2. Value-added taxes - Main features and implementation issues

Although most VAT systems are built on the same core VAT principles (see Chapter 1), there is considerable diversity in the design of VAT systems in OECD countries. This is notably illustrated by the variety of reduced rates, exemptions and other preferential treatments and special regimes that are widely used in OECD countries, for practical or historical reasons, to support certain economic sector or to achieve equity or social objectives.

This chapter presents an overview of the VAT rate structures in OECD countries and their evolution between 1975 and 2020 (Section 2.2) and looks in some detail at the VAT exemptions that exist in these countries (Section 2.3). This is followed by an overview and analysis of the wide variety of special regimes used in OECD countries on the following aspects: specific restrictions to the right to deduct VAT on specific inputs (Section 2.4), registration and collection thresholds (Section 2.5), and the application of margin schemes (Section 2.6). It also presents the VAT Revenue Ratio as an indicator of the revenue effect of VAT exemptions, reduced rates and non-compliance (Section 2.7) and the measures taken by governments to combat VAT fraud and avoidance (Section 2.8).

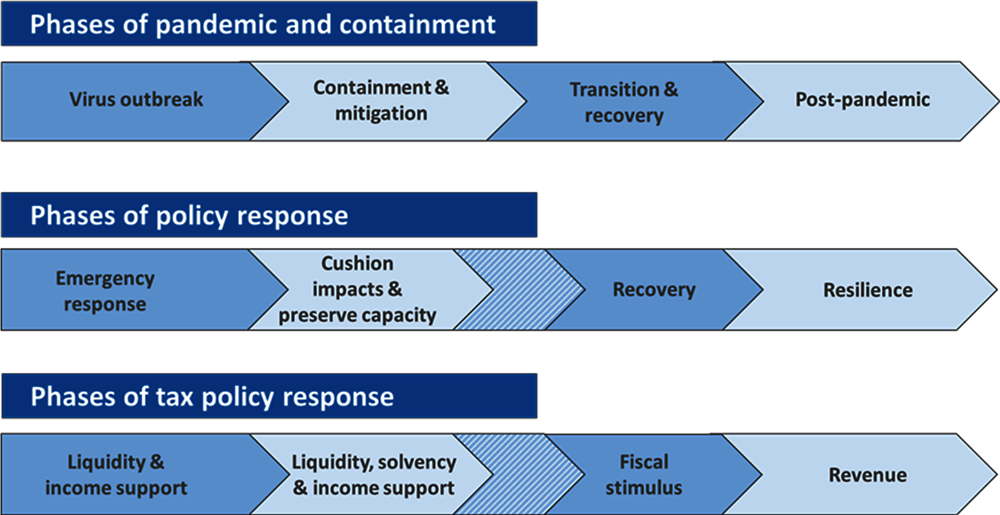

This Chapter concludes with a special section on the VAT policy and administration measures introduced by OECD countries as part their fiscal and tax policy responses to the COVID-19 outbreak. These VAT measures have been particularly important in supporting business cash flow and in alleviating tax compliance burdens for businesses given the restrictions in place in many countries. Most OECD countries have also taken VAT measures to facilitate emergency medical responses and to support the healthcare sector. These measures are discussed in further detail in the special section on COVID-19 VAT measures below. In addition, a comprehensive overview of temporary change to VAT rates implemented by countries in this context is included in Section 2.2 and country notes to Annex Table 2.A.2 below.

2.2.1. Standard VAT rates have remained stable in recent years

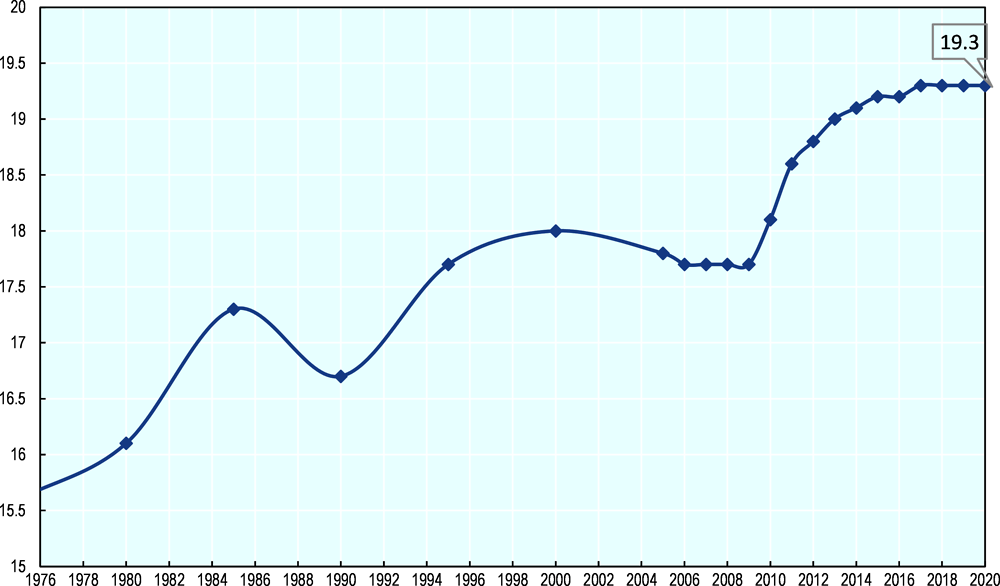

The evolution of VAT rates in the OECD can be divided into five periods. The first period between 1975 and 2000 has seen a progressive increase in the average standard VAT rates from 15.6% in 1975 to 18.1% in 2000.

During a second period, between 2000 and 2009, the standard rate of VAT remained stable in most countries, with 26 out of 36 countries maintaining a rate between 15% and 22%. As of 1 January 2009, only four countries had a standard rate above 22% (Denmark, Iceland, Norway and Sweden –see Annex Table 2.A.1).

The third period, between 2009 and 2014, was marked by a considerable increase in the standard VAT rate in many countries, often in response to financial consolidation pressures caused by the economic and financial crisis. VAT standard rate increases have played a key role in many countries' consolidation strategies, since raising additional revenue from VAT rather than from other taxes (such as income taxes) is often considered more effective (it generates immediate additional revenue) and less detrimental to economic growth and competitiveness than income taxes (Jens Matthias Arnold, 2011[1]). Between January 2009 and December 2014, 23 OECD countries raised their standard VAT rate at least once. These changes occurred principally in European Union (EU) countries (Czech Republic, Estonia, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, the Netherlands, Poland, Portugal, Slovak Republic, Slovenia, Spain and United Kingdom) but also in a number of non-EU countries (Iceland, Israel, Japan, Mexico, New Zealand, and Switzerland). Two OECD countries lowered their standard VAT rate temporarily and then raised it again during this period (Ireland and the United Kingdom). This evolution resulted in a hike of the unweighted OECD average standard VAT rate from 17.7% in January 2009 to an all-time record level of 19.2% on 1 January 2015. Ten OECD countries operated a standard VAT rate above 22% on 1 January 2015 against only four in 2009. All these countries belong to the European Union, except Iceland and Norway.

