6. Convergence

This chapter assesses the policy and regulatory framework for broadcasting and pay TV services in Brazil. It looks at licensing of both free-to-air broadcasting and pay TV services, as well as related data collection. Must-carry rules, the digital terrestrial television transition and issues related to public service and community broadcasting are covered. A section on local content examines subsidies and licensing, content quotas and pluralism, and new platforms and services. The second half of the chapter examines competition policy related to mergers and acquisitions, significant market power and advocacy. It also analyses specific competition cases in the communication and broadcasting sectors in light of a convergent environment.

Licensing of FTA services

Free-to-air (FTA) broadcasting services are considered public services in Brazil. As such, private broadcasting stations operate through a delegated act from the State, as defined by the Constitution of 1988, to provide services through a concession. The licensing process of broadcasting services is mainly regulated by Decree No. 52 795 of 1963, and by subsequent decrees amending the text. Namely, Decree No. 236 of 1967 limits the number of concessions per region and the ownership structure, while Law No. 13 424 of 2017 defines the renewal process of broadcasting licences.

The assignment process for broadcasting licences (outorga de concessão para serviço de radiodifusão) is administered by the Ministry of Science, Technology and Innovation (Ministério da Ciência, Tecnologia, Inovações e Comunicações, MCTIC). The process depends on whether the licence is for television or radio, and on whether the station will be used for commercial or educational purposes.

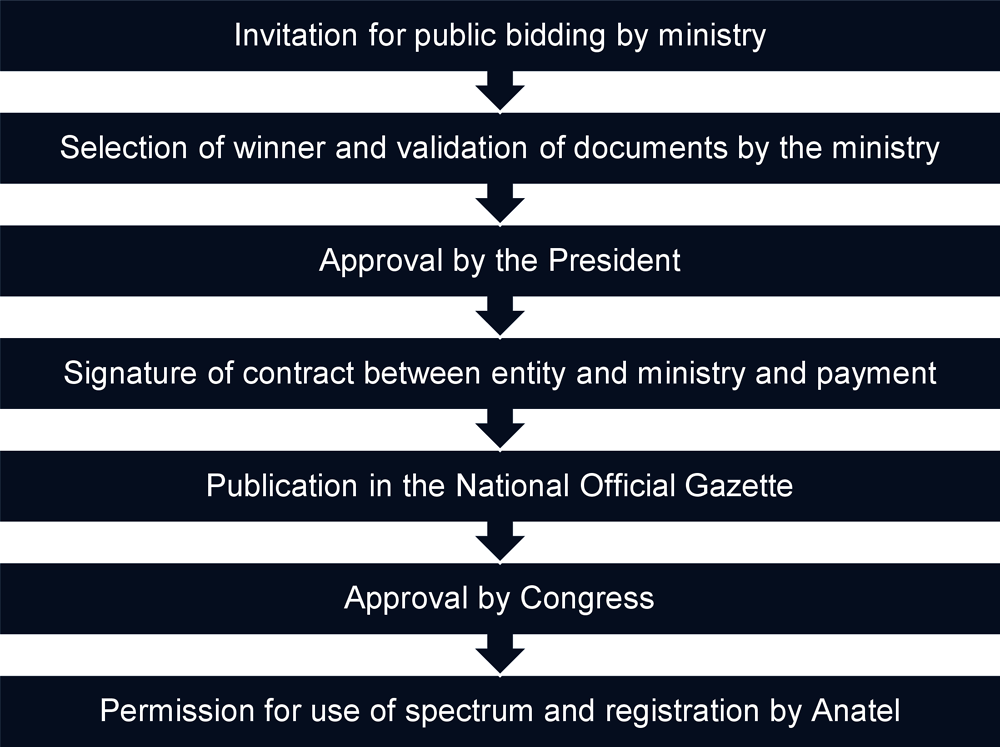

The licensing for commercial TV stations is conducted through a public procurement process with competitive bids, which is regulated by the General Procurement Law No. 8 666 of 1993. The licensing process is lengthy, with multiple steps, and may take many years (Figure 6.1). While official and reliable data are not readily available, some stakeholders claim that obtaining a commercial TV broadcasting licence may take 10-15 years.

The process starts with MCTIC publishing a call for tenders, in accordance with the National Broadcasting Licensing Plan (Plano Nacional de Outorgas, PNO). The PNO is a non-binding document published by MCTIC with the upcoming calls for tender in each region. The call for bids is rare; the last call for commercial TV licences was published in 2010. There have also been specific calls for educational TV broadcasting stations (2011), educational radio stations (2011-12), community radio stations (2011 and 2012-13) and television retransmission (2012) (MCTIC, 2020[1]).

The process after the public call for bids close is extensive. After a 60-day window for bids, a commission within MCTIC analyses the bids according to the criteria of best economic offer and best technical conditions to operate. The winning entity then has 120 days to specify all the technical operational details and the physical location of the station.

If all required documents are properly submitted and deemed valid, the licence application is sent to the President of the Republic for approval. Once the President approves, and after the entity has paid for its offer, the entity and MCTIC sign a concession contract; an extract is published in the official federal gazette. However, the contract will only be valid after obtaining final approval of Congress, as mandated in Article 223 of the Constitution.

The procedure continues at the National Telecommunications Agency (Agência Nacional de Telecomunicações, Anatel), which authorises use of the radiofrequency spectrum. After Anatel’s technical approval and registration, the station must be operational within 12 months or the licence will automatically expire. Licences for television stations are valid for 15 years and can be renewed indefinitely without another bidding process.

MCTIC and Anatel seem to co-operate, but the process remains complex and entails high transaction costs. For example, Anatel checks for irregularities in the application, but MCTIC determines how to deal with any that turn up.

In addition to steps between MCTIC and Anatel, approval by the President’s Office can add up to two years to the process. Approval by Congress is said typically to take around four months. Interaction between the federal government and the states can also introduce delays. For example, clearance from the federal tax revenue office only remains valid for only 30 days. This is often not enough time for the states to respond. As a result, the process often expires before it is complete.

Brazil allows retransmission of signals in certain circumstances. The signal of the main television station may not reach all locations near border areas or if it does it may be inadequate. In such cases, other entities can operate stations dedicated to retransmitting (Retransmissão de Televisão, RTV). They can also repeat the signal (Repetição de Televisão RpTV) produced by a content-generating station (i.e. television retransmission).

Any interested party can request an RTV or RpTV broadcasting authorisation, which MCTIC issues according to Decree No. 5 371 of 2005, which is subject to the availability of spectrum managed by Anatel. This authorisation does not grant the right to create content. Rather, it enables retransmission of content from a main television station.1

In contrast to a broadcasting licence, the RTV and RpTV broadcasting authorisation has no predetermined period of validity, can be revoked at any time by a ministerial decision, and does not require approval of the President or Congress.2 There are 8 470 digital television retransmission authorisations in Brazil, which compares to 680 television licences (MCTIC, 2020[1]).

Licensing for commercial radio stations follows the same process as the one for television stations (Figure 6.1) except the Minister of Communications approves applications rather than the President (Decree No. 52 795 of 1963, art. 6). Licences for radio stations are valid for ten years. They can then be renewed successively by ministerial decision, followed by presidential sanction. No other bidding process or approval by Congress is needed (Brazil, 1972[3]).

Licences for educational radio and television stations with no commercial purposes are exempt from a bidding process (Decree No. 52 795 of 1963, art. 13 and Law-Decree No. 236 of 1967, art. 14). Hence, only MTCIC needs to analyse demands for licences. It approves licences for radio stations, while the President approves licences for television stations. Afterwards, they are sent to Congress for final approval. Public institutions or universities are the only ones entitled to set up educational television stations.

The Law-Decree No. 236 of 1967 (art. 12) limits the number of radio or television station licences for an entity at any given locality. For television stations, the limit is ten licences, with a maximum of two in each state. Only five of the ten licences may use the very high frequency (VHF) spectrum. For radio stations, the number depends on the technology and coverage area (i.e. local, regional or national). This limitation effectively requires entities to use retransmitting or repeating services to cover greater geographical areas. It also means that larger television groups work through affiliates rather than exercising direct control and ownership.

