Chapter 10. Evolving business models

Three thriving e-commerce business models include those that use online platforms, offer subscription services and incorporate online-offline models. As digital transformation and the pandemic evolve, new e-commerce business models are difficult to predict.

Policy can support e-commerce innovation by removing regulatory barriers that preserve artificial distinctions between online and offline commerce and encouraging regulatory flexibility, experimentation and transparency.

They vary widely in terms of size, functionality and profitability. Consequently, they cannot be reduced to a few categories, let alone a single sector. No one size fits all.

Online platforms share a number of economic characteristics. These include positive direct and indirect network effects, cross-subsidisation, scale without mass, potentially global reach, panoramic scope, disruptive innovation, switching costs and, in some markets, winner-take-all or winner-take-most tendencies.

Different platforms succeed for different reasons. Some correctly anticipate key market trends, while others strengthen trust. Still others focus on expansion, customer loyalty and innovation more than profit for many years. Several leading platforms gained momentum by building on the foundation of more established platforms.

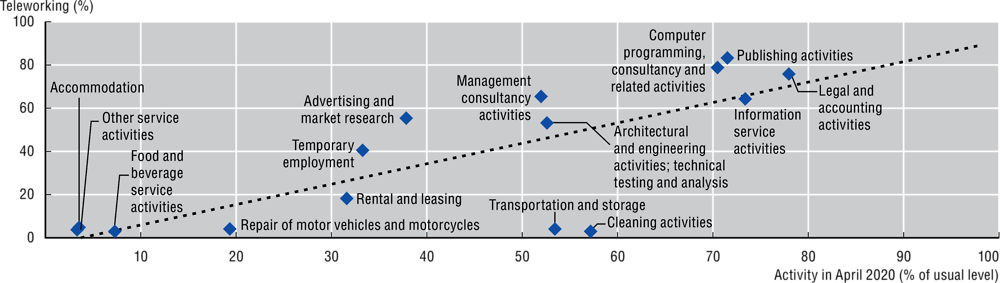

During the COVID-19 pandemic, many businesses have embraced digital tools to help them implement and increase teleworking. In France, industries with the highest levels of teleworking maintained business activity at 70% to 80% of the normal level in April 2020. This was higher than in other industries.

The COVID-19 crisis is challenging the survival and growth of start-ups, which typically play a key role to create jobs, innovation and long-run growth in the OECD. Nevertheless, the pandemic is creating business opportunities to use digital technologies to address the challenges arising from the pandemic.

New business models driven by digitalisation have contributed to an increase in non-standard forms of work, such as temporary jobs, part-time contracts and self-employment. At the same time, digitalisation has also enabled new forms of work, such as jobs mediated by online platforms. More than one-third of the labour force in most OECD countries are employed in non-standard forms of work.

Non-standard workers can enjoy higher flexibility and autonomy, but also lack the same rights and protection as standard workers. The COVID-19 pandemic has hit non-standard workers more severely. They are more exposed to health risks, unable to telework and often receive less government support than employees.

Digital technologies are enabling business models and organisations. In some cases, firms are creating entirely new markets. In others, new players are shaking up the terrain, forcing traditional businesses to reinvent themselves to survive. This chapter examines new e-commerce business models and their implications for policy. It discusses the variety of business models adopted by online platforms, as well as implications for work in the digital era. Finally, it sheds light on the changes in business models and work practices implied by the COVID-19 pandemic.

E-commerce facilitates trade across borders, increases convenience for consumers and enables firms to reach new markets. Digital technologies enable e-commerce innovations and often serve as the backbone of business model developments. Some of these technologies, like smart assistants enabled by artificial intelligence (AI), constitute new channels for selling or purchasing products over electronic networks. Other emerging technologies, like big data analytics, foster the growth of new data-driven business models for e-commerce and can support transactions moving on line.

E-commerce has taken on new importance as the health and economic crisis related to the COVID-19 pandemic unfolds. In countries with lockdowns and stay-at-home orders, firms that operated only physically before the pandemic have turned to e-commerce as a way to survive. At the same time, firms that engaged in e-commerce prior to the pandemic are not only finding themselves with a competitive advantage, but are also innovating in what and how they sell on line.

New business models push out the e-commerce frontier in two ways (OECD, 2019[1]). First, new business models can enable more transactions to move online in a given market or for a given set of participants, an effect referred to as the “intensive margin” of e-commerce. Second, new business models can enable whole new markets to emerge for goods and services not previously available on line, or allow new participants to enter the market. This effect is referred to as the “extensive margin” of e-commerce (OECD, 2019[1]). Three e-commerce business models that have been particularly transformative are those that: i) use online platforms; ii) offer subscription services; and iii) incorporate online-offline models (OECD, 2019[1]).

E-commerce business models that use online platforms are thriving

The most common type of e-commerce business model uses online platforms, and they are thriving during the COVID-19 crisis. Amazon, for example, has been experiencing Black Friday-like demand since the onset of the pandemic. It hired an extra 75 000 workers in the United States to help process the increase in orders (Neate, 2020[2]).

As multi-sided markets, online platforms benefit from both direct and indirect network effects, whereby economies of scale benefit users on both sides of the market. In the context of e-commerce, these sides can be understood as buyers and sellers. Typically, buyers gain utility from the presence of more sellers, assuming there is an expansion in the scope and/or variety of products for sale. Similarly, sellers benefit from a large number of potential buyers. As digital services, platforms are characterised by relatively higher fixed costs and comparatively lower marginal costs. This means the additional cost of hosting another buyer or seller can be close to zero.

In the context of e-commerce, online platforms act as intermediaries between buyers and sellers to facilitate the exchange of goods and services over the Internet. The large number of actors in a digital marketplace allows a potentially infinite variety of goods and services available for sale, in contrast to the more limited scope of products available in physical stores. In particular, a large number of potential buyers and low marginal costs pushes out the extensive margin of e-commerce because it enables sales of previously unprofitable (e.g. niche) products (Ellison and Ellison, 2018[3]).

Big data analytics and AI can improve matching buyers and sellers, or indeed the match between consumers and content. E-commerce firms can use data gleaned from their customers to algorithmically optimise and personalise matching and product recommendations. Such data includes browsing patterns, the length and nature of user engagement with particular features, responsiveness to design or format changes, and the behaviour of similar users. Researchers have found changes in algorithmic design can alter the rate of matching between buyers and sellers in the context of online platforms (Fradkin, 2017[4]). This, in turn, improves overall engagement and the likelihood of matches.

E-commerce platforms bring together buyers and sellers who may be dispersed geographically and involve parties that have not met before. Some sellers on online platforms are large and may have established brands that buyers trust. In contrast, smaller, potentially unknown vendors may have more difficulty establishing conditions that would lead buyers to transact willingly with them. In addition, third-party providers and sellers operating on multi-sided markets may be unsure about payment or buyers’ reliability.

Online platforms can provide mechanisms that help resolve information asymmetries, build trust on both sides of the market, and ensure that transactions are safe and reliable to foster e-commerce. They can easily collect, store, communicate and verify information on both sides of the market, particularly following repeated transactions. This can create trust based on the transaction history of all users on the platform rather than between one particular buyer and seller. Common trust-building mechanisms include minimum quality standards, reputation and review systems, digital identity authentication and provision of insurance (OECD, 2019[5]).

Blockchain technology can also help improve trust in e-commerce. Blockchain removes the need for an intermediary for third-party verification for trusted transactions. This could help develop distributed, peer-to-peer networks with multiple sides without the need for a centralised online marketplace. OpenBazaar, for example, has no fees for listings, selling or commissions, and accepts over 50 cryptocurrencies as payment (OECD, 2017[6]). Other potential applications of blockchain related to trust could involve the development of a portable and decentralised reputation system.

The COVID-19 pandemic has shown that e-commerce business models using online platforms can help increase participation of firms in e-commerce, both domestically and across borders. While online platforms differ, each offers incentives to add users, which typically means low entry costs for sellers. As a result, SMEs and, in some cases sole traders, can compete alongside more established firms on online platforms. SMEs have been among the many firms that have turned to e-commerce during the COVID-19 pandemic. When online platforms operate in multiple international markets, being active on the platform can give sellers access to new markets overseas.