The increases in standard VAT rates observed until the end of 2014 have not continued and OECD countries have entered a new period of relatively stable standard VAT rates. Only four OECD countries have increased their standard VAT rate between January 2015 and January 2020, i.e. Colombia (from 16% to 19%), Greece (from 23% to 24%), Japan (from 8% to 10%) and Luxemburg (from 15% to 17%). During the same period, two OECD countries have reduced their standard VAT rate, i.e. Iceland (from 25.5% to 24%) and Israel (from 18% to 17%). As a result of these changes in various directions, the increase in the unweighted OECD average standard VAT has remained limited, from 19.2% in 2015 to 19.3% in 2020 (see Figure 2.1).

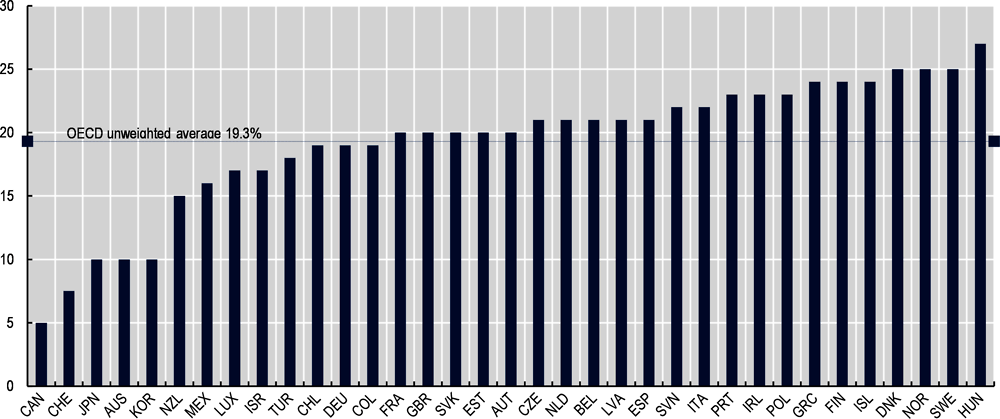

Major differences in standard VAT rates can be observed among OECD countries, with rates ranging from 5% in Canada (note, however, that most Canadian provinces levy specific sales taxes or Harmonised Sales Taxes alongside the Federal 5% GST), 7.7% in Switzerland and 10% in Australia, Japan and Korea to 25% in Denmark, Norway and Sweden and 27% in Hungary (see Figure 2.2). On 1 January 2020, 23 OECD countries operated a standard VAT rate of 20% or more, with 9 of these countries having a standard VAT rate of 23% or more. All these countries are EU Member States, except for Norway (with a 25% VAT standard rate).

The average standard VAT rate of the 23 OECD countries that are members of the EU (including the UK until 1 February 2020) is at 21.8%, which is significantly above the OECD average (19.3%). EU Member States are bound by common rules regarding VAT rates (VAT Directive 2006/112/EC), which set the minimum level of the standard VAT rate at 15%.

2.2.2. OECD countries continue to apply a wide variety of reduced rates

Most OECD countries continue to apply a wide variety of reduced VAT rates and exemptions (see Annex Table 2.A.2 and Annex Table 2.A.3). With the exception of Chile, all OECD countries that have a VAT apply one or more reduced rates to support various policy objectives. A major reason for the application of reduced rates is the promotion of equity. Countries generally consider it desirable to alleviate the VAT burden on necessity goods and services (e.g. food, water), which typically form a larger share of expenditure of lower income households by taxing them at a preferential VAT rate. Most countries also apply reduced VAT rates or exemptions to medicine, health, education and housing. Reduced VAT rates have also been used to stimulate the consumption of “merit goods” (such as cultural products) or promoting locally supplied labour-intensive activities (e.g. tourism) and addressing environmental externalities.

Evidence suggests that exemptions and reduced VAT rates are not an effective way of achieving such objectives (OECD/KIPF, 2014[2]) and can be even regressive in some instances. Other measures, such as providing targeted through the income tax and/or the social transfer and benefit system, tend to be more effective in addressing equity concerns and to pursue policy objectives other than raising tax revenues (Thomas, 2020[3]). Reduced VAT rates that are targeted at supporting lower-income households (i.e. to address distributional goals) typically do have the desired progressive effect. Notably reduced rates for basic food generally provide greater support to the poor than to the rich as a proportion of household income and as a proportion of expenditure. However, despite their progressive effect, research led notably by the OECD has shown that these reduced VAT rates remain a very poor distributive tool. This is because better-off households tend to benefit more in absolute terms from VAT reduced rates than low-income households. As richer households tend to consume more, and more expensive products than poorer households, their consumption of the tax-favoured goods and services is generally greater than that of poorer households. Research has also demonstrated that preferential VAT rates to stimulate employment (e.g. in the tourism or hospitality sectors), or to support cultural activities (e.g. theatre) or pursue other non-distributional goals, clearly benefit richer households more than lower-income categories of the population, and often considerably so.

Preferential VAT regimes such as reduced rates and exemptions (see Section 2.3) also tend to considerably add to the complexity of the VAT system, increase the compliance burden for businesses and negatively impact on compliance levels (C. Evans; R. Highfield; B. Tran-Nam; M. Walpole, 2020[4]). A more effective policy to achieve distributional objectives is generally to reduce the scope for reduced VAT rates where possible and use measures that are directly targeted at increasing the real incomes of poorer households and public services for these households. It is recognised, however, that although this analysis is widely shared, it is often difficult if not impossible to implement it in practice. The political economy obstacles to broadening the VAT base (in particular their perceived distributional impact) can indeed be formidable, and often insurmountable, particularly where the social transfer and benefit system may not be sufficiently effective to ensure that poorer households are properly compensated for the impact of a VAT increase on the cost of their consumption basket.

EU Member States are bound by common rules regarding the operation of reduced VAT rates (VAT Directive 2006/112/EC). This common framework allows Member States to apply one or two reduced rates of not less than 5% to a restricted list of goods and services set out the VAT Directive. Some EU countries are allowed to apply special VAT rates below the standard rate of not less than 12% for goods not in the list of possible reduced rates (a “parking rate”) and super-reduced rates below 5% on certain supplies. For the time being, over 40 different standard and reduced VAT rates are being applied in the EU, often based on specific derogations granted to individual Member States.