There is also a large number of community radio broadcasters in Brazil. Community radio broadcasting service is regulated by Law No. 9 612 of 1998 and by Decree No. 2 615 of 1998. Ministerial ordinances specify the rules of the public concession and service provision. The process also requires the publishing of a PNO, an invitation for public bidding and assessment of the files. When more than one party is interested in the licences, a selection process is carried out. MCTIC validates documents and publishes results, which are then reviewed by the President and Congress. Cancelling the licence before the end of this period is only possible if authorised by a final court decision, as established in art. 223 of the Constitution (Brazil, 1988[4]).3

In addition to this complex procedure, community radio broadcasting must meet requirements for local community coverage. This includes site installation; a board of directors formed by local residents; and use of low power (i.e. not more than 23 watts in the transmission of their programming). They may not insert commercial advertising; licences are valid for ten years.

MCTIC collects a licence fee for commercial broadcasting television, but the methodology for calculating the price was not complete at the time of writing. Anatel collects additional fees for use of spectrum, station licence, installation and operation fees (Chapter 7). The renewal of any type of broadcasting licence is not onerous.

Technical initiatives to improve the broadcasting licensing process to adopt proven automated approaches are currently under consideration or being implemented. Decree No. 9 138 from 2017 reduced the number of documents needed to renew broadcasting licences from 23 to 17. This move is expected to shorten the licensing request period to one year.

Substantial automation of the entire system is envisioned through Mosaico, a unified digital platform to manage spectrum resources developed and managed by Anatel (Anatel, 2020[5]). The intent is to consolidate Anatel data from many different systems and databases (e.g. on grants, coverage and billing) and to make the data accessible to the public. This initiative would benefit from automation processes used for similar projects by OECD countries such as Mexico.

Anatel is laying the foundation to improve spectrum management for broadcasting services, but reforms will require legislative approval. Anatel Resolution No. 721, published on 12 February 2020, has two aims. First, it seeks to modernise the allocation and assignment of radio frequency spectrum bands. Second, it aims to assign channels for radio and television broadcasting services to better accommodate the use of digital technology. These proposed reforms would require revision of legislation for broadcasting and ancillary services.

Brazil has a complex process for granting broadcasting licences compared to other countries. This complexity pertains to separate approvals required, typical time required to obtain a licence and number of applications awaiting processing. In the United Kingdom, for instance, the regulator Ofcom seeks to award licences in 25 days; in Brazil, stakeholders mention decisions that take 8-15 years. Estimates of the waiting lines for broadcasting licence applications vary widely. However, lines can reach more than 5 000 when licences for community broadcasting are excluded. Overall, the backlog of broadcasting licence applications can reach into the tens of thousands, although not all of these are for new licences. Some are requests for renewal, or for increased power.

Licensing of pay TV services

The Brazilian legal framework distinguishes sharply between broadcasting and pay TV. Broadcasting is defined as public and commercial FTA services and radio, while pay TV is defined by the SeAC law (Lei do Serviço de Acesso Condicionado, Law No. 12 485 of 12 September 2011) (Brazil, 2011[6]). In this respect, the definition of broadcasting excludes delivery of content over cable or satellite since consumers must pay for it.

The SeAC law covers paid TV content irrespective of how technology is delivered. It thus includes cable, microwave (i.e. multichannel multipoint distributions service [MMDS], also known as “wireless cable”), and satellite delivery of content. The SeAC law identifies four distinct activities in the value chain: production, programming, packaging and distribution (Box 6.1). These activities are overseen by Anatel and the National Film Agency (Agência Nacional do Cinema, Ancine).

The SeAC licensing process, which lies wholly within Anatel, is becoming more efficient. Anatel previously took about a year to license pay TV services. However, recent improvements, such as use of the Mosaico system, have shortened the process to about six months.

The pay TV licensing process is not particularly cumbersome, but disparities may undermine convergence. A large disparity exists between SeAC licences and those that apply to FTA broadcasters, educational broadcasters and community broadcasters which are not well suited for a convergent environment.

With the enactment of the SeAC law in 2011, all modalities of pay TV services (i.e. cable, satellite, multichannel distribution service, and pay TV services using ultra-high-frequency [UHF] channels) were incorporated within a common pay TV services framework. The law distinguishes among four activities that collectively comprise the value chain:

Production: elaboration, composition, constitution or creation of audio-visual content.

Programming: selecting, organising or formatting audio-visual content presented in the form of programming channels.

Packaging: organising programming channels to be distributed to the subscriber.

Distribution: delivery, transmission, broadcasting, distribution or provision of packages or audio-visual content to subscribers by any electronic means.

Ancine has responsibility for content programming and packaging, while Anatel oversees content distribution.

Legislation that prohibits vertical integration may undermine the move towards convergence. As mentioned in Chapter 2, the SeAC law resulted from the desire of the audio-visual sector for support to produce independent content, among other objectives.

The law also brought vertical ownership restrictions related to telecommunication and pay TV services in Brazil. Namely, Articles 5 and 6 prohibit de facto vertical integration of content distribution (i.e. communication providers) with content producers or programmers. Article 5 stipulates that communication service providers cannot own more than 30% of a content producer or programmer. Article 6 prohibits communication service providers from hiring national artistic talents or licensing events of national interest to produce content.

Vertical integration should be studied on a case-to-case basis. A blanket prohibition may raise competition issues in a convergent environment. The issues related to that ownership restriction, for example, became a critical point in the merger procedure between AT&T and Time Warner (Warner Media) (see subsection on competition).

Efforts are being carried out to simplify regulations concerning pay TV services. Ancine, for example, approved the Instructive Norm No. 153 of 18 March 2020 based on a regulatory impact assessment (Ancine, 2020[7]). This has resulted in the largest reform on pay TV since the SeAC law (Possebon, 2020[8]). The most significant change with respect to compliance revolved around the national content quota. The reform reduced redundancy on requirements from pay TV channels from the same economic group, and increased the validity of the use of the same content for quota purposes to seven years. It also allowed compensation of national quotas from one week to the other. Moreover, as a result of the changes, Ancine also simplified regulations. For example, it revised guidelines on prior disclosure of programming; it reduced reporting requirements from sports and news channels; and it matched advertisement time rules to FTA regulations with the Instructive Norm No. 153 (Ancine, 2020[7]).

Brazil needs a coherent approach to convergence. Anatel and Ancine are both currently investigating, albeit separately, how over-the-top (OTT) services are changing the dynamics of the pay TV market. They are both taking targeted measures and responding to merger cases to help both foreign and national service providers to adapt to a new technological context. However, they are working independently. Brazil needs a coherent institutional and regulatory framework to promote convergence.

Data collection of pay TV and broadcasting services

Greater efforts are needed to collect and analyse data for broadcasting services. Anatel, following its mandate, only collects data on pay TV services. It provides data for subscriptions on pay TV by technology and by state. Some information on concessions and frequencies assigned for broadcasting is also available on Anatel’s data portal.

However, MCTIC is responsible for the collection and publication of FTA broadcasting data. Most pending licensing applications are paper-based and not digitised. Therefore, data from pending applications are still based on estimates. MCTIC does not collect data rigorously or classify them appropriately.

Starting in 2019, MCTIC began introducing business intelligence systems to improve the process of licence applications by broadcasters, as well to streamline its analysis routines. MCTIC is looking into automating the analysis of licence applications. However, substantial efforts are still needed to improve data collection, monitor the quality of service and streamline data governance in the broadcasting sector.

Must-carry rules

“Must-carry” rules apply to the compulsory transmission of certain channels (canais de programação de distribuição obrigatória) by both cable and satellite TV services defined by the SeAC law. Anatel regulates must-carry rules through Resolution No. 581 of 26 March 2012 and its amendments (Anatel, 2012[9]). Must-carry rules establish that pay TV operators must carry at least one channel from recognised national FTA broadcasters unless they can prove technical or economic unviability. As of February 2019, Anatel recognised 16 national footprint FTA broadcasters: Band, Canção Nova, Globo, Ideal TV, TV Aparecida, Record, Record News, Rede Brasil de Televisão, Rede Internacional de Televisão, Rede CNT, Rede RBI, Rede TV!, Rede Vida, SBT, TV Cultura and TVCI) (Anatel, 2019[10]).

Must-carry rules are typically applied according to the transmission technology. This is because cable TV is considered a local service, while satellite TV is considered a service with a national footprint. Satellite TV services are only required to carry one channel for each of the 16 national networks. Networks that cover more than one-third of the population and at least five regions of Brazil are considered to be “national”; as a result, direct-to-home (DTH) satellites are obliged to carry the signal.