However, sellers may need to make a range of complementary investments to buy and sell on line effectively. Trading at a distance, including potentially across borders, requires significant upstream and downstream investments in several areas. These include supply-chain management; secure payment systems; delivery and fulfilment mechanisms; and customer-facing services like dispute resolution mechanisms and customer service. E-commerce across borders may also require communication in foreign languages.

As a result, online platforms have begun to offer complementary services for firms that trade on their platform. Such services include fulfilment, logistics, customer service and software-as-a-service offerings. SMEs disproportionately benefit from these services. Without them, they would require significant up-front fixed costs that can be difficult for a small firm to cover. Platform-enabled services can transform this fixed cost into a variable cost, easing the financial burden. These new solutions push out the extensive margin of e-commerce, enabling new participants to enter the marketplace.

E-commerce subscription services are becoming more popular

Subscriptions are becoming an increasingly popular business model for e-commerce, including in the context of the COVID-19 pandemic. This business model is characterised by regular and recurring payments for the repeated provision of a good or service. In the e-commerce context, this encompasses a range of new and emerging businesses, from streaming services like Netflix to recurring purchases of consumer goods such as the Dollar Shave Club. In the first three months of 2020, almost 16 million people created Netflix accounts, a marked increase caused in part by lockdown and stay-at-home measures (BBC, 2020[7]). The subscription model can also relate to recurring purchases of a combination of digital and tangible products. For example, a subscriber to a printed newspaper could receive access to its digital content.

Subscription e-commerce business models typify a broader trend towards more continuous, digitally enabled access to or provision of goods and services. Digital technologies enable easy ordering of goods and services, removing associated transaction costs and thus improving convenience for consumers. Firms benefit from regular and ongoing revenue streams. Many subscription business models relate to products that deplete with use and require replenishment (Chen et al., 2017[8]). Interestingly, connected devices that use streams of data through sensors, software and network connections have become associated with physical goods to make continuous or recurring purchases.

Many emerging subscription services offer access to digital products that are only tradeable as a result of digital transformation, like software services. The pricing of non-rivalrous digital goods with low or zero marginal costs can be difficult for firms. One solution is bundling many digital products and charging a single price (Bakos and Brynjolfsson, 1999[9]; Bakos and Brynjolfsson, 2000[10]). E-commerce subscription business models, such as Spotify or Netflix, are examples of this theory in practice (Goldfarb and Tucker, 2017[11]).

Some digitalised subscription models pursue a “freemium strategy” that limits use of or access to content. Those who pay the relevant subscription fee enjoy a higher quality service, which may include additional content or the absence of advertising. This model can help new and small firms gain market share by enabling the consumer to experience the service without initial up-front costs. As those users who pay for premium services are also likely to use the service more, firms can respond appropriately (European Commission, 2015[12]).

Cloud computing technology has spurred e-commerce through subscription business models. Cloud computing enables individuals and organisations to access resources through an online interface. Such resources include software applications, storage capacity, and networking and computing power. Some well-known variants of this model include infrastructure-as-a-service, platform-as-a-service and software-as-a-service.

Such cloud computing resources can be priced on demand and used in a flexible, scalable and adaptable manner. This enables users to reduce the costs of fixed investment in information and communication technologies (ICTs). This, in turn, allows users, including SMEs and individuals, to access computing resources that would otherwise be prohibitively expensive. As cloud computing increases the availability, capacity and ubiquity of computing resources, it also enables the diffusion of sophisticated digital technologies (e.g. AI and big data analytics) that would otherwise have been prohibitively expensive.

Experimentation with online-offline e-commerce business models is increasing

As e-commerce has become more prevalent, many conventional firms and retailers are experimenting with the inclusion of online distribution channels alongside their brick-and-mortar operations. In the context of the pandemic, this includes smaller retailers that are trying to survive during the total drop off of sales in physical stores. However, leveraging the Internet, or other electronic networks, to integrate e-commerce into an existing firm-level business model often requires complementary investments and capacities. This can include supply-chain and fulfilment arrangements, as well as consolidated inventory systems.

For example, many firms have developed “click-and-collect” mechanisms to enable consumers to order and purchase on line. Consumers then collect the relevant items in a local brick-and-mortar store; in another location such as a locker; or kerbside. This allows consumers to immediately purchase the good or service at a distance, but to save on shipping costs, delays and inconveniences associated with delivery. Notably, this mechanism enables firms to retain their current centralised inventory system. It reduces their operational costs associated with physical brick-and-mortar stores. Furthermore, it enables them to acquire useful data about users.

To the extent that click-and-collect mechanisms are located in a brick-and-mortar store, they may allow consumers to check quality and assess the colour, style and size of the product within the store itself. In addition, consumers can make returns in store, which may encourage them to purchase on line. One survey found consumers were more willing to purchase on line if they could return in a brick-and-mortar store (United Postal Service, 2018[13]). Other developments in this space include kerbside fulfilment, whereby consumers can order groceries on line and then drive to their local brick-and-mortar store to pick them up immediately (Howland, 2016[14]). This model enables consumers to shop at a distance and retailers to minimise expensive investments in home-delivery supply and logistics systems. Major retailers like Walmart, Amazon, Target and Nordstrom have all adopted such systems.

In one emerging e-commerce business model, online fashion businesses and others are including offline features to enable the sale of fit-critical goods and services on line. On the one hand, an offline distribution channel re-introduces frictions to the business model and may increase costs. On the other, it can increase the extensive margin of e-commerce by enabling new types of products to be sold on line.

Firms that sell heterogeneous or bespoke products like clothing may benefit from consumers’ ability to physically inspect the product before purchase. For example, several online apparel retailers have opened brick-and-mortar stores that allow consumers to try on products before ordering them on line. Bonobos has opened over 30 “guide shops” to enable consumers to try the product for fit and quality. Consumers then place their order on line, a process that increases conversion, minimises returns and increases the average purchase value. Online brands such as Birchbox, Daniel Wellington, Harry’s and Warby Parker have also added a physical component to the traditional e-commerce experience.

Other firms are increasingly experimenting with online ordering mechanisms within or near brick-and-mortar stores themselves to boost sales, enable customisation and increase efficiency. For example, many restaurants have adopted ordering, purchasing and paying by application or kiosk for almost immediate pick-up. Indeed, the fast food chain McDonald’s has installed digital self-order kiosks in all 14 000 of its US stores (Hafner and Limbachia, 2018[15]). These kiosks rely on touch-screen technology to relay information via wireless networks from customer orders to the kitchen, where the meals are made on demand. Users tend to spend more time considering their options when using an automated kiosk, which can result in selecting more items for purchase (Houser, 2018[16]). Similarly, increased revenues may result because users are more likely to customise their orders, which typically carries an additional fee. One study found that online ordering resulted in 14% more customisation requests than orders made in person (Goldfarb et al., 2015[17]).

An emerging and innovative example of embedding online ordering mechanisms within brick-and-mortar stores is the partially automated grocery store pioneered by Amazon (Amazon, 2019[18]). After entering the store via a mobile application, consumers can simply select the desired products and then immediately leave the store without a formal checkout. While the aim of their business model is to increase the efficiency of the shopping experience by partially automating the payment process, it can also help foster social distancing.

Innovative payment mechanisms boost e-commerce and social distancing

Online payment innovations help unlock e-commerce potential by promoting trusted online transactions between unknown parties, and also support social distancing. Three innovative forms of holding and conducting payments that can facilitate e-commerce include: digital wallets, mobile money and cryptocurrencies. These mechanisms are not necessarily discrete – indeed, mobile money and cryptocurrencies are both stored in forms of digital wallets. However, together they have the potential to drive future developments in the e-commerce landscape.

Digital wallets, also known as “e-wallets” or “electronic wallets”, are one mechanism of enabling online payments. Such wallets act as intermediating application layers that hold financial information about the relevant funding source on both sides of the transaction (e.g. credit card details) (Cheok, Huiskamp and Malinowski, 2014[19]). Essentially, digital wallets tokenise financial information such that it does not need to be directly shared with an unknown party.

