Poland

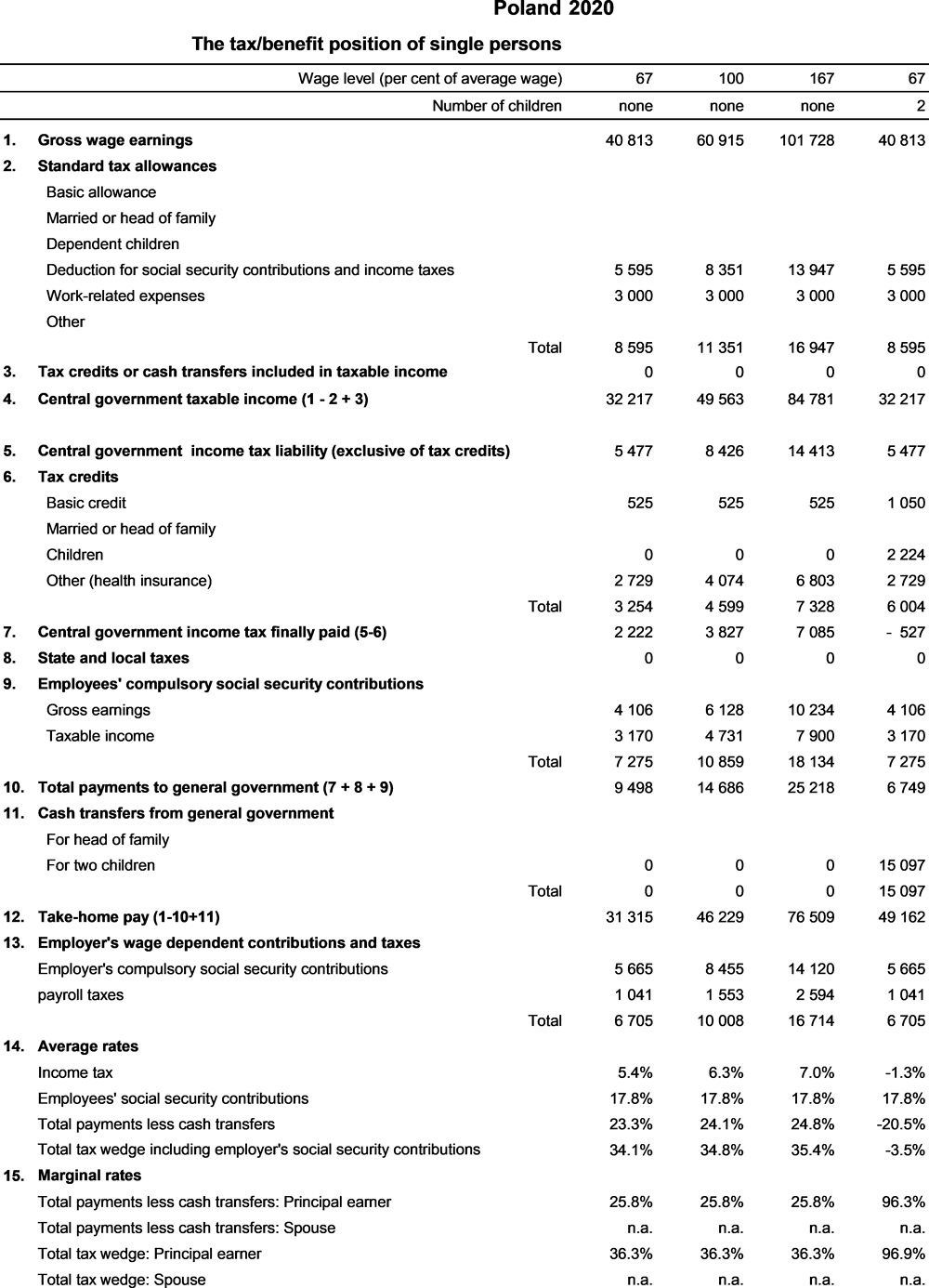

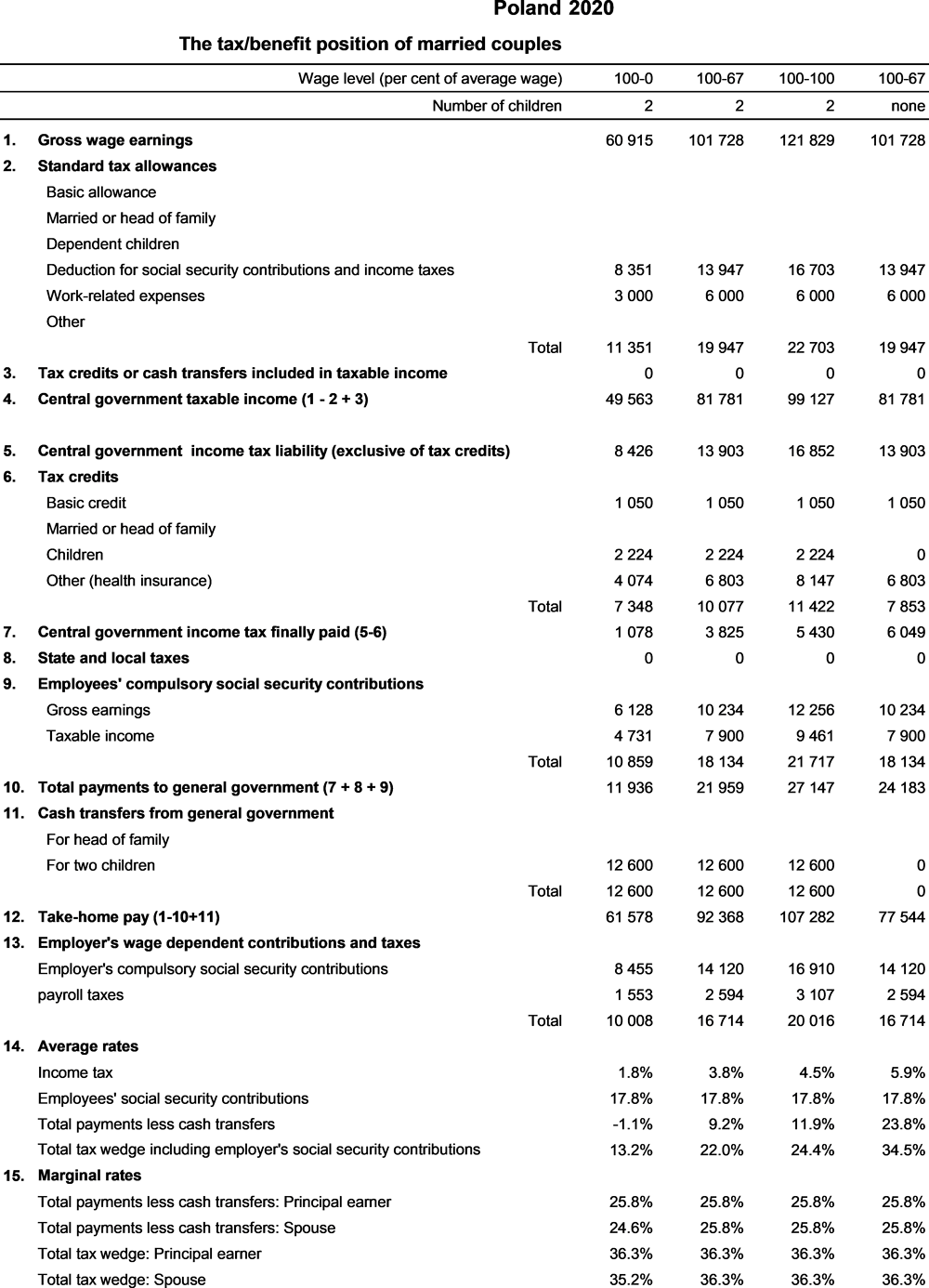

This chapter includes data on the income tax paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Zloty (PLN). In 2020, PLN 3.93 were equal to USD 1. In that year, the average worker earned PLN 60 915 (Secretariat Estimate).

An individual being a tax resident in Poland is liable to tax on the basis of world-wide income, irrespective of the source and origin of that income. (The term “residency” is understood similarly to Article 4 paragraph 2 point a) of the OECD Model Tax Convention on Income and Capital).

1.1. Central government income tax

1.1.1. Tax unit

Individuals are taxed on their own income, but couples married during the whole calendar year1 can opt to be taxed on their joint income. In the latter case, the ‘splitting’ system applies: the tax bill for a couple is twice the income tax due on half of joint income, provided the joint income does not include capital income taxed at the flat 19% rate. Single individuals with dependent children are also entitled to use the splitting system (their family quotient is two). For the purpose of this report, it is assumed that married couples are taxed on joint income.