Between 2018 and 2020, a number of countries have expanded the application of their reduced VAT rates. Greece reclassified a number of basic foodstuffs to include them in the scope of its 13% reduced VAT rate. The scope of this 13% VAT rate was also extended to restaurants and hotels, to infant food and other baby products, such as diapers and car seats, and to bicycle helmets. Greece also reduced its VAT rate for the supply of electricity and domestic gas from 13% to 6%. Spain expanded the application of its super reduced VAT rate of 4% to a wider range of bread products. The Slovak Republic extended the list of food items, including fruit and vegetables, which are subject to the 10% reduced VAT rate. Poland introduced an updated and simplified VAT rate structure along with the possibility for businesses to acquire certainty on the applicable VAT rate through a binding decision (WIS). Italy, Belgium, Germany and Iceland reduced their VAT rates for feminine hygiene products from 22% to 5%, from 21% to 6%, from 19% to 7% and from 24% to 11% respectively. The UK announced that it will apply a zero-rate to feminine hygiene products as of 1 January 2021. Germany extended the application of its 7% reduced rate to long-distance rail travel as part of environmental policy measures. Sweden made its 6% reduced rate applicable to the exploitation of natural areas outside urban areas, national parks, nature reserves and national city parks. Some countries have expanded the scope of their reduced VAT rates to support specific economic sectors. Hungary and the Slovak Republic reduced their VAT rate on accommodation services from 18% to 5% and from 20% to 10% respectively. The Czech Republic lowered its VAT rate on hairdressing and clothing repair services to 10%. Portugal extended the application of its reduced VAT rate of 6% to domestic assistance services by telephone to the elderly and chronic patients, as well as to admissions to cultural exhibitions, zoos, parks, aquariums, botanic gardens, museums and buildings of national interest. Slovenia introduced a new reduced VAT rate of 5% for printed and electronic publications (incl. e-books). A number of EU countries have reduced their VAT rates on electronic publications following an EU Council agreement in 2018 that EU Member States are allowed to apply reduced rates on these publications (e.g. e-books and e-newspapers) thereby aligning EU VAT rules for electronic and physical publications. Reduced rates now apply to e-books and e-publications in 16 of the 36 OECD countries that have a VAT – these are all EU Member States, except Norway.

Japan has moved from a single VAT rate to a dual rate system, by introducing a new reduced rate of 8% on a number of food and beverage items, when it increased its standard rate from 8% to 10%. Chile is now the only OECD country with one single VAT rate.

Given the political difficulty to significantly reduce the scope of reduced rates (and exemptions) and the limited scope for increasing standard VAT rates, which are already at a relatively high level in many cases, countries are increasingly looking at other measures to raise additional VAT revenue and improve the efficiency of their VAT systems (OECD, 2018[5]). These measures mainly include the collection of VAT on the supplies of goods and services from online sales (see Chapter 1) and measures designed to improve compliance and combat fraud (see Section 2.8).

2.2.3. Temporary VAT rate reductions have been introduced in response to the COVID-19 crisis

Several OECD countries have included temporary VAT rate reductions, including zero rates, in their tax responses to the COVID-outbreak. Most of these measures have been aimed at supporting the healthcare sector. Some countries have introduced temporary rate reductions to stimulate consumption and/or to support specific economic sectors that have been hardest hit by the COVID-19 crisis (e.g. tourism, hospitality). A comprehensive overview and description of these VAT rate reductions in OECD countries is included in the Country notes to Annex Table 2.A.2 (in italics).

Most OECD countries have introduced zero rates or reduced rates for supplies and imports of medical equipment and sanitary products (gloves, masks, hand sanitiser…) and for healthcare services where these were not yet VAT exempt or subject to reduced rates under normal rules. The European Union introduced a six-month suspension of VAT and customs duties on protective equipment, testing kits and medical equipment such as ventilators. The European Commission published an indicative list of goods potentially covered by this relief but leaves it to the discretion of Member States to decide according to their particular national needs. This relief applies to goods imported by or on behalf of state organisations or charitable or philanthropic organisations approved by the competent authorities of the Member States. The initial measure applied for a period of six months and was further extended until the end of April 2021.

A number of OECD countries apply temporary reduced VAT rates (including zero-rates) to supplies of a range of medical products and equipment needed to combat the COVID-19 outbreak, including Austria, Belgium, France, Germany, Greece, the Netherlands, Portugal and Spain. Germany, the Netherlands, Poland and Portugal apply a 0% VAT rate to donations of certain medical material and equipment to hospitals. In the Netherlands, a rate of (effectively) 0% is applied to the hiring of healthcare workers by healthcare facilities or institutions qualifying for the VAT exemption of medical services.

Some countries have introduced VAT rate reductions to support specific economic sectors, such as restaurants (Austria, Belgium, Germany, Greece); accommodation (Austria, Czech Republic, cinema, culture or sports (Austria, Greece, the Netherlands, United Kingdom); or passenger transport (Greece and Turkey). The United Kingdom introduced a temporary reduced rate of 5% for certain supplies relating to hospitality, holiday accommodation and admissions to certain attractions from 15 July 2020 to 31 March 2021.Poland introduced a temporary 0% VAT rate for the supplies of laptops and tablets to educational institutions.

A few OECD countries have introduced more general temporary rate reductions. Germany reduced its standard VAT rate from 19% to 16% and its reduced VAT rate from 7% to 5% from 1 July to 31 December 2020. Ireland reduced its standard VAT rate from 23% to 21%, with effect from 1 September 2020 until 28 February 2021. Norway decreased its 12% reduced VAT rate to 6% from 1 April until 31 December 2020.

The VAT component of OECD countries’ tax responses to the COVID-19 crisis is discussed further in the Special section at the end of this Chapter.

VAT regimes in the OECD make extensive use of exemptions, in addition to reduced rates (see Annex Table 2.A.3). In this context, exemption means that the supplier does not charge the VAT on its outputs and, as a consequence, has no right to recover the VAT on its related inputs. In some jurisdictions, exemption is referred to as “input taxation” to indicate that the supply is not free of VAT but that there is a “hidden VAT” in the price of the exempt supply - i.e. the VAT burden incurred on the inputs is embedded in the price of the exempt outputs. Exemption is thus not the same thing as absence of taxation.