Digital wallets vary in their service offerings and features. Some wallets directly process payments, transferring money between buyers and sellers (e.g. PayPal); others transfer financial details between the payment processors of either party (e.g. Google Wallet). Digital wallets can hold a variety of currencies, including cryptocurrencies (see below). They can be used from any connected device, including mobile phones and other smart devices (e.g. smart watches). Mobile wallets are a sub-type of digital wallet, with mobile-specific features and services, that can be used to make purchases on line. However, they are also increasingly used in point-of-sale transactions, for example by street vendors or in brick-and-mortar stores, using connected devices.

Mobile payments, or mobile money, is a second form of payment innovation that enables e-commerce. It is useful particularly for the unbanked (i.e. those without access to financial services). Mobile money differs from digital wallets in that payment is made via mobile communication networks. It does not necessarily require an existing relationship with a financial services provider.

Mobile money is mediated by mobile network operators who use a system of agents to accept regular (fiat) currency in the form of cash. They store an equivalent value in a digital wallet, which can then be transferred to other users or withdrawn later. Mobile money is typically associated with a mobile phone number and often uses two-factor authentication through a personal identification number issued at the point of registration. Mobile money can typically be transferred to others who are registered with the same mobile money system, including to merchants in exchange for goods and services.

A third emerging payment mechanism involves distributed ledger technologies (DLTs), also known as cryptocurrencies. Cryptocurrencies like bitcoin operate through a distributed database independent of central banks or financial institutions. They provide a means of making anonymous, validated transfers of value. However, other extensions of blockchain-enabled payments may hold more potential for e-commerce. These include use of “smart contracts”, namely self-executing and deterministic software protocols that only transfer value after particular conditions are met.

Smart contracts could hold particular promise for e-commerce when combined with connected devices. For example, a blockchain-enabled, connected washing machine could initiate an e-commerce transaction through a smart contract when it detects that it is out of detergent (OECD, 2017[6]). Connected devices could also potentially transact with each other in an autonomous fashion using smart contracts, thereby facilitating a completely new kind of e-commerce. A bitcoin-based start-up called 21 has outlined a model whereby environmental sensors could passively collect data and sell it to other machines or institutions for micropayments of cryptocurrencies, like bitcoin (Pate, Kun and Srinivasan, 2016[20]). Blockchain technology could therefore enable e-commerce transactions between connected devices rather than simply between individuals and firms.

Public policies can foster e-commerce innovation

As digital transformation and the COVID-19 pandemic evolves, new business models will arise in ways that are difficult to predict. Business model innovations that make use of data and digital technologies often challenge traditional policy frameworks. Policy can support e-commerce innovation in two important ways.

First, governments can remove regulatory barriers that preserve artificial distinctions between online and offline commerce. Technological changes have blurred the boundaries between online and offline activities, as well as between goods and services. This has an impact on policy settings that often rely on an increasingly artificial distinction between traditional commerce and e-commerce.

Indeed, firms are increasingly combining the most promising aspects of both traditional commerce and e-commerce. As a result, ambiguity will rise, especially as firms increasingly seek an online presence during the COVID-19 pandemic. The mix of online and offline distribution models means, for example, that brick-and-mortar stores increasingly go beyond the simple point-of-service purchase of products. Instead, physical stores often extend the online experience facilitated by e-commerce, and vice versa.

Innovative business models may use brick-and-mortar stores as a point of collection or return of products bought on line, or as a temporary storage facility before delivery. Existing licensing, permitting or zoning rules – particularly at the local level – may not allow such functions. In so doing, they constrains the development of promising e-commerce business models (e.g. omni-channel models) (OECD, 2019[5]). At the same time, road and sidewalk rules, many of which are local, usually do not account for the potential use of autonomous robots and unmanned aerial vehicles to deliver e-commerce products over the last mile. This inhibits new forms of delivery or raises uncertainty.

Policy can also support e-commerce by encouraging regulatory flexibility, experimentation and transparency. Policy experimentation can help ensure a firm’s ability to innovate, while remaining within the spirit of existing laws. Outcome- or performance-based regulations, as well as regulatory sandboxes, can enable firms to test innovative products or services in a contained environment (Attrey, Lesher and Lomax, 2020[21]). In the e-commerce context, such sandboxes have been used to test the use of drones for delivery and digital payment mechanisms (OECD, 2019[5]), two innovations that can contribute to social distancing. Regulatory sandboxes are also an important instrument for “regulatory learning”.

At the same time, policy makers should avoid focusing on a particular type of e-commerce business model. For example, while e-commerce business models that use online platforms are among the most prominent today, advances in digital technologies such as DLTs may ultimately diminish the role of such platforms. Increased transparency, including through better communication of existing regulations and their specific application to e-commerce, is another important step in reducing uncertainty for innovative e-commerce firms.

Although the previous section includes a focus on third-party business-to-consumer (B2C) and consumer-to-consumer (C2C) platforms for e-commerce, the range of online platforms is far broader. Other platforms differ in functionality, encompassing everything from carpooling services and app stores to superplatforms. On superplatforms, for example, users can accomplish most or even all of what they might want to do with a smartphone without ever leaving the app. The platforms also differ in how they generate revenue. Some draw revenue from advertisers, others from transaction fees and still others from subscriptions. Some use a combination of the three.

There is wide variation among even the leading online platforms in their profitability per employee. Facebook, for example, with its work force of about 25 000, looks extremely profitable on a per-employee basis in comparison to the other companies (Figure 10.1). Apple ranked third in this chart although the company employed about five times as many people as Facebook – this fact indicates the substantial level of Apple’s net income. Meanwhile, Amazon registers barely a blip on the chart. This is consistent with its practice of prioritising investment in research and development, improved customer service and growth, while keeping accounting profit low. It also reflects that it employs more than half a million people (on at least a part-time basis).

Nevertheless, online platforms do tend to share a number of economic characteristics. These include direct and indirect network effects, cross-subsidisation, scale without mass, potentially global reach, panoramic scope, generation and use of a broad set of user data, disruptive innovation and switching costs. In some markets, they also include winner-take-all or winner-take-most tendencies. Although many of these characteristics are not unique to online platforms, their combined presence can magnify their effects and lead to explosive growth.

A host of factors can explain why certain platforms succeed. Some forego profit for years to drive customer loyalty, scale and innovation. Others piggyback on a larger, established platform to build scale. Still others leverage assets from one platform business to another.

Online platforms serve interdependent users via the Internet

The term “online platform” has been used to describe a range of services available on the Internet. These include marketplaces, search engines, social media, creative content outlets, app stores, communications services, payment systems, services comprising the “collaborative” or “gig” economy and much more.

They have some important things in common, including the use of ICTs to help users interact; the collection and use of data about those interactions; and network effects. They also drive innovation and play a vital role in digital economies and societies.

But what are they? OECD (2019[23]) offers a definition: an online platform is a digital service that facilitates interactions between two or more distinct but interdependent sets of users (whether firms or individuals) who interact through the service via the Internet.

This definition can accommodate government, non-profit and other non-commercial online platforms, as well as commercial ones (such as the third-party B2C and C2C e-commerce platforms discussed earlier), provided the word “user” is reasonably flexible. For example, some governments – as trusted sources of personal identification and public information – have already built online identity and access management platforms. These are used by public administrators on one side and citizens seeking access to government applications and information on the other (European Commission, 2015[24]; OECD, 2011[25]). Businesses, too, may eventually use these platforms to verify identities in the course of commerce.

It is both appropriate and necessary for the word “users” to be interpreted in a reasonably broad manner. Users and beneficiaries of online platforms go beyond individual consumers. They also include employees, governments and businesses both large and small, which may be acting as buyers, sellers or employers.

At the same time, some businesses do not qualify as an online platform under the above definition. Cloud services providers, for example, are online businesses, but not platforms because they serve only one set of users: customers to whom the service is providing ICT resources. Another example is traditional radio stations before the advent of streaming. They were platforms because they served two sets of users (listeners and advertisers), but were not on line.

The proposed definition is not intended to be universal or permanent. Markets and businesses change so any definition of “online platforms” will need to evolve with them. For this report, the definition clarifies which kinds of entities are being covered and helps to keep the scope manageable. Consequently, the term “online platform” is really more of an engineered concept than a natural and unchanging fixture of digital economies and societies.