1.1.1.1.1. Gross employment income

For taxation purposes, taxable gross employment income in Poland includes both cash income and the value of benefits in kind. More specifically, gross employment income includes base salary, overtime payments, bonuses, awards, compensation for unused holidays, and costs that are paid in full or in part by the employer on behalf of the employee.

1.1.2. Tax allowances and tax credits

1.1.2.1. Standard reliefs

Basic relief (since 1st October 2019): A non-refundable tax credit of:2

‒ PLN 1 360 – for the tax base not higher than PLN 8 000;

‒ PLN 1 360 minus the amount resulting from the following formula: PLN 834.88 × (tax base PLN 8 000) ÷ PLN 5 000, for the tax base higher than PLN 8 000 and not higher than PLN 13 000;

‒ PLN 525.12 - for the tax base higher than PLN 13 000 and not higher than PLN 85 528;

‒ PLN 525.12 minus the amount resulting from the following formula: PLN 525.12 × (tax base– PLN 85 528) ÷ PLN 41 472, for the tax base higher than PLN 85 528 and not higher than PLN 127 000,

Relief for children: Yes3.

A taxpayer can deduct from the due tax decreased by the amount of health contributions specified in the PIT Act, the amount, which is equal for each month of raising a child:

PLN 92.67 (annually PLN 1 112.04) for the first child, if the income received by parents (married or single parent, who meets special requirements) does not exceed in the tax year the amount of PLN 112 000. For other parent the threshold of income is PLN 56 000;

PLN 225.00 (annually PLN 2 700.00) for the fourth and every next child.

Since 1st of January 2015 taxpayers whose due tax is lower than the amount of relief for children, may claim for cash refund for amount of relief which has not been utilized. However, such cash refund cannot exceed the amount of deductible social security and health insurance contributions paid by taxpayer (with some exceptions).

Relief for health insurance contributions: A tax credit is almost equal to health insurance contribution paid to the National Health Fund. The contribution is 9% of the calculation basis whereas the tax credit is 7.75% of this basis.

Relief for other social security contributions: An allowance is provided for all social insurance contributions paid by the taxpayer.

Relief for selected work-related expenses: Standard deductions depend on the number of workplaces and on whether place of residence and workplace are within the same town/city or not. The annual amounts in PLN (deductible from income) are:

1.1.2.2. Main non-standard tax reliefs

Expenses for the purpose of rehabilitation incurred by a taxpayer who is a disabled person, or a taxpayer, who supports the disabled;

Equivalent of blood donations, donations made for the purposes of public benefit activity and of religious practice – in the amount of donation, no more than 6% of income;

Donations made for charity church care - in the amount of the donation;

Expenses incurred for the use of the Internet – a taxpayer is entitled to deduct the Internet tax allowance within the next two years, providing that during the phase preceded this period he did not deduct expenses for the use of the Internet (up to PLN 760);

Expenses incurred during undertaking of thermo-modernization project for single-family residential building up to 53 000 PLN,

Abolished allowance (since 2007 continued on the acquired right basis) for interests payments on mortgage loans raised no later than in 2006 on acquisition of housing property on the primary market – up to the amount of interests related to the part of loan not exceeding PLN 325 990 for investments finished in 2017.

Donation made to public benefit organizations – up to 1% of due tax.5

Abolished tax credits (continued on the acquired rights basis), i.e. expenses for saving with the aim of buying a house or flat, the amount of social contributions paid on income of an unemployed person hired by a taxpayer in order to take care of their children and/or house.

1.4. Solidarity surcharge

The act on the Solidarity Support Fund for Disabled Persons entered into force on 1 January 2019. The purpose of a new legislative proposal is to introduce a new institution in a form of fund, managed by the Minister of Family, Labour and Social Policy, which will be focused on social support for people with disabilities. The source of the Fund's revenues are primarily a compulsory contribution to the Fund representing since 2020 0.45% of the base of the contribution rate to the Labour Fund (the compulsory contribution to the Labour Fund has decreased from 2.3% of the basis for the calculation of contributions to pension and disability insurance to 2% since 2020), as well as the solidarity contribution on the income of individuals - in the amount of 4% from a surplus of income (gross income minus SSC of employee) over PLN 1 million for a tax year.

2.1. Employees’ contributions

Employees pay 13.71% of the gross wage. This contribution includes:

Pension insurance contribution – 9.76% of the gross wage.6 3.65 percentage points of the pension contribution are treated as non-tax compulsory payments because these payments are either made to the OPF (1.46%) and to personal sub-account in ZUS (2.19%) or only to sub-account in ZUS (3.65%).