There are likewise differences between analogue and digital channels for must-carry. Satellite and cable distribution platforms are obliged to carry analogue channels, but not obliged to pay. For digital channels, they typically negotiate a price. FTA broadcasters may wish not to have their signals carried over, but in Brazil, all main national channels have signed agreements to have pay TV operators distribute their channels. Copyright contracts typically anticipate transmission of content conducive to these agreements.

Must-carry rules also include the transmission of public channels, as established by SeAC, without any type of financial compensation in return:

analogue channels of local broadcasters

channels of the federal legislative powers (TV Senado and TV Câmara) and of municipal and state assemblies

Federal Supreme Court channel (TV Justiça)

Executive power channels (TV Brasil/EBC and NBR)

educational and cultural channels from the federal government (reserved but not implemented)

community channel (reserved for shared use by non-governmental organisations, but not implemented)

citizenship channel (reserved for shared use by the federal, state and municipal governments, but not implemented)

university channel (reserved for shared use by high-level education institutions, but not implemented).

Digital terrestrial television

Brazil began to set standards for digital terrestrial television (DTT) in the 1990s. Working groups were set up by the Ministry of Communications (1991), the Brazilian Association of Radio and Television Broadcasters (Associação Brasileira de Emissoras de Rádio e Televisão, ABERT) and the Brazilian Society of Television Engineering (Sociedade Brasileira de Engenharia de Televisão) (1994).

In 1998, Anatel and the Ministry of Science and Technology joined the process, which resulted in technical support for the Japanese ISDB-T standard. This standard was chosen largely on the basis of the quality of its mobile reception (CNTV, 2018[11]).

In 2003, Presidential Decree No. 4 901 officially established the Brazilian System of Digital Television (Sistema Brasileiro de Televisão Digital, SBTVD). It announced several public objectives for digital television in Brazil (Brazil, 2003[12]):

promoting social inclusion and cultural diversity

creating a universal network for long-distance education

fostering Brazilian technology and the national industry of ICT.

The SBTVD Committee oversaw a series of public events and consultations. Subsequently, Decree No. 5 820 of 2006 (Brazil, 2006[13]) announced that the digital television transition would be achieved by 2013 with the analogue switch-off by 2016. The decree officially adopted the ISDB-Tb standard. This is the ISDB-T with a few modifications enabling interactive middleware applications such as Ginga.4 It also mandated that commercial broadcasters would have 6 MHz for ten years for simultaneous analogue and digital transmissions. Commercial broadcasters had until 2011 to express interest for a “mirror” digital channel (CNTV, 2018[11]).

Despite these plans, the analogue switch-off was delayed. In 2013, the government issued a ministerial ordinance to accelerate the digital TV transition and to release the 700 MHz band for IMT (Ministério das Comunicações, 2013[14]). This was accompanied by Presidential Decree No. 8 061 of 2013 that modified the timeline, establishing the analogue television switch-off between 2015 and 2018 (Brazil, 2013[15]).

From 31 August 2013, only digital broadcasting licences were granted. The plan for television channels was modified, and by the end the 2013, part of the 700 MHz band was auctioned (Chapter 5). Winning bidders had to ensure the successful completion of the digital switchover by carrying out different activities. These ranged from communication campaigns to distribution of digital TV reception set-top boxes for low-income families to ensure that 90% of the affected households could receive digital TV before the analogue switch-off.

Difficulties with the analogue switch-off in Rio Verde city and in the State of Goiás prompted the government to divide its initial plan into two stages. The first phase (2016-18) would perform the switch-off in all the state capitals, metropolitan areas and other areas required to rapidly release the 700 MHz band. The second phase (up to 2023) would perform the switch-off in the remaining regions of the country. The project budget would be primarily used to complete the first phase, including communication campaigns and the distribution of digital TV (DTV) reception set-top boxes to expand coverage.

In the first phase of the switch-off process, 1 379 cities, distributed in 62 different clusters, went through the analogue switch-off. This represented nearly 130 million people (63% of the population). More than 12 million DTV set-top boxes were distributed for low-income families. The second stage of the plan, running from 2019-23, aims to cover the remaining 37% of the population (more than 77 million people), distributed in 4 191 cities.

As in the first phase, individual broadcasters rather than municipalities are implementing the switch-off in the second phase. The cost of set-top boxes has varied given that many parts need to be imported and that technical specifications were reformulated. By the end of the first phase in 2018, unit costs were around USD 45.7 (BRL 167) before distribution expenses. Television transmitters linked to local governments pose a particular challenge as many are still broadcasting in analogue mode.

Going forward, there will be little need for set-top boxes. Since 2012, all flat-panel TVs have been required to have a DTV receiver. By 2023, all TV sets in Brazil will likely have one.

Brazil has fallen short of achieving all of its goals for the digital transition. The country has allocated and assigned the 700 MHz band in a timely fashion and distributed set-top boxes for low-income populations. Despite these successful technical accomplishments, the 2003 objectives for a more inclusive and diverse television ecosystem were not attained. For example, Brazil has not awarded any new commercial broadcasting licences since the digital transition took place, despite the ample availability of spectrum.

The digital transition was a missed opportunity to transform the sector. With all the spectrum available, the DTT transition in Brazil could have been used to reform the broadcasting sector. Specifically, it could have helped reduce market concentration, promote media plurality with the entry of new actors, streamline administration and foster transparency in licensing. Ultimately, however, it served to reproduce the same economic and institutional structures (CNTV, 2018[11]).

Multiprogramming (i.e. the transmission of multiple sub-channels of content within a single 6 MHz digital channel slot) is technically feasible in the Brazilian digital TV system. However, Brazil has only authorised its deployment to four public channels within the federal branch of government. These were explicitly named in the law that implemented digital television to be used for specific public purposes (Brazil, 2006[13]). Specifically, commercial, educational and community broadcasters are not allowed to use multiprogramming.

In the context of the COVID-19 crisis, Brazil has temporarily expanded the scope of multiprogramming. It now enables commercial broadcasters that partner with federal, state or municipal entities to provide content related to education, science, technology, innovation, citizenship and health (Brazil, 2020[16]).

Overall, Brazil has made only limited use of multiprogramming capabilities to date. This must be viewed as an additional missed opportunity of the digital transition. Full exploitation of multiprogramming could potentially enable a huge increase in the number of channels available. This, in turn, could represent a gain both in competition and in media pluralism.

Public service broadcasting

The 1988 Constitution (Article 223) establishes the principle of complementarity between the commercial, public and government broadcasting regimes. This means these three services should co-exist and not substitute each other. However, sectoral laws have not made this principle explicit or explained the difference between public and government broadcasting.

In many OECD countries, public broadcasting may serve as an important complement to the programming, providing content that satisfies interests not otherwise addressed. Where such broadcasters are independent of government, they are called public service broadcasters (PSBs). Typically, PSBs provide educational, children, religious, cultural and minority interest programming, which might not be commercially attractive. At their best, these broadcasters also provide a trusted and quality news service and high-quality universal service content (Mendel and Salomon, 2011[17]).

The primary PSB in Brazil is the Empresa Brasil de Comunicação (EBC). EBC was created by Decree No. 6 246 of 24 October 2007, which was subsequently converted into Law No. 11 652 of 7 April 2008. EBC consolidated and expanded on various institutions that already existed and sought to provide an integrated structure (Box 6.2).

The Brazilian Broadcasting Company (Empresa Brasil de Comunicação, EBC) was created in 2007 by Provisional Measure No. 398 and Decree No. 6 246. EBC inherited the radio and TV channels managed by the State-owned Radiobrás and the Educational Communication Association Roquette-Pinto (Associação de Comunicação Educativa Roquette-Pinto). EBC was in charge of unifying and managing federal public broadcasters, establishing the Public Communication System and articulating a vision for the National Public Communication Network (Rede Nacional de Comunicação Pública, RNPC).

