6. Meat

This chapter describes recent market developments and highlights the medium-term projections for world meat markets for the period 2021-30. Price, production, consumption and trade developments for beef and veal, pigmeat, poultry, and sheepmeat are discussed. The chapter concludes with a discussion of important risks and uncertainties that might affect world meat markets over the next ten marketing years.

International meat prices declined in 2020 due to the impact of COVID-19. Logistical hurdles and reduced food service and household spending temporarily curtailed import demand by some leading importing countries. COVID-19 related market disturbances reduced incomes in net meat-importing, low-income countries, significantly eroding household purchasing power and compelling consumers to substitute the intake of meat products with cheaper alternatives. The fall in international meat prices would have been greater if the People’s Republic of China (hereafter “China”) had not sharply increased its import demand due to the African Swine Fever (ASF) outbreak, which continues to limit local production. Significantly higher feed costs further hampered the profitability of the meat sector at the start of the outlook period.

This year’s edition of the OECD-FAO Agricultural Outlook projects the global meat supply to expand over the projection period, reaching 374 Mt by 2030. Herd and flock expansion, especially in the Americas and China, combined with increased per animal productivity (average slaughter weight, improved breeding, and better feed formulations) will support the meat market. China is projected to account for most of the total increase in meat production, followed by Brazil and the United States. Increase in global meat production is led mainly by growth in poultry production. The increase in pigmeat production will remain limited in the first three years of the Outlook due to the slow recovery from the outbreaks of ASF in China, the Philippines and Viet Nam. The recovery process is assumed to be completed by 2023, especially in China, supported by the rapid development of large scale production facilities that can ensure biosecurity.

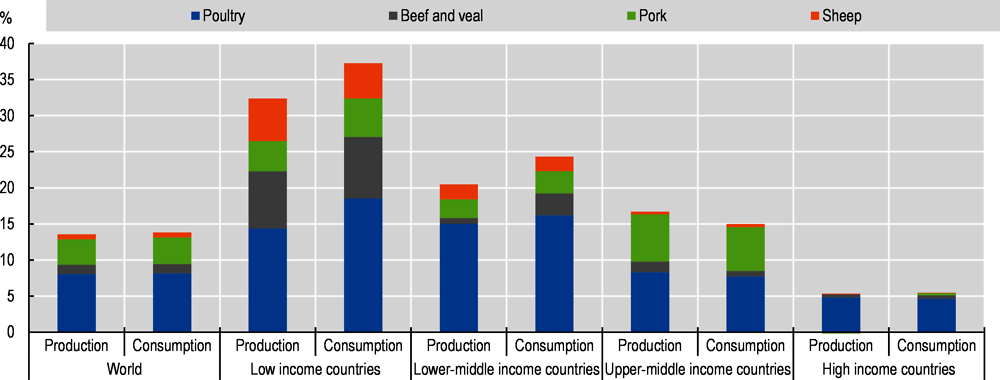

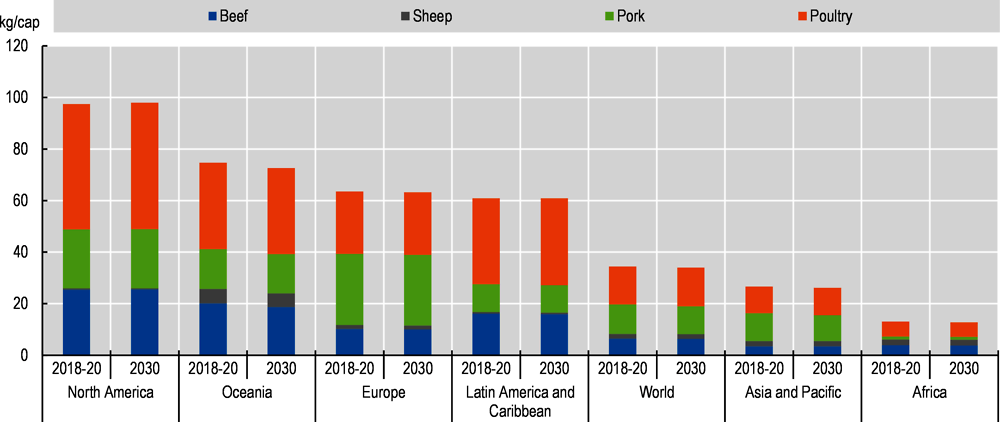

Growth in global consumption of meat proteins over the next decade is projected to increase by 14% by 2030 compared to the base period average of 2018-2020, driven largely by income and population growth. Protein availability from beef, pork, poultry, and sheep meat is projected to grow 5.9%, 13.1%, 17.8% and 15.7% respectively by 2030 (Figure 6.1). In high income countries, however, changes in consumer preferences, ageing, and slower growing populations will lead to a levelling off in per capita meat consumption and a move towards the consumption of higher valued meat cuts.