Although it is a significant departure from the basic concept of VAT, all OECD countries apply a number of exemptions. A wide variety of motivations exist for the application of VAT exemptions. These include the difficulty to determine the tax base (e.g. financial and insurance services) or the desire to exclude activities from the VAT base that are considered as public service or as serving a purpose of general and/or social interest (education, health, postal services, charities). A number of other exemptions have their roots in tradition, such as letting of immovable property and the supply of land and buildings. Certain sectors that are exempt from VAT may also be subject to other specific taxes (e.g. property, insurance, financial services).

Exemptions beyond these core items are also numerous and cover a wide diversity of sectors such as culture, legal aid, passenger transport, public cemeteries, waste and recyclable material, water supply, precious metals and agriculture (see Annex Table 2.A.3). To this regard, EU Member States are subject to common rules providing for the exemption of supplies considered as in the public interest such as postal services, healthcare, social services, education, public broadcasting and charities but also for a number of specific supplies such as financial and insurance services, transactions involving immovable property and gambling. However, EU Member States may choose to allow business to opt to tax certain transactions and set specific conditions for some exemptions.

A number of services that are generally exempt in OECD countries are taxed in certain countries. For example, postal services is taxed in Australia, Canada, Japan, New Zealand and Norway; betting or gambling is taxed in Australia, Canada, Korea, New Zealand, Turkey and the United Kingdom; and insurance services are taxed in Mexico, New Zealand and Turkey and zero-rated in Australia. On the other hand, the transportation of passengers, which is taxed in most countries, is exempt (to some extent) in Chile, Denmark, Ireland and Korea. Chile treats, services that are not specifically listed in the law as “out of scope” of its VAT i.e. they are actually treated in a similar way as exemptions. These include legal, accounting, engineering, architecture and other professional services.

The standard advice in VAT design is to have a short list of exemptions, limited to basic health, education and perhaps financial services. By not allowing the deduction of input tax, VAT exemptions create an important exception to the neutrality of VAT (see Chapter 1). The following paragraphs provide an overview of the main, often adverse consequences of exemptions.

VAT exemptions introduce a cascading effect when applied in a B2B context. The business making an exempt supply can be expected to pass on the uncreditable input tax by including it in the price of this supply. This “hidden tax” will subsequently not be deductible/recoverable by the recipient business. If the outputs of this recipient business are not also exempt, this hidden VAT will presumably be part of the price for the supplies on which it will charge output VAT. The result is a hidden tax at a variable rate depending on the number of production stages that are subject to the tax. This distorts businesses’ production decisions and choices of organisational form. The size of this cascading effect depends on where the exemption is applied in the supply chain. If the exemption is applied at the stage of the final consumption, there is no cascading effect and the consequence is simply a loss of tax revenue since the value added at the final stage escapes tax. If the exemption occurs at some intermediate stage, the consequence of the cascading effect may be an increase of net revenues in a non-transparent manner.

Exemptions create incentives for reducing tax liability by vertical integration (“self-supply”) and disincentives for outsourcing as firms have an incentive to produce their inputs internally rather than to purchase externally and incur irrecoverable VAT. This may lead to economic inefficiencies from the distortion of the structure of the supply chain. It can also initiate a dynamic whereby exemptions feed on each other resulting in “exemption creep”: once a sector receives an exemption, it has an incentive to lobby for exemptions for those from whom it buys its inputs in order to avoid paying hidden VAT on its inputs.

Exemptions generally lead to the under-taxation of supplies to consumers, who face a tax burden equal to the tax on inputs used by the businesses without its value-added, and an over-taxation of businesses who are unable to deduct the “hidden” tax embedded in their inputs. It also leads to the taxation of investments rather than consumption, which is in contradiction with the main purpose of the tax.

The VAT exemption of financial services is often mentioned as one that is increasingly problematic. In a recent paper (GFV N°087 of March 2019), the European Commission recalled that the European Union’s VAT exemption rules for financial and insurance services have not kept pace with developments in these sectors, which makes these rules increasingly complex and difficult to apply in practice. This has led to rising litigation rates, legal uncertainty, and high administrative and regulatory costs. These rules are also interpreted and applied inconsistently across Member States, leading to competitive distortion within the EU. The European Commission has therefore launched a public consultation on this topic in October 2020.

In the international context, exemptions compromise the destination principle for taxation of internationally traded goods and services (see Chapter 1). When an exporter uses exempt inputs, it is not possible to remove the irrecoverable VAT resulting from the exemption applied at an earlier stage in the production chain. The export thus becomes effectively “input taxed”. On the other hand, businesses that use exempt inputs have an incentive to import from countries where these inputs are zero rated for export instead of purchasing them from exempt domestic providers. It has been suggested that managing exemptions also imposes increased administrative and compliance costs. As is the case for differentiated rate structures, it may often be difficult for businesses and tax administrations to distinguish between exempt and taxable supplies, in particular in complex areas such as financial services. Businesses that make both taxable and exempt supplies are often faced with complex allocation rules to determine the share which is attributable to taxed outputs and for which it is thus entitled to an input tax credit. However, there is little evidence on the quantitative extent to which exemptions increase administration and compliance costs (Bird and Gendron, 2007[6]).

For further reading on the theoretical and practical justification of exemptions, see (de la Feria, n.d.[7]); and on the potential of broadening the tax base by reducing the scope of exemptions as an alternative to increasing VAT rates, see (European Commission, 2011[8]).

Although the burden of the tax should not fall on businesses, the right to deduct the VAT on inputs is limited to the extent that those inputs are used for producing taxable outputs. The right to input VAT deduction is legitimately denied in cases where inputs are used to make onward supplies that are not taxable, i.e. exempt without credit (e.g. health care, financial services – see Section 2.3 above) or outside the scope of VAT (e.g. supplies for no consideration). Input-VAT deduction is also denied when purchases are not (wholly) used for the furtherance of taxable business activity, for example, when they are used for the private needs of the business owner or its employees (i.e. final consumption). All these limitations to the right to deduct input VAT result from the application of the basic principles of VAT design.

In addition to the rules described above, most OECD countries have legislation in place that provides for restrictions to input VAT deduction on a number of goods and services because of their nature rather than because of their use by businesses. This is often with a view to ensuring the (input)taxation of their deemed final consumption (see Annex Table 2.A.4).

Restrictions to the deduction of input VAT on entertainment costs are the most widespread, although the items included in that category may vary widely. These restrictions may include VAT incurred on restaurant meals; on (alcoholic) beverages; reception costs; hotel accommodation; attendance at sporting or cultural events; and on gifts and transport services. Seven OECD countries (Chile, Colombia, France, Israel, Japan, Switzerland and Turkey) have not implemented such specific limitation to the right of deduction. The deduction of input VAT on the purchase and/or the use of cars is also subject to limitations in 23 out of the 36 OECD countries operating a VAT. On the other hand, Israel, Japan and Switzerland do not report any of these specific restrictions. In Mexico, there are no specific restrictions but the law provides that input VAT deduction is allowed only on inputs that are “strictly indispensable” for the principal activity. The expenses deductible for VAT purposes must also be deductible under the Income Tax Law, which provides a list of “Authorised deductions” for each type of regime.