Business models used by online platforms can be categorised in various ways

There are many ways to describe and categorise the business models of online platforms. There is no ideal, one-size fits all approach because different typologies are suitable for different purposes. The most intuitive approach is a functional one that sorts based on what platforms do for users or how they do it. This group can be further divided into broad and narrow functional typologies. Then there are typologies based on users of platforms, the kinds of data platforms collect, what they do with these data and their source of revenue. For example, a fairly detailed breakdown of functional categories could include the following:

ad-supported content

blogs

broadcast media streamed on line (CNN, BBC)

music streaming (Deezer, Spotify)

news aggregators (Yahoo! News)

print media appearing on line (Chosun Ilbo, Corriere della Sera, National Geographic, Paris Match)

video streaming (Qzone, Youku, YouTube).

app stores (Apple App Store, Baidu Mobile Assistant, Google Play)

ad-supported messaging (WeChat, Facebook Messenger)

C2C

with payment feature (eBay, MercadoLibre Marketplace, Taobao)

no payment feature (Craigslist, Leboncoin)

crowdsourcing

competitive (Topcoder)

non-competitive (Waze)

dating (Meetic, Tinder)

FinTech

currency exchange (CurrencyFair)

crowdfunding (Indiegogo, Kickstarter)

mobile payments (Alipay, PayPal, WeChat Pay)

online brokers (Fidelity, Saxo Bank, Strateo)

food delivery (Deliveroo, UberEats)

gaming (Amazon Twitch, Huya)

job platforms

full-time, traditional jobs (Careerbuilder, LinkedIn, Monster)

freelancing/crowdsourcing (Freelancer, Mechanical Turk, TaskRabbit)

maps (Baidu Maps, Bing Maps, Google Maps)

online literature (Amazon Self-Publishing, Qidian)

repositories for scholarly research (SSRN)

search advertising

general, or “horizontal”, search (Baidu, Google, Yahoo!)

price comparison sites (PriceGrabber, PriceMinister, ShopZilla)

other specialised, or “vertical”, search (Amazon for products, LexisNexis for lawyers, PogoFrog for physicians)

short-term accommodation (Airbnb, HomeAway)

social media

general social media (Baidu Post Bar, Facebook, WeChat)

microblogging (Sina Weibo, Twitter)

professional networking (LinkedIn)

photo sharing (Flickr, Instagram)

video-sharing sites (iQIYI, TikTok, Youku, YouTube)

special-interest sites (such as Ping for music, Kidzworld for children and Ravelry for knitting)

superplatforms, or “platforms of platforms” (WeChat, QQ)

third-party B2Bs (Alibaba, Amazon Business)

third-party B2Cs

tangible goods (Amazon Marketplace, eBay, Tmall)

services (Jianke)

transportation

long-distance carpooling (BlaBlaCar)

on-demand ride service (Lyft, Uber)

travel booking

cruises (Vacationstogo.com)

rental cars, flights and hotels (Booking.com, Ctrip, Expedia, Opodo)

short-term home rentals (Airbnb, Atraveo, Homeaway).

Many more functional categories could be added, depending on how narrow and comprehensive one wishes the descriptions to be.

Another basis for describing and categorising online platform business models is the source(s) of their revenue. Leading possibilities include the following:

Advertisers who pay fees to the platform for placing (“serving”) text, display or banner advertisements on web pages, or when users click on an ad, or for higher positions in keyword search rankings.

Sellers who pay transaction fees (commissions charged when a transaction is completed on the platform, e.g. transaction fees paid by B2C sellers, commissions paid by developers who sell apps on an app store and transaction fees paid by sellers or service providers who accept mobile online payments); and sellers who pay subscription fees (B2C platforms may charge some of their third-party sellers a monthly or annual membership fee). It also includes listing fees and/or additional service fees for complementary services connected to the platform. These could include customs clearance and value-added tax refund services for third-party sellers, interest-bearing loans to SMEs with a solid track record of sales on a platform and fulfilment services).

Buyers who pay transaction fees and/or additional service fees for complementary services connected to the platform (such as interest-bearing loans to individuals who have a solid track record of paying for goods on a marketplace platform).

Consumer subscribers (e.g. on dating platforms) who pay periodic subscription fees for the right to use a platform’s services for a given length of time; subscribers may also pay additional service fees.

Employers who pay transaction fees (e.g. on freelancing or gig work platforms) and additional service fees (e.g. for better visibility of listings).

Workers who pay transaction fees and subscription fees (e.g. on freelancing or gig work platforms).

Several business models of online platforms have multiple kinds of revenue sources. For example, some derive revenue from both sellers’ transaction fees and advertisements. OECD (2019[23]) provides further detail on the business models used by 12 of the world’s leading platforms.

It can sometimes be useful to apply several typologies at once for finer compartmentalisation. For instance, the hybrid approach in Figure 10.2 could help policy makers in the employment and labour fields.

This hybrid approach simultaneously uses six criteria to categorise platforms: functionality (the descriptors in the blue circles), the medium of work delivery (physical versus digital); and whether the work is routine, manual or cognitive, and labour- or capital-intensive. The sixth criterion – more subtle because not overtly identified – is a broader version of functionality. It is responsible for the limitation of the universe of online platforms to just the types represented by the blue circles: platforms that facilitate the delivery of a (usually paid) service.

The use of so many sorting mechanisms enables a tight compartmentalisation of online platforms. In so doing, it gives policy makers a more accurate and detailed view of the platforms’ traits, similarities and differences. This demonstrates that even broad typological approaches can be effective at classifying platforms when used with other approaches.

Online platforms share certain economic characteristics

Positive direct network effects. For certain kinds of online platforms, the utility for users on one side depends on the number of other users on that same side. This is called a direct network effect. The effect is both positive and direct when utility increases as the user base on the same side of the platform grows. Examples of online platforms with positive direct network effects include social media and instant messaging (IM) platforms. Both applications are useless to the consumer if he or she is the only person using them, but their value increases as the number of other users grows. Positive direct network effects can lead to rapid and formidable growth, as they create a kind of virtuous circle: the more users on one side, the more valuable the service becomes, which attracts even more users to that side, etc. Incidentally, not all platforms have positive direct network effects. Some (e.g. dating platforms) even have negative direct network effects (utility on one side decreases as the user base on the same side increases).

Positive indirect network effects. In contrast, all platforms have positive indirect network effects. When indirect network effects exist, the entity or market in question must be two-sided or multi-sided. Positive indirect network effects occur when a group of users (say, third-party sellers on a B2C platform) benefits more as the number of people in another group of users (buyers who use the same platform) increases, and possibly vice versa. Thus, if a platform provides better service to one side of its market, it increases the demand for its service on the other side(s). When indirect network effects operate in both directions of a two-sided market, another type of growth-driving virtuous circle arises. As more users join one side, the platform becomes more attractive to users on the other side(s). This, in turn, leads more users to join that side, thereby increasing the appeal of the first side, etc. Where positive indirect network effects exist, platforms provide a valuable service. They solve a co-ordination problem between two or more sides that stand to benefit if they can be united and helped to interact. That, in turn, can be a lucrative business for the platforms.

Cross-subsidisation. Online platforms commonly try to reach at least a viable size by capitalising on the multi-sided nature of their markets. Specifically, to increase the user base on one side of their business, many platforms subsidise it. At first, they might take on debt as a strategy. However, if the business grows enough, they will rely on revenues from the other side. In many cases, this subsidy is absolute in a pecuniary sense. In other words, subsidised users do not pay any monetary price to use the platform. Among the types of platforms that employ this strategy are, for example, most or all of the leading search engines, social media platforms and IM platforms. Advertising revenues make it possible to offer free services to users on the other side of the platform’s business.

Scale without mass. This term reflects the possibility to grow extensively, and to do so quickly and inexpensively compared to scaling up in physical goods markets, due to the extremely low and still dwindling unit costs for processing, storing, replicating and transmitting data (OECD, 2019[27]). That cost structure means that once online platforms absorb fixed costs for things like computer hardware and initial software development, they can serve many additional users while incurring extremely low or negligible marginal costs. That enables the platforms to grow – even to the point where they are serving hundreds of millions or possibly billions of people – without increasing investments in tangible assets or taking on new employees at anywhere near the same growth rate.