Meat consumption has been shifting towards poultry. In lower income developing countries this reflects the lower price of poultry as compared to other meats, while in high-income countries this indicates an increased preference for white meats which are more convenient to prepare and perceived as a healthier food choice. Globally, poultry meat is expected to represent 41% of all the protein from meat sources in 2030, an increase of 2 percentage points when compared to the base period. The global shares of other meat products are lower: beef (20%), pigmeat (34%), and sheep meat (5%). Per capita meat consumption in China is projected to return to its longer term trend by 2023, as the ASF impact on domestic pigmeat prices abates. As a result, one-third of the overall increase in meat consumption over the projection period is attributed to pigmeat. China will account for 70% of the increase in pigmeat consumption from the reference period to 2030. In light of these factors, global meat consumption per capita is projected to increase 0.3% p.a. to 35.4 kg in retail weight equivalent (r.w.e.) by 2030. Over one-half of this increase is due to higher per capita consumption of poultry meat.

International meat trade will expand in response to growing demand from countries in Asia and the Near East, where production will remain largely insufficient to meet demand. Import demand in several middle and high income Asian countries has been steadily increasing in recent years due to a shift toward diets that include higher quantities of animal products. International trade agreements have included specific provisions for meat products that improve market access and create trade opportunities.

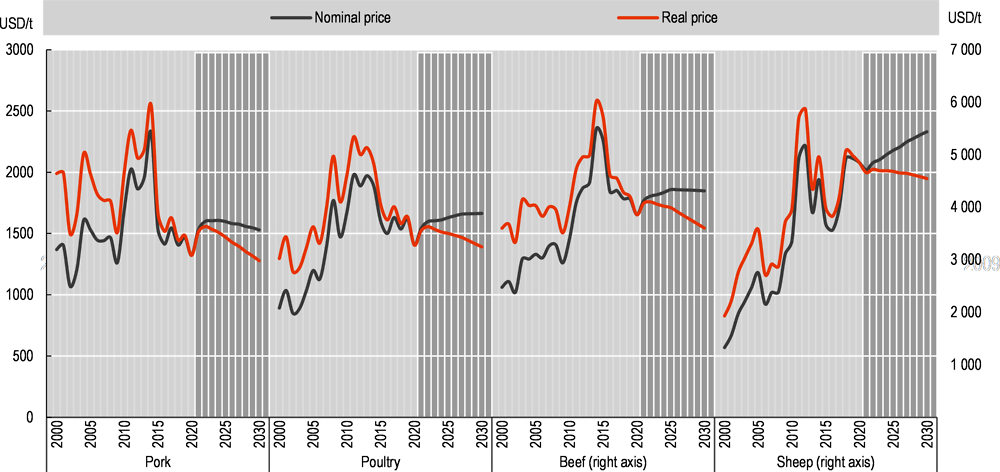

This Outlook projects that nominal meat prices for beef, pork, and poultry will recover in 2021, as demand in high income countries recovers from the COVID-19 pandemic. Further nominal price increases are foreseen, albeit modestly, up to 2025 as income and consumer spending are assumed to recover in other countries, especially in middle-income countries where meat demand is responsive to income. Over the first years of the projection period, supply constraints in several Asian countries, particularly China, will induce higher import demand and lead to higher prices. This is especially relevant for the pigmeat sector, where ASF-related losses have decreased production in Asia.

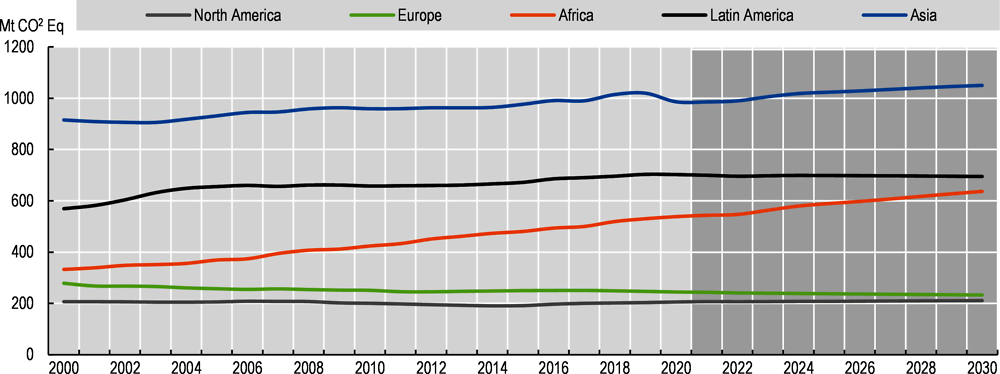

Greenhouse gas emissions (GHG) from meat production comprised about 54% of total emissions from agriculture during the 2018-20 base period (in CO2 eq. basis). The increase of emissions by the meat sector of 5% by 2030 is considerably less than the increase in meat production, due primarily to the increased contribution of poultry production and to projected higher meat output from a given stock of animals. The adoption of new technologies to reduce methane emissions, for example feed supplements that are not widely available today, could further reduce future per unit emissions.

Animal disease outbreaks, sanitary restrictions, and trade policies will affect the evolution and dynamics in world meat markets. The effectiveness of global efforts to prevent and control the spread of ASF will significantly influence the growth in the amount of meat traded internationally. It remains uncertain by how much global import demand will increase to satisfy the ASF-induced meat deficits in affected countries. This is expected to add volatility to meat prices in the early part of the projection period. The modalities of existing or future trade agreements (for example, the African Continental Free Trade Area or the Regional Comprehensive Economic Partnership) will influence the size of trade flows and meat trade patterns over the outlook period, both globally and bilaterally.