The restriction to input-VAT deduction may often be limited to a portion of the VAT incurred. This can for instance be the case for the VAT incurred on the use of cars by the employees of a business, which can be limited to a fixed percentage. Some countries restrict the deduction of input VAT on cars to 50%, even if the car is fully used for business purposes.

The rationale behind those limitations is generally threefold. First, it aims at avoiding the administrative burden associated with the need to control the actual use of goods and services that may easily be used for dual business/private purposes due to their very nature. Second, it is a way of reducing the risks of fraud. Third, such commodities often contain an element of “consumption” - for example restaurant meals. This third justification may be considered inconsistent with the main features of the VAT system. Indeed, businesses (or their employees) never actually “consume” goods and services within the meaning of the VAT when they are used in the furtherance of a taxable activity.

All taxes impose compliance costs on businesses and administrative costs on tax authorities, but VAT is often considered as particularly burdensome for small and medium size businesses (SMEs) to comply with (European Commission, 2013[9]) (Evans et al., 2018[10]). Many countries have therefore introduced simplified regimes for SMEs to ease their compliance burden. These regimes can be grouped into three main categories: those that provide for an exemption from the VAT regime (exemption thresholds); those that facilitate the calculation of the VAT liability; and those that simplify accounting, filing and/or payment obligations (OECD, 2015[11]).

Most OECD countries (except Chile, Mexico and Spain) apply exemption thresholds below which small businesses are not required to charge and collect the tax on their outputs and their input VAT is not deductible. In Colombia and Turkey, the exemption threshold only applies to individuals and not to companies or incorporated businesses. The consequences of such exemptions are equivalent to treating small businesses as non-taxable businesses. There are two kinds of exemption thresholds: registration thresholds that relieve suppliers from both the requirement to register for VAT and to collect the tax; and collection thresholds for which taxpayers, even those below the threshold, are required to register for VAT, but are relieved from collecting the tax until they exceed the threshold. Different types of activities (e.g. supply of services vs supply of goods) or sectors (e.g. the non-profit sector) may be subject to different thresholds or even be excluded from their application (e.g. the construction sector). In most cases registration thresholds do not apply to foreign businesses and in some cases collection thresholds apply only to individuals or to businesses for which commercial accounting is not compulsory.

Annex Table 2.A.5 provides an overview of applicable collection and registration thresholds in OECD countries. In principle, the calculation of thresholds is generally based on annual turnover. In Japan, businesses (companies and individuals) are not required to register and account for VAT during the first two years of establishment if they remain below a capital-based threshold; a threshold based on an annual taxable turnover applies after the first two years (with some exceptions, based on levels of turnover). Although thresholds are generally based on annual turnover, their application may be subject to additional rules and conditions.

The levels of these thresholds vary significantly across OECD countries. Three broad groups can be distinguished.

Twenty countries have a relatively high general threshold above USD 30 000 of turnover per year: Australia, Austria, Belgium, Czech Republic, Estonia, France, Hungary, Ireland, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, New Zealand, Poland, Slovak Republic, Slovenia, Switzerland and the United Kingdom. Of these France, Italy, Japan, Poland, Slovak Republic and the United Kingdom have a particularly higher threshold of more than USD 90 000.

Nine countries have a relatively low threshold between USD 5 000 and 30 000: Canada, Denmark, Finland, Germany, Greece, Iceland, Israel, Netherlands and Portugal. Two countries have a low threshold below USD 5000: Norway and Sweden.

Since 2018, six OECD countries have raised their threshold: Austria, France, Germany, Hungary, Israel, Korea, Netherlands and Portugal while none has reduced it.

There are no definitive arguments on the need for, or the level of, thresholds. The main reasons for excluding small businesses (a notion that may vary considerably across countries) are that the costs of tax administration are disproportionate to the VAT revenues raised and, similarly, the VAT compliance costs can be disproportionate for many small businesses compared to their turnover. It is also assumed that smaller businesses may be less compliant. A relatively high threshold may give an advantage to small businesses, distorting competition with larger companies. A relatively low threshold may act as a disincentive for businesses to grow or as an incentive to avoid VAT by splitting activities artificially. It can also frustrate policy efforts to formalise the economy. However, the latter may be at least partly addressed by applying a simpler alternative tax to businesses below the VAT threshold and thus bring them into the “formal” economy. The level of the threshold is often the result of a trade-off between minimising compliance and administration costs, and the need to protect revenue and avoid competitive distortion.

All OECD countries that have a registration or collection threshold give the option to businesses below the threshold to register and account voluntarily for VAT, except Israel and Korea. Voluntary registration is often intended to provide an option for small businesses to avoid the disadvantages of non-registration - but they increase tax administration costs and impose compliance costs on entities that elect to be in the system. This also increases the risk of VAT fraud by “fly-by-night” traders, who register and claim VAT refunds before disappearing again. Countries therefore often impose a minimum period of time during which taxpayers that have registered voluntarily must remain registered. This period varies from one year (Australia, Canada, Czech Republic, Greece, Hungary, Japan, Slovak Republic and Switzerland) to two years (Denmark, France, and Norway) or in some cases, three years (Netherlands and Sweden) or five years (Austria, Germany, Portugal and Slovenia).

Recent research (Li Liu, 2019[12]) shows that firms tend to bunch below the registration threshold by restricting their reported turnover to avoid having to register for the VAT when they have a high share of sales to private consumers (B2C) but tend to register voluntarily, even when their turnover is below the threshold, in cases where they have a low share of such B2C sales, a high input-cost ratio, and more competition in the industry.

One challenge of VAT thresholds is to minimise incentives for small businesses to underreport turnover so as to remain below the exemption threshold, and/or to incentivise small businesses to grow their business. The adoption of a flexible threshold is one option. Under such a regime, small businesses that exceed the regular VAT threshold are not obliged to register immediately but are allowed to continue to benefit from the exemption as long as they do not exceed the threshold by a significant percentage. For example in France, businesses that exceed the regular thresholds of EUR 85 800 (for goods) and EUR 34 400 (for most services) may continue to benefit from the exemption if their turnover does not exceed EUR 94 300 and EUR 36 500 respectively for more than a year.

