be provided with a level playing field to expand investment opportunities and reverse the shrinking share of private investment. Allowing private entry to railway investment is a welcome step and should be widened to all sectors. Corporate deleveraging should restart and shadow banking should continue to be reined in once the recovery is on a stable path.