The projections assume that the economic impact of the COVID-19 pandemic will be short-lived and mainly affect the meat sector through income effects that reduce demand for higher valued meat products. Some uncertainties remain on the food services sector’s recovery path, which represents a significant part of meat consumption and, in particular, sales of expensive cuts which are not fully replaced by retail sales. These uncertainties may also affect the supply of meat and meat processing, given that health protocols and restrictions in the movement of people have led to several meat processing facilities and slaughterers to lower their operational capacities.

The projections assume that consumer preferences will evolve following historical patterns and that income and prices will shape diets. However, other factors that could influence the meat outlook over the medium term include changing consumer preferences and attitudes towards lower meat protein consumption at a quicker pace than has been observed in the past years. The emergence, albeit from a low base, of alternative protein sources, such as cultured and plant-based substitutes for meat, and automation of the labour intensive processing, packaging (including labelling) and distribution sectors will also influence projections.

International meat prices declined in 2020 due to the impact of COVID-19, which temporarily curtailed meat demand by some leading consuming and importing countries. Logistical hurdles, reduced food service, reduced household spending due to lower incomes all contributed to this reduced demand. The fall in international meat prices would have been larger had there not been a sharp rise in meat imports by China, where ASF continues to limit local production.

World meat production remained stable in 2020 at an estimated 328 Mt, as output increases in poultry and ovine meats offset contractions in pig and bovine meat production. Total poultry meat production in 2020 is estimated at 134 Mt, up 1.2 % from 2019, underpinned by a sharp rise in demand in China.

The on-going outbreak of ASF was the main factor causing reduced pigmeat production in East Asia, especially in China. Bovine meat output also fell in some major producing countries, caused by the limited availability of animals for slaughter (in Australia, New Zealand, and the European Union) and regulations associated with animal welfare, and the purchasing and transport of animals by the processing sector (India).

World meat imports in 2020 are expected to have reached 36.3 MT, growing by 6.3% year-on-year, led mainly by AFS-induced imports by China; excluding China, global meat imports fell by 1.4 Mt, or 4.3%. Leading exporters ‒ including Brazil, Canada, the European Union, the Russian Federation (hereafter “Russia”), and the United States ‒ supplied much of the expanded import demand for meat.

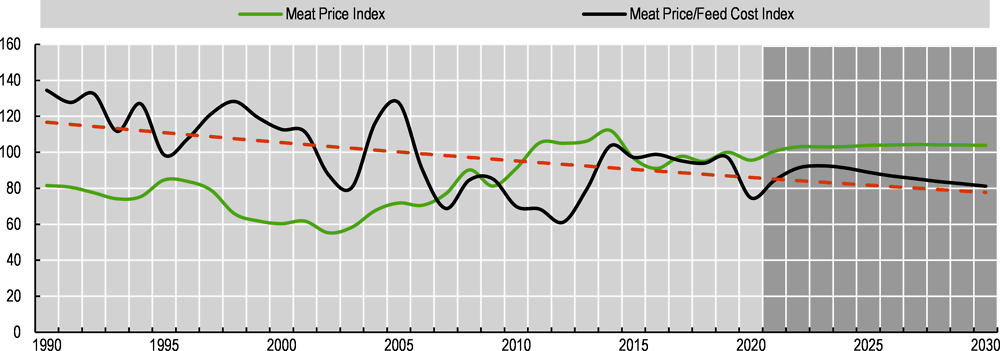

Meat prices are anticipated to rebound from COVID-19 induced lows in 2020, and to rise moderately over the medium term as demand recovers and higher feed costs are passed through; yet, they are expected to remain well below their peaks of ten years ago (Figure 6.2). The projected rise in nominal meat prices is expected for all meats, although each sub-sector has different dynamics given their respective biological supply responses to recent shocks. However, the ratio of nominal meat prices over feed prices is projected to decline, albeit at a slower pace compared to recent years (Figure 6.3). The downward trend in this ratio reflects ongoing feed productivity gains within the sector, whereby less feed is required to produce a unit of meat output. Nevertheless, higher feed costs are further hampering the profitability of meat production at the start of the projection period.

All meat prices are projected to fall from the base period levels of 2018-20, and back to longer term real trends as costs of meat production decline in real terms. The exception is sheep meat, the prices of which have displayed an increasing trend as exports from New Zealand have been constrained in view of the rising opportunity costs of pasture land induced by rising long-term real prices of dairy products. The reference price for pigmeat in heavily traded Pacific markets (represented by the US national base price) will increase early in the projection period to meet robust demand, particularly from China, but will be contained by rising export supplies from Brazil, the European Union, and the United States. Poultry prices (represented by Brazil’s fresh, chilled or frozen export prices) are expected to closely follow grain prices given the high share of feed costs in their production and the swift response of production to global rising demand. Beef prices (represented by US choice steer prices) are projected to increase from cyclically lower base period levels, but to remain constrained as supplies and cattle inventory levels increase in key exporting countries such as Argentina, Australia, and the United States.

