copy the linklink copied!Netherlands

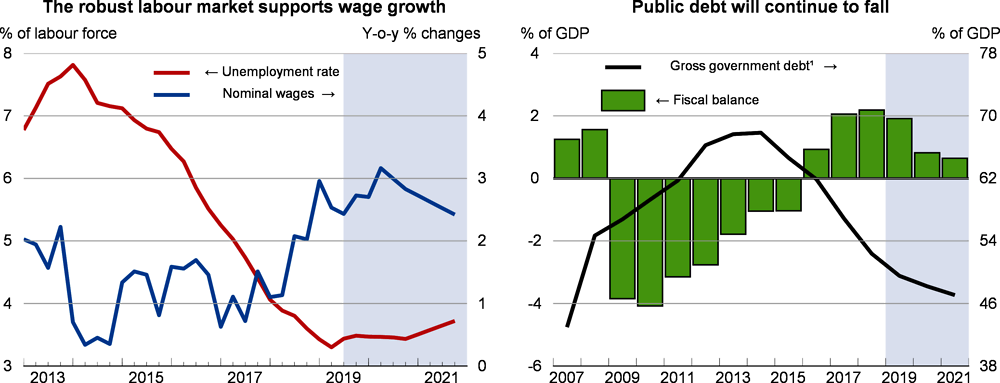

After declining in 2019 due to the slowing of world trade, economic growth in 2020 is projected to be boosted by a significant fiscal stimulus package. The labour market will remain strong, with a low unemployment rate and solid wage growth.

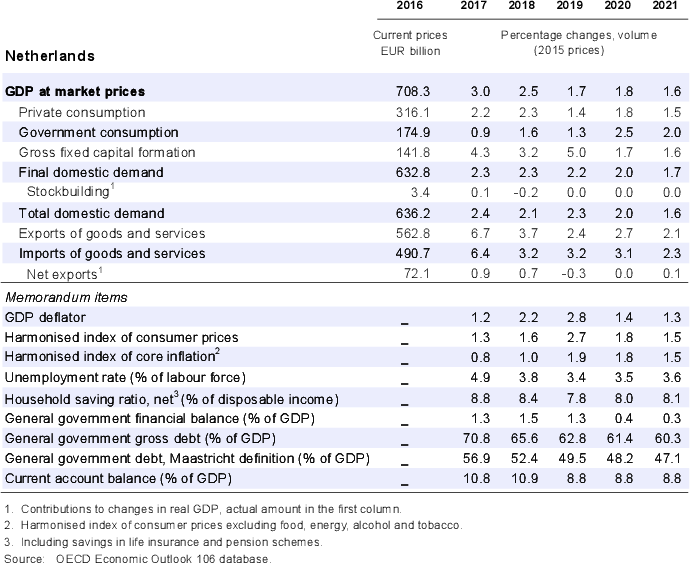

The planned fiscal impulse will slow the decline in public debt as per cent of GDP. There remains fiscal space to intervene should the international environment deteriorate further, particularly in the event of a disruptive Brexit outcome. Reducing the tax wedge between regular employees and self-employment would improve inclusiveness.

Weak external demand is weighing on growth

Weak external demand, especially from Germany, is weighing on export growth and has reduced the current account surplus slightly. By contrast, growth of business investment has picked up. Private consumption has been robust, largely reflecting low unemployment and strong wage growth. Consumer and business confidence, on the other hand, remain subdued. Headline inflation has fallen, as the effects of the past VAT increase have dropped out. A tight housing market has pushed up house prices, and housing construction has slowed.

Fiscal policy will support the economy

Fiscal policy has become supportive. The budget for 2020 includes a reduction in income taxes and an increase in employment tax credits. Additional government spending will be directed to stimulate affordable housing and welfare. The fiscal package is about 1% of GDP and is estimated to increase growth in 2020 by 0.6 percentage point. The fiscal policy stance is appropriate given the economic slowdown, the sound fiscal position, the favourable debt trajectory, and the low cost of government financing. An active fiscal policy will support demand and narrow the current account surplus. Policy should consider additional action in the event of a disruptive Brexit outcome.

With government financing costs near historical lows, an investment fund, as proposed by the government, could help to strengthen the economy’s potential to cope with the forthcoming challenges of digitalisation, climate change and population ageing. Despite recent progress in reducing labour market duality, further reforms, in particular to the tax system and social security contributions, need to put self-employed and regular employees on the same footing.

Weaker trade and Brexit are risks for growth

GDP growth is projected to increase slightly, to 1.8%, in 2020 and then slow to 1.6% in 2021. Demand in 2020 will be mainly supported by private consumption and the strong fiscal stimulus. A sharper-than-expected deceleration in key export markets, including Germany, is a downside risk. The Netherlands remains vulnerable to continued uncertainty around Brexit. Furthermore, high levels of house prices and household debt pose a risk for financial stability. Despite recent measures to reduce household debt, particularly the reduction of the mortgage interest payment tax deductibility, efforts should be continued and financial risks monitored. An upside risk is a stronger-than-anticipated rise in business confidence.

Metadata, Legal and Rights

https://doi.org/10.1787/9b89401b-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.