Chapter 3. Financing a sustainable recovery from the COVID-19 pandemic

The fiscal and monetary environment in Emerging Asia remains challenging. The current context calls for innovative financing solutions to finance the recovery post-pandemic. The chapter explores these solutions at length. First, policy makers should consider options for managing the stock of public debt, including participation in multilateral initiatives, swap arrangements, or debt buybacks. Alternative financing sources such as green, social and sustainability bonds can enable a sustainable and equitable recovery. The development of this market segment requires resolute policies, including robust regulatory frameworks, higher supply of sovereign bonds, and incentives to increase investor participation. In addition, insurance-linked securities could provide an extra layer of financial coverage against extreme events such as pandemics. There is also scope for regional co-operation in financing the recovery. For instance, sovereign catastrophe risk pools could provide a mechanism for Emerging Asian governments to enhance their financial preparedness against pandemics and other large external shocks.

All around the world, the COVID-19 pandemic has exposed gaps in healthcare systems, disrupted businesses and public services, derailed supply chains, and shattered job markets (see Chapters 1 and 2). Although conditions have improved in many countries as vaccination rates have increased, recovering from one of the biggest global socio-economic crises in decades will involve many challenges, particularly for Emerging Asian economies.

Ensuring the availability of suitable financing in a way that does not put the stability of financial markets and fiscal policy at risk is a critical consideration as governments address the challenges of the pandemic. As it stands, Emerging Asian governments do have some room for manoeuvre, yet they are also dealing with rising levels of fiscal stress. Against this backdrop, this chapter aims to contribute to policy making by discussing financing options for the public sector in detail. In so doing, it presents options for financing policies in a more sustainable manner.

Firstly, the chapter sets out a number of ways in which governments can manage their current stock of debt. It then looks at how they can narrow financing gaps by harnessing bond markets, and at policies that can deepen the markets for government debt. More specifically, it looks at how green, social and sustainability bonds can be used to finance a sustainable and equitable recovery from the pandemic. The chapter then discusses insurance-linked securities, and the role of multilateral institutions in lowering the cost of credit. Finally, it reviews regional risk-pooling mechanisms to hedge potential losses from catastrophic events.

As the pandemic drags on, the economic environment remains challenging, and designing fiscal and monetary interventions is increasingly complex. Considering the tightness of their fiscal headroom, policy makers face a trade-off between maintaining policy support in the near term, and preserving financial stability in the medium term. At this juncture, there is still arguably some space for governments in the region to intervene in many Emerging Asian economies; although constraints could harden if a new wave of COVID-19 cases were to stress healthcare systems, or if monetary policies began to tighten in response to increasing inflationary pressure.

The current fiscal environment – the pandemic has already stretched public finances

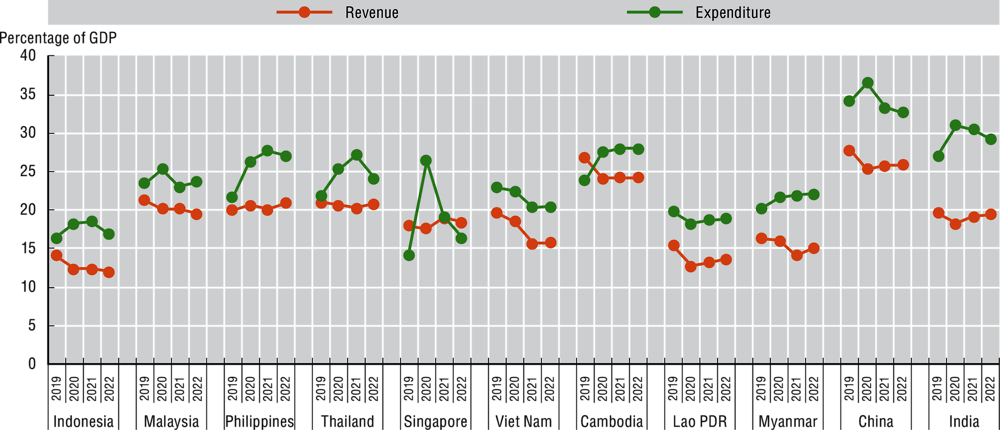

The COVID-19 pandemic has significantly increased the pressure on public finances due to supportive measures such as cash-transfer packages and higher healthcare budgets. In certain cases, governments in the region have already had to reduce or suspend some expenditure items in favour of the pressing need to lessen fiscal burdens. The ratio of general government spending to gross domestic product (GDP) in the region has risen markedly, increasing to a range of 18-37% in 2020, from 14-34% in 2019 (Figure 3.1). The uptick in spending to manage the response to the pandemic coincided with a drop in revenues as economic activity fell back. Still, the spending-to-GDP ratio is expected to stabilise by the end of 2021, and decline in 2022, as governments rein in their budgets.

Near-term fiscal concerns mostly revolve around the debt-service burden of an economy, and data on this seem to provide some grounds for reassurance. Still, the rather muted changes in interest payments thus far have been against a backdrop of persistently low interest rates across Emerging Asia, a trend that will be discussed in detail in the subsequent section. Meanwhile, general government borrowing as a proportion of output jumped sharply across Emerging Asian economies in 2020. Moreover, it is anticipated to continue to inch upwards in some of the countries in 2021, albeit at a slower pace. Indonesia, Malaysia, Myanmar, the Philippines, Thailand, and Viet Nam are projected to record higher net borrowing ratios by the end of 2021 compared to 2020, before these ratios begin to recede.

The levels and sustainability of public debt in Emerging Asia are cause for concern

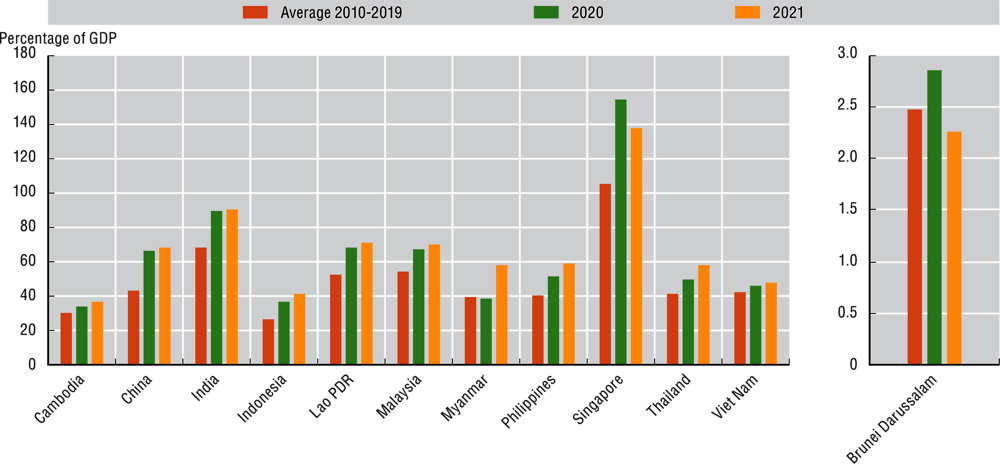

The widening deficits expectedly led to a significant rise in governments’ stock of debt (Figure 3.2, Panel A) after the outbreak of the pandemic. The public debt of Emerging Asia (excluding Brunei Darussalam) increased by an average of 15.5 percentage points from 2019 to 2020. Moreover, debt levels are forecast to have risen by the end of 2021. With GDP levels generally declining in 2020, debt-to-GDP ratios have surged by an average of about 9 percentage points since 2019 across the 12 economies of Emerging Asia. Public debt ratios at the end of 2020 ranged from roughly 2.9% in Brunei Darussalam, to 154.9% in Singapore (Figure 3.2, Panel A). Notably, the general government gross debt ratios of Singapore, the People’s Republic of China (hereafter “China”), India, Cambodia and Thailand hit all-time highs in 2020. In parallel, fiscal deficits have widened sharply in 2020 in all countries in Emerging Asia and are anticipated to have deteriorated further in 2021 in Indonesia, Malaysia, Myanmar, the Philippines, Thailand and Viet Nam (Figure 3.2, Panel B). Furthermore, a comparison with the pre-pandemic period 2010-2019 shows that both debt levels and fiscal deficits have deteriorated markedly in 2020 and 2021 compared to that period.

As sovereign debt has increased sharply worldwide, the question of its sustainability has come to the fore. The standard framework of analysis suggests that four main factors determine debt sustainability: the initial level of debt, economic growth, the degree of fiscal balance, and the burden of debt-service (Bohn, 1998). Box 3.1 provides a brief overview of the general considerations and features of the fiscal frameworks that governments adhere to. Fiscal frameworks are indeed an important tool for supporting fiscal sustainability and increasing the predictability of public policies. Another important attribute of fiscal frameworks is that they facilitate communication with – and accountability to – the public.

Fiscal frameworks – which comprise fiscal rules, fiscal institutions and budgetary procedures – are an important tool for supporting fiscal sustainability and increasing the predictability of public policies. Most countries rely on a combination of numerical and procedural rules. The design of fiscal frameworks should achieve three main goals. The first of these is to ensure the sustainability of the public finances. The second is to support the stabilisation of the economy through counter-cyclical fiscal policy whenever this is appropriate. Finally, the third main goal is to facilitate communication with, and accountability to, the public (IMF, 2021b).