The entity, headquartered in Brasilia, has regional offices in Rio de Janeiro and São Paulo. EBC has a budget of around USD 178 million (BRL 650 million). Of this amount, USD 109 million (BRL 400 million) is used to operate the network. EBC is staffed with 800 journalists, 500 employees in other content activities and 500 technicians. Part of EBC’s budget comes from the Contribution to Foster Public Broadcasting (Contribuição para o Fomento da Radiodifusão Pública, disbursed by the Telecommunication Fund (Fundo de Fiscalização das Telecomunicações) (Chapter 7).

The television broadcasting channels that are part of EBC include TV Brasil and TV Brasil Internacional. In April 2019, the TV NBR channel was shut down and merged under TV Brasil.

The RNPC network has 4 main broadcasting stations and more than 40 partner stations. EBC also provides governmental communication services through TV Brasil (previously TV NBR) group and the radio broadcast programme “A Voz do Brasil”.

Source: EBC (2020[18]), “Sobre a EBC”, http://www.ebc.com.br/institucional/arquivo/sobre-a-ebc (accessed on 10 March 2020).

EBC was created with an intent similar to that of other national public broadcasting systems. Specifically, it sought to strengthen democracy in Brazil by adding another voice to the public discourse. This voice would complement commercial broadcaster content, and be independent of government control.

The resources of the EBC to achieve its goals have always been modest compared to some of the best-known national public broadcasting systems. In 2019, for example, EBC had some 2 000 employees, and a budget of USD 158 million. By comparison, the United Kingdom’s BBC had more than 22 400 employees in 2019, and revenues of USD 6 209 million. In the same year, Canada’s CBC had 7 400 employees and revenues of USD 438 million. The BBC and the CBC have greater resources even though both serve countries with far fewer residents than Brazil.

In 2016, the government implemented changes in the governance structure of EBC by means of Provisional Measure No. 744. It enabled the President to dismiss the Director of EBC, who under previous law could not be removed from office before the expiration of his or her four-year term (Toffoli, 2016[19]). In addition, Provisional Measure No. 744 sought to abolish the Executive Board of the agency. It also abolished the Curator Committee, replacing it with an Editorial and Programming Committee.

The provisional measure was subsequently converted into Law No. 13 417 of 2017 (Brazil, 2017[20]). All of the changes reduced the independence of EBC, placing it directly under the control of the President. Civil society stakeholders, journalists and EBC employees criticised these measures for undermining the editorial autonomy of EBC (Intervozes; Reporters without Borders, 2020[21]) (Herrera, 2019[22]).

In 2019, Decree No. 9 660 attached EBC to the Special Secretary of Communications of the Presidency (Brazil, 2019[23]). In April 2019, a decision from EBC unified the main public channel in the country, TV Brasil, with the government channel TV NBR, rebranded as the new TV Brasil.

The Federal Prosecutor’s Office (Ministério Público Federal, MPF) has questioned the constitutionality of this restructuring. MPF argues it may be a possible infringement of the separation between commercial, public and governmental broadcasting regimes. It has also expressed concerns about the impact of the restructuring on social participation and plurality of views (Ministério Público Federal, 2019[24]).

Decree No. 5 820 of 2006 (Brazil, 2006[13]) established the assignment of broadcasting spectrum, as well as the framework for the transition to digital television. For each digital commercial channel, the firm awarded the concession must be assigned a channel of 6 MHz for digital transmission. This is in addition to any spectrum the firm may have already held for analogue transmission. The decree also obliges MCTIC to ensure that at least four channels of 6 MHz each are available to the federal government in each of the significant municipalities identified in Anatel’s Basic Plan for Digital TV Channels (Plano Básico de Canais de TV Digital, PBTVD). These four channels are intended to transmit i) sessions of the Executive branch; ii) educational programmes for long-distance learning; iii) cultural programmes; and iv) local community programmes (the “citizenship” channels). Out of the four reserved channels, only the Executive branch channel was implemented.5

Additionally, Anatel included in its spectrum planning the digital channels to serve the existing public broadcasting channels of the EBC (Box 6.2), the Chamber of Deputies, the Senate and the Federal Supreme Court (Anatel, 2011[25]).

There are seven public FTA channels with significant national coverage in Brazil (Table 6.1).

In 2009, the government established a plan to deploy a common integrated broadcasting infrastructure to be used by all public channels (including TV Câmara, TV Senado, and the Executive Power channel [currently under EBC]). The other public channels were also to use this same infrastructure.

The integrated public broadcasting provider, which would have been cost-effective for covering rural areas, has been implemented to a limited extent. In 2012, MCTIC authorised the use of multiprogramming for the four digital channels identified in the decree that implemented digital television (Brazil, 2006[13]). The federal entities responsible for those channels are permitted to share them with other federal agencies, and with state and municipal authorities, but only for limited purposes. These include educational, artistic and cultural purposes; dissemination of cultural productions and local or regional programmes; and production of independent content.

In 2015, as part of the effort to foster multiprogramming among public channels, TV Brasil, NBR, TV Escola and Canal Saúde launched a system in Brasilia (RNP, 2015[26]). They planned to make this service available in 460 municipalities by the end of 2019, but implementation appeared to be falling short.

Meanwhile, the Legislative Digital Television Network promotes infrastructure sharing by providers of congressional public channels. It brings together over 60 public broadcasters using the same multiprogramming technology to share sub-channels. This arrangement covers TV Câmara, TV Senado and a range of state and municipal assemblies (Câmara dos Deputados, 2020[27]).

Financial autonomy is a crucial condition for a sustainable public service broadcasting system, but EBC appears to lack stable funding. The public service broadcasting system should not be subject to inappropriate financial or political pressures in its editorial decisions. Predictable funding, independent of the political cycle, is essential to journalistic and programming independence. In the United Kingdom, for example, the BBC is mainly funded by a service fee paid by consumers, which goes directly to the BBC’s budget. In the United States, PBS is supported by cultural grants and donations from viewers and listeners. In Brazil, Law No. 11 652 of 2008 (Brazil, 2008[28]), as amended, provides several sources of funding, including normal budget allocations for EBC. In addition, the amendment to the law obliges telecommunication service providers to contribute funds to EBC. The defined funding sources, however, do not appear to provide EBC with a stable source of funding.

EBC needs stable and sufficient funding, as well as editorial autonomy, to function well. PSBs can play an important role in informing citizens. This is particularly relevant if the objective is to provide verified and reliable content that follows strict journalistic standards. PSBs could potentially serve Brazil well as services are widely available. To function well, however, they need to be independent and well- funded. Some sources indicate EBC has never been resourced at the level needed to fulfil its full potential (Mendel and Salomon, 2011[17]).

Community broadcasting

Community broadcasting refers to broadcasting stations based in civil society that operate for social objectives rather than for profit. These broadcasters have a strong link to a particular community, whether based on geography or an interest (Mendel and Salomon, 2011[17]). Community broadcasting is widely recognised for its important contribution to diversity and pluralism (Mendel and Salomon, 2011[17]). It typically depends on special licensing procedures, reserving spectrum for this purpose and often relying on targeted financial schemes and subsidies.

In Brazil, as in other OECD countries – such as the United Kingdom, Canada and France – community broadcasting is regulated differently than its commercial counterpart. Regulations concerning community radio and community television in Brazil are fragmented and treated within entirely different frameworks.

In Brazil, community radio was created by Law No. 9 612 from 1998 (Brazil, 1998[29]). It is regulated by Decree No. 2 615 of 1998 and Ministerial Ordinance No. 462 of 2011, which establish the criteria for the granting and renewal of community broadcasting licences. These laws prohibit community radio broadcasters from forming any network, which limits considerably how community broadcasters could share infrastructure. This, in turn, limits how they can leverage each other’s resources to reduce costs to each of their respective communities. They may not carry any advertisements and no public funding has been made available for them.

In sum, community radio broadcasters face many hurdles under Brazilian law, despite the known benefits of allowing these broadcasters to service their community for a small fee. For example, they act as local messengers with information about births, marriages, local products (Mendel and Salomon, 2011[17]).

Community television is framed under a family of regulations in Brazil that is distinct from those used for community radio. The existence of community television is foreseen in the legal instruments that have regulated pay TV since 1995. Specifically, as part of their must-carry provisions, broadcasters must create a “basic channel” (canal básico) that contains “community channels for the free and shared use by non-governmental and non-profit organisations” (Brazil, 1995[30]). These provisions were later incorporated into the 2011 SeAC law. Since then, community television in Brazil reaches audiences through must-carry obligations on pay TV service providers, and not through FTA broadcasting. In February 2020, there were 4 607 community FTA broadcasters in Brazil.