Sickness/maternity insurance contribution – 2.45% of the gross wage,

In case of pension and disability insurance, contributions are not paid on the part of the wage that exceeds PLN 156 810.7

2.2. Employers’ contributions

In respect of income paid under an employment contract with a Polish entity, employers have an obligation to pay social security contributions and payroll taxes equal to 20.08% of gross wage. This value consists of:

A) Social security contributions:

9.76 % are aimed for pension insurance8. 3.65 % of the pension contribution are treated as non-tax compulsory payments because these payments are either made to the OPF (1.46%) and to personal sub-account in ZUS (2.19%) or only to sub-account in ZUS (3.65%),

In case of pension and disability insurance, contributions are not paid on the part of the wage that exceeds PLN 156 810.

3.2. Transfers for dependent children

From 1st of November 2012 families where the average monthly income per household member for the previous period is no greater than PLN 539 or PLN 623 when there are one or more disabled children in the household) are entitled to family allowances. From 1st of November 2015 the income criteria will be as high as PLN 674 and PLN 764. Families receive PLN 89 (from 1st of November 2016 – PLN 95) monthly for a child no older than 5 years, PLN 118 (from 1st of November 2016 – PLN 124) monthly for a child of 5 up to 18 years old, and PLN 129 (from 1st of November 2016 – PLN 135) monthly for a child of 18 up to 24 years old. The calculations in this Report are based on the assumption that the children are aged between 6 and 11 years inclusive.

Single parents are entitled to a supplement of PLN 185 (from 1st of November 2016 – PLN 193) for each child up to a maximum of PLN 370 (from 1st of November 2016 – PLN 386) for all children (and PLN 265 (from 1st of November 2016 – PLN 273) for a disabled child up to a maximum of PLN 530 (from 1st of November 2016 – PLN 546) for all children).

There are several supplements to family allowances:

for large families – PLN 90 (from 1st of November 2016 – PLN 95) monthly for the 3rd and next children in the family;

for education of disabled children – PLN 80 (from 1st of November 2016 – PLN 90) monthly for children not older than 5 years and PLN 100 (from 1st of November 2016 – PLN 110) for children older than 5 years.

3.2.1. Parental benefit

On 1 January 2016 a parental benefit was introduced, aside from the already existing family and care benefits. The parental benefit is provided to families to which a child is born but whose members had not been eligible to a parental or maternity leave: students, the unemployed (regardless of registration with a labour office), people employed on the basis of civil law contracts, employees and people pursuing non-agricultural economic activity if they are not collecting maternity benefit. The parental benefit is granted regardless of income in the amount of PLN 1,000 a month for 52 weeks (after giving birth to one child in one labour), 65 weeks (after giving birth to two children in one labour), 67 weeks (after giving birth to three or four children in one labour) and for 71 weeks (after giving birth to five or more children in one labour).

3.2.2. Family 500 Plus Programme

Financial support for families with children

1 April 2016 (Act on state support for upbringing children entered into force 1 April 2016)

The Act on state support for upbringing children introduced new benefits- in amount of 500 PLN monthly per child until the child turns 18, which would be means-tested for the first child and available for all families for every additional child. The new benefit of PLN 500 a month (untaxed) is available for parents, actual guardian or legal guardian of a child until the child turns 18. The benefit will also be paid for the second child and any subsequent child without application of any income criteria. It will be paid for the first child if income of the family per one member does not exceed PLN 800 a month (PLN 1,200 if there is a disabled child in the family)9. Eligibility to this benefit is established for a year (from 1 October to 30 September).

Since 1st July 2019 the extension of 500+ programme came into force: there is no income testing hence every child is eligible for the benefit so the transfer has become universal.

Since January 2017, the tax schedule has been changed by introduction of degressive basic tax credit. The work-related expenses, tax allowances, relieves are the same as in previous years.

Since 2012, there were also changes in Social Security Contribution. Since February 2014, 14.96% of the old-age insurance contribution (2.92 percentage points) are transferred by ZUS to a privately-managed fund (OPF) but since July 2014 this part of contribution will be transferred only if insured persons decides to – otherwise all 7.3 percentage points of the contributions will be passed to subaccount in ZUS.

On 1st January 2019 as the solidarity contribution on the income of individuals - in the amount of 4% from a surplus of income (gross income minus SSC of employee) over PLN 1 million for a tax year was introduced.