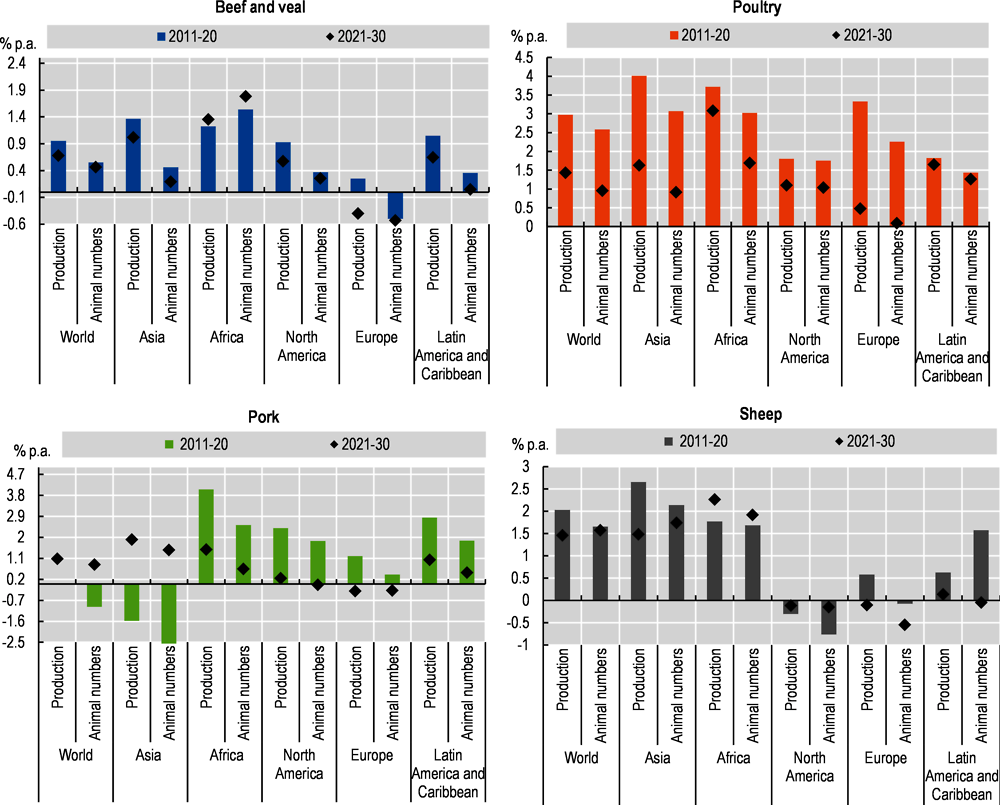

Global meat production is projected to expand by nearly 44 Mt by 2030, reaching 373 Mt on the basis of higher profitability, especially in the first years of the outlook period as meat prices rebound post-COVID-19 (Figure 6.3). Overall, most meat production growth will occur in developing regions, which will account for 84% of the additional output. The market share of the Asia and Pacific regions will return to 41%, after dipping during the ASF crisis, mainly due to developments in China which is the world’s largest meat producer. The production share of the world’s top 5 meat producers ‒ China, the United States, the European Union, Brazil, and Russia ‒ will gradually trend downwards from its current level, illustrating an emerging broader base for global production. Globally, low real interest rates will facilitate livestock expansion, and the increasing size and consolidation of production units towards a more integrated production system, especially in emerging developing countries (Figure 6.4).

Poultry meat will continue to be the primary driver of meat production growth, albeit rising at a slower rate in the projection period relative to the past decade. Favourable meat-to-feed ratios compared to other ruminants, together with its short production cycle, enables producers to respond quickly to market signals while allowing for rapid improvements in genetics, animal health, and feeding practices. Production will expand rapidly from sustained productivity gains in China, Brazil, and the United States, and investments made in the European Union (due to lower production costs in Hungary, Poland and Romania). Rapid expansion is foreseen in Asia as the shift away from pigmeat in the short term will benefit poultry in the medium term.

Pigmeat output is projected to rise to 127 Mt by 2030, up 13% from an ASF-reduced base level in 2018-20201 and benefiting from more favourable meat-to-feed ratios compared to beef meat production. The ASF outbreak across Asia, starting in late 2018, will continue to affect many countries in the early years of the outlook period, with China, the Philippines and Viet Nam suffering the greatest impact. It is projected that ASF outbreaks will continue to keep global pigmeat output below previous peak levels until 2023, after which it is expected to steadily increase over the remainder of the outlook period. This Outlook assumes that pigmeat production in China and Viet Nam will start to increase in 2021 and attain 2017 levels by 2023. Most of the pigmeat production increase in ASF-affected regions will be the result of a shift away from backyard production facilities to commercial production facilities. Pigmeat production in the European Union is projected to decrease slightly as environmental and public concerns are expected to limit its expansion. Russia, the fourth largest pigmeat producer, has almost doubled output in the last decade in response to import bans and domestic policies to restructure and stimulate production. It is projected to expand production by a further 10% by 2030.