The DTT transition in Brazil risks leaving community television behind. Brazil has made advances to provide community television through pay TV technologies, such as cable and satellite TV. TV COM Brasil, for example, brings together 120 community television channels.6 However, little has been done concerning community television through digital broadcasting. The 2006 decree for digital television broadcasting did not reserve any channels for community television in its vision for the DTT transition.

Community and commercial television broadcasters in Brazil compete on the same playing field, but without the same tools. In practice, to access FTA broadcasting frequencies, community and commercial television broadcasters compete for public bids. It is unclear how community broadcasters can do this effectively given legal limitations on their fundraising. Community broadcasters in Brazil are expected to present applications under a complex, inflexible and opaque system. They then wait up to a decade for a broadcasting licence.

The government needs to engage with civil society and relevant stakeholders to develop, implement and monitor public policy for community broadcasting. Brazil could also benefit from studying how other countries in the region have integrated community needs into FTA broadcasting. Uruguay, the Plurinational State of Bolivia, Ecuador, Chile and Argentina provide examples of good practices for recognising and promoting community FTA television, including the reservation of digital channels (CNTV, 2018[11]).

Local content

Brazil has long been concerned about promoting its national and regional culture through its cinema. The 1988 Constitution, for example, emphasises the importance of local content. Article 220 calls for the “promotion of national and regional culture of fostering independent productions aimed at their diffusion, and regional differentiation of cultural, artistic and press production” (Brazil, 1988[4]).7

Over the past decade, Brazil has enacted legislation to strengthen local content in its cinema in response to several setbacks. Embrafilme – the government-owned film producer, distributor and regulatory authority – closed in the 1990s. Coupled with the economic crisis, the loss of Embrafilme resulted in fewer Brazilian films on national screens. In 1993, for example, the Brazilian film industry produced only about 0.6% of all films exhibited in Brazil (Silva and Silva, 2015[31]). These concerns over local content became increasingly prominent around 2009-11. They are notably reflected in laws enacted in 2001, 2006 and 2011 (SeAC).

The situation has improved considerably over the past 20 years, but there is much room to enhance acceptance of Brazilian national productions. It is positive that 81.1% of film launches in Brazil in 2018 were of national productions, but those productions reached only 22.8% of theatre audiences and generated only 19.8% of revenues. In terms of revenues, the five leading studios in Brazil in 2018 were Disney, Warner, Sony, Universal, and Fox (Ancine, 2019[32]).

While FTA and pay TV services are treated differently, successive laws and regulations address the importance of local content consistently. The regulatory framework in Brazil has a sharp dichotomy between FTA broadcasting services and pay TV (including satellite and cable). Despite this split, successive legislative and regulatory instruments have treated local content concerns in a consistent manner. The most notable instruments to foster local content are the following:

an Audio-visual Sectoral Fund (Fundo Setorial do Audiovisual, FSA) to subsidise the production of Brazilian content, together with a fee to support the national film industry (Contribuição para o Desenvolvimento da Indústria Cinematográfica Nacional, CONDECINE)

a minimum number of days per year when Brazilian movie theatres (as a function of the number of screens per theatre) must show Brazilian films, and subject to additional requirements to ensure diversity

package quotas whereby a third of TV channels must show Brazilian content, and a third of these must show independent content of Brazilian origin.

Subsidies and financing mechanisms

Over the past two decades, Brazil has enacted a series of measures to support and stimulate national film production. The country first established subsidies and quotas for national film production in Provisional Measure No. 2 228-1 of 2001 (Brazil, 2001[33]). These arrangements were further refined by Law No. 11 437 of 2006, and again by Law No. 12 485 of 2011 (SeAC).

These same laws created Ancine, which took on the regulatory roles of Embrafilme. Among its responsibilities, Ancine aims “to stimulate the diversification of national cinematographic and video-phonographic production and the strengthening of independent production and regional productions with a view to increasing their offer and constantly improving their quality standards” (Brazil, 2011, p. art. 6[6]).

The above-mentioned laws also created a funding mechanism to support development of the national film industry. Brazil created a fee known as CONDECINE (Contribuição para o Desenvolvimento da Indústria Cinematográfica Nacional) imposed most notably on the “placement, production, licensing and distribution of cinematographic and video-phonographic works for commercial purposes” (Brazil, 2011, p. art. 32[6]). It is imposed by market segment, which is defined to include both broadcasting and pay TV (Brazil, 2011, p. art. 1[6]).

The distribution of CONDECINE funds has evolved since the laws were first enacted. In the 2001 legal text, CONDECINE funds were directed to the general Treasury and then redirected to Ancine to finance the agency. Following the amendments of 2006, the funds were allocated to a new Audio-visual Sectoral Fund (Fundo Setorial do Audiovisual, FSA) within the national culture fund (Fundo Nacional de Cultura) (Brazil, 2011, p. art. 34[6]). However, in some cases, Ancine still collects the funds (Chapter 7). CONDECINE funds are disbursed exclusively for the audio-visual sector through several specific programmes.

The FSA expanded the forms of funding of the audio-visual sector, emphasising investment. It invests in audio-visual content production and participates in its returns. However, if the project does not yield the expected returns, the producer is not indebted to the fund.

Key programmes to support audio-visual content production in Brazil are:

a programme to support film development (Programa de Apoio ao Desenvolvimento do Cinema Brasileiro, PRODECINE)

a programme to support the development of Brazilian audio-visual content, including TV programmes and series (Programa de Apoio ao Desenvolvimento do Audiovisual Brasileiro, PRODAV)

a programme to support the development of cinema and audio-visual infrastructure (Programa de Apoio ao Desenvolvimento da Infraestrutura do Cinema e do Audiovisual, PROINFRA)

financing mechanisms for the cinema industry (Fundo de Financiamento da Indústria Cinematográfica Nacionao, FUNCINE), which serves as additional support schemes with their own financing methods (Brazil, 2011, pp. art. 42-46[6]).

Content quotas

In parallel with subsidies for film, Provisional Measure No. 2 228-1 of 2001 (Brazil, 2001[33]), which is the same law that established Ancine, introduced quotas for national productions. For cinema exposition in theatres (art. 55), the quota is expressed as a number of days per year, as a function of the number of screens provided by the theatre. For domestic video distribution companies (art. 56), quotas for national content are expressed in terms of the channel’s qualified space. Distribution has the same meaning here as in the SeAC law, and thus includes cable, satellite and MMDS. Qualified space is defined in the SeAC law (Brazil, 2011[6]) as the “total space of the programming channel, excluding religious or political content, sports events and events, competitions, advertising, teleshopping, infomercials, electronic games, mandatory political propaganda, audio-visual content broadcast in free voting hours, journalistic content and show host anchoring programs.” For purposes of quotas, however, Ancine Normative Instructions define qualified space as “serial or non-serial audio-visual works of the types fiction, documentary, animation, reality show, video-musical and variety” (Ancine, 2012[34]).

An Ancine Normative Instruction from March 2020 sets current quotas, which are updated annually by decree (Ancine, 2020[7]). Summarising, there are three main quotas established for pay TV channels:

To be classified as a qualified space Brazilian channel under the SeAC law (Brazil, 2011[6]), a distribution channel must provide at least 21 prime-time hours per week of Brazilian audio-visual content (slightly more for a channel for children or adolescents), half of which must be produced by an independent Brazilian producer.

For other channels, a minimum of 3 hours and 30 minutes per week of content aired on prime-time must be Brazilian and must constitute qualified space, and half of these must be by independent Brazilian production companies.

For packages or bundles consisting of multiple channels, Ancine Normative Instructions likewise establish quotas (art. 28) on the mix of channels and the content of each in terms of qualified space, Brazilian content and independent content (UNESCO, 2016[35]; Ancine, 2012[34]).

Media pluralism

Media pluralism is generally viewed in two ways. First, it requires a multiplicity of voices that reflect, for example, differences in geography, ethnicity, religion, political perspective and gender. This is sometimes called the internal aspect of pluralism. Second, it must be possible to hear those voices over a multiplicity of different media. This is sometimes called the external aspect of pluralism. Ensuring that local concerns and preferences are addressed is an important aspect of media pluralism.