Potentially global reach. This is possible thanks to the end-to-end interoperable design of the Internet. To the extent that technical Internet openness is respected, online platforms can attract customers all over the world.

Panoramic scope. Some platform companies benefit from economies of scope because of complementarities between two or more of their services on a given platform or across platforms. In some cases, development costs and/or data can be shared across business lines. Applications can be given a common look and feel so that users gain familiarity with “sister” platforms more quickly. That can help a company’s newer platforms to gain users faster, giving them a potential competitive advantage over new “solo” platform companies. Offering more services may also keep users connected to a particular company’s offerings. That, in turn, means the company can collect more user data. These may be used to further refine the platforms’ services or to enable the company to enter another market more easily and effectively.

Generation and use of user data. Online platforms are by no means the only types of businesses that generate and capitalise on user data. However, they may be distinguished by the richness of their user data, the sheer amount at their disposal and the sophisticated ways in which they use that data. Various platforms create and rely on user data, and share them, to different degrees. Some use them only to improve their own service. Others make insights gleaned from the data, or even the data themselves, available to others.

Switching costs. Some, but not all, online platforms require or encourage investments by users that, once made, are not easily transferable to other platforms. In the context of social media, for example, such investments may include setting up and personalising an account profile, uploading content (including photos, videos, posts or product information and offers) and establishing a community of friends, followers or customers. More broadly, these investments may include simply becoming familiar with a platform’s look and feel, and developing trust or confidence in it. When such investments are not easily transferable and are substantial enough, they could discourage users from switching to another platform. This is true even if prices rise, quality declines or the service provides less privacy (OECD, 2012[28]). Furthermore, when their data is tied not only to a particular platform, but to a whole ecosystem of which the platform is just one part, users may be even less willing to switch.

Winner-take-all or winner-take-most. Some markets in which online platforms operate exhibit winner-take-all or winner-take-most tendencies (Iansiti and Lakhani, 2017[29]; Frank and Cook, 1996[30]). This is primarily due to the confluence of positive network effects and economies of scale and scope. Successful platforms in such markets can experience hyper growth that is all but impossible for even innovative companies to achieve in physical product markets. Facebook, for example, reached 100 million users just 4.5 years after its launch. In comparison, it took 16 years for mobile phones to gain 100 million users, while wired telephones needed 75 years to reach that mark (Dreischmeier, Close and Trichet, 2015[31]). However, not all markets in which online platforms operate have winner-take-all or winner-take-most characteristics. Network effects need to be strong; switching costs must be high; and users must find it difficult or undesirable to multi-home (which means they tend not to use multiple, rival platforms simultaneously).

The world’s leading online platforms succeeded for different reasons

Business acumen. All of the leading platform companies are successful because they are well managed, although this acumen may manifest in different ways. Some can anticipate market trends or drive them in the first place. Others have a knack for continually raising efficiency and customer loyalty, hiring talented personnel, building trust, making smart acquisitions or increasing convenience for their users.

Foregoing profit for many years in favour of building customer loyalty, scale and funding innovation. Some platforms use their income to improve their services and grow their customer base for more than a decade before ever taking any of it in the form of profit. Such investments can pay off over the long term.

High-quality design and photography as a competitive advantage. Some platforms have succeeded in distinguishing themselves with aesthetically advanced web designs that attract and retain users.

Intense focus on customer service. Zealously and continuously improving customer service has been a key element of success for some of the world’s major platforms.

Low-overhead business model, or “scale without mass”. This is a common success factor among the major online platforms. In principle, virtually every online platform has the potential to capitalise on scale without mass, but the leading firms excel at it.

Piggybacking on a larger, established platform to build scale. Several of the major online platforms received an important, early boost to their user bases by riding on top of an existing platform. In some cases, that existing platform was owned by the same company as the new platforms; in others, it was owned by a different firm.

Leveraging assets from one platform market to succeed in others. Some online platform companies have built new businesses by taking the assets (not only physical infrastructure, but also users, data, software, know-how) developed in one market where they are operating at scale and using them in new ways to enter another market.

Protectionism. Some Chinese platforms scaled up to hundreds of millions of domestic users without serious competition from large foreign platforms because the key players were blocked in the People’s Republic of China (hereafter “China”).

OECD (2019[23]) provides examples of all the factors just mentioned.

Digital transformation has contributed to an increase in non-standard forms of work

In recent years, new business models enabled by digitalisation have contributed to an increase in non-standard forms of work. This is an umbrella definition that includes several contractual arrangements such as temporary jobs, part-time contracts and self-employment. As their common feature, such non-standard jobs differ from the “standard” of full-time, open-ended contracts with a single employer. Although some of these forms are not new, digitalisation, together with globalisation and changes in regulations and policies, have contributed to their diffusion. Digital technologies have also enabled new forms of work, such as jobs mediated by online platforms. Although recent trends have not been uniform, non-standard work encompasses over a third of the labour force in a majority of OECD countries (OECD, 2019[32]).

Temporary and part-time employment are on the rise in many countries

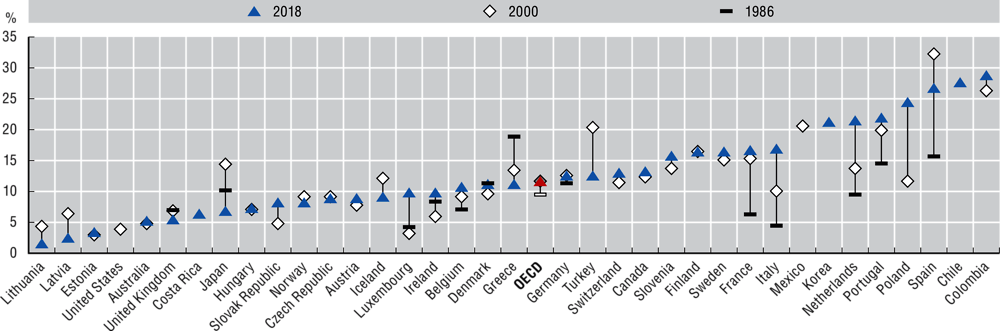

Between 1986 and 2018, temporary employment increased in around half of OECD countries, with some showing a marked upward trend (Figure 10.3). Part-time employment has risen in most of the OECD, with some exceptions such as Iceland, Poland and Sweden. The share of involuntary part-time in total part-time employment has increased in two-thirds of them, although it has declined in some others (OECD, 2019[32]).

Working part-time is an arrangement that concerns more women than men. One in four employed women works part-time. The share of men working part-time – although increasing – is still relatively low, at 9% (up from 5% in 1986). Two-thirds of involuntarily part-time workers are women.

In about half of OECD countries, “short part-time” work (i.e. individuals working no more than 20 hours per week) has also grown (Figure 10.4). Part of this increase may reflect workers’ preference for greater flexibility; part of it has also been driven by the rise in atypical contracts, e.g. on-call and zero-hour work contracts. In 2016, on-call work affected about 8% of the workforce in the Netherlands, whereas 3% of British workers were on a zero-hour contract in the same year (OECD, 2019[32]).

The growth of self-employed workers has not been uniform across the OECD

Self-employment has had a stable incidence over total employment since 2000 in most OECD countries. The COVID-19 pandemic may affect this trend, as laid-off workers turn to self-employment to ensure an income. In most EU countries, there has been a sectoral shift. Self-employment in agriculture has declined, while it has increased in construction and knowledge-intensive services (European Commission, 2020[33]). Countries like the Netherlands, the Czech Republic, the Slovak Republic and the United Kingdom have also seen substantial increases in the share of own-account workers (i.e. self-employed without employees) in total employment in recent decades. Conversely, the overall share for the OECD is not uniform (OECD, 2018[34]). Self-employment may signal a shifting preference towards entrepreneurship. However, in the four countries noted above, policies (and, in particular, tax incentives for self-employment) have tended to play an important role in the rise of self-employment.

