Ireland

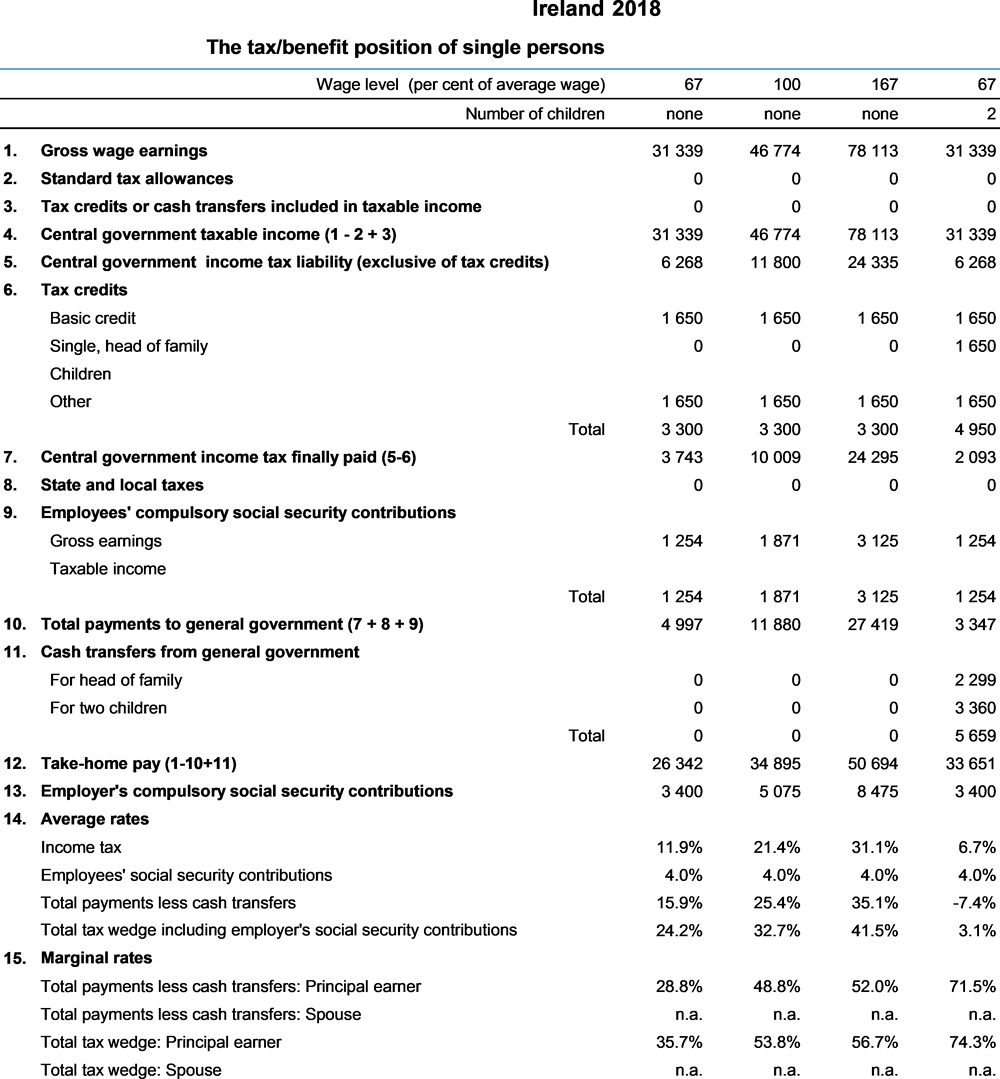

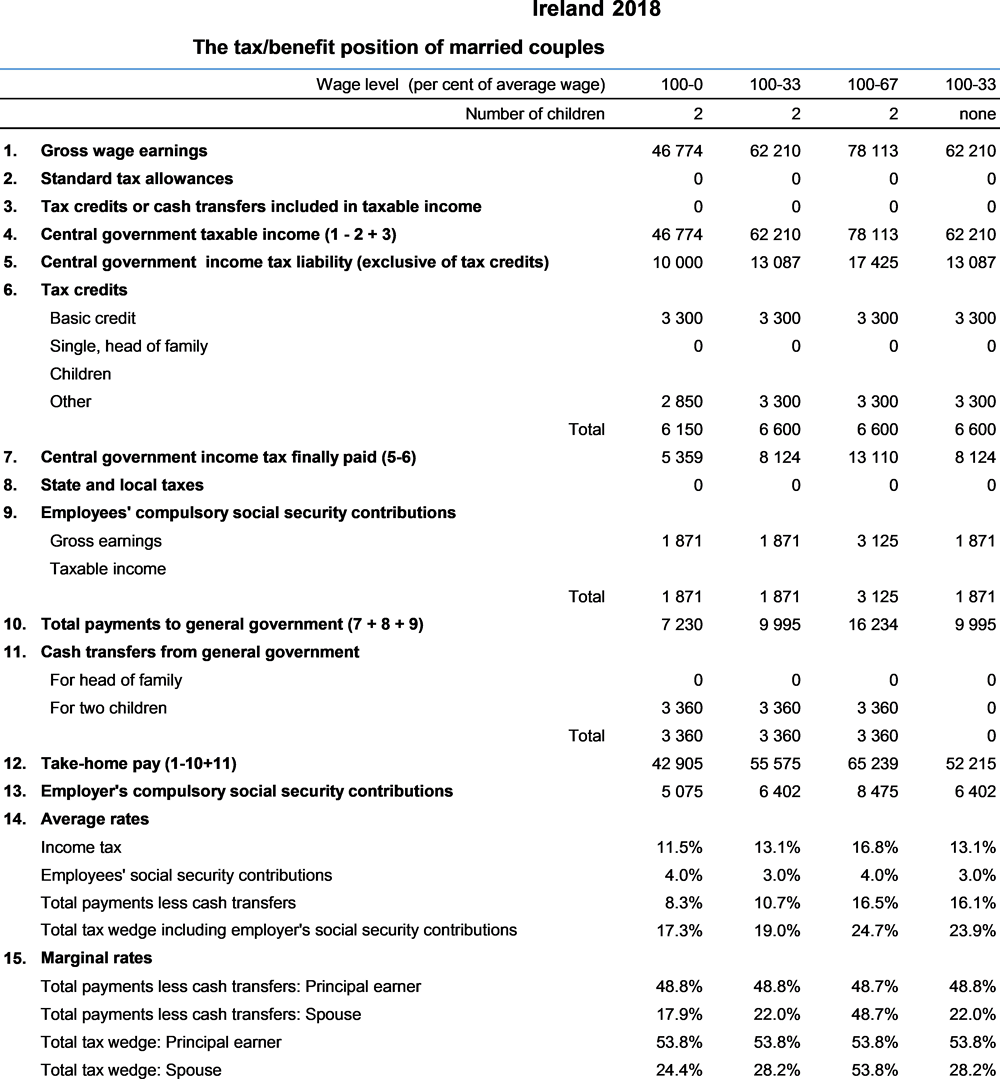

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Euro (EUR). In 2018, EUR 0.85 was equal to USD 1. In that year, the average worker earned EUR 46 774 (Secretariat estimate).

1. Personal income tax systems

1.1. Central/ federal government income taxes

1.1.1. Tax unit

Tax is levied on the combined income of both spouses. Either spouse may, however, opt for separate assessment, in which case the tax payable by both spouses must be the same as would be payable under joint taxation. A further option allows either spouse to opt for assessment as single persons in which case they are treated as separate units. The calculations presented in this Report are based on family taxation.

1.1.2. Tax credits

1.1.2.1. Standard reliefs:

-

Basic reliefs: The single person's credit is EUR 1 650 per year.

-

Standard marital status reliefs: The married person's credit is EUR 3 300 per year (i.e. twice the basic credit of EUR 1 650).

-

Employee credit: With the exception of certain company directors and their spouses and the spouses of partners in partnership cases, all employees, including (subject to certain conditions) children who are full-time employees in the business of their parents, are entitled to an employee credit of EUR 1 650.

-

Earned Income credit: Individuals in receipt of earned income are entitled to an earned income credit of EUR 1150 for 2018et seq. Note: The combined employee credit and earned income credit is limited to EUR 1 650.

-

One-Parent Family credit: The single parent family credit is EUR 1 650.

1.1.2.2. Main non-standard tax reliefs applicable to an AW

-