Film production in Brazil has increased, but regional and independent content lag behind. Since 2007, Brazil has seen an increase in domestic audio-visual content, including regional and independent productions. This has been driven, among several factors, by market demand, trends in competition among new and existing content distributors, and increased choices for consumers. In addition, subsidies and the financing mechanism and quotas, for example, led to more film production in Brazil during the last decade. Despite ongoing efforts to foster national content, regional and independent content remain insufficient.

For FTA broadcasting, content production remains concentrated in the largest cities in Southeast Brazil (Valente et al., 2009[36]). Namely, these broadcasters are concentrated in Rio de Janeiro (i.e. Globo and TV Brasil) and São Paulo (i.e. SBT, Bandeirantes, Record, RedeTV! and CNT). Valente et al. (2009[36]) found the average FTA broadcasting programming time dedicated to regional content production was only 10.83% (Box 6.3). Another assessment from 2011 identified the insufficient development of Brazilian independent content production (Mendel and Salomon, 2011[17]). The lack of current data on FTA broadcasting is itself a symptom of the fragmented legal and regulatory system in Brazil. Neither Ancine nor Anatel have regulatory responsibility for FTA broadcasters. As a result, there is no systematic gathering of data on market structures, nor developments over time.

In 2009, the Observatório do Direito à Comunicação studies the diversity of content in FTA television in Brazil in terms of the proportion of regional content within FTA programming. In reflecting on these questions, it considered the continental proportions of the country. It concluded that “regionalisation of production emerges as a central issue in order for Brazilians to be able to recognise themselves in this important space of mediation, debate, values and opinions that are the media” (Valente et al., 2009[36]).

The study measured the presence of regionalised programming in broadcast stations in 11 Brazilian capitals: Porto Alegre, Curitiba, Belo Horizonte, Rio de Janeiro, Brasilia, Cuiabá, Salvador, Natal, Recife, Fortaleza and Belém. They measured the percentage of regional production by considering the hours of regional content broadcast per day by each of the 58 broadcasters. These broadcasters represented nearly all of the FTA broadcasting offer in the 11 cities. The study further tabulated results according to the broadcasters’ own list of genres, such as journalism, entertainment, sports, culture and more.

The study found the large majority of programming in Brazil is not dedicated to regional content. Most affiliated regional broadcasters analysed simply tend to reproduce content from the large national networks of broadcasters. Data from this 2009 study indicate that only 10.83% of average programming time was dedicated to regional production.

There were considerable differences between networks and across regions. TV Brasil, the public broadcaster, ranked at the top in terms of percentage of hours of programming with regional content (25.55%). Commercial networks had a distinctly lower fraction of time dedicated to regional programming, with an average of 9.14% (Table 6.2).

The study sheds light on the economies of scale enjoyed by national productions compared to regional productions. Moreover, it indicates that large national networks often limit their affiliates to showing local or regional programming at specified times.

Legislation and other factors have stimulated creation of Brazilian content on pay TV, but it is in decline. Legislative measures for pay TV introduced in 2001, together with sectoral developments, as well as new trends in market demand coupled with emerging forms of competition among new and existing content distributors and programmers, resulted in an increase of local audio-visual content.

The percentage of programming hours dedicated to Brazilian content on pay TV grew from 2015 to 2017. It reached a peak of 17.7% of programming hours in pay TV in 2017, well beyond the established quota. However, the proportion of Brazilian content in pay TV declined in 2018 to 13.8% (Table 6.3). This downward trend is likely to reflect the diminishing subscription base of pay TV services in Brazil (Chapter 3).

New platforms and services

Demand for local and original content has led OTT players to invest in Brazilian productions and expand the Brazilian audio-visual titles included in their libraries, despite the fact that there is no local content quotas applicable for OTT services. Netflix, for example, had ordered the production of 11 original Brazilian titles by 2019. Amazon Prime, which entered the Brazilian market in 2016, ordered its first original Brazilian title in 2019.

More Brazilian series than movies were available online. In terms of local content within OTT audio-visual platforms, Brazilian movies represented about 6.3% of the movies’ library in the seven main OTT platforms. Meanwhile, Brazilian series accounted for 23.1% (Table 6.4). Moreover, the 2017 ICT household survey in Brazil (CGI.br, 2018[40]) shows that Brazilian content tends to play an important role in the audio-visual content consumed online in the country (Figure 6.2).

Media literacy

Media literacy enables people to have the skills and understanding to make full use of the opportunities presented by both traditional and new communications services, while raising awareness of the potential risks associated with using these services (Ofcom, 2020[41]). While media literacy in important in the traditional audio-visual element, it is even more important in a converged and increasingly online environment. In the latter, content diversity and media plurality may take a different shape than when content is transmitted via traditional channels. Online channels may lead to a “hyper-personalisation” of media content.

Therefore, at present, some converged regulators within the OECD, such as Ofcom in the United Kingdom, are looking into the question of preserving the integrity of user choice in an online environment, by increasing media literacy. According to Ofcom, “in an online environment where the possibility for direct content regulation diminishes, the need for a media-literate public increases. Consumers and citizens need to be aware of the risks and opportunities offered across an array of online and mobile service activities, while stakeholders need to understand and monitor to what extent people are aware of changes and developments (Ofcom, 2020[41]).” Looking ahead, an important element for Brazil to consider when designing a new integrated and overarching policy approach to audio-visual content, is how to foster media literacy.

Generally, competition in the communication sector is protected and promoted via ex ante sectoral regulation and ex post antitrust regulation. Ex ante regulatory measures in the communication sector are justified by the existence of market failures that reduce competition. For example, these market failures include network externalities, economies of scale and scope, barriers to entry, existence of essential facilities and switching costs.

Brazil has adopted this style of ex ante and ex post safeguarding of competition. The general antitrust regime is complemented by sectoral regulation. In this regard, the Administrative Council for Economic Defence (Conselho Administrativo de Defesa Econômica, CADE), has independent jurisdiction over competition in the telecommunication sector. Anatel, the telecommunication regulator, has also specific ex ante competition duties in this sector as well.

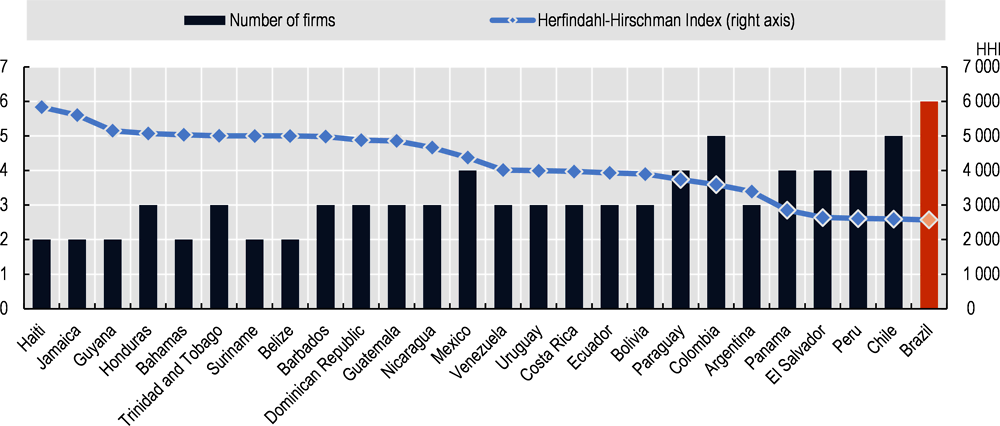

The competitive dynamics of the communication sector in Brazil, at a national level, has been relatively stable over time when measured by market shares. Particularly in the mobile telephony market, the level of concentration, measured by number of operators and the Herfindahl-Hirschman Index (HHI) Index, is lower than other countries in the Latin American region (Figure 6.3).

Despite concentration levels in communication markets, such as in the mobile telephony (Figure 6.3), and the vertical integration among network operators and service providers, competitive challenges arise in the communication sector in relation to access to essential infrastructure and potential anticompetitive conducts tending to foreclose the market. Market conditions vary throughout the country, determined by the circumstances in each municipality. As a result, the intensity of these challenges varies from municipality to municipality.

The roles of BCPS, Anatel and Ancine

CADE is the antitrust authority that monitors, prevents and investigates abuses of economic power. Meanwhile, the Secretariat of Competition Advocacy and Competitiveness (Secretaria de Advocacia da Concorrência e Competitividade, SEAE) advocates for competition on behalf of government agencies and society.