Other ways exist to reduce compliance costs for SMEs while avoiding the disadvantages of the exemption. One way used in many countries is to apply simplified presumptive schemes to facilitate the calculation of the VAT liability. For example, certain small businesses may be allowed to apply a single flat rate to turnover for determining the amount of VAT to be remitted to tax authorities instead of requiring a detailed VAT calculation of input and output VATs. An alternative simplification scheme for calculating VAT liability relies on simplified input tax credit calculations. A more detailed description of such regime is given in an OECD study on SME taxation (OECD, 2015[11]).

In most cases, registration thresholds do not apply to foreign businesses. However, the OECD VAT/GST Guidelines recommend that jurisdictions implementing a vendor registration regime for collecting the VAT on B2C supplies of services and intangibles by foreign suppliers do so without creating compliance and administrative burdens that are disproportionate to the revenues involved or to the objective of achieving neutrality between domestic and foreign suppliers. They specifically acknowledge that thresholds have been implemented by some jurisdictions to achieve this objective, adding that a balance should be sought between the desire to minimise administrative costs and compliance burdens for tax administrations and foreign suppliers and the need to maintain an even playing field between domestic and foreign businesses. The report on Mechanisms for the Effective Collection of VAT/GST where the Supplier is not Located in the Jurisdiction of Taxation (OECD, 2017[13]) provides further guidance on key policy aspects to consider for the possible implementation of such a threshold. These include neutrality aspects on the competitive position of domestic and foreign suppliers; simplification aspects on the potential reduction of compliance costs for foreign businesses and tax administrations; and the determination of the level of the threshold, including the calculation method (based on the supplier’s turnover in the taxing jurisdiction or its worldwide turnover).

Among the 12 OECD jurisdictions requiring foreign suppliers of inbound services and intangibles to final consumers to register and account for the VAT in their jurisdiction, six apply a registration turnover threshold below which foreign suppliers are relieved from that obligation, i.e. Australia, Iceland, Japan, New Zealand, Norway and Switzerland. In these countries, the registration threshold is the same for domestic and foreign vendors. The EU is considered as one single jurisdiction in this context, as the absence of a registration threshold for non-EU suppliers of remote telecommunication, broadcasting and electronically supplied services under its Mini One Stop Shop (MOSS) regime (non-Union scheme) is set at EU level. A voluntary threshold of 10 000 EUR was implemented as of 1 January 2019 for remote intra-EU supplies of these services to final consumers by EU vendors (Union scheme).

Most countries allow or utilise specific methods for determining the VAT liability in special circumstances. The purpose of these methods is usually to simplify VAT administration and compliance and/or to address specific circumstances. Typical examples are the margin schemes, which are often used when the deduction of input tax according to the normal rules is considered too difficult or impossible – see for instance the resale of second-hand goods bought from private individuals, and the activities of travel agencies. Under a margin scheme, the tax base is calculated on the difference between the price paid by the taxpayer and the price of resale rather than on the full selling price. The reseller is not allowed to deduct the input VAT embedded in the buying price of the items that are resold under the margin scheme.

The Annex Table 2.A.6 shows that all the EU countries employ a margin scheme for travel agencies, second-hand goods, works of art, collector's items and antiques since they share the same legislative root. Beyond the EU, eight other OECD countries employ margin schemes, i.e. Australia (on new residential property, gambling and second hand goods); Chile (second-hand real property); Colombia (sale of used cars, sale of fixed assets made by an intermediary, sale of gasoline); Israel (on coins and postal stamps, furniture, dwellings, used vehicles and foreign currency exchange); Mexico (second hand cars); Norway (on second hand goods, works of art, collectors’ items and antiques); Switzerland (Collector’s items such as works of art and antiques); and Turkey (on travel agencies).

VAT performance can be measured through different methods, depending on the dimension of the performance to be measured. It has traditionally been estimated by the “efficiency ratio”, defined as the ratio of VAT revenues to GDP divided by the standard rate (expressed as a percentage). Although the efficiency ratio has been widely used as a diagnostic tool in evaluating VATs, it does not distinguish a product-type VAT from a consumption-type VAT. This difficulty is addressed by taking final consumption as a reference for the potential tax base rather than production (Ebrill et al., 2001[14]). If measured by the ratio of revenue from the tax to the product of the standard VAT rate and aggregate consumption, a benchmark VAT levied at a uniform rate on all consumption would have “C-Efficiency” of 100% provided that all the tax due is collected by the tax administration.

The estimates of the VAT Revenue Ratio (VRR) for OECD countries presented in this section builds on the “C-Efficiency ratio” principles. It provides an indicator that combines the effect of loss of revenues as a consequence of exemptions and reduced rates, fraud, evasion and tax planning. Although the VRR has to be interpreted with care and erosion of the tax base may be caused by a variety of factors, it may support policymakers in assessing the revenue raising performance of their VAT system and in identifying opportunities to raise additional revenues by improving VAT performance.

2.7.1. What does the VRR measure?

The aim of the VRR is to provide a measure of the extent to which a country collects its VAT on the natural base of the tax: final consumption expenditure. The VRR thus measures the difference between the VAT revenue actually collected and what would theoretically be raised if VAT was uniformly applied at the standard rate to the entire potential tax base and all revenue was collected:

Where: VR = actual VAT revenues; B = potential tax base and r = standard VAT rate

The ‘standard’ rate refers to the default rate applicable to the tax base, unless otherwise advised by legislation. Legislation can (and many countries do) provide that lower (or higher) rates are applicable to a defined list of products. Reduced VAT rates are still widely used in OECD countries, mainly for equity or social objectives (basic essentials, health, education, etc.). No OECD countries apply higher VAT rates (see Annex Table 2.A.1).

In the VRR calculation formula as presented above, the potential tax base (B) is based on the Final Consumption Expenditure under Item P3 in the national accounts. However, the SNA measures consumption expenditures at market prices, i.e. including VAT. This VAT element must be deducted from the amount under P3 for the VRR calculation, because the theoretical basis for taxation should not include the tax itself.As a result, the VRR estimates presented in Annex Table 2.A.1 have been calculated as follows:

Where: VR = actual VAT revenues; FCE = Final Consumption Expenditure (Item P3 in National Accounts); and r = standard VAT rate.

2.7.2. The challenge of assessing the tax base

The main methodological difficulty in the calculation of the VRR lies in the assessment of the potential tax base, since no standard assessment of the potential VAT base for all OECD countries is available. The potential VAT base includes all supplies of goods, services and intangibles made for consideration (or deemed to be made for consideration) by businesses or any other entity acting as a business (e.g. individuals, government entities providing supplies for direct consideration, etc.) to final consumers. In principle, the tax base ultimately corresponds to the expenditure made by final consumers to obtain goods, services and intangibles. In practice, however, many VAT systems impose VAT burden not only on final household consumption, but also on various entities that are involved in non-business activities or in VAT exempt activities (Chapter 1 and this chapter). In such situations, VAT can be viewed as treating such entities as if they were end consumers, or as “input taxing” the supplies made by such entities on the presumption that the burden of the VAT imposed will be passed on in the prices of the outputs of those non-business activities. The tax ultimately collected by the government in these situations is the tax on these inputs.