On the other hand, and as noted by Debrun and Jonung (2019), meeting these three objectives simultaneously can be challenging and can lead to the so-called policy trilemma. For instance, long-term fiscal targets that are based on numerical rules, such as the debt-to-GDP ratio, may in fact take an excessively narrow view of sustainability.

Additional features that are desirable in fiscal frameworks include resilience, ease of monitoring, operational guidance, and enforcement (IMF, 2021b). Furthermore, Ardanaz et al. (2021) argue that fiscal rules should include features to accommodate exogenous shocks.

The literature on the impact of numerical fiscal rules has grown in recent decades. Most studies suggest that the implementation of numerical fiscal rules has been effective in achieving both fiscal sustainability and macroeconomic stability (Gomez-Gonzalez, Valencia and Sanchez, 2021; Bergman and Hutchison, 2015; Frankel, Vegh and Vuletin, 2013; Neyapti, 2013). Strong fiscal rules are likewise associated with an improvement in the current account balance (Afonso et al., 2021) as well as with an improvement in access to markets, due to lower bond spreads and higher sovereign ratings (Sawadogo, 2020). Another strand of literature explores the advantages and drawbacks associated with different types of numerical and non-numerical fiscal rules. Table 3.1 summarises some of these findings.

In practice, however, markets’ tolerance of debt levels necessitates a case-by-case analysis. The precise thresholds are a matter of market judgement and can be dynamic or change over time.

The OECD countries implemented various policies in terms of securing long-term fiscal sustainability. Medium-term expenditure frameworks, for example, are an important tool for overcoming the limitations of the annual budget cycle by adopting a medium-term perspective (i.e. at least three years from the current budget) for achieving fiscal objectives (OECD/ADB, 2019). Another tool is performance budgeting, which has been widely adopted by OECD countries starting from the 1990s. Performance budgeting is defined by the OECD as “the systematic use of performance information to inform budget decisions, either as a direct input to budget allocation decisions or as contextual information to inform budget planning, and to instil greater transparency and accountability throughout the budget process, by providing information to legislators and the public on the purposes of spending and the results achieved” (OECD, 2019).

Spending reviews represent an additional tool for streamlining fiscal management. They entail an assessment of the implementation efficiency and effectiveness of existing government policies and have proven to be an important tool for governments to control total expenditure, to align spending allocations with government priorities and to improve the effectiveness of policies and programmes (OECD, 2021a). In addition, independent fiscal institutions (i.e. independent parliamentary budget offices and fiscal councils) have been established across OECD countries to “provide independent analysis of fiscal policy and performance, thus promoting fiscal transparency, sound fiscal policy and sustainable public finances” (OECD, 2020a). Finally, green budgeting frameworks could support the achievement of environmental and climate-related objectives by providing policy makers with a clearer understanding of the environmental and climate impact of budget choices. Green budgeting relies on four key mutually reinforcing building blocks, namely: a strong strategic framework; tools for evidence generation and policy coherence; reporting to facilitate accountability and transparency; and an enabling budgetary governance framework (OECD, 2020b).

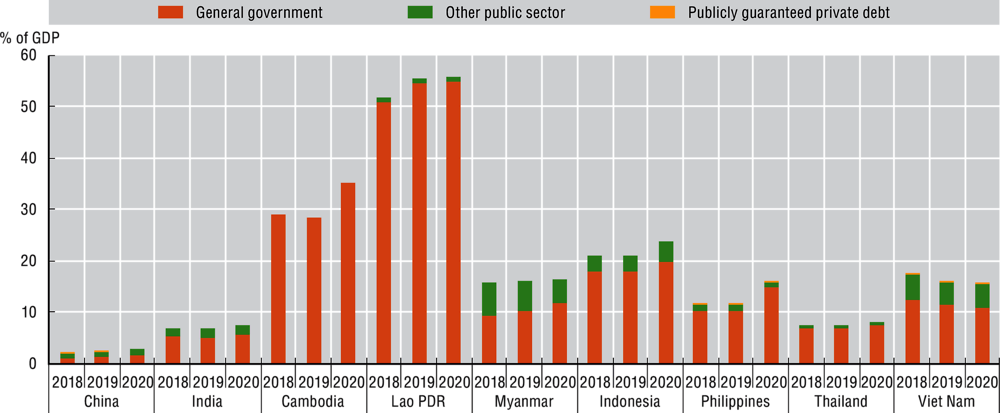

Drawing on the lessons of the Asian financial crisis of 1997-98, and in order to mitigate risks related to exchange rates, governments in Emerging Asian economies have favoured domestic sources of credit over external ones. Since the crisis, Emerging Asian economies have been especially keen to keep their external public debt-to-GDP ratios in check. In 2020, public and publicly-guaranteed external debt did rise, however, driven by spending on support measures to ride out the pandemic (Figure 3.3).

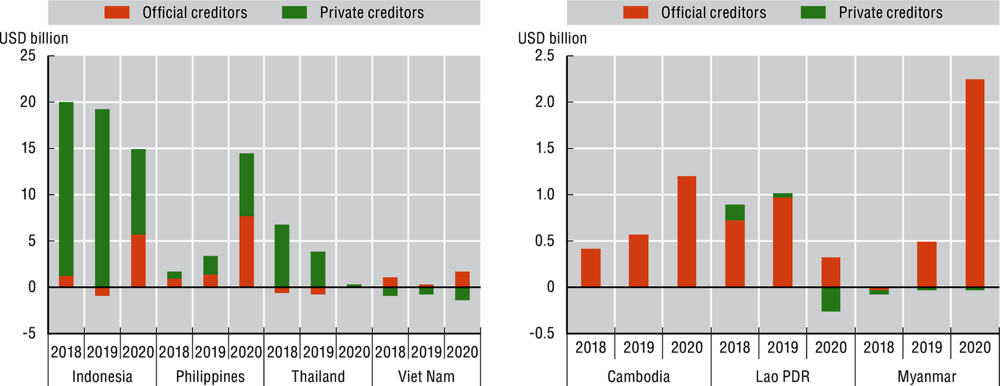

For many countries in the region, multilateral development banks and official bilateral sources have stepped in to meet a substantial chunk of long-term foreign currency financing demands of their public sectors (Figure 3.4). The exceptions are China, which relied more on private creditors, and to some extent, Thailand.

Thus far, credit rating agencies have arguably been more flexible than in previous years in applying their ratings frameworks in their assessments of credit risk despite the marked rise in the gross sovereign debt stock. In Emerging Asia, save for the four rating downgrades outlined in Table 3.2 (i.e. dark orange cells), credit rating agencies have mainly adjusted their outlooks downwards. The changes were also not unanimously on the downside, with Viet Nam receiving outlook upgrades in the first half of 2021 from all three of the major credit rating agencies.

Apart from containing expenditure and targeting it more effectively, there is also scope for governments to improve revenue collection through specific policies. For instance, the digital economy, which has grown rapidly in Emerging Asia in the past few years, is a potential avenue to expand the tax base. At the same time, governments can also leverage digital tools more than they already do, in order to facilitate compliance and improve tax administration (Box 3.2). However, it should be acknowledged that tax increases may be difficult to implement in the post-pandemic recovery phase and are thus not the first option of choice.

As an alternative to taking on additional debt, and in light of structural changes such as digitalisation, it is important for governments to explore income streams that they have not yet tapped. Higher tax rates are not necessarily a good strategy in periods of crisis, as they may stifle recovery and overburden pandemic-weary firms and workers. However, in economies in which compliance is weaker, and where the informal sector is large, it is an opportune time to find solutions in order to expand the tax base.

In this respect, many governments are now looking to broaden the tax base through wider regulatory coverage in the digital space. As the OECD (2021b) has argued, fiscal policy must adapt in order to take account of a digitalised environment that imposes “new constraints on social protection systems and income tax bases”. The OECD report also underlines that digitalisation provides opportunities for fiscal policy, in that it can enable efficient public administration and enhanced tax compliance given the appropriate infrastructure and systems. As the Asian Development Bank (ADB) has observed (ADB, 2021c), a number of Asia’s developing economies have responded to the fiscal challenges of the pandemic by setting forth tax rules for the domestic e-commerce businesses.

The OECD’s framework recommends a two-pillar approach to managing the tax challenges of a digitalised economy. The first pillar concerns governments’ rights to levy taxes that go beyond a company’s physical presence of establishment. Pillar two, meanwhile, seeks to create a global minimum tax on multinational enterprises, in order to address remaining questions of tax-base erosion, as well as issues of profit shifting (OECD, 2021c). Another relevant recommendation in the OECD’s framework, given the importance of the value added tax (VAT) as a source of revenue in Emerging Asia, is to strengthen the integrity and performance of VAT regimes.