CADE’s responsibilities are related to the control of anticompetitive conduct on a case-by-case basis. For its part, the sectoral regulator Anatel can impose asymmetric regulations on players with significant market power and declare facilities as essential; this is more in line with ex ante regulatory measures.

Both agencies use different instruments to promote and protect competition. On the one hand, Anatel established a regulatory framework based on asymmetric measures to mitigate the possibility of exercising abuse of dominance by an undertaking with significant market power. On the other, CADE can impose appropriate sanctions when an economic agent is found to being engaged in anticompetitive behaviour. It can also review and approve mergers in the communication sector.

CADE does not have a co-operation agreement with Anatel, although the two agencies have co-operated extensively over the years. Eventually, CADE may urge Anatel to provide supporting data and/or analysis on the specificities of the Brazilian communication market. This would inform CADE’s investigations into anticompetitive conduct and mergers. Anatel and CADE co-operation agreements would thus help create common ground in the assessment of competition issues in the communication sector.

For audio-visual services, Ancine and CADE have a formal co-operation agreement. In competition cases, Ancine has exclusive responsibility as an expert for content programming and packaging, while Anatel is responsible for content distribution markets. One of the explicit goals of the SeAC law is the “defence of competition through free, fair and wide competition and the prohibition of monopoly and oligopoly in the activities of audio-visual communication of conditioned access”. However, the role of Ancine in competition cases is not explicit in the SeAC law. Nor does it appear to be explicit in the enabling measure for Ancine (Provisional Measure No. 2 228-1 of 2001). Still, Ancine clearly can and does play a role in mergers, as seen in the AT&T/Time Warner case.

Multiple regulatory agencies have led to diverse regulations depending on the technology, even though their services overlap. The presence of different agencies without authority to resolve conflicts has created challenges. This creates both incoherent regulations and legal uncertainty.

Moreover, under this fragmented scenario, traditional audio-visual services and new digital service providers such as OTTs, face a different regulatory treatment. For instance, new OTT providers do not have vertical integration restrictions such as the one faced by pay TV service providers. Similarly, consumer protection regulation, regulatory fees and tax schemes are generally more stringent on traditional service providers.

Substantive issues

Mergers and acquisitions

The Brazilian Competition Policy System (BCPS) is composed of CADE and SEAE. It prosecutes any act that seeks to, or can, produce anticompetitive effects, even if such effects are not produced. The legal framework is set out mainly in the 2011 competition law (Law No. 12 529 of 2011). The law applies across all economic sectors, including communication.

Active companies in the communication market must request prior authorisation to conduct a merger. They must meet two criteria:8

At least one of the companies involved in the deal belongs to a group that has posted, on the latest balance sheet, an annual gross revenue or total turnover in the country that is equal to or above BRL 750 million (USD 205 million)9 in the year prior to the transaction.

A second agent involved in the deal and belonging to another group has posted, on the last balance sheet, an annual gross revenue or total turnover in the country equal to or above BRL 75 million (USD 20.5 million)10 in the year prior to the transaction.

CADE analyses and approves mergers, consulting as needed with Anatel. CADE has issued different merger guidelines to provide technical background and certainty to its decisions. Additionally, it uses guidelines from the European Commission and the United States Federal Trade Commission (Horizontal Merger Guidelines) to help analyse potential mergers. This implies assessment of potential anticompetitive effects deriving from the merger, as well as potential efficiencies, both dynamic and static (Possas, Ponde and Fagundes, 1997[43]).

Significant market power

Since the liberalisation of the communication sector in Brazil, one of the main objectives of the regulatory framework has been the promotion of competition. For example, the restructuring of Telebrás established some provisions, including ownership restrictions and asymmetric regulation, to outweigh first-mover advantages. Under this scenario, incumbents had more duties than did entrants. These included universal service targets, compliance with a price cap control, stricter fulfilment of non-interruption of the service and accounting separation. Meanwhile, entrants had rights conferred on them that were not shared by the incumbents. For example, entrants could use wireless local loop technology and acquire cable TV companies.

CADE does not conduct regular market analysis of the communication sector to assess whether there is dominance or significant market power of certain players. Such analysis is done on a case-by-case basis. The administrative process may be initiated either ex officio or through a complaint filed by any economic agent. On the basis of periodic studies, Anatel declares the significant market power of certain agents and establishes asymmetric regulatory measures to balance competitive conditions.

Anatel’s adopts regulatory measures to ensure free, ample and fair competition between all providers in the telecommunication sector. These measures are based on the identification of players with significant market power. The methodology for defining ex ante asymmetric regulatory measures is established through the Competition Plan (PGMC), adopted through Resolution No. 600 of 2012, and subsequently amended in 2018. This methodology comprises four steps: i) analysis of retail markets; ii) analysis of wholesale markets; iii) definition of asymmetric regulatory measures; and iv) designation of groups with significant market power. Following this methodology, Anatel analyses whether the agent has significant market power at the retail level. If so, it can impose an asymmetric regulation in the wholesale market upon the agent (Chapter 5).

The amendment to the PGMC offers different approaches to solve competitive issues. First, it classifies geographical areas in four different categories depending on the competition level in each area. Similarly, it adopts regulation according to the companies’ size. On the one hand, this includes the application of specific regulatory measures to companies with significant market power. On the other, it includes the concept of “Prestadores de Pequeno Porte”, small ISP suppliers that hold a maximum participation of 5% in the national retail market (Chapter 3).

Anatel seeks to amplify the deregulation of small ISPs. To that end, it analyses different criteria to determine the significant market power of an economic agent in a defined relevant market. These include holding a market share greater than 20%; the stability of the market share over time; and the difference between the agent’s market share and its competitors, such as the ability to exploit economies of scale in the relevant market.

Similarly, Anatel analyses an ISP’s ability to exploit economies of scope based on the PGMC. It considers two factors in determining the significant market power of an economic agent. First, it looks at control over infrastructure whose duplication is not economically viable (essential facilities). Second, it examines concurrent operations in the wholesale and retail markets (vertical integration) (Anatel, 2018[44]).11

Given current market conditions, the asymmetric regulatory measures imposed on participants with significant market power are related to transparency and price control. Regulatory measures have also focused on the sharing of passive infrastructure (i.e. ditches, ducts, poles) and other network facilities that are bottlenecks for the entrance and growth of communication service providers. Anatel re-evaluates relevant markets, asymmetric regulatory measures and significant market power every four years.

Competition advocacy

The 2011 competition law (Law No. 12 529) that modernised CADE also established SEAE as the governmental unit responsible for competition advocacy. Article 19 obliges SEAE to provide non-binding advice on the following, among others: promotion of competition; proposals for novel or modified normative acts of general interest to economic agents; and, when pertinent, drafts of normative acts submitted to public consultations.

SEAE’s analysis is usually informed by the OECD’s Competition Assessment Toolkit. Since 2011, SEAE has analysed more than 2 100 normative proposals from Anatel, as well as draft bills. SEAE opinions have ranged from issues concerning the mandatory distribution of hybrid set-top boxes in 2016.12 For example, SEAE suggested that DTH companies should not be obliged to supply the hybrid box to receive local open channels. It also suggested a veto to some anticompetitive aspects of the Antennas law in 2015.13

Recent and ongoing cases in telecommunications and adjoining services

After restructuring of the BCPS in 2012 (Law No. 12 529 of 2011), CADE became solely responsible to follow-up, instruct and adjudicate conduct that violates the economic order.

For example, CADE sanctioned Telemar Norte Leste on March 2015 for abuse of its dominant position in the telecommunication industry. The company had controlled more than 90% of the fixed telephony market in the denominated Region I of the General Concession Plan. CADE found that Telemar monitored its customers’ calls to the call centre of its only competitor (Vésper, a “mirror” company of Oi). In this way, Telemar offered its customers’ specific service plans to impede their migration to the competitor.14

In 2013, CADE conditionally approved the acquisition of 50% of Brasilcel (owned by Portugal Telecom and PT Móveis) by Vivo (Merger file No. 53500.02137/2010). The conditions aimed at preventing Vivo from obtaining full control of Brasilcel. This was because Brasilcel was the majority shareholder of Vivo, which held share in Telco (an indirect holder of TIM). Therefore, CADE established that Vivo would either need to sell its shares in Telco, or have a new shareholder with experience in the telecommunications industry and without shares in other communication operators in Brazil.