Since August 2019 gross wages up to 85 528 PLN for people under 26 years old are exempted from PIT. Since October 2019 the first marginal tax rate has been lowered from 18% to 17%.and work-related expenses were more than doubled.

4.1. Changes to labour taxation due to the covid-19 pandemic

Exemption from social security contributions (employee’s and employer’s part) for up to 3 months period for enterprises registered before February 2020:

exemption of 50% from SSC in enterprises that have reported to Social Security Fund from 10 to 49 people

exemption of 100% from SSC in enterprises that have reported to Social Security Fund from 1 to 9 people,

Since less than half of the full-time workers within sectors B to N are affected by the temporary exemption of social security contributions, the measure is not considered in the Taxing Wages calculations.

Subsidies for employee remuneration costs and social security contributions up to three months period:

a subsidy to downtime pay in the amount of 50% of minimum wage plus social security contributions

a subsidy up to half of the salary of employees, but no more than 40% of the average monthly salary from the previous quarter plus social security contributions

The subsidy can be granted if the decline in sales revenues amounted to:

not less than 15% - calculated as the ratio of total sales revenues in the following two months period after Jan 2020, to the total sales revenues from the corresponding 2 months of the previous year (i.e. 2019); or

not less than 25% - calculated as the ratio of total sales revenues in any given month in the period after Jan 2020 compared to the turnover from the previous month.

Subsidies for employee remuneration costs and social security contributions for micro, small and medium-sized enterprises for up to 3 month period in the amount of:

50% of minimum wage plus social security contributions per employee, if the decline in sales revenues amounted to 30%,

70% of minimum wage plus social security contributions per employee, if the decline in sales revenues amounted to 50%,

90% of minimum wage plus social security contributions per employee, if the decline in sales revenues amounted to 80%.

A decline in total sales revenues is calculated based on the following two months of 2020 compared to the total sales revenues from the corresponding 2 months of 2019.

5.1. Identification of AW and valuation of earnings

The Polish Central Statistical Office calculates average monthly wages and salaries for employees on the basis of reports of enterprises. The figures include overtime and bonus payments and also include information for part-time employees converted to full-time equivalents. Male and female workers are included. The information, which includes estimates for different sectors, is published in the monthly Statistical Bulletin.

5.2. Employers’ contributions to private pension, health and related schemes

The equations for the Polish system are mostly calculated on a family basis.

The standard functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Two additional functions (Tax93 and ftax) have been incorporated to carry out an iterative calculation for central government tax. These allow for the fact that the church tax is calculated as 9% of Central Government tax and is also allowed as a deduction when calculating taxable income. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.

Notes

← 1. However, a widowed spouse is entitled to apply the joint income taxation.

← 2. Applicable only in a tax return.

← 3. It concerns a child of 18 years old or younger or a child up to 25 years old provided they are students or a disabled child irrespective of their age. The actual description in section 4.

← 4. For the purpose of the calculations in this publication, it is assumed that the worker has the same town/city as place of residence.

← 5. This relief is distinct from an allowance for donations deducted from income.

← 6. Since July 2014 out of total 19.52% of social contributions 7.3% goes to subaccount in ZUS either – if voluntarily stated by insured person – 2.92% goes to account in open ended funds and 4.38% to subaccount in ZUS.

← 7. The contribution ceiling of pension and disability insurance funds for a given calendar year may not exceed thirty times the amount of the projected average monthly remuneration in the national economy for that year, as set forth in the Budgetary Act.

← 8. Since July 2014 out of total 19.52% of social contributions 7.3% goes to subaccount in ZUS either – if voluntarily stated by insured person – 2.92% goes to account in open ended funds and 4.38% to subaccount in ZUS.

← 9. Some of the features (namely, joint taxation and child tax credit) of the Polish tax system are optional and therefore can influence eligibility to “500+” family, and in a consequence tax wedge, in a non-linear way. As they both determine “net income for income test” and because of no tapering of “500+” sometimes it may be preferable not to use joint taxation or child tax credit (or to use it partially) in order to get the most appropriate net income to maximize the family benefit payments. As for now model treats both joint taxation and child tax credit as obligatory. With the parameters in the excel file (average wage etc.) it does not alter the results. However, if any of the parameters change, the previous statement may not hold.

← 10. Lump-sum annual work expenses for an employee having one workplace and living in the place (town, city) where the workplace is; employees living outside the city (town) where their workplace is may deduct 3 600 PLN annually.