Online platform workers are a small but increasing share of the labour force

Online platform workers are defined as workers who use an app or website to match with customers to provide a service in return for money. Services offered range from highly capital-intensive (such as providing accommodation) to highly labour-intensive (such as cleaning). Many services combine capital and labour (such as providing transport) (OECD, 2016[26]). Platform work may be a worker’s main occupation, or secondary work to supplement their income (OECD, 2019[35]).

Although analysts have attempted several times to estimate the number of online platform workers, it remains a challenging task. Traditional labour surveys are not designed to capture this type of work. In recent years, official statistical agencies of OECD countries have introduced questions on online platform workers into labour force surveys and Internet usage surveys. The resulting estimates indicate that platform-mediated employment is still a small share of overall employment, typically about 0.5% to 3% (OECD, 2019[32]).

Using tax data, researchers estimated the share of gig workers among Canadian workers at about 1.7 million (8.2%) in 2016, up from 1 million (5.5%) in 2005 (Jeon, Liu and Ostrovsky, 2019[36]). This figure includes unincorporated self-employed freelancers, day labourers, and on-demand or platform workers. The study observed an increase in gig workers in 2012-13. It noted the increase coincided with the proliferation of online platforms in Canada that started at that time.

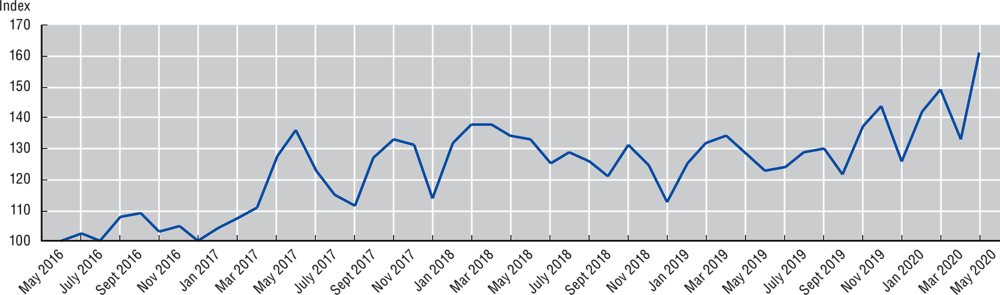

The Online Labour Index produced by the Oxford Internet Institute provides an indication of trends in platform work (Kässi and Lehdonvirta, 2016[57]). The index tracks projects and posts for freelance online workers in real time from five of the world’s largest English-language online labour platforms. This only represents a subset of platform work. Specifically, it shows work carried out entirely on line but not work obtained on line and carried out locally (like ridesharing and delivery). Nonetheless, it can indicate the general trend in platform work.

Data over recent years showed a stabilising trend for platform work between May 2016 and the end of 2019, followed by an upward trend in 2020 compared with the previous year. In the aftermath of the COVID-19 pandemic, the demand for online platform workers dropped dramatically. However, this trend seems to have reversed. Based on postings, the demand for platform workers was 30% higher over the previous year. This increase was driven mainly by “software development & technology” jobs, as documented in the iLabourProject (Figure 10.5).

Non-standard jobs may result in lower quality jobs

Non-standard work may offer advantages such as greater flexibility and autonomy, a better work-life balance and opportunities for additional sources of income. However, some factors may limit workers’ flexibility and autonomy. Some workers will be “falsely self-employed”. In other words, their income depends on a single employer; they cannot set their remuneration or choose their working time. In principle, platform workers can choose their own hours. However, in practice, demand may be highly concentrated in certain parts of the day. Furthermore, the platform sets the pay rate for many of these workers. They may also face other restrictions, including the use of uniforms and stringent instructions on how to do their job.

Increased job instability that often characterises new, non-standard forms of employment may result in reduced well-being for workers in the absence of policies that guarantee adequate rights and protections. This is all the more relevant in the context of the emerging impact of the COVID-19 pandemic, which severely affected many non-standard workers. They may represent up to 40% of total employment in sectors most affected by containment measures across European OECD countries (OECD, 2020[37]). Furthermore, non-standard workers in many countries have limited access to paid sick leave. They may also lack access to income support during quarantine periods or job loss (OECD, 2020[38]). Careful policy action can help overcome the risks associated with non-standard work. Recent OECD research offers policy directions to address the potential drawbacks of a changing labour market (OECD, 2019[32]).

Employment status is a gateway to worker rights and protections, but some workers fall in a “grey zone”

Ensuring correct classification, thus also tackling misclassification, is essential to guaranteeing that workers have access to labour and social protection, collective bargaining and lifelong learning. In recent years, countries have adopted several measures to strengthen compliance with regulations (OECD, 2019[32]). However, ambiguity persists regarding workers who appear to fall somewhere in the grey zone between dependent and self-employment. This is particularly true for workers in the platform economy. They are typically classified as own-account workers, but share to varying degrees characteristics of employees, depending on the work performed through the platform. In many instances, employer-worker relationships are difficult to classify. They may require a revision of the legislation and, in particular, of what it means to be “an employee”, “self-employed” and/or “an employer”.

Several OECD countries consider classification of platform workers as a policy priority. They are actively addressing the issue through analysis and adaptation of their legislation or through other actions (OECD, 2019[39]). In Portugal, for instance, the “Uber law” adopted in 2018 establishes that platforms operating in the passenger transport sector are employers, not just intermediaries. In the United States, several state laws provide that workers are self-employed, rather than employees, of platforms, if several conditions are met (OECD, 2019[39]). The state of California, on the other hand, adopted a bill that qualifies platform workers as employees. In countries such as Australia, Canada, Spain and the United Kingdom, numerous platform workers have challenged their employment status by taking their work platform to court, particularly in the delivery and passenger transport sector (OECD, 2019[39]).

Some countries, using various approaches, have identified subgroups of non-standard workers. They have awarded these subgroups the rights and protections hitherto granted only to employees. For instance, some have targeted the financially dependent self-employed, while others have created a “third category” of workers (with the risk of increasing ambiguity). Even where individuals are correctly classified and genuinely self-employed, there may be a case for government intervention to improve their labour market outcomes. For example, these workers may be in a position where there is only one buyer (OECD, 2019[32]). Governments should consider policy avenues to give non-standard workers greater adequate employment protection, access to collective representation, better training opportunities and stronger social security.

Policy responses

Strengthen the rights and benefits of non-standard workers

Several countries, including the United Kingdom, the Netherlands and Poland, have considered introducing minimum rates for some groups of self-employed workers (OECD, 2019[32]). In other cases, governments or the platforms themselves have set minimum wages for platform workers. Since January 2018, for example, New York City has imposed a minimum wage for Uber and Lyft drivers. The platforms Favor, a delivery platform in the United States, as well as Upwork and Prolific in the United Kingdom, have established minimum wages. Meanwhile, the Czech Topdesigner.cz and the Spanish adtriboo.com, have set a minimum or a fixed price for certain tasks. These rates are based on the average number of hours that workers spend on them (OECD, 2019[32]).

As an alternative (or complement) to setting minimum wages, countries including Canada and Sweden have extended collective bargaining rights to certain groups of self-employed workers. In France, the El Khomri law adopted in 2016 allowed platform workers to form and join a trade union organisation, and to assert their collective interests through it. Collective bargaining can help shape the future of work, supporting and complementing public policy. The role of social partners and their ability to work co-operatively is crucial in this regard. Trade unions are expanding their membership to workers in non-standard forms of employment and developing new strategies to negotiate with employers. In Sweden and Denmark, such actions have led to the signature of collective agreements between platforms and trade unions. In Germany, they have spurred the creation of a work council, which will be able to negotiate a collective agreement on working conditions for Foodora couriers. Following an agreement with trade unions in 2018, employee representatives joined the supervisory board of European Company (Societas Europaea, SE) Delivery Hero, a publicly listed online food-delivery service active in several European countries. In addition to worker-led initiatives, some platforms have also begun to address platform workers’ limited access to representation and social dialogue, mostly in response to government threats to reclassify their activities (OECD, 2019[32]).

