Executive Summary

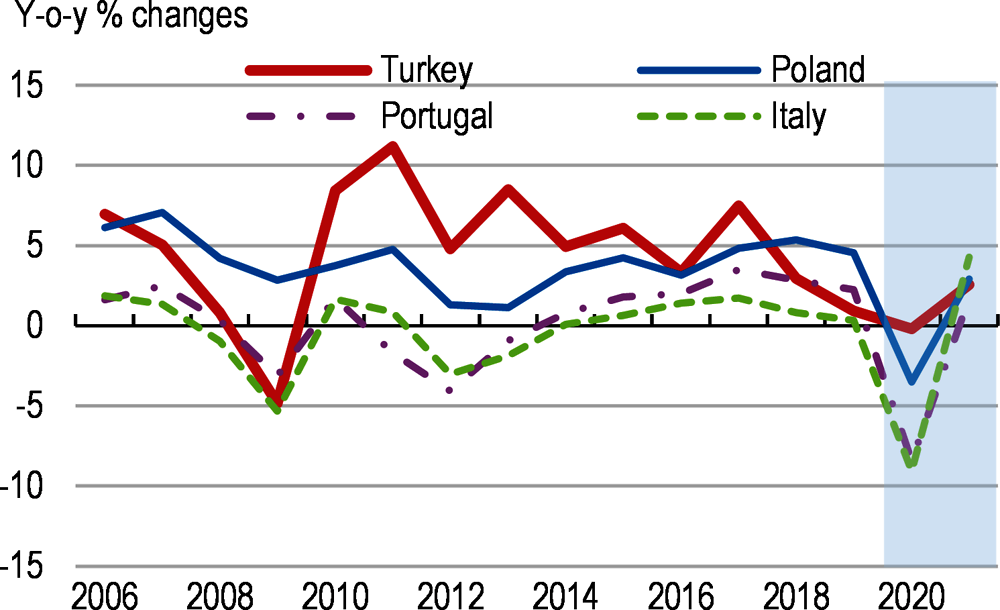

The impact of the pandemic on economic activity unfolded later than in other countries in the region, but was sharp. Turkey managed to contain the number of COVID-19 cases relatively effectively in the first phase of the outbreak, thanks to a strong intensive care infrastructure and targeted lockdowns. Cases however surged again after the easing of containment measures in June and continued to increase sharply in Fall. Employment and aggregate demand contracted strongly in the first wave, then rebounded following vigorous government support. However, they are again facing headwinds. Tourism and hospitality sectors, which generate high demand for other products and services and provide employment across many regions, are particularly affected. The authorities have provided ample quasi-fiscal support to safeguard corporate liquidity, employment and incomes of households. The Central Bank flanked these measures with a more expansionary monetary stance and financial policies promoted massive credit expansion. The government began to scale down these measures after an increase in the current account deficit and inflation, a weakening in investor confidence and a sharp exchange rate depreciation between July and October.

Given Turkey’s relatively modest social safety nets and elevated corporate debt, a full recovery from the COVID-19 crisis is expected to take time. The high leverage reflects a build-up of corporate debt since 2010, exacerbated by the increased value of foreign currency denominated debts following depreciation episodes of the Turkish Lira. Businesses started to deleverage after the financial turmoil of 2018, but the pandemic will further impair the health of corporate balance sheets.

Turkey went into the COVID-19 crisis with sound public finances but extensive off-balance sheet commitments. This resulted from massive government stimulus in 2019 and 2020 and came mainly in the form of government credit guarantees and through lending by public banks. In particular, concessional credits by public banks to households and businesses during the pandemic has increased the share of quasi-fiscal expenditures and amplified contingent liabilities for public finances. Addressing weak fiscal transparency by publishing a regular Fiscal Policy Report encompassing all contincent liabilities would help to improve confidence on financial markets, increasing room for fiscal manoeuvre.

The pandemic amplified monetary policy challenges. Inflation is high and has long been stuck well above the official target of 5%. Actual and expected inflation rose after the COVID-19 shock. Monetary policy interventions related to the pandemic supported economic activity, the exchange rate and liquidity of banks. They also added to concerns whether monetary policy prioritises growth and employment over price stability. Faced with massive capital outflows and a sharp exchange rate depreciation, the Central Bank started to tighten liquidity in August, increased the policy interest rate in late September, the effective funding rate in October, and, as this proved insufficient, again the policy rate in November. It also normalised its policy framework. Foreign reserves remained nevertheless low and risk premia high.