Beef production will grow to 75 Mt by 2030, just 5.8% higher than in the base period. Slow growth is attributable to weak beef demand as consumers shift preferences to poultry meat. Sub-Saharan Africa is projected to have the strongest growth rate at 15%, due to high population growth. In the major producing and exporting regions, growth will be more modest. In North America, the largest producing region, beef production is projected to grow 6% by 2030. Production in Europe is projected to fall 5% as inventories of dairy cows, responsible for approximately two-thirds of the beef supply, will decrease following productivity gains in the milk sector. Other factors limiting the growth potential of this sector in the European Union are a reduction in suckler cowherds due to their low profitability, escalating competition in export markets, and declining domestic demand. In Australia, beef supply will remain tight as above average pasture production encouraged farmers to increase their livestock inventories, a significant change from the drought conditions that have prevailed over the past few years. A gradual recovery in production is expected to follow, but herd rebuilding is expected to take several years. In India, beef production is projected to fall by 33% by 2030 due to reforms in animal transportation and collection regulations that affect the welfare of animals; these are assumed to remain in place for the duration of the outlook period. Overall, beef producers have less ability to increase slaughter in the short term but have more flexibility to increase carcass weights, meaning that in the early years of this Outlook beef production will be due to higher efficiency rather than more slaughtered animals, barring any severe droughts.

Growth in sheep meat production will mostly originate in Asia, led by China, Pakistan, and India but significant increases in production are projected to occur in Africa, particularly in the least developed countries of Sub-Saharan Africa. Despite limitations linked to urbanisation, desertification, and the availability of feed in some countries, sheep and goats are well adapted to the region and the extensive production systems it utilises. In Oceania, production growth is expected to increase moderately because of ongoing competition for pastureland from beef and dairy in New Zealand, which is the major exporter, as well as the extreme and prolonged drought in Australia where total sheep numbers fell from 72 to 63 million from 2017 to 2020. Sheep meat production in the European Union is expected to remain stable as it will be sustained by the voluntary coupled support in the main sheep-producing Member States.

The projections assume that situations due to COVID-19 and animal diseases (ASF and Highly Pathogenic Avian Influenza ‒ HPAI) will normalise in the short term, and that no further critical shocks will hit feed grain markets. As a result, meat supply will rise in response to increasing demand over the medium term with further intensification of production and efficiency gains. If the situation evolves differently, these projections will need to be revised accordingly.

6.4.1. Greenhouse gas emissions will increase slowly

It is estimated that humans and the animals raised for food constitute 96% of all mammals on earth, and that poultry represents 70% of all live birds.2 It is projected that stocks of farmed animals for meat will increase during the next decade, rising 11%, 9%, 2% and 18% for poultry, pigs, beef cattle and sheep respectively. These projections imply higher output-to-animal inventory ratios, which while slowing compared to the previous decade, represent continued increases in the productivity of animal stocks over the period, by 6%, 3%, 4% and a 2% respectively. These changes in herd inventories and productivity increases are reflected in the meat sector emissions, which are projected to rise by 5% by 2030. This growth is considerably less than the rise in meat production due primarily to shifts towards poultry production, national low carbon emission initiatives, and increased productivity which yields higher meat output from a given stock of animals. New technologies that reduce methane emissions which are not widely available at present, such as feed supplements and seaweed, could further reduce future per unit emissions. The strongest growth in meat-related greenhouse gas emissions will be in Africa (Figure 6.5). A renewed effort to reduce GHG emissions could include policies such as carbon taxes and specific regulations combined with incentives to adopt technologies and production systems that reduce the sector’s GHG footprint.