In a second decision, CADE fined Vivo BRL 15 million (USD 6.9 million)15 for violating their Merger Settlement Agreement (Termo de Compromisso de Desempenho, TCD). This agreement, reached with CADE in 2010, was a condition for approving the 2007 Telco transaction (Merger file No. 53500.012487/2007). At the time, this merger authorised Telco’s participation with 23.7% of the ordinary shares in Telecom Italia (controller of TIM). This approval was based on a TCD that obliged Vivo to keep Telefônica Brasil’s (Vivo) and Telecom Italia’s (TIM) activities separate and independent in Brazil. Besides the fine, CADE imposed the reversal of the increase of Telefônica Brasil’s stake in Telco.16

Regarding zero-rating practices, MPF presented in 2016 a claim against Claro, TIM, Oi and Vivo, which together control almost the entire mobile broadband market. MPF argued these ISPs were restricting competition through their offer of zero-rating deals as they led to a discriminatory treatment. Essentially, the deals offered Internet access plans with privileged conditions for certain content and applications such as Facebook and WhatsApp. After preliminary investigations, however, CADE’s General Superintendence did not find enough evidence that these behaviours could generate anticompetitive effects in the markets to justify a formal proceeding. As a result, the case was closed (Case No. 08700.004314/2016-71) (Kira, 2018[45]).

Recent and ongoing cases in audio-visual and convergent services

FTA services

The 1988 Constitution established that “media cannot be directly or indirectly object of monopoly or oligopoly” (art. 220, paragraph 5), but it seems not to have been well enforced. The only competition case concerning broadcasting relates to sports content. The case, which lasted 13 years, involved TV Globo Ltda., Globo Comunicações and the Brazilian Association of Brazilian football clubs. Since the mid-1980s, Brazil’s leading broadcaster, Globo, has been the sole broadcaster of content from the country’s most important sports organisation, the Brazilian Football League.

In 1997, a legal complaint about the broadcasting rights contract then in effect was brought before the Secretary of Economic Law (Secretaria de Direito Economico, SDE).17 The three main issues were: i) the exclusive purchase of the broadcasting rights of the BFL by the largest FTA TV broadcaster in Brazil, Globo; ii) the joint sale of those rights by the biggest Brazilian football teams, the “Club of 13,” allegedly constituting a cartel; and iii) control by a single player (Globo) of the bundling of rights across all five commercial media formats (i.e. FTA TV, pay TV, pay per view, mobile and Internet).

The SDE investigated and then proposed that CADE create two separate packages for FTA TV broadcasting rights. It also recommended to unbundle the five media formats and sell them separately. However, the SDE found the joint sale of rights by the Club of 13 to be efficient, recommending against any intervention by CADE. In Brazil, football is extremely popular. It has the power to attract and maintain broadcasting audience share not only for football matches, but also across all programming. Therefore, it is a major source of competition among broadcasters. Moreover, Globo held almost half of all audience share and earned about 75% of all advertising revenue in the FTA sector.

The amounts paid by Globo to the participating clubs are indicative of the Brazilian Football League’s importance. In 2005, Globo paid more than 3.5 times the combined total paid for FTA rights to the São Paulo State Championship, the National Football Cup (Copa do Brasil) and the South American Cup.

A preference clause may have helped Globo to remain the lone broadcaster of the Brazilian Football League from 1997 to 2011. Under that clause, rival broadcasters had to submit every bid to Globo. If Globo matched the bid within 30 days, it won the contract. Accordingly, the overarching antitrust issue in the case was whether and to what degree the contract between Globo and the Club of 13 foreclosed competition from rival broadcasters.

In 2010 (13 years after the complaint was filed) CADE settled the case. The settlement involved four components:

Globo unilaterally waived the “preference clause” for renewal of the 2012-14 Brazilian Football League broadcasting contract. The clause was deemed unreasonably costly to competition. Furthermore, the Club of 13 pledged not to reintroduce the preference clause in future contracts.

The Club of 13 undertook to award the broadcasting rights to the Brazilian Football League through an auction with clear and objective rules.

The Club of 13 committed to award separate contracts for the five relevant media platforms to facilitate entry.

The winner of the FTA TV auction would be allowed to sub-license its broadcasting rights, enabling (sub)licencees to exercise the right to choose which games to broadcast.

Nonetheless, the settlement would prove ineffective. Globo and the individual teams simply engaged in bilateral negotiations outside the framework of the Club of 13, thereby circumventing the settlement. Two other broadcasters did express interest after the settlement and submitted offers to individual teams. Ultimately, every club signed with Globo again.

Mattos (2012[46]) concludes the circumvented settlement reflects a shared view among the clubs about Globo. Essentially, it demonstrates that Globo’s offer is well beyond its competitors’ capacities in terms of audience share, quality of the broadcasts and ability to generate advertising revenues.

While that may be true, the key question remains. Did Globo foreclose competition through exclusive dealing arrangements, regardless of whether they are embedded in a single contract with the Club of 13 or in several contracts with individual clubs? The market would be much less competitive if two conditions persist: lengthy contracts that mean rivals rarely have an opportunity to enter; and preference clauses between Globo and individual clubs. The market would be much more competitive if the contracts were relatively short with no preference clauses.

Pay TV

In the pay TV realm, the most recent and relevant competition case involved a merger review related to AT&T’s intended acquisition of Time Warner (Warner Media) in 2016. This proposed merger encountered resistance by a number of authorities in different countries. The proposed entity would control AT&T, HBO, Turner (e.g. TNT, CNN and Cartoon channels) and Sky. Several Brazilian stakeholders raised objections, including broadcasters through their association ABERT. As mandated by the SeAC law, CADE notified both sector regulators, Anatel and Ancine.

The parties involved in the merger argued for the acquisition based on activities of the businesses in the United States. The proposed merger would combine Time Warner’s media content with AT&T’s fixed telephony, mobile telephony, broadband and television businesses in the United States. The parties contended that the merger would hasten AT&T’s ability to develop and distribute the next generation of consumer video services in the United States through multiple platforms. They said that American consumers would benefit from a greater choice of plans and packages (e.g. pay TV, broadband and telephony); more access to content across their devices; and a better alternative to other pay TV companies. Over time, AT&T hopes for opportunities to obtain additional revenues through innovations in new products and services. Overall, AT&T expects the merger would generate USD 1 billion in annual cost synergies in the United States.

The parties also emphasised that FTA broadcasters have 60-70% of the market in Brazil, as well as the relatively low price of service in Brazil. They contended that the monthly price of pay TV services in 2015 was on average less than USD 40. This price was much lower than the approximate prices in Argentina (USD 70), Japan (USD 55) and the United States (USD 50).

The parties added that pay TV operators have progressively faced pressure from OTT providers. They argued that providers such as Netflix and YouTube, for example, have lower operating costs for three reasons. First, they do not have to invest in SeAC infrastructure (cable, satellite, etc.). Second, they are covered by a more favourable tax regime. Third, they are not subject to Ancine’s regulatory obligations (e.g. content quotas). Thus, OTT vendors could freely choose which content they want to make available to users and therefore are in a clear competitive advantage.

As their final argument, the parties described intense competition in the programming and pay TV markets. They further pointed to increasing competitive pressure from direct-to-consumer services via the Internet (e.g. Netflix). As a result, the parties asserted the merger presented no competitive concerns.

Within CADE’s merger review, Ancine’s technical note, however, identified several reports of price discrimination between agents. Ancine and Anatel also observed that, despite the presence of at least five suppliers, two groups control the bulk of the market: in 2018, the Sky group and Claro/Net had joint market shares of 79.1%. Although they bundle other communication services, the large, traditional communication groups had not managed to erode the market position of Sky or Claro/Net.

Ultimately, in October 2018, CADE ruled in favour of allowing the merger without requiring divestiture, but subject to conditions. The following remedies were imposed: i) the companies must continue to operate separately, without exchanging sensitive information; and ii) the merged entity must not discriminate in relation to prices and contract term. The conditions appear to address Ancine’s concerns over possible price discrimination in the licensing of channels and possible limits on access to pay TV packages by competitors.