On tax administration, Kochanova and Larson (2016), who utilised a cross-country dataset on e-government systems, found that “e-filing systems reduce tax compliance costs in general, while e-procurement has an observable impact in countries with higher levels of development and better-quality institutions”. Separately, the OECD (2021d) argues that it was clear from the outset that the digitalisation of tax administrations could significantly help in blunting the impact of the COVID-19 crisis on operations. And the governments have responded accordingly. According to the OECD report, the experience of the pandemic has convinced about 60% of the governments surveyed to consider changing their previous strategy on the digitalisation of tax administration processes, while about three quarters of them plan to continue moving audit work from operations in the field to the virtual or digital space.

Finally, co-operation between tax administrations in Emerging Asia is essential in the fight against tax evasion and to protect the integrity of domestic tax systems. The exchange of information for tax purposes is a key pillar of this co-operation. There have been calls for increased attention to this matter within Southeast Asia. For instance, ASEAN draws attention to tax co-operation as one of the key elements for supporting regional competitiveness and expresses commitment to improving the implementation of exchange of information processes in line with international standards (ASEAN Secretariat, 2015).

The private sector is also struggling to stay afloat

The financial standing of the private sector has also been badly hit by the pandemic in Emerging Asia. Notwithstanding the support measures that governments have implemented, many firms – particularly micro, small and medium enterprises (MSMEs) – have closed down. Interestingly, Vandenberg (2021) provides evidence that bankruptcies have actually fallen in some relatively high-income economies in Asia over the course of the pandemic, but also notes that enterprises may fail or close permanently without actually undergoing an insolvency or bankruptcy procedure. The author posits that the lower number of bankruptcies could be associated with the speed and “unreservedness” of government stimulus measures. If enterprises that have so far managed to avoid bankruptcy thanks to government support measures are to continue surviving, the author contends that “measures need to continue until economic recovery takes hold”.

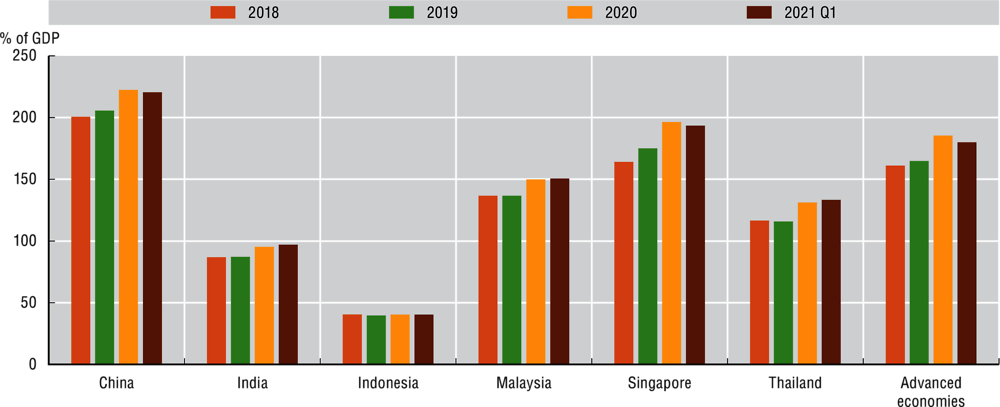

In some countries in the region, private sector debt-to-GDP ratios are already well-over 100% of GDP (Figure 3.5). In China, the ratio even exceeds the average levels of emerging and advanced economies alike. This is a critical metric because the pandemic has placed enormous pressure on corporate earnings and ultimately on the serviceability of private debt. Meanwhile, as anticipated, the share of non-performing loans to gross loans in some Emerging Asian countries went up in 2020 and 2021 (Figure 3.6). While the absolute ratios remain arguably generally benign, the large share of big firms in the aggregate borrowing figures, and the significant degree of regulatory forbearance in facilitating the restructuring of loans, may have masked the severity of the situation.1, 2 Indeed, the impact on MSMEs, which already were underfinanced by formal credit channels even before the pandemic, may only be partially captured.

The recovery from the COVID-19 pandemic will be shallow and highly exclusive if the financing needs of MSMEs, which the pandemic has hit especially hard, are not addressed appropriately. MSMEs’ fundamental importance in economic and social welfare cannot be overemphasised. They are a critical component both of well-functioning domestic marketplaces and of external trade. In Asia, they comprise over 95% of firms, accounting for 30-60% of output, and providing 50-70% of employment (Yoshino and Taghizadeh-Hesary, 2018). Beyond their economic contribution, MSMEs are also immensely important in maintaining and strengthening the domestic supply chains. Ensuring that they flourish is a critical factor in bolstering the social fabric of an economy.

Banks are the primary source of formal credit of MSMEs in Emerging Asia, and few of them have access to equity and bond markets. Since banks generally see MSMEs as riskier clients, however, many of them are unable to obtain the loans that they need. Channelling funds into MSMEs to help them meet their needs has, therefore, long been an important public policy issue. Even before the COVID-19 pandemic, financing for MSMEs was a challenge in many countries, including those in Emerging Asia, even though some governments were already providing support. Such measures include mandated credit programmes in countries like Indonesia and the Philippines.

With the global economy and international trading conditions facing considerable uncertainties, banking sectors have become more risk-averse, and some of the services they provide have become more costly.3 In the recent period of tighter credit conditions, smaller firms appear to have been affected disproportionately compared to the larger ones. The findings of Kim et al. (2021) indicate that while small and medium enterprises account for only around 23% of the demand for trade finance at the banks featured in the survey, they account for 40% of trade-finance rejections.

Against a backdrop of tight credit conditions, governments are under pressure to mobilise alternative financing solutions for MSMEs, as they navigate the challenges of the COVID-19 pandemic. Alleviating the liquidity constraints that MSMEs face, regardless of whether they are involved in trade, has to involve the banks one way or the other. However, banks themselves also need help at this time, even if only temporarily.

The results of a 2020 survey by the International Financial Corporation that covers banks involved in trade finance show that, although they have crisis response strategies in place, 91% of the banks in the survey said they need some form of additional support from development finance institutions (Starnes et al., 2021). Furthermore, 96% of banks’ detailed requests in this regard related to the need to expand their financial capacity.

The International Chamber of Commerce (ICC, 2020) has outlined some specific interventions that governments and other stakeholders have undertaken, also listing other actions that could help to alleviate the credit tightness. While mainly focusing on trade finance, some of these measures are also applicable to, and supportive of, MSMEs as a whole. The suggested ways forward tend to cover multiple fronts, and several of them are potentially applicable to Emerging Asian economies.

One such suggestion is transitioning to paperless trading by voiding all legal requirements for trade documents to be in paper format, and fast-tracking the adoption of the United Nations Commission on International Trade Law’s Model Law on Electronic Transferable Records.

Revisiting the application of the Basel III macroprudential rules is another relevant suggestion, in an effort to limit the capital constraints that may hinder the deployment of essential finance, particularly to MSMEs, and for governments also to consider reducing the risk weights for banks’ exposures to MSMEs.

The other potentially practicable suggestions for the region include expanding the guarantees on banks’ trade exposures, in order to free up their balance sheets and, in turn, to free up funding resources; ensuring that export-credit agencies are equipped to provide adequate support for short-term trade transactions, with appropriate coverage limits and geographical scope; and enlarging the scale of development bank schemes, in order to provide liquidity for trade-finance transactions and mitigate the corresponding risks.

Financial technology (FinTech) solutions, including digital banks, can also be leveraged to meet the financing needs of MSMEs. In a study that analysed the lending behaviour of digital banks towards micro and small enterprises in China, Sun (2021) found that digital banks managed to evaluate these borrowers remotely, and to sustain lending during the COVID-19 pandemic. In sub-Saharan Africa, IFC (2021) likewise observes that, among financial institutions, “FinTech and mobile money companies saw their businesses grow while more traditional institutions such as banks, savings, and credit co-operatives and microfinance institutions, experienced downturns”.

However, building on these encouraging developments in future will require a digital infrastructure that is stable, affordable, and secure. It will also require enterprise managers with sufficient understanding of the process, and the capacity to access financing through these channels. Finally, it will require regulations that cover micro- and macroprudential risks appropriately, while supporting the development of innovative tools.

Source: Authors’ elaboration.

The current monetary environment: Prolonged monetary accommodation has kept borrowing costs low

Emerging Asian economies have implemented a mixture of monetary policies to keep the system as liquid and accommodative as possible, and to avert a significant loss in market confidence. These policies include, among others, direct lending and forbearance, loan guarantees, loan reclassification and restructuring, and adjustments to interest rates and reserve requirements.4 Taken together, these measures exert a downward pressure on the already-low cost of borrowing.

As things stand, the policy interest rates of many Emerging Asian economies are at multiple-year, if not historic, lows. In India, the prevailing central-bank repurchase agreement, or repo, rate of 4% is the lowest in over two decades. Bank Indonesia’s seven-day reverse repo rate of 3.5%, which it adopted as its key rate in August 2016, is at its lowest since the publicly available time series was first released in June 2015. The same can be said of Bank Negara Malaysia’s overnight policy rate (1.75%), Bangko Sentral ng Pilipinas’s overnight reverse repurchase rate (2%), and Bank of Thailand’s policy rate or 1-day bilateral repurchase rate (0.5%), all of which are at record lows since the respective data series based on the current definitions were published in April 2004, June 2016, and May 20005 (see Chapter 1).