Interest on qualifying loans: This relief can no longer be claimed by new applicants but those who had claimed prior to 2012 are still eligible for relief up to 2018 inclusive. The relief varies between 25% and 15% of the following limits.

-

Medical Insurance: Relief at the taxpayer’s standard rate of tax is available for taxpayers who make a payment to an authorised insurer under a contract which provides for the payment of medical expenses resulting from sickness of the person, his wife, child or other dependants. The maximum relief is EUR 1 000 in respect of an adult and EUR 500 in respect of a child. This relief is now granted at source and is paid to the insurance provider.

-

Work related Expenses: These are relieved to the extent that they are wholly, exclusively and necessarily incurred in the performance of the duties of an employment.

-

Home Carers Allowance: This is a tax credit of EUR 1200 for families where one spouse works at home to care for children, the aged or incapacitated persons, where the carer spouse’s income does not exceed EUR 7 199. A reduced measure of relief is granted for income between EUR 7 200 and EUR 9 600: if the income exceeds EUR 7 200 the tax credit is reduced by one half of the income of the Home Carer that exceeds this limit. This credit and the increased standard rate tax band for two income couples (see tax schedule below) are mutually exclusive but the person may opt for whichever is the more beneficial. If the Home Carer earns income of up to EUR 7 200 in his/her own right for the tax year, the full tax credit may be claimed. For the purposes of this tax credit, income means any taxable income such as income from a part-time job, dividends, etc. but does not include the Carer’s Allowance payable by the Department of Social Protection.