In the absence of a standard assessment of the potential VAT base for all OECD countries, the closest statistic for that base is final consumption expenditure as measured in the national accounts, VAT is indeed, ultimately a tax on final consumption. Final consumption expenditure in national accounts is calculated according to a standard international norm, the System of National Accounts (SNA 2008 - except for Turkey, Chile and Japan that still use SNA 1993) under Item P3 Final consumption expenditure.

2.7.3. The average VRR for OECD countries has remained stable

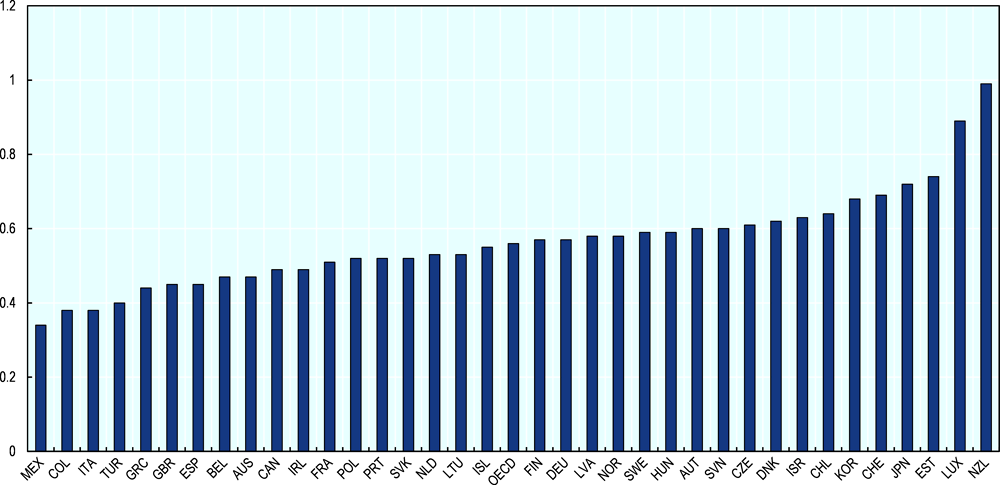

Across the OECD, the unweighted average VRR has remained relatively stable at 0.56 in 2017 and 2018, up 0.1% compared to 2016, as is shown in Annex Table 2.A.7. This OECD average has remained around this level since 2010 (0.55), after it had declined during the financial and economic crisis in 2008-9 (from 0.59 in 2007 to 0.53 in 2009). This estimate suggests that, on average, 44% of the theoretical potential VAT revenue is not collected.

The VRR estimates vary considerably among OECD countries. In 2018 the estimates ranged from 0.34 in Mexico and 0.38 in Colombia and Italy, to 0.89 in Luxembourg and 0.99 in New Zealand. An additional four OECD countries have an estimated VRR above 0.65, i.e. Estonia (0.74), Japan (0.72), Switzerland (0.69) and Korea (0.68). All the other OECD countries that operate a VAT (30 out of 36) have a VRR below 0.65; eleven of these countries have a ratio below 0.50. This suggests that a considerable part of the theoretical potential VAT revenue remains uncollected in many OECD countries. The VRR rose in 26 countries compared to 2016, with Poland’s estimated VRR showing the biggest increase from 0.45 to 0.52 and Latvia’s and Hungary’s estimated VRR rising from 0.55 to 0.59 and from 0.54 to 0.58 respectively. The impact of the increase of the estimated VRR of these 26 countries on the OECD average was partly offset by the introduction of Colombia with a VRR considerably below the OECD average of 0.38, and the drop in the estimated VRRs for Australia (from 0.50 to 0.47) and Luxemburg (from 0.92 to 0.89). The VRR estimates remained unchanged for eight OECD countries.

The VRR levels notably reflect the fact that preferential treatments, such as reduced rates and exemptions, are still widely used in OECD countries (see Annex Table 2.A.2 and Annex Table 2.A.3). This is confirmed by tax expenditures data, which reflect the cost of tax concessions (OECD, 2010[15]).

It appears that there is no direct correlation between the level of the standard VAT rate and the VRR. Countries with very different VAT rates may have comparable VRRs. Australia and Ireland, for example, have a very similar VRR estimate 0.47 and 0.49 respectively while their standard VAT rates are at very different levels, i.e. 10% and 23% respectively. Although two thirds of countries (25 out of 36) have a VRR between 0.45 and 0.65, they have standard VAT rates that vary widely from 5% (Canada) to 25% (Denmark, Norway, and Sweden) and 27% (Hungary). These last four countries combine high standard VAT rates (25% and 27%) with a VRR above the OECD average, at respectively 0.62, 0.58, 0.59 and 0.59; while Mexico and Turkey combine lower standard VAT rates (respectively 16% and 18%) with a VRR estimate considerably below the OECD average (respectively 0.34 and 0.40). Japan combines a low VAT rate (8% in 2017-18) and the absence of reduced rates with a relatively high VRR (0.72).

The respective weight of the different factors that affect the VRR may vary widely across countries depending on the circumstances. The two countries with the highest VRR, New Zealand and Luxembourg, are both far above the OECD average (with respectively 0.99 and 0.89 compared to an average of 0.56) and even significantly above the country that immediately follows (Estonia with a VRR of 0.74). However, the reasons behind these high ratios are very different.

The VRR for Luxembourg has increased constantly between 1996 (0.54) and 2014 (1.23). This increase was correlated with deep changes in the EU marketplace, in particular the liberalisation of financial services and the boom of e-commerce. It is reasonable to assume that these market factors and the specific VAT treatment of these markets have had a strong upward effect on Luxembourg’s VRR. It may be assumed that Luxembourg’s position as an international financial centre has resulted in additional VAT revenue for the country. The supply of financial services is generally exempt from VAT in Luxembourg without the right to deduct the input tax, in accordance with EU VAT rules, including when supplied to customers in other EU Member States. This means that the non-deductible VAT incurred by financial service providers in Luxembourg increases Luxembourg’s VAT revenues while a large share of the corresponding final consumption occurs in other EU Member States, as a result of the increased cross-border trade in financial services. Luxembourg had also become an international centre for e-commerce, notably as a consequence of the VAT treatment of this activity under EU VAT legislation until 1st January 2015. According to this legislation, e-commerce supplies to final consumers in other EU Member States were taxed in the Member State where the supplier was established. The low standard VAT rate in Luxembourg, the lowest in the EU (15 % until 2014), acted as an incentive to e-commerce suppliers to establish in Luxembourg; and this generated additional and continuously increasing revenue for the country as internet trade continued to grow. This changed as of 1 January 2015. Since that date, intra-EU e-commerce sales to final consumers are no longer subject to VAT in the Member State where the supplier is established (which was often Luxemburg). These sales are now subject to VAT in the Member State of these consumers’ residence and at the rate applicable in that Member State. The loss of VAT revenues for Luxemburg from this change of the intra-EU place of taxation rules for e-commerce is reflected in the VAT revenue and VRR estimates for Luxembourg (which have declined from 1.25 in 2014 to 0.89 in 2018).