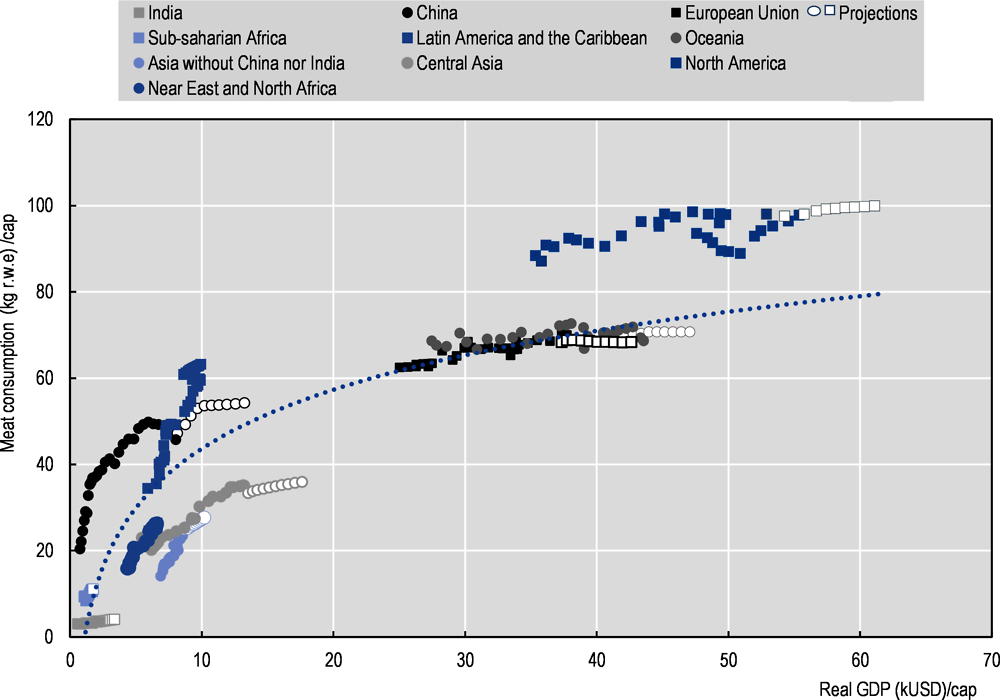

Determinants of meat consumption are complex. Demographics, urbanisation, incomes, prices, tradition, religious beliefs, cultural norms, and environmental, ethical/animal welfare and health concerns are key factors that affect not only the level but also the type of meat consumption. The past several decades have witnessed considerable changes in the impact of each of these factors across a broad array of countries and regions. Population growth is clearly the main driver of increased consumption, and the projected global increase of 11% will underpin a projected increase of 14% in global meat consumption by 2030, compared to the base period of this Outlook (Figure 6.6). It is the main reason why meat consumption is projected to grow by 30% in Africa, 18% in the Asia and Pacific region, and 12% in the Latin American region; the projected increase in meat consumption is 0.4% in Europe and 9% in North America.

Economic growth is another important driver of meat consumption. Income growth enables the purchase of meat, which is typically a more expensive source of calories and proteins. It is also accompanied by other structural changes such as greater urbanisation, higher labour participation, and food service expenditures that encourage higher meat purchases. The response of per capita meat consumption to income increases is demonstrably higher at lower incomes, and less so at higher incomes where consumption is largely saturated and limited by other factors such as environmental, and ethical/animal welfare and health concerns.

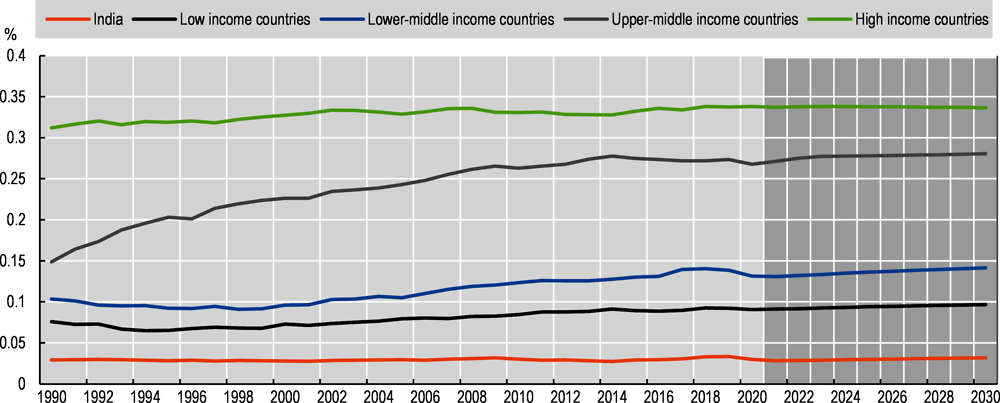

Empirical evidence on consumer behaviour suggests that increases in income stimulate a higher consumption of high value foods such as animal protein compared to other foods such as carbohydrates. In general, the evidence since 1990 suggests that such a shift has been marginal (Figure 6.7). The shares of meat proteins in total protein availability has increased somewhat for upper middle-income countries, but recently less so or not at all for lower middle-income and low-income countries when income increases have not been high enough to stimulate a dietary shift, or in high-income countries where diets remained unchanged. These trends are not anticipated to change much over the next decade. Indeed, it is possible that higher incomes in lower middle-income and low-income countries in particular may induce higher per capita food consumption, but not necessarily a higher share of meats in diets.

A clear trend is the rise of poultry meat consumption in virtually all countries and regions (Figure 6.7). Consumers are attracted to poultry due to lower prices, product consistency and adaptability, and higher protein/lower fat content. Consumption of poultry meat is projected to increase globally to 152 Mt over the projection period, accounting for 52% of the additional meat consumed. On a per capita basis, the expected robust growth rates in poultry consumption reflect the significant role it plays in the national diets of several populous developing countries, including China and India.

Global pigmeat consumption is projected to increase to 127 Mt over the next ten years and to account for 33% of the total increase in meat consumption. On a per capita basis, pigmeat consumption is expected to marginally increase over the outlook period while its consumption declines in most developed countries. In the European Union, for example, it is projected to decline as changes in the composition of the population influence diets that will favour poultry to pigmeat; the former is not only cheaper, but perceived as a healthier food choice. In developing countries, per capita consumption of pigmeat, which is half that in developed countries, is expected to marginally increase over the projection period. Growth rates are sustained in most of Latin America, where per capita pigmeat consumption has grown rapidly, backed by favourable relative prices that have positioned pork as one of the favoured meats, along with poultry to meet rising demand from the middle class. Several Asian countries, which traditionally consume pork, are projected to increase consumption on a per capita basis once the impact of ASF wanes.