Typically, regulations aim to limit excessive working hours by establishing, for instance, compulsory resting times and paid annual leave. Extending such requirements to non-standard forms of work may affect the ability of workers to choose their working hours and time flexibly and autonomously. Government action has therefore rather focused on regulating atypical contracts, such as those with “zero-hours”.

Such reforms aim to reduce unpredictability in working hours, and its impact on overall earnings and the worker’s ability to plan ahead. Finland, for example, restricts this type of contract to situations where employers truly have a variable need for labour. Along with Ireland and Norway, Finland also requires employers to provide information (such as the minimum number of hours) up-front or in the employment contract. These three countries, along with the Netherlands and the state of Oregon in the United States, require advance notice of work schedules. Australia and the United Kingdom give employees the right to request a more predictable contract after a certain period of time (OECD, 2019[32]).

Self-employed workers generally take responsibility for ensuring their own safety and health. New forms of work, such as online platform work, also bring new or increased risks. These are due to their tasks (e.g. transport), as well as the high levels of competition they face. Countries have taken steps to extend occupational and safety health protection to non-employees. Some, for example, have decoupled such protections from the employment relationship (Australia, Ireland, Lithuania, Malta, Turkey and the United Kingdom). Some countries have also connected related regulation to the workplace rather than to any specific contract type (Australia, Bulgaria, Canada and Poland). Korea plans to extend the Occupational Safety and Health Act to “all working people”. It also requires employers to take specific health and safety measures for non-regular workers, including dependent contractors and delivery workers. In France, the El Khomri law foresees that the platform must reimburse workers if they voluntarily insure themselves against the risk of occupational accident or illness.

Reform social protection as to ensure better coverage

Self-employed workers in many countries do not have access to the same social protection benefits as employees, such as those concerning unemployment, incapacity or old age. In recent years, governments have responded with different policy approaches. These range from extending social protection rights to certain groups of workers in the “grey zone” to broader reforms of social protection systems targeting self-employed workers at large (OECD, 2019[39]).

Denmark and France have introduced significant reforms to their social protection system. These aim to establish portability of entitlements for individuals moving between (or even combining) employee status and self-employment. In 2018, Denmark introduced a new unemployment benefit system that treats all income sources equivalently. The system has three aims. First, it seeks to increase access to unemployment insurance for self-employed, non-standard workers and on-demand employees. Second, it aims to make it easier to combine self-employment and employment income. Finally, it wants to make it simpler for self-employed individuals to prove discontinuation of operations. In France, social protection reform brings coverage of the self-employed under the general social protection scheme. This limits the administrative changes required if a person moves between employment and self-employment. Among its goals, the reform aims to ensure continued social security coverage throughout people’s careers.

The European Union adopted a Council Recommendation on Access to Social Protection for Workers and the Self-Employed in November 2019 (European Commission, 2019[58]). It aims to encourage EU member states to adopt policy in four areas. First, they could allow non-standard workers and the self-employed to adhere to social security schemes (closing formal coverage gaps). Second, they could allow these workers to build up and take up adequate social benefits as members of a scheme (adequate effective coverage) and help them transfer social security benefits between schemes. Third, they could increase adequacy of social security systems and rights. Fourth, they could increase transparency of social security systems and rights.

Extend training rights beyond standard employees

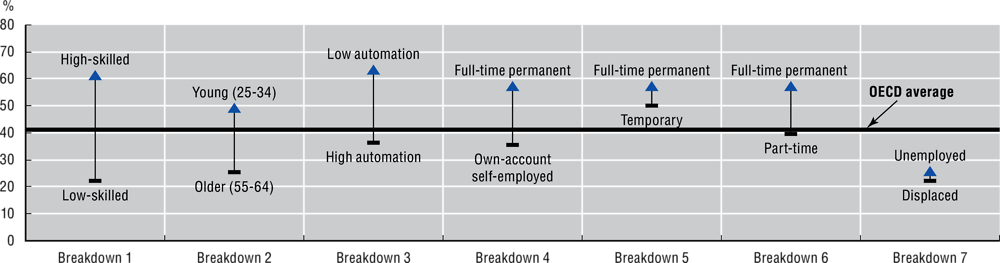

With the rise of non-standard work, many workers face more fragmented careers, and may thus change jobs and employment types several times. These changes often demand reskilling and upskilling opportunities, which typically are not available or accessible for non-standard workers. As employers typically provide training, these workers, and particularly own-account workers (thus including platform workers), are often excluded. This results in lower participation in training (Figure 10.6). As they lack representation in trade unions, they are also not entitled to training rights negotiated through collective bargaining.

The other main barriers to training are lack of time and of financial resources. These issues may be common to other work categories, but are worse for non-standard workers, who have to invest time in looking for jobs. Platform workers may be at a greater disadvantage in this regard. For example, they may be working to tight deadlines or on low piece-rates for micro-tasks, which may leave them little time for training. This is particularly true for platform workers on low incomes. In addition, many online platform workers have little scope for career development where they work. This may discourage both platforms and workers themselves to invest in training.

Some OECD countries have extended available financial incentives, such as tax deductions and subsidies, to support training for the self-employed, including own-account workers. Since January 2018, France has extended entitlements to the Individual Learning Account (ILA) to self-employed workers. In Ireland, the Springboard+ programme offers free courses leading to qualification. In 2017, the programme was extended to the self-employed who want to upskill in biopharma/med tech, and ICT sectors. As other examples of supporting the cost of training, Korea, Austria and Belgium make certain subsidies dependent on the payment of social security contributions, or conditional on enrolment in an employment insurance plan. Lastly, countries like Austria, Finland and Luxembourg provide wage replacements schemes to self-employed enrolled in training.

Specific training obligations for platforms are limited. The El Khomri law in France requires platforms to pay employers’ contributions for training, cover expenses for the recognition of prior learning and provide a training indemnity for all gig workers above a certain revenue. In August 2018, France passed another relevant law: “For the freedom to choose one’s professional future” (Pour la liberté de choisir son avenir professionnel). It requires platforms to contribute financially to the ILA when workers earn at least half of the minimum wage per month.

Several countries acknowledge the need for systems of lifelong learning that could deal with increasingly non-linear career paths and support individuals as they move between jobs throughout their lives (OECD, 2019[39]). Individual learning schemes (ILS), for example, are attached to individuals rather than to a specific employer or employment status. Under ILS, individuals can undertake continuous training throughout their working lives and at their own initiative.

The OECD distinguishes three types of ILS (OECD, 2019[40]). First, ILAs are virtual individual accounts that accumulate training rights over time. Second, individual savings accounts for training are real, physical accounts in which individuals accumulate resources over time for training. Third, training vouchers provide individuals with direct subsidies for training purposes, often with co-financing from the individual.

Of the three types, vouchers are the most popular. Individual savings accounts for training are rarely used, while the French Compte personnel de formation (CPF), established in 2015, is the only example of an ILA. The CPF allows any active person, from first entry into the labour market until retirement, to acquire training rights that can be mobilised throughout their professional life. Training rights are maintained across different forms of employment. They extend through periods of non-employment and are transferrable between employers. Participation in the CPF has increased continuously since its creation in 2015. However, it remains limited, at 2.1% of the labour force in 2018. This is mainly due to the complexity of the system, which a recent reform has tried to address.

Design is critical in ensuring effectiveness of ILAs (OECD, 2019[41]). The features of a well-designed ILA comprise simplicity; adequate and predictable funding; greater generosity for those most in need; provision of effective information, advice and guidance; a guarantee of access to quality training; and explicit account of the links with employer-provided training (OECD, 2019[41]).

Adapt activation policies to their needs

Some OECD countries have also taken steps to ensure own-account workers can receive skills advice and guidance. This has mainly occurred by extending skills advice and guidance services provided by public employment services (PES). In Germany, the Federal Employment Agency enhanced the range of counselling services available for all adults (including the self-employed), going beyond the traditional focus given to the unemployed population. In Flanders (Belgium), both employees and self-employed workers can apply to the PES for career guidance vouchers. In Latvia, the PES provides career consultations free of charge not only to the unemployed, but also to the self-employed.