Natural rates of interest have generally declined, and are hovering around historic lows in some countries

The natural rate of interest is a key variable for analysing debt dynamics and the sustainability of sovereign debt. For instance, a lower natural rate of interest may also imply lower potential growth, as many of the factors that affect the natural rate of interest also influence potential growth. Lower potential growth is likely to weigh on governments’ ability to deal with rising debt stocks. In theory, it is the real (inflation-adjusted) interest rate that would prevail when actual output equals potential output (Borio, Disyatat and Rungcharoenkitkul, 2019). Meanwhile, the drivers of the natural interest rate can include demographic profiles, productivity, the extent of risk aversion, efficiency of financial intermediation, and investment-specific technology (Brand, Bielecki and Penalver, 2018; Sudo, Okazaki and Takizuka, 2018).

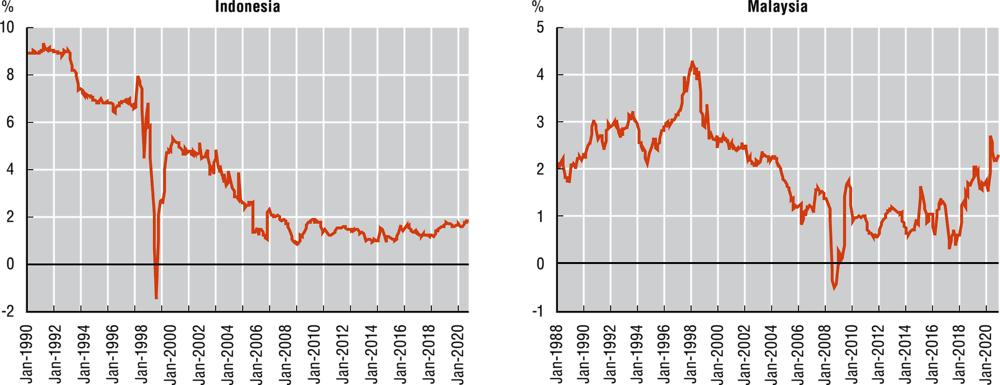

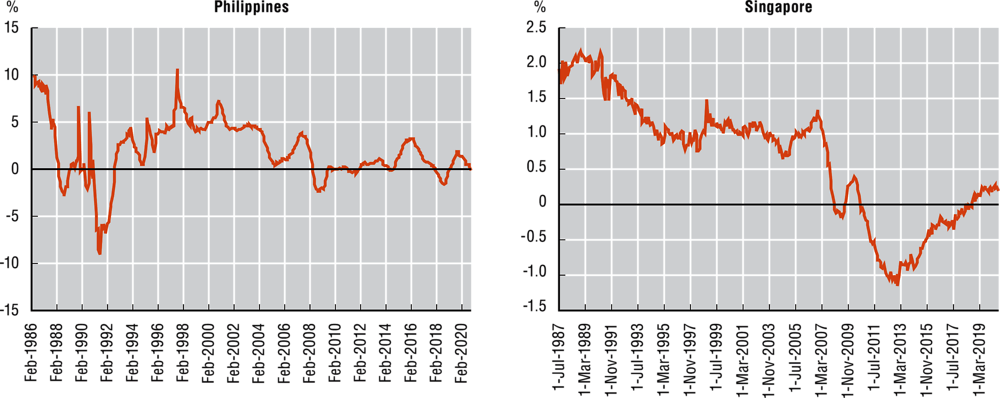

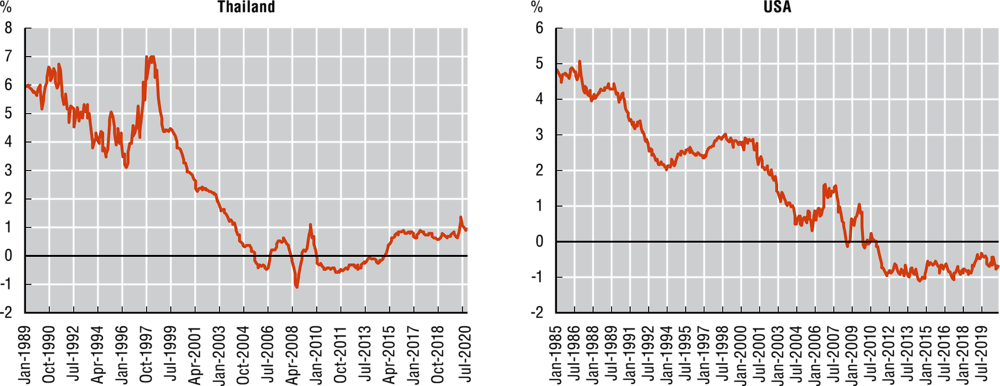

Despite the challenges inherent in measuring them, there seems to be a consensus that natural interest rates are trending downwards in developed and developing economies alike (see Box 3.4). Emerging Asian economies are no exception, although there are also cases in the region where the trend is on the rise. As Figure 3.7 shows, every one of the five Emerging Asian economies selected for the sample experienced a decline in their real natural rate of interest over the period under analysis. This finding concurs with the results of previous analyses, which showed a decline in the natural interest rate in Emerging Asian countries (Zhu, 2016; Maybank, 2018). This decline was already in progress for these countries in the early 1990s, but then the Asian financial crisis halted the trend (Tanaka, Ibrahim, Brekelmans, 2021). During the crisis, Thailand, Indonesia, Malaysia and the Philippines experienced sharper spikes in natural interest rates, reflecting how deeply the crisis affected their economies. Following the crisis, the decline in natural real interest rates resumed at the start of the 2000s in all countries in the sample. In Singapore and Thailand, the trend turned in an upward direction once again from 2013 onwards, after a tightening of monetary policy in the United States. In Indonesia and Malaysia, meanwhile, the real natural interest rate appears to have stabilised since the global financial crisis.

There is broad consensus that the natural rate of interest has been declining globally over recent decades, although the magnitude of the decline varies among studies. Those based on US data show that the natural rate of interest has declined since the 1980s, particularly since the Great Recession (Williams, 2015). Another estimate showed that the natural rate of interest in the United States dropped to close to zero during the global financial crisis, and stayed there until 2016 (Holston, Laubach and Williams, 2017).

Elsewhere in the literature, Lubik and Matthes (2015) find a secular decline in the US natural rate over the last few decades. Furthermore, Del Negro et al. (2017) observe a decline in the natural rate of interest in the United States since the 1990s, attributing most of this decline to investors’ increased preference for safe and liquid short-term assets. However, estimates of the decline differ, ranging between 0% and 2%, depending on the concept used in the study (Fiedler et al., 2018).

A declining natural rate of interest trend has likewise been observed in other advanced economies, including Canada, the euro area, and the United Kingdom, over the 55 years from 1961 to 2016 (Holston, Laubach, and Williams, 2017; Hong and Shell, 2019). Similar results were found by other studies focusing on Canada (Mendes, 2014), the euro area (Constâncio, 2016; Bonam, et al. 2018), and Japan (Fujiwara et al., 2016). In addition, Haavio, Juillard and Matheron (2017) have shown that the natural rate of interest in the euro area was negative during the Great Recession, and has remained so ever since. Furthermore, Galesi, Nuño and Thomas (2017) have also found support for the observation that the natural rate of interest has dropped over the past few decades, and has even turned negative in some advanced economies.

In general, estimating the natural rate of interest in emerging economies is more challenging, due to the limited length of data series and ongoing structural changes (Goyal and Arora, 2013). However, some studies have tried to provide estimations for Asian economies. For instance, Perrelli and Roache (2014) document the sizeable decline in the natural rate of interest in 24 emerging economies, including in Asia. In emerging economies, the authors reveal, the likely ranges for the natural rate of interest fell by more than 200 basis points between 2002 and 2013.

Similarly, Zhu (2016) shows that, apart from in China, the natural rate of interest in Emerging Asian economies has fallen by more than 4% in recent decades. Other estimates show that the natural rate in ASEAN countries has been declining for two decades. Global factors that are also likely to have contributed to the decline include lower global interest rates, lower public debt, reduced sovereign risk, and an increased supply of savings that have translated into a deepening of financial markets (Maybank, 2018).

Source: Tanaka, Ibrahim and Brekelmans (2021).

Overall, the Southeast Asian countries, especially Singapore and Thailand, show a similar overall trend with regard to real natural rates of interest to that of the United States. Still, all of them display idiosyncrasies that cannot purely be associated with shifts in the US interest rate. For instance, in the Southeast Asian countries, the shock of the Asian financial crisis had a much larger impact on the natural rate of interest than in the United States. In addition, while the natural rate of interest remained stable after 2010 in the United States, there were slight increases in some Southeast Asian countries after 2013.

In the current fiscal and monetary environments as described above, policy makers in Emerging Asia should consider a range of options for managing public debt. In this regard, this chapter discusses various options for managing the current stock of debt, including multilateral initiatives, swap arrangements, debt buybacks, and debt cancellations and write-downs.