Global per capita beef consumption, which has declined since 2007, is projected to fall by a further 5% by 2030. Asia and the Pacific is the only region where per capita beef consumption is projected to increase over the outlook period, albeit from a low base. In China, the world’s second largest consumer of beef in absolute terms, per capita consumption is projected to rise a further 8% by 2030, after having risen 35% in the last decade. But most countries that have high beef per capita consumption will see their level of beef consumption decline in favour of poultry meat. For example, in the Americas, which is where preferences for beef are among the highest in the world, per capita consumption will fall in Argentina (-7%), Brazil (-6%), the United States (-1%), and Canada (-7%). It is also expected to fall significantly in Australia and New Zealand.

Global sheep meat consumption, a niche market in some countries and considered a premium component of diets in many others, is projected to increase to 18 Mt over the outlook period and to account for 6% of the additional meat consumed. Sheep meat consumption worldwide, on a per capita basis, is comparable in both developing and developed countries. In many Near Eastern and North African (NENA) countries, where sheep meat is traditionally consumed, per capita consumption is projected to continue its long-term decline as that for poultry increases. Demand growth in this region is linked to the oil market, which substantially influences the disposable income of the middle class and government spending patterns.

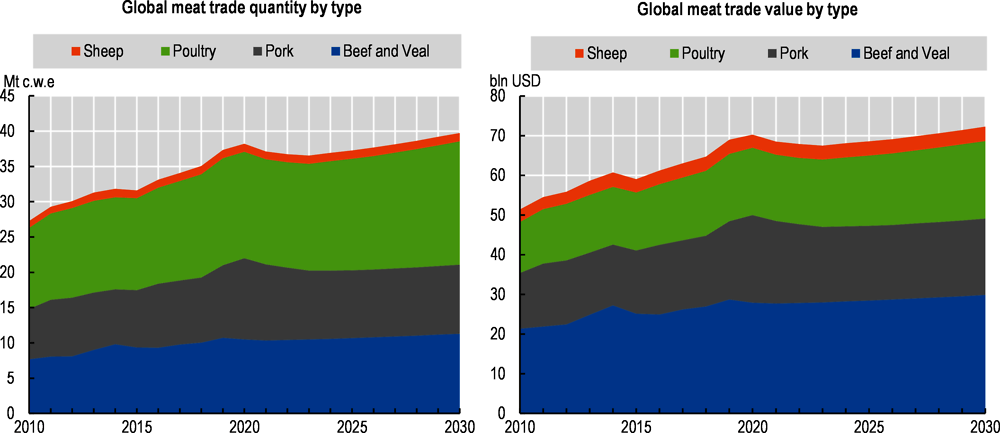

Global meat exports are projected to be 8% higher by 2030 than in the base period, reaching 40 Mt. This may appear to be a considerable slow-down in the growth of meat trade compared to the previous decade, but is largely the result of high pigmeat trade during the ASF crisis in Asia, particularly in China. By 2030, the proportion of meat output traded will be stable at around 11%.

Rising imports over the next decade will be comprised mainly of poultry, the largest contributor, and beef. Together, these two meat types are projected to account for most of the additional meat imports into Asia and Africa where consumption growth will outpace the expansion of domestic production.

Meat exports are concentrated, and the combined share of the three largest meat exporting countries – Brazil, the European Union, and the United States – is projected to remain stable and account for around 60% of global world meat exports over the outlook period. In Latin America, traditional exporting countries are expected to retain a high share of the global meat trade, benefiting from the depreciation of their currencies and surplus feed grain production. Brazil, which is the largest exporter of poultry meat, will become the largest beef exporter with a 22% market share. India’s exports of beef will plummet by 53% to 0.6 Mt by 2030, given the government reforms concerning animal welfare that are assumed to remain in place over the outlook period; exports fell by 14% in 2020, and are expected to fall a further 26% in 2021 (Figure 6.9). Meat trade in value is dominated by beef and veal, but increasingly dominated by poultry in quantity

Import demand is expected to increase the fastest in terms of volume in Africa, 1.4 Mt or 48% from the base period. The Asian region will account for 52% of global trade by 2030. The greatest increases in imports will occur in the Philippines and Viet Nam, the latter for poultry meat. While Chinese meat imports remain high in the early part of the projection period, a gradual decline is projected in the second half of the projection period as pigmeat production recovers from the ASF outbreak. The increased import demand for pigmeat in China is expected to yield high benefits for Brazil, Canada, the European Union, and the United States. In Russia, the long-term effects of the routinely extended 2014 import ban on meat, which this Outlook assumes will be prolonged until the end of 2021, has stimulated domestic production, and meat import levels are expected to continue to decline over the projection period.

Sheep meat exports from Australia and New Zealand have benefitted from the weak NZD and AUD relative to the US dollar, as well as from strong global demand. Shipments to China are projected to remain high as significant growth in Chinese demand for sheep meat is expected for the duration of the ASF outbreak. This contrasts with decreased demand from the United Kingdom and continental Europe in the first half of the outlook period. Imports by the Near East and North Africa region are projected to increase. As a result, Australia is expected to continue to increase its lamb production at the expense of mutton. In New Zealand, export growth is projected to be marginal as land use has shifted from sheep farming to dairy.