The COVID-19 crisis has taken a terrible human toll and the necessary containment measures have battered OECD economies and societies. Fortunately, digital technologies, business models and work practices are playing a crucial role in helping avoid a complete standstill. This is accelerating ongoing processes of technology proliferation and adoption across businesses, as well as the intensity and extent to which businesses use digital technologies to maintain operations.

The economic threats from the crisis need to be mitigated to avoid damaging business dynamism, and thereby employment and innovation, during the recovery.

COVID-19 as an accelerator of technology adoption by business

Broad and representative surveys of ICT usage in business will not deliver data covering the pandemic period until 2021. However, various evidence suggests that many firms (and other organisations) are taking up digital tools, or further deploying and making greater use of them. This is allowing them to operate during the pandemic.

If they can, businesses have rapidly altered their way of working to allow employees to telework. Estimates for various OECD countries suggest that a significant minority of jobs – between about one-quarter and one-third – can plausibly be performed from home (Dingel and Neiman, 2020[42]; Boeri, Caiumi and Paccagnella, 2020[43]). Others estimate that “around 30% of North American and Western European workers are in occupations that allow home-based work” (ILO, 2020[44]). These shares are markedly higher than other regions, including Latin America (23%), Eastern Asia (19%) and Eastern Europe (18%); the global estimate is 18%. Only 10% to 15%, or fewer, of workers in OECD countries were estimated to have been home-based in 2019 (ILO, 2020[44]). Consequently, COVID-related restrictions on movement are likely to have incited a significant additional portion of workers to telework if they could.

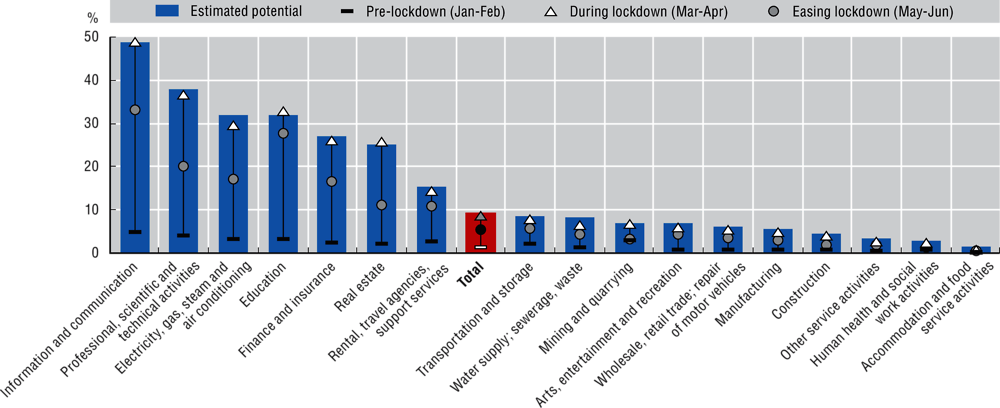

Information is limited on how much of this potential for teleworking has been taken up during the COVID-19 crisis. However, estimates for Italy show large relative increases in teleworking across all industries between January-February 2020 (pre-lockdown) and March-April (when stringent lockdown measures were in force). Indeed, teleworking reached roughly the estimated potential level in most industries. This finding is based on previous estimates of the share of business’ staff that can perform jobs remotely (Figure 10.7). The level of teleworking receded as lockdown restrictions were progressively eased in May and June. However, they still remained many times above the pre-crisis level.

The potential for teleworking, and the extent of teleworking achieved during the pandemic, vary considerably between industries. In Italy, almost half of workers in the information and communication sector were able to telework during COVID-19. Meanwhile, around a third of employees in other relatively highly digitalised industries were able to telework. This included those in professional, scientific and technical activities, and in finance and insurance. The levels of telework were lower (5% to 10% of employees) in industries that rely on specialist machinery and resources that cannot be remotely accessed. These include industries such as transport and storage, mining and quarrying, manufacturing, and construction. The lowest rates of teleworking in Italy occurred in accommodation and food service activities. In this sector, demand (as well as supply) was especially curtailed by lockdown measures that restricted almost all travel outside the home.

Similar patterns were seen in France. Across all industries, a quarter of employees teleworked in the last week of March 2020 when lockdown measures were in full force. The share reached 36% on average in services industries (DARES, 2020[45]) and was higher (28%) for larger firms than smaller firms (20%). Furthermore, the share reached around 60% in industries that were already highly digital-intensive (e.g. information and communication services; financial and insurance activities). The greatest proportional increase occurred in real estate activities where teleworking increased 13-fold.

Canada likewise saw increases in teleworking during the early stages of COVID-19. Before 1 February 2020, 11% of businesses had more than half of employees teleworking. This share had jumped to 35% by 31 March 2020. Moreover, in 18% of firms all employees were teleworking on 31 March. Concurrently, the share of firms in which 10% or fewer workers teleworked fell from 78% of businesses prior to 1 February to 51% on 31 March 2020 (Statistics Canada, 2020[46]).

The ability to maintain business activity appears strongly associated with the ability for workers to telework (Figure 10.8). Together, these data provide a strong indication of the contribution digital technologies can make to resilience in times of crisis.

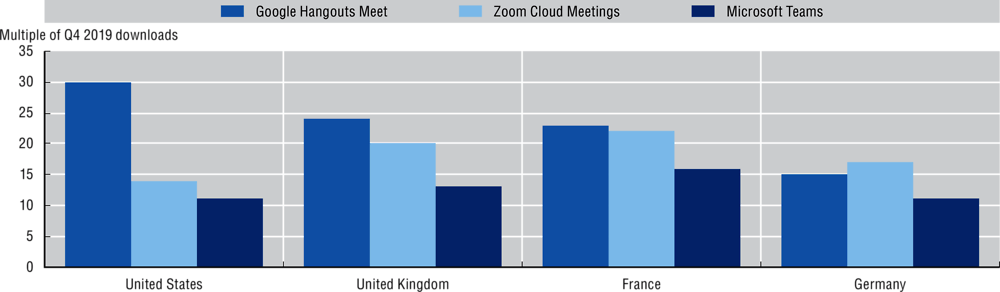

Following from the above, a significant portion of companies in OECD countries will likely have faced strong incentives to adopt teleworking practices, or to expand them across employees as far as possible. This appears to accord with exponential increases in downloads of videoconferencing apps, which are crucial in helping people learn and work from home (Figure 10.9). Nevertheless, these services are available for both personal and business use. Videoconferencing and teleworking tools have undoubtedly helped many businesses continue to operate during the COVID-19 pandemic. However, firms may have also faced the need to understand and manage additional risks. These risks could include ensuring appropriate security, privacy and confidentiality of data transiting remote connections or transmitted via such online tools. Firms can vary in their level of cybersecurity and the geographical locations in which data are stored. SMEs may be especially likely to need support to use digital tools to keep operating during the COVID-19 crisis. Moreover, they may need more help than other businesses to follow safe online working practices and adhere to relevant privacy and security requirements.

Figure 10.10 shows that, alongside video conferencing, online tools such as Trello and Slack have experienced marked increases in use in countries for which data are available (France, Hungary and Poland). Such tools help teams share information, co-ordinate and collaborate.

Some businesses have previously hesitated to embrace teleworking. However, the COVID-19 crisis has given businesses a direct interest in the practice to maintain operations and reduce employees’ exposure to the virus. Governments are supporting this change, especially among SMEs, helping them quickly develop teleworking capabilities. Japan has expanded support for SMEs to introduce teleworking in the office environment. Meanwhile, Korea has developed digital infrastructure to help SMEs work remotely and to allow investor relations on line rather than in person. Italy set up a website to help businesses and education institutions understand and choose between relevant web-based tools. Spain introduced the Talent Accelerate programme to strengthen digital skills in SMEs through training.

Private initiatives can also support SMEs. In France, industry associations support SMEs through a toolkit on teleworking and advice to companies. Singapore worked with industry partners to curate a list of digital solutions to help businesses cope with COVID-19 challenges. Items on the list range from remote working and visitor management to selling on line, billing and online payments. Industry partners offer these solutions to businesses free of charge for a limited time. Singapore also supports industry by providing government grants to consider additional digital solutions such as online collaboration and virtual meetings (for remote work) and temperature screening and queue management (for visitor management).