As governments may need to take continuous supportive measures in 2022, this chapter also reviews a range of financing sources. These include capital market solutions, such as Environmental, Social and Governance (ESG)-themed bonds, and innovative tools such as insurance-linked securities. This chapter also emphasises how regional co-operation could play in bringing the various financing options fully into operation, through means such as regional risk pools.

Multilateral initiatives are critical in keeping highly indebted economies afloat

With the encouragement of the International Monetary Fund and the World Bank, the Group of Twenty (G20) countries launched the Debt Service Suspension Initiative (DSSI), which aims to lessen the debt burden of low-income and least-developed countries, as they recover from the impact of the COVID-19 pandemic. The DSSI suspends debt service payments (both principal and interest), and provides emergency relief for 73 eligible countries (World Bank, 2021c). In Emerging Asia, Cambodia, Lao PDR and Myanmar are eligible for the DSSI, although only Myanmar is currently participating as of 5 November 2021 (World Bank, 2021c). Cambodia and Myanmar are classified as low-risk countries both for external and overall debt distress. By contrast, Lao PDR is classified as high-risk on both metrics. Myanmar’s participation stands to save the country about USD 379.9 million (0.6% of GDP) from May-December 2020, and USD 793.7 million (1.0% of GDP) from January-December 2021 (World Bank, 2021c).

The DSSI comes with a number of conditions, the purpose of which is to balance the needs of debtors with the needs and rights of creditors. The conditions require that savings be channelled into social, health, or economic spending, for the purposes of navigating the COVID-19 crisis. Under the terms of the initiative, debt restructuring must also be neutral in net present value (NPV), and countries must not take on new non-concessional debt while still participating in the initiative.6 The NPV neutrality is a critical feature of the programme, serving to mitigate moral hazard. The repayment period is five years, with a one-year grace period for a maximum term of six years. All the Paris Club creditors have agreed to these conditions, and the IMF and World Bank also strongly encourage other creditors to adopt similar terms, whether the debt is sovereign or private.

Swap arrangements are a valuable tool for restructuring debt

Depending on the national context, swap agreements can also be used in renegotiating the terms of debt. In the process of renegotiation, payments can be earmarked for a particular objective. The debt-for-policy swap is an umbrella term for a type of financial swap where a sovereign issuer accepts debt relief in exchange for participation in a mandated policy action. Under such a scheme, the creditor buys the debt of a participating debtor country in exchange for a commitment to channel payments directly into achieving policy goals selected by the creditor. This is instead of directing the payments into servicing debt. Debt-for-environment swaps (also called “debt-for-climate” swaps) are perhaps the most common instruments of this kind.

Debt-for-climate swaps have the potential to provide debt relief for Emerging Asian economies while simultaneously promoting projects and policies to advance climate change mitigation or disaster prevention goals. These may be particularly useful for Asian island nations which are some of the most exposed to climate and natural disaster risks worldwide. This approach would not be entirely novel to Emerging Asia. For instance, the United States Tropical Forest and Coral Reef Conservation Act (TFCA) is a “debt-for-nature” swap that allows eligible countries to redirect payments of concessional debt owed to the United States to approved grant-making programmes if they meet certain economic and political criteria. From 1998 to 2020, USD 233.4 million were used to restructure loan agreements in 14 countries, providing USD 339.4 million to 20 projects. TFCA agreements saved more than 67 million acres of tropical forest over this period including in the Philippines and Indonesia (Nature, 2020). Cassimon, Essers and Renard (2009) find that a series of debt-for-education swaps between Germany and Indonesia in the 2000s did not open much fiscal space for Indonesia, but the earmarking required in the agreement may have contributed to the construction and equipment of 511 learning resource centres for advanced teacher training (teacher upskilling), and the construction of 100 junior high schools in the eastern provinces. Notably, these objectives were not unilaterally imposed by Germany, but rather consistent with education goals of the Indonesian government at that time. The desires of the country receiving relief must be taken into account in any of these arrangements; therefore setting up debt-for-policy swaps may be difficult in countries with weaker medium- or long-term sectoral plans.

Debt-for-equity swaps are another variation on this arrangement, and they are utilised in both the public and private sectors. In this type of deal, a share in a public or private company is exchanged for an equivalent amount of debt. This provides a mutual benefit, both to the debtor (debt-relief and investments), and also to the creditors (partial recovery of debt beyond what would be expected otherwise) (World Bank, 1993).

Debt buybacks can be a strategy for lowering the cost of debt service over time

In the same way, a debt buyback, wherein debtors offer a lump-sum payment in exchange for the cancellation of the remainder of the outstanding debt, can also be an option for some countries. Creditors are more likely to accept these terms when it appears that the lump-sum payment is the best possible outcome for them with respect to the debt in question.

Diwan and Spiegel (1991) examine this approach to debt management, by exploring its implementation in the Philippines in 1989. In September of that year, the Philippines reached an agreement with creditors whereby the government would purchase USD 1.3 billion in debt at the rate of 50 cents per dollar, and banks would provide USD 715 million in new money at a rate 0.675% above the London Interbank Offered Rate (LIBOR), with a 15-year maturity and 7.5 years of grace (total duration of 22.5 years). The new money was disbursed in three tranches, and the buyback was executed on 3 January 1990, with the Philippines ultimately paying a net price of 24 cents on the dollar (Diwan and Spiegel, 1991).

Stiglitz and Rashid (2020) suggest that voluntary buybacks could provide savings for governments if the debt to be bought back is trading at a discount. “‘Agree[ments] to spend the savings on creating and promoting global public goods’, [such as] public health expenditures and climate change mitigation and adaptation (but not loss-and-damage)” will create future climate financing space at the expense of present reserves.

Debt cancellations and write-downs are an option under extreme conditions

Under extreme conditions, and when it becomes apparent both to debtors and creditors that a full and timely repayment of debt is highly unlikely (e.g. Haiti’s earthquake), the parties involved may conclude agreements to cancel and write down debt.

Although debt cancellations and write-downs could provide some relief to governments struggling to manage their stock of debt, recourse to these options is currently not considered in the Emerging Asia region. This is due to the fact that these options may have some harmful long-term effects. Debt cancellations and write-downs present potential moral hazards. Governments may engage in more profligate spending and debt accumulation in anticipation of some of the debt being cancelled or written down, or they may respond to a successful negotiation of a debt cancellation or write-down by assuming more debt in the space opened by the cancellation or write-down. As such, debt cancellations and write-downs must be an absolute last resort available only in cases of clearly-defined emergencies and be accompanied by strict legislative prohibitions against taking on new debt for a period of time with similarly extremely narrow and clearly-defined exceptions.

As with debt cancellations, elaborating the terms of a debt write-down can be a protracted and costly endeavour if it requires the conclusion of several individual bilateral arrangements. The development of common term sheets to which parties agree through a joint initiative can reduce administrative costs for debtors, and may allow creditors to start accessing repayments more quickly (UNESCAP, 2020).

Examples of debt cancellations or write-downs by Paris Club creditors include three-year payment deferrals for Honduras and Nicaragua after Hurricane Mitch in 1998, one-year payment deferrals for Sri Lanka and Indonesia after the Indian Ocean tsunami in 2004, and a three-year deferral of payments for Liberia in 2008 amid significant long-term political upheaval in the country (Club de Paris, n.d.). While the debt stocks were not reduced, creditors absorbed a loss in terms of net present value by accepting deferred payments.

Prevailing conditions present significant opportunities for policy makers. First, there is an opportunity to increase the efficiency of how the financial resources that are available in the system are put to use. Second, there is an opportunity to harness other financing modalities in order to facilitate recovery from the pandemic. Against this backdrop, this section discusses the financing options for the public and private sectors in Emerging Asia, with the aim of laying a robust foundation for a sustainable and equitable economic recovery.

In particular, this section examines four key topics. The first of these is the viability of themed bonds, or of bonds that are in accordance with environmental, social and governance (ESG) principles. The second key area of focus is to look at considerations for issuing offshore bonds. The third key area to examine is the role that multilateral institutions can play in harnessing innovative tools. A fourth key area to look at, meanwhile, is ex-ante financial measures and, in particular, insurance-linked securities.

Given the significant differences between Emerging Asian countries, however, it is important to underline that certain options that are viable for one country may not be viable for another, or may simply not be appropriate at present. Similarly, financing needs and challenges can vary depending on what the money is needed for, and in which sector. Needs may also vary depending on the level of development of financial markets, including the infrastructure of these markets in the country in question. The preparedness of regulatory architecture to accommodate different types of market participants on both the demand side and the supply side also matters.7

ESG-themed bonds have a lot to offer to enable a sustainable recovery

Issuing debt securities as interest rates hit rock bottom is a reasonable option as governments seek to fund their recovery from the COVID-19 pandemic. Nevertheless, considering the other pressing challenges at present, and in particular those that relate to climate change, it is important to tailor financing in a manner that takes ESG factors into account. Indeed, sustainable finance has arguably become a premium investment class in recent years. Moreover, the fixed income securities market is a critical space in the drive towards sustainable finance, and there is growing momentum for this market to develop in the direction of ESG-themed debt securities.

In this respect, two key areas require discussion. The first of these is green bonds, and the barriers to overcome in order to develop this market. Then there is the question of social and sustainability bonds, either those relating specifically to managing the COVID-19 pandemic, or to other social outcomes.