Several assumptions drive the results of the analysis of the medium to longer term outlook for meat markets. The first concerns the impact of diseases ‒ human and animal ‒ on meat markets. COVID-19 clearly affected meat markets in 2020 and will have implications for the medium term as the decrease in consumer demand is expected to put downward pressure on agricultural prices and production.3 This Outlook assumes that the impacts of COVID-19 on economic growth and on restrictions in the movement of people and goods will be short-lived and that recovery will start in 2021. However, any prolongation of the pandemic and slower economic recovery may affect supply in terms of logistical issues in processing, transport, and trade. At the same time, the impact of the pandemic on meat demand as countries recover will be important in so far as the extent to which it has affected the restaurant/hotel and tourism sectors.

Animal diseases such as ASF, highly pathogenic avian influenza (HPAI), foot and mouth disease (FMD) always pose significant risks for meat markets. Outbreaks can occur quickly and shock markets, which may take years to recover. This Outlook assumes that recovery from ASF in East Asia will be completed by the end of the projection period, but there is risk that this is not the case or that ASF emerges elsewhere.4 Investments to restructure and modernise production and processing facilities in the pigmeat sector, the successful development of a vaccine, as well as the implementation of recently developed compartmentalisation guidelines from the World Organisation for Animal Health (OIE),5 may have implications for future production and trade. It should be noted that Russia’s investments in its pigmeat sector enabled it to nearly double its output over the last decade.

This Outlook has long held that existing markets for beef and pigmeat are segmented, i.e. into “Pacific” and “Atlantic” markets. Recent evidence suggests this segmentation is less evident as markets have become increasingly integrated over time. For example, price correlations between the two markets have increased in the last decade. The segmentation of markets was originally caused by the division of countries between those free of FMD and those which were not; as such, trade was partitioned accordingly and countries affected by FMD could not trade with countries free of FMD. However, once the World Organisation for Animal Health (OIE) was able to facilitate the zoning of FMD-free areas within countries without resorting to vaccinations, the trade risk of an FMD outbreak was minimised. This allowed other zones of an FMD-affected country to increase trade in response to market signals (international prices) with countries free of FMD6. In time, countries such as Brazil, which was initially pivotal in the “Atlantic” market, were able to develop markets in the “Pacific” zone.

Assumptions regarding productivity improvements and climate change policies will affect Outlook analysis of the meat sectors contribution to climate change. As meat is a significant user of resources ‒ of land, feed and water ‒ lower demand along with productivity improvements imply lower demand for these resources. For example, lower demand and higher productivity for beef implies lower animal inventories and hence fewer feed inputs (meat production in 2018-20 uses around 37% of the calories produced by the crops covered in this Outlook). 7 Lower production would also imply lower GHG emissions from meat production compared to past decades. The role of the meat sector is critical in discussions on climate change, and future policies may have important consequences for production and trade.

Finally, this Outlook assumes that consumer preferences will evolve according to historical patterns. As a result, dietary preferences for lower meat consumption (e.g. vegetarian or vegan diets) or for alternative protein sources (e.g. cultured and plan-based protein substitute for meat) are assumed to expand slowly and to be adopted by a small part of population concentrated mainly in high income countries, and therefore hardly affect meat consumption over the next decade. Nevertheless, while the competition from substitutes will increase, consumer choice will continue to be influenced by the nutritional content in meat as compared to protein substitutes.

Consumers are also expressing concerns about meat production systems, including traceability and the use of antimicrobials in feeds. While the technical benefits of antimicrobial use in animal production are well documented, there is a growing preference for antimicrobial-free meat due to the global risks associated with antimicrobial resistance.8 If antimicrobial-free meat production systems are adopted by an increasing share of producers, this may affect global meat markets, albeit in the longer term. The extent to which consumers are willing to pay a premium for such meat remains unclear.

Nevertheless, as consumer preferences for such diets increase more quickly than in past years, meat demand may contract, reducing in turn meat production and import demand.

Notes

← 1. Unless otherwise specified, % changes refer to the change from the average base period 2018/20 and 2030.

← 2. Dasgupta, P. (2021), The Economics of Biodiversity: The Dasgupta Review, Abridged Version, HM Treasury, London, p.1.

← 3. OECD (2020), "The impact of COVID-19 on agricultural markets and GHG emissions", OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/57e5eb53-en.

← 4. Frezal, C., S. Gay and C. Nenert (2021), "The Impact of the African Swine Fever outbreak in China on global agricultural markets", OECD Food, Agriculture and Fisheries Papers, No. 156, OECD Publishing, Paris, https://doi.org/10.1787/96d0410d-en.

← 5. OIE (2020), Compartmentalization Guidelines: African Swine Fever, Paris.

← 6. Holst, Carsten and von Cramon-Taubadel (2012), "International Synchronisation of the Pork Cycle," Acta Oeconomica et Informatica, Faculty of Economics and Management, Slovak Agricultural University in Nitra (FEM SPU), Vol. 15(1), pp. 1-6, March.

← 7. For more analysis see OECD/FAO (2020), OECD-FAO Agricultural Outlook 2020-2029, OECD Publishing, Paris/FAO, Paris, https://doi.org/10.1787/1112c23b-en.

← 8. Ryan, M. (2019), "Evaluating the economic benefits and costs of antimicrobial use in food-producing animals", OECD Food, Agriculture and Fisheries Papers, No. 132, OECD Publishing, Paris, https://doi.org/10.1787/f859f644-en.