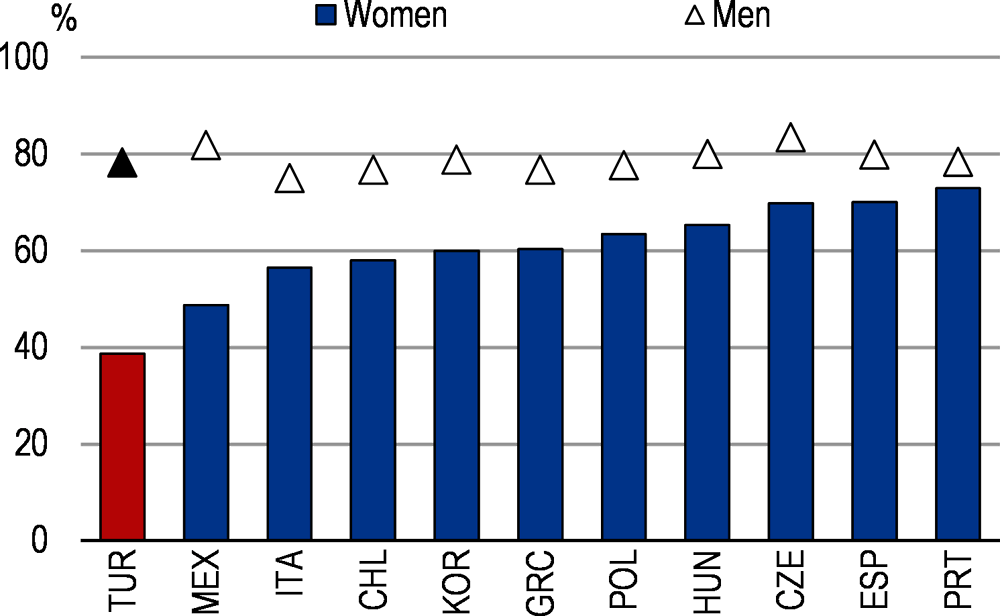

The pandemic exacerbated structural challenges related to high unemployment, low labour force participation and widespread informality. The crisis has hit the informal sector workers and the self-employed the hardest because they are concentrated in labour- and contact-intensive activities where physical distancing is hard to apply. They are also excluded from employment-related social safety nets. While there has been progress in creating quality jobs over the past 15 years, bringing with it major gains in well-being, challenges have remained. The number of jobs decreased strongly after both the 2018 financial turmoil and the COVID-19 shock. Labour force participation, in particular by women, is still very low. High legal employment costs, including one of the OECD’s highest minimum-to median-wage ratios and some of the most restrictive permanent and temporary employment regulations, and an expensive severance system, foster informality. They impede a more efficient allocation of resources towards the relatively narrow but gradually growing share of fully formal firms and higher technology start-ups.

Reducing greenhouse gas emissions and local air pollution, as well as preserving land and coastal resources are pressing issues. Greenhouse gas emissions increased at the fastest pace of the OECD in the past decade. Poor air quality is a major concern, in particular in large cities. Turkey, with its distinct natural assets, should seize the opportunity to make green recovery measures a more important part of its stimulus packages .

Turkey’s position in international governance benchmarks displays major room for progress. Reinforcing the governance environment, as envisaged in the 2019-23 National Development Plan, requires improvements regarding rule of law, public integrity and judicial credibility. Turkey should catch-up with international standards on the fight against corruption, such as bribery, money laundering and terrorism financing. Progress in fighting corruption would also constitute the necessary base for other policies to work more effectively.

The entrepreneurial vigour of the economy is remarkable even under difficult macroeconomic conditions and regional geo-political tensions. However, only a minority of firms create high quality jobs in best practice business organisations. The majority of small-and-medium sized businesses draw on informal or semi-formal employment, management and legal and administrative (including tax) compliance practices. Structural reforms to allow more flexibility in labour markets, more competition in product markets and major progress with the quality of governance would help to unleash Turkey’s full potential by improving productivity, job creation and fostering digital transformation. There is also room for more trade opening in agriculture, services and public procurement. Macroeconometric simulations for this Survey found that a package of reforms could lift Turkey’s GDP per capita level by more than 10% over 10 years as compared to a scenario with no policy changes.

Rigid labour market rules impose high costs on fully formal firms. Reducing the large non-wage labour costs, making statutory minimum wages affordable for lower productivity firms, and modernising labour regulations and social protections for permanent and temporary workers are particularly important in present circumstances. They would ease job creation in the formal sector. More recourse to bargaining at enterprise-level (along regional and firm conditions rather than one-size-fits-all national legislation) would help all firms, including the lower productivity ones, to comply with law, escape informality and access the know-how, labour and capital resources of domestic and global markets.

The pandemic amplified financial pressures on the productive sector, which was already strained by the 2018 shock. Some firms, which were already over-leveraged before the COVID-19 shock, now face debt overhang. Fundamentally viable firms should be supported, to the extent possible in non-debt-creating ways. At the same time, as in other OECD countries, the insolvency system is expected to face a wave of restructurings after the Covid shock. It started to be reformed with a framework agreement on financial restructurings, and more flexible arbitration and mediation rules. However, implementation lagged and the system remains costly, slow and has a low recovery rate. The eco-system of bad loan management, asset reallocations, equity investing and long-term investment financing will steer broad-based restructurings in the period ahead. Its performance will affect the future strength and productivity of the business sector.

Turkish firms lag behind in the adoption of advanced digital technologies and thus forego large dividends from digitalisation. Shortcomings in digital skills and limited access to fast broadband have formed bottlenecks to a more widespread adoption of the most advanced ICT tools and activities. There is also a digital divide between large and small firms and across socio-economic groups. During the COVID-19 shock, recourse to teleworking and other digital applications accelerated - despite Turkey’s economic structure being less prone to these transformations. Strengthening vocational education and adult learning in digital areas would help the productive sector better tap the potential of technological change. Streamlining problem-solving skills in education would improve the related capacities of students, especially among girls and of students from socioeconomically disadvantaged backgrounds.

The skills of the population should be improved more generally. There is a notable fringe of international-quality professionals in technical and management roles, and important progress was achieved in secondary and tertiary enrolments. Still, despite progress in OECD PISA test results, the average quality of education falls significantly behind. The heterogeneity of vocational education programmes and of academic degrees constitute a major challenge. Performance-based public spending, as prescribed by the well-designed but not fully implemented 2005 Public Financial Management and Control Law should be implemented in priority in education.