Green bonds herald a number of advantages for governments seeking finance

One potential upside of bond and security instruments that are in line with ESG principles is that they help guide how the funding is used. Green bonds that focus on environmentally responsible projects are used widely, and are one of the most promising financial instruments for financing the transition to a low-carbon economy (OECD, 2017). Another advantage of green bonds is their feature to spread the cost of funding the mitigation of climate change across several human generations. This characteristic makes green bonds particularly suitable for raising funding for green investments, both public and private (Sachs, 2015; Monasterolo and Raberto, 2018). Green bonds are also a good option for attracting a broad spectrum of institutional investors (OECD, 2017).

Due to their explicit link with tangible policies, green bonds may also represent a way for governments in Emerging Asia to increase the credibility of their sustainability objectives. In combination with the attractive risk-return profile of green bonds from the perspective of investors, these factors strengthen the argument for further broadening and diversifying the investor base by opening up the market to new types of institutional investors, as well as to retail investors. Depending on what the proceeds are to be used for, several types of green bonds exist on the market, including standard green bonds, green revenue bonds, green project bonds, green securitised bonds, and green certificates. The characteristics of these instruments are summarised in Box 3.5, and will be discussed in detail in the paragraphs below.

The most common type of green debt securities are the standard, so-called “use-of-proceeds”, green bonds. These can be defined as debt securities used to fund projects that have a positive environmental impact, or that deliver climate-related benefits (Table 3.3). Proceeds are clearly earmarked for climate-friendly investments, and yet green bonds are backed by the issuer’s entire balance sheet. Issuing green bonds does entail additional transaction costs, however, to the extent that issuers must track, monitor and report on the use of the proceeds.

Green revenue bonds are non-recourse-to-the-issuer debt obligations, for which the credit exposure is to the pledged cash flows of the relevant revenue streams, fees and taxes (ICMA, 2017). Meanwhile, green project bonds are bonds issued for a single project, or for a number of pooled green projects, for which risks are borne entirely by the underwriter –with or without potential recourse to the issuer (ICMA, 2017).

As regards green securitised bonds, they are collateralised by one or more specific green projects. This category includes, but is not limited to, covered bonds and asset-backed securities. In the event of default, green securitised bonds could provide recourse to the issuer, but only to the underlying assets. The repayment of green securitised bonds usually depends on the cash flows that are generated by these assets. For instance, cash flows could take the form of charges paid by consumers to use infrastructure that has been built using the proceeds of a green bond (Kaminker and Stewart, 2012).

Another option is to attach a green certificate to a standard government bond, as a pledge for equivalent green spending rather than specifically earmarking funds for green projects. According to some researchers, green certificates have lower costs and are more liquid than standard green bonds. This design would also make market prices more informative about environmental performance (Bongaerts and Schoenmaker, 2020).

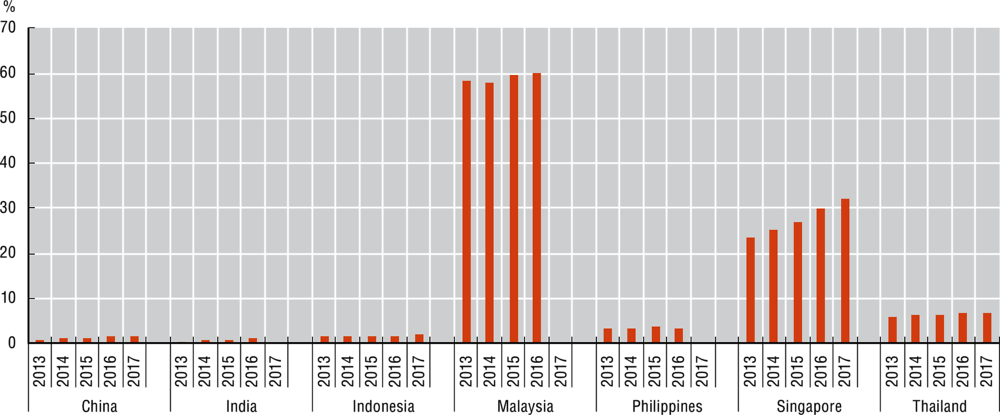

In terms of market size, data as of the third quarter of 2021 show that the combined value of outstanding green, social, and sustainability bonds in the seven economies in Emerging Asian for which data are available is more than USD 225 billion (Figure 3.8), which is still fairly small. In 2020, these bonds accounted for nearly 0.9% of the total for all outstanding bonds (i.e. local and foreign currency bonds). Nevertheless, the debt stock has grown at an encouraging pace of about 24% annually in compounded annual growth terms between 2018 and the first three quarters of 2021, even when pandemic bonds are excluded. China still accounts for the highest share in outstanding bonds, but the other economies in the region are gradually catching up.

With regard to the currency profile of these assets, while over 70% of outstanding green bonds in ASEAN are denominated in the local currency, social and sustainability bonds are mostly denominated in foreign currency (ADB, n.d.). However, local currency issuances are expected to expand further in the coming years, as domestic markets for these themed bonds develop. The interest in these instruments in Islamic financial markets (e.g. Indonesia and Malaysia) is also likely to result in more local currency issuances.

Challenges to the further development of green bond markets in Emerging Asia

Setting out clear parameters for the classification of green bonds, and establishing a credible system of certification, are critical elements in erecting a robust architecture for the ESG financial market to build upon. In this regard, the current debate revolves around the complexity of the existing evaluation process. This is especially the case for green bonds. Meanwhile, the appropriateness and clarity of national regulatory frameworks are also important considerations.

The issuance of a green bond involves a series of specific steps, and is more complex compared to plain-vanilla bonds. As a result, the entire process requires staff with knowledge of climate-related issues and environmental accounting and communication processes. Among other recommendations, the International Capital Markets Association’s (ICMA) Green Bond Principles encourage green bond issuers to seek out external reviews in order to evaluate both the alignment of green bonds with the Principles themselves, and to make a qualitative assessment of the overall “greenness” of the bonds. These reviews can in themselves be complicated and lengthy. The salient features of Green Bond Principles are explained in Box 3.6.

The Green Bond Principles developed by ICMA are voluntary guidelines that encompass four core criteria. The first of these is the use of the proceeds, the second considers the selection and evaluation of projects, the third criterion relates to fund management, and the fourth is about reporting. For as long as a green bond is outstanding, the Green Bond Principles recommend that the issuer should disclose both a reconciliation of the green account (i.e. the total amount of proceeds from the green bond issuance) against project expenditures, and information on how the unallocated balance (i.e. the difference between the green account and total project expenditures) is placed. Furthermore, the Green Bond Principles identify four types of external reviews, namely: second-party opinion, verification, certification by the Climate Bonds Initiative (CBI), and green credit ratings (Dorfleitner et al., 2021).

Second-party opinions are the most popular external reviews for green bonds. They contain a thorough and detailed description of the issuer’s green bond framework, and of the rules and procedures for climate-related activities. Verification reports are less lengthy and detailed compared to second-party opinions, and are typically issued by auditing firms. The CBI certification scheme is based on scientific criteria that ensure consistency with the goal of the Paris Agreement to keep global warming well below 2 degrees Celsius. Finally, green credit ratings are more quantitative in their nature, and focus on an issuer’s environmental performance data. They are issued by traditional credit rating agencies.

The reporting of specific information is likely to pose similar challenges from an issuer’s perspective. The issuers of green bonds must prepare, keep and make available an information file on the use of the proceeds. This information needs to be updated each year, until all of the funds have been allocated, and as necessary thereafter. This information file must include the list of projects in which the funds have been invested, the amounts invested, and the impact that these investments are expected to have. When confidentiality clauses, or the multiplicity of underlying projects, make it difficult to disclose sufficiently detailed information, the Green Bond Principles recommend presenting the file in generic terms, or on the basis of aggregated portfolios (i.e. the percentages allocated to certain categories of projects).

Transparency is a key factor in communicating about the expected impact of projects. The Green Bond Principles recommend using qualitative and, where possible, quantitative performance indicators. Examples of quantitative indicators in this regard include energy capacity, power generation, the degree of reduction or elimination of greenhouse gas emissions, the number of people who have gained access to clean energy, the size of the reduction in the volume of water consumed, and the reduction in the number of vehicles needed. The Green Bond Principles also outline the main underlying methodology or assumptions that should be used in providing quantitative assessments. Issuers that are able to quantify the ultimate impact are encouraged to include it in their regular reporting.

The importance of dedicated regulatory frameworks

Most developing economies, including those in Emerging Asia, lack a dedicated legal framework for the issuance of green bonds (ADB, 2018b). This means that they lack clear definitions, that there is a risk of “greenwashing”, and also that they lack a common framework for the classification of green bonds. This lack of an adequate over-arching framework tends, in turn, to curtail the supply of green bonds, while also fuelling investors’ apprehensions. As pointed out by Shishlov et al. (2016), one of the major challenges for the green bond market is guaranteeing its environmental integrity in order to tackle the greenwashing risks that could hamper its success. Investors are fully aware of the existence of a greenwashing risk. An investor survey carried out by the Climate Bonds Initiative showed that green credentials and transparency on the part of issuers are the most important factors for green bond investors making investment decisions (CBI, 2019).