1.1.3. Tax schedule

1.1.4. Low income exemption and marginal relief tax

Where total income of an individual aged 65 and over is less than or equal to the income exemption limit that income is exempt from tax.

Exemption limits:

-

Single / Widowed: EUR 18 000

-

Married: EUR 36 000

The exemption limits may be increased in respect of children, as follows:

-

One or two children (each): EUR 575

-

Subsequent children: EUR 830

The marginal relief rate of tax applies where liability to tax at the marginal relief rate is less than that which would be chargeable under the normal tax schedule and where total income is less than twice the relevant exemption limit, otherwise tax is charged under the normal tax schedule.

Marginal relief tax is charged, where applicable, at a rate of 40% on the difference between total income and the relevant exemption limit.

1.1.5. Universal Social Charge (USC)

The USC is charged on an individualised basis on gross income at 0.5% on income up to and including EUR 12 012, at 2% for income in excess of EUR 12 012 but not greater than EUR 19 372, at 4.75% for income in excess of EUR 19 372 but not greater than EUR 70 044, and at 8% above that level. The lower exemption threshold is EUR 13 000.The USC does not apply to social welfare payments, including contributory and non-contributory social welfare State pensions.

USC rates for individuals whose total income does not exceed EUR 60 000 and who are (a) aged 70 years and over or (b) who hold FULL medical cards: The 2% rate applies to all income over EUR 12 012.

There is a surcharge of 3% on individuals who have income from self-employment that exceeds EUR 100 000 in a year.

1.2. State and local income taxes

No State or local income taxes exist in Ireland.

2. Compulsory Social Security Contributions to Schemes Operated within the Government Sector.

2.1. Employees' contributions

Contributions are payable at a rate of 4 percent of an employee's gross earnings less allowable superannuation contributions. No distinction is made by marital status or sex. Those earning less than EUR 352 per week are exempt. The following is a breakdown of the 2018 rate of contribution together with ceilings where applicable:

2.2. Employers' contributions

Like employees' contributions, employers' contributions are payable as a percentage of gross employee earnings less allowable superannuation contributions. The following is a breakdown of the 2018 rate of contribution:

The employers' contribution is reduced from 10.85% to 8.6% in respect of employees earning less than EUR 376 per week. 0.1% increase in National Training Levy from 1 January 2018 included in Employer PRSI for Class A and Class H employments

3. Universal Cash Transfers

3.1. Transfers related to marital status

None.

3.2. Transfers for dependent children

These are payable to all children under the age of 16 (or under 18 years, if the child is undergoing full time education by day or is incapacitated and likely to remain so for a prolonged period). These payments do not depend on any insurance or on the means of the claimant. Entitlements to higher rate for the third and subsequent child are being phased out over two years. The amounts payable in 2018 are as follows:

3.3. Transfers for low income families

A non-taxable family income supplement is payable to low income families where either the principal earner and/or the spouse are in full-time employment. Full-time employment is defined as working nineteen hours per week or more. The hours worked by the principal and the spouse can be aggregated for the purposes of this definition. When calculating income for the purposes of the relief superannuation payments, social welfare payments, tax payments, health and employment and training levies are all subtracted to arrive at disposable income.

The level of payment is dependent on the amount of family income and the number of children. The supplement payable is 60% of the difference between the family income and the income limit applicable to the family. A minimum of EUR 20 per week is payable to eligible families. No supplement is payable to families with income in excess of the relevant income limit.

The income limit for a family with two children in 2018 is EUR 612 per week.

One Parent Family Payment: This payment is available for men and women who for a variety of reasons are bringing up a child or children without the support of a partner. The payment which is means tested is payable in full where the person’s earnings does not exceed EUR 110.00 per week (EUR 130.00 per week from 29 March 2018). Where earnings are between EUR 110.00 per week (EUR 130.00 per week from 29 March 2018) and EUR 425.00 per week a reduced payment is received. The amount of the full payment for 2018 is EUR 193.00 per week (EUR 198.00 per week from 29 March 2018) plus EUR 29.80 per week (EUR 31.80 per week from 29 March 2018) for each child.

4. Other Main Changes in Tax/Benefit System Since 2016

4.1. Earned Income credit

Individuals in receipt of earned income are entitled to an earned income credit of EUR 1150 for 2018 et seq. Note: The combined employee credit and earned income credit is limited to EUR 1 650.

5. Memorandum Items

5.1. Employer contributions to private social security arrangements

Information not available, although such schemes do exist.

2018 Tax equations

The equations for the Irish system in 2018 are mostly on a family basis using mainly a tax credit system for the first time. But social security contributions are calculated separately for each spouse. This is shown by the Range indicator in the table below.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.