Nevertheless, there are a number of reasons to be optimistic for the future as far as market infrastructure is concerned. As mentioned above, groups such as ICMA and CBI have put together voluntary guidelines. ICMA has separate guidelines for green, social, sustainability and sustainability-linked bonds that also cover traditional and sukuk bonds. Meanwhile, the CBI has developed its own standard for the certification of green bonds.

Apart from these two umbrella groups, government institutions in countries including China, India, Indonesia, Malaysia, the Philippines, and Thailand have started developing their own frameworks and guidelines, although the scope and depth of these do vary. In 2015, China published a set of guidelines on green bonds, as well as a catalogue of endorsed projects (Yu, 2016; WRI, 2016). For its part, India released an official set of requirements for green bonds in 2016, closely mirroring the general architecture of the Green Bond Principles (SEBI, 2017). In addition, Indonesia rolled out a framework on green bonds and sukuks in 2018 (Government of Indonesia, 2021). Malaysia published a framework for “sustainable and responsible” sukuks in 2014 (Government of Malaysia, 2019). Furthermore, the Philippines released a set of guidelines on issuing green bonds in line with ASEAN’s Green Bonds Standards in 2018 (Government of the Philippines, 2018). Even more recently, Thailand published a sustainable financing framework in 2020 (Government of Thailand, 2020).

Multilateral organisations have also adopted green bond guidelines, and established various taskforces and working groups for greening the financial system. Examples of such initiatives include the joint roadmap for a sustainable financial system from the United Nations and the World Bank (UN Environment and World Bank, 2017), and also the work of the Taskforce for Climate-related Financial Disclosures (TCFD, 2017). At the same time, ASEAN is developing a common taxonomy for sustainable finance, which will provide the bloc with a common language in this domain, while also complementing initiatives at the national level (ASEAN, 2021).

In addition to the regional approaches, developing frameworks that are coherent at the global level could yield various benefits. Indeed, a global taxonomy could attract institutional investors and reduce the cost of cross-border capital flow transactions. An important initiative in this respect is the G20 Sustainable Finance Working Group (hereafter “SFWG”), established by the G20 member countries.8 In 2021, the SFWG has been tasked with developing a multi-year G20 Sustainable Finance Roadmap (hereafter “Roadmap”), which identifies the G20’s priorities in the area of sustainable finance. The Roadmap also sets out the work to be carried out by the SFWG on three specific priority areas: improving the comparability and interoperability of approaches to align investments to sustainability goals; overcoming information challenges by improving sustainability reporting and disclosure; and enhancing the role of International Financial Institutions in supporting the goals of the Paris Agreement and 2030 Agenda (SFWG, 2021).

The supply of sovereign green bonds remains rather limited

Demand for green bonds tends to outweigh supply. Furthermore, leading issuers such as the World Bank and the European Investment Bank have so far carried out part of their issuance through private placements, a type of transaction that does not bring any real additional liquidity to the market. A generalisation of public green bond issuances, however, could achieve this kind of desirable liquidity.

In Emerging Asia, the supply of sovereign green bonds is relatively sparse outside the core markets of China and India. In ASEAN, meanwhile, only Indonesia and Thailand have so far issued sovereign green bonds. Indonesia is leading the way, with four green bond and sukuk issuances between 2018 and 2020, for a total of USD 2.8 billion (Table 3.4). Meanwhile, the Thai government issued the country’s first sovereign sustainability bond in August 2020. It was for USD 2.06 billion, and the government allocated the proceeds to transport and land use. Relative to domestic GDP, however, the amounts that Indonesia and Thailand have issued do appear very low. In Indonesia, each issuance was below 0.5% of GDP, while Thailand’s issuance was equivalent to 1.82% of GDP. These low levels show that there is significant potential for stepping up sovereign issuance in these two countries alone.

It is important for issuers to reassure investors with regard to risk

For any investment product, the risk-return ratio remains the first criterion of choice for investors. Thus, the profile of the issuer is a critical factor for investors. This is also true for green bonds, most of which continue to be issued by entities with elevated credit ratings, such as the World Bank. This reasoning is all the more true as prudential rules, such as the internationally-applied Basel III measures, have a tendency to get stricter. In turn, these strict regulations have the effect of encouraging investments in the least risky assets.

Investing in green bonds presents a range of specific risks for investors, such as reputational risk if the project that the bonds are financing fails to meet its stated green objectives. This risk notwithstanding, investors with reasonable doubts that a bond will actually meet the required environmental expectations only have limited opportunities for legal enforcement of the asset’s green integrity. Looking ahead, investors’ confidence may increase if they can seek penalties if the bonds fail to achieve the anticipated impacts.

Policy options for addressing challenges and developing a green bond ecosystem

In order to develop sustainable finance, it is important to address barriers both for issuers and investors. In particular, a broad pool of investors is crucial to ensuring the successful development of sovereign green bond markets, and to make sure yields respond accurately to fundamentals. The following sub-section of this chapter seeks to bring several options to the attention of policy makers in Emerging Asia. Table 3.5 summarises these options, both on the supply side and on the demand side.

Leveraging external support and private placements to overcome complexity and cost

In order to reduce the cost of external reviews and streamline the reporting process, governments in Emerging Asia should take advantage of the support they can get from organisations and experts such as development banks, structuring advisors, and stock exchanges. In particular, public development banks could play a multifaceted role in the green, social and sustainability bond market. For instance, public development banks have the potential to mobilise private investors by issuing guarantees or by providing first loss tranches to enhance the risk/return profiles of projects in developing economies. In addition, public development banks can provide technical support to prepare sovereign issuances (OECD, 2021e).

As an example from Emerging Asia, the ADB assisted Thailand’s government in designing and issuing the country’s first sustainability bond in 2020. The ADB has provided its technical assistance within the framework of ASEAN’s Catalytic Green Finance Facility. Its assistance includes help with external reviews, the development of internal systems to monitor the use of bond proceeds, and the preparation of post-issuance reports. Thailand’s sustainability bond raised 30 billion Thai baht (THB), or approximately USD 964 million, and was oversubscribed three times. The country’s government will use the proceeds of the bond to finance green infrastructure, namely the eastern section of the Orange Line of Bangkok’s MRT mass rapid transit system. The Thai sustainability bond will also fund social impact projects to support the country’s recovery from the COVID-19 pandemic, such as public health measures, job creation through small and medium-sized enterprises, and the development of local public infrastructure with social and environmental benefits (ADB, 2020a).

Notwithstanding the longer-term desirability of a generalisation of public issuance in order to foster liquid markets, governments could also potentially cut costs by envisaging private placements of green bonds, selling them directly to a limited number of investors. In addition to cutting costs, private placements can also speed up the issuance of a bond.

To date, private placements of green bonds have largely been used in emerging market economies as a market-development tool by multilateral development banks. However, private placements could also fulfil a niche role in the sovereign green bond market in Emerging Asia, in particular when multilateral development banks are supporting the issuance. The types of investors that may participate in private issuances, such as state-owned enterprises, mutual funds, pension funds, and other asset managers, have ample endowments, and typically turn to government securities to minimise investment risk. The Indonesian government, for example, turned to these types of investors in April 2020 when it placed debt privately in order to finance its response to the COVID-19 pandemic (Box 3.7).

In April 2020, the country’s government raised 62.6 trillion Indonesian rupiah (IDR), or around USD 4.05 billion, by selling three series of bonds through private placements. The buyers in the private placement sale were domestic banks that were looking to meet the central bank’s new requirement of higher reserves in the form of government bonds.

In addition, the government of Indonesia and Bank Indonesia agreed on a burden sharing scheme in July 2020, in light of the government’s increased financing needs triggered by the pandemic. A new law has been issued in March 2020, authorising Bank Indonesia to purchase long-term government bonds in the primary market. To ensure a transparent market mechanism, Bank Indonesia’s purchase of government bonds in the primary market is conducted in line with the following priority order: a regular auction; an additional auction, known as greenshoe option; and a private placement. In this respect, a private placement is to be held when the issuance target has not been fulfilled even with the green shoe option.

In order to finance the public goods package – comprised of health spending, social protection, as well as support of key economic sectors and local governments – Bank Indonesia has committed to purchase bonds through private placements and bear the full interest expense until their maturity dates. These bonds had maturities between five and eight years and coupons equivalent to the weighted average of the 3-month reverse repo rate. As of early November 2020, Bank Indonesia had purchased IDR 253 trillion (equivalent to approximately USD 18 billion) of government bonds via private placements to finance the public goods package, and absorbed the full interest cost of these bonds.

Source: Authors’ elaboration based on AMRO (2021), Diela and Suroyo (2020) and national sources.

Developing sound procedures to manage the proceeds of green bonds

The Green Bond Principles require issuers to disclose how they will use the proceeds, and to prove that all of the money will flow into green projects throughout the life of the bond. In addition, it is essential to make sure that the amount of capital raised matches up with the cost of the projects that it will finance, and that there are enough green projects in progress or in the pipeline to account for the proceeds. As such, sovereign issuers should plan in advance for how they will manage the proceeds if they do not expect to invest them immediately and there have to be safeguards to track the allocation of proceeds, and to make sure that the same eligible green project does not get listed more than once. In Malaysia and Thailand, for example, the countries’ green bond frameworks mention explicitly that they will maintain a register to record the allocation of proceeds, and that they will manage and invest any unallocated proceeds in short-term liquid instruments (Box 3.8).

In Indonesia, the proceeds of each green bond or sukuk are managed within the government’s general account, in accordance with prudent treasury-management policies. Upon request from specific ministries, this general fund then credits proceeds from green bonds and sukuks to a designated account at the ministry in question in order to fund projects that fit the definitions set out in Indonesia’s green bond framework.

Malaysia has also developed a specific framework for a Sustainable Development Goal (SDG) sukuk. Under the terms of this framework, the net proceeds of the sukuk will be transferred to the government’s specific development fund. In turn, the finance ministry will maintain an SDG Sukuk register to track and manage the allocation process. The register will contain information on the parameters of each sukuk issuance, such as the pricing date, the maturity date, and a list of eligible expenditures. The Malaysian government plans to fully allocate the net proceeds to eligible projects within the first year of issuance. Unallocated proceeds will be held in cash and cash equivalent.

In the case of Thailand, the net proceeds of any green, social and sustainability financing instrument will be transferred to the government’s treasury reserve account. Safeguards are in place to ensure that the allocation of proceeds does not allow any double listing of the same eligible green or social project. The balance of the net proceeds will be adjusted on a regular basis to match allocations for eligible green and social projects made during the life of the financing instruments. In addition, a register will be maintained in order to record the allocation of the proceeds. Pending the full allocation of the net proceeds to eligible green or social projects, any unallocated funds will be managed and invested in temporary liquid instruments (i.e. cash or cash equivalents).

Source: Authors’ elaboration based on World Bank (2018) and national sources.

In making sure that net proceeds from a green bond flow into a suitable form of allocation, an important question is whether governments should open a special account to manage the funds that they raise from green bonds. Practice differs among the ASEAN countries that have already adopted specific frameworks for sovereign green bonds (Box 3.8). In Indonesia and Thailand, the net proceeds are held in the government’s general treasury account, while in Malaysia they are transferred to the government’s development fund. Although there is currently no consensus on the best practice in this regard, setting up a special account for the management of net proceeds may streamline the allocation process and enhance investor confidence. In Fiji, for example, the economy ministry opened a designated, ring-fenced sub-account in order to store the proceeds from the issuance of green bonds (RBF, 2017).

Developing clear and standardised definitions to reduce the risk of greenwashing, and facilitate cross-border transactions

For green sovereign bond markets to thrive in Emerging Asia, they need to attract institutional and retail investors alike. Policies aimed at diversifying and increasing the participation of both institutional and retail investors in the sovereign green bond market are, therefore, of the utmost importance for policy makers across the region.

One of the biggest bottlenecks for the development of green bond markets in the countries of Emerging Asia is the lack of an overarching framework to define and classify green bonds. In most countries across the region, the market for green bonds is generally not subject to government regulation. And in countries that lack a clear regulatory framework for green bonds, the risk of greenwashing is arguably higher.

Yet despite the limited development locally of comprehensive frameworks of this kind, the ICMA Green Bond Principles are, at the current juncture, considered to be the most widely accepted standards to promote transparency and disclosure in the green bond market, and to reduce the risk of greenwashing. Issuers of sovereign bonds in Emerging Asia need to adhere to the ICMA principles in order to enhance the integrity of the green bond market, and thus to send a signal of reassurance to investors.

Indonesia, for example, has integrated the ICMA Green Bond Principles into its framework for green bonds and sukuks. Under the terms of the framework, the proceeds of each green bond and sukuk will be used exclusively to finance or re-finance expenditure that relates directly to eligible green projects. These are defined as projects that promote the transition to a low-carbon economy and to climate-resilient growth. They must fall into at least one of the several sectors that the framework sets out (Government of Indonesia, n.d.). These include renewable energy, energy efficiency, resilience to climate change for highly vulnerable areas and sectors. They also encompass projects to reduce disaster risk, sustainable transport, and facilities that convert waste into energy. Furthermore, they also include waste management, the sustainable management of natural resources, green tourism, and sustainable buildings and agriculture.

Other examples in this respect are the various initiatives undertaken by public authorities in China and India towards ensuring clear and standardised definitions of green bonds, in line with international standards.

As mentioned above, China’s central bank published a set of guidelines for green financial bonds in 2015, including criteria for the management of proceeds, and requirements on disclosure (Yu, 2016). It also took decisive steps towards the standardisation of green bonds, by publishing a catalogue of endorsed projects (WRI, 2016). The catalogue describes the types of projects that are eligible for green bonds, and is based on Chinese environmental policies and international environmental standards. As regards the specific types of endorsed green projects, the latest version of the catalogue contains a four-level classification, which grades green projects into several categories. These encompass saving energy and protecting the environment, cleaning up industrial production and the energy sector, developing the so-called eco-environment industry, upgrading infrastructure in an environmentally sustainable manner, and green services. The 2020 catalogue contains more sectoral standards and regulations than previous editions, thus increasing the requirements for third-party verification of green bonds (CBI, 2020).

In India, there is a set of official requirements for green bonds from the country’s Securities and Exchange Board, which follows the general architecture of the Green Bond Principles, turning some of their recommendations into firm requirements. These requirements cover the definition of green bonds, plus external review, the tracking of the proceeds, and disclosure (SEBI, 2017).

In order to facilitate cross-border transactions in Emerging Asia, the standardisation of definitions for green bonds is essential, but without resorting to a heavy-handed approach. Imposing overly detailed standards has the potential to increase issuance costs, so standards should allow enough room for flexibility to respond to the different constraints that issuers may face. As noted above, there has already been some movement in Emerging Asia to create regional standards for green bonds, notably in the form of the joint statement from ASEAN’s seventh meeting of finance ministers and central bank governors, affirming that action is underway to develop a sustainable finance taxonomy (ASEAN, 2021).

Increasing the supply of sovereign green bonds, in particular from sub-national entities

More sovereign issuers in Emerging Asia could launch green bonds. In so doing, they would signal support for the market, and would contribute to its deepening by increasing the supply of green bonds in the medium term. Arguably, the issuance of sovereign green bonds could send a strong signal that governments are committed to supporting the market, by providing opportunities to invest in a broad range of projects and at relatively low yields. A deeper market would create favourable conditions for a decline in yields.

Furthermore, increasing the supply of sovereign green bonds will attract more investors. In turn, this will then also incentivise more private actors to issue green bonds. Aside from national governments, the relevant public actors that could issue green bonds are sub-national entities, such as regional or provincial governments, and municipalities. Looking ahead, public green banks (Box 3.9) are relatively new financial institutions that could also potentially play a role in expanding the offering of green bonds in Emerging Asia.

In November 2020, the UK’s national infrastructure strategy set out the government’s intention to establish a new infrastructure bank. The new bank will pursue two central policy objectives through its interventions in the infrastructure market. The first of these is to tackle climate change, in line with the UK’s target of bring greenhouse gas emissions to net zero by 2050. The second main objective is to support regional and local economic growth through better connectivity, opportunities for new jobs, and higher levels of productivity. Although the new infrastructure bank’s initial focus will be climate change, the government will review the case for expanding it to include other areas, such as strengthening the country’s natural capital.

In terms of capital and financial management, the Bank will start with 22 billion pounds (GBP) of financial capacity. This will consist of GBP 12 billion to enable lending and investment, plus GBP 10 billion in the form of guarantees. The bank will be able to borrow up to GBP 7 billion from a government credit facility administered by the Debt Management Office, and also from private markets, including through the issuance of green debt instruments.

The Bank was officially launched in June 2021 and made its first private sector transaction in early December 2021. The transaction will help capitalise a new GBP 500 million fund with NextEnergy Capital, a leading investment manager in the solar infrastructure sector. The fund, NextPower UK ESG, is a private 10-year solar infrastructure fund that aims to raise GBP 500 million to invest into subsidy-free solar power plants in the United Kingdom. The Bank is providing financing to the initial seed assets of the fund, comprising two major subsidy-free solar farms in the United Kingdom, and plans to invest up to GBP 250 million on a match-funding basis with the private sector.

Source: HM Treasury (2021) and UKIB (n.d.).

Just as national governments can issue government bonds to finance green investments in areas like clean energy or energy efficiency, cities, regions, provinces and public utilities could issue green bonds to finance investments in green public infrastructure. And since a large share of greenhouse emissions originates in cities, and with cities across Emerging Asia expected to grow further, green bonds can be a means for cities to secure funding for green investments. Aside from cities issuing green bonds directly, another option is to issue them through municipal bond agencies. Such agencies can act on behalf of several municipalities or other sub-national actors. One example of this is the Municipal Bond Agency in the United Kingdom (CIPFA, n.d.). While green bond issuance by municipalities is not new in OECD countries (Box 3.10), no cities in Emerging Asia have so far issued this type of debt.