The factors underlying the constant very high VRR since the implementation of the VAT (GST) in New Zealand are very different from the Luxembourg ones. First, unlike Luxembourg, New Zealand operates a very broad GST tax base with limited exemptions (see Annex Table 2.A.3) and a limited use of zero rates (see Annex Table 2.A.2). Second, New Zealand treats public services as GST taxable (see Chapter 1). Although this does not generate actual additional revenue (the GST charged by public bodies to the government is compensated through budgetary transfers and the GST collected on local government activities is included in local taxes), this increases the share of revenues from GST in total tax revenues, which has an upward effect on the VRR. On the other hand, the potential GST base determined on the basis of the national accounts (see section above) does not include the value added by the government. The combination of these factors may explain why the VRR for New Zealand is so high and even sometimes above 1.

At the opposite end, Mexico and Colombia have the lowest VRR (0.33 and 0.38 respectively) amongst OECD countries. This is likely to be due to a combination of factors such as the scope of VAT exemptions, the application of a domestic zero rate and a low compliance level.

2.7.4. A number of factors influence the VRR

In theory, the closer the VAT system of a country is to a “pure” VAT as a broad-based tax on all final household consumption, the closer its VRR is to 1. A VRR close to 1 can be taken as an indicator of a VAT bearing uniformly on a broad base with effective tax collection. A lower value reflects such factors as the effects of reduced rates, exemptions or a failure to collect all tax due. A VRR above 1 is possible in theory, notably where almost all the tax base is covered by a VAT at a single standard rate and a number of exemptions without right to deduction apply so that the cascading effect of the exemption provides additional revenue for the government that exceeds the cost of the exemption. In practice, the VRR rarely equals 1 and a number of complex factors, alone or in combination, may influence the results positively or negatively. These include:

The application of lower VAT rates to a number of goods and services and the level of such lower rates that reduce the tax revenue and have a negative impact on the VRR.

The level of the registration and/or collection threshold under which small businesses do not account for VAT. These thresholds reduce the amount of VAT collected, although it could be argued that the adverse revenue consequences of such thresholds are likely to be limited since the businesses under the thresholds will generally not be able to deduct any input VAT and their value added can be expected to be modest.

The scope of the exemptions. Depending on the features of the exemptions and market structures, exemptions may influence the VRR upwards or downwards. Exemptions may reduce the tax revenue when the exemption applies to goods or services directly supplied to final consumers without requiring much investment or expenditure other than the supplier’s own labour. They may increase revenue when the exemption occurs early in a supply chain and the revenue arising from the non-recoverable input VAT and its cascading through the value chain exceeds the potential tax arising from taxation at standard rates with the deduction of input tax (e.g. financial service supplied to businesses). The application of a VAT exemption for financial services in particular may have a considerable impact on the VRR, given the economic importance of this sector in many countries.

The VAT treatment of public sector activities. Final consumption by government is the second largest final use in national accounts after household consumption. From a VAT perspective, governments’ activities are exempt or outside the scope of VAT in most countries, New Zealand being the notable exception treating all governments activities as taxable. As a consequence, public bodies cannot deduct the input VAT paid on their taxable expenditure, again with the exception of New Zealand that provides a full right to deduct input tax for government activities. A number of countries have created mechanisms for balancing the adverse effects of the exemption of public sector activities, such as targeted VAT refunds, full or partial right to deduct input VAT, budgetary compensations or extended taxation of government activities. The different options chosen by governments may have varied impacts on the VRR. Compensations outside of the VAT system (e.g. a simple budgetary compensation) have no direct effect on the VRR. The government activities remain input taxed, generating the corresponding VAT revenue, before and after the compensation measures. A measure that provides the right to input-VAT deduction to government bodies will normally reduce VAT revenue if the outputs remain exempt, and hence influence the VRR downwards. Applying VAT to government activities like New Zealand does, on the other hand, will increase the amount of VAT collected and influence the VRR upwards, as it results in the taxation of the total output rather than just the inputs.

The implementation of an effective regime for the collection of VAT on supplies of goods, services and digital products from online sales by foreign vendors and electronic marketplaces. Many VAT regimes have struggled to ensure the proper collection of VAT on online trade, in particular when faced with the challenge of collecting these taxes from non-resident vendors, which has caused increasingly important revenue losses as the value and volume of digital trade has continued to increase (see Chapter 1).

The capacity of the tax administration to manage the VAT system efficiently and the degree of compliance by taxpayers influences the VRR as low compliance has a negative impact on VAT revenues. The level of taxpayer insolvencies and bankruptcies can also influence the VRR.

The failure of a tax administration to operate an appropriate VAT refund process (with timely refunds of excess input-VAT credits to domestic businesses and/or refunds to non-resident businesses), which is contrary to the fundamental principle of VAT-neutrality, may influence the VRR upwards (for the “wrong” reasons).

Similarly, the failure of a VAT regime to ensure the proper implementation of the destination principle to the exportation of goods and/or services, notably by taxing exports in the origin jurisdiction or by exempting exports without a right for the exporter to recover the associated input-VAT, my influence the VRR upwards “for the wrong reasons”.

The evolution of consumption patterns may also affect the tax revenue. The VRR can for instance decline, all other things equal, when the share of consumption of necessities that are taxed at the lower VAT rate increases, e.g. as a result of an economic crisis (OECD, 2020[16]).

Finally, also the possible impact of the differences between the measurement of final consumption expenditure in the national accounts and countries’ potential VAT base should be taken into account when interpreting the VRR.

For further technical discussion on the factors influencing the calculation of the VRR see (OECD, 2016[17]).

2.7.5. Policy and compliance factors influencing the VRR

The level of the VRR rarely depends on one factor in isolation but rather on the interaction between them. For example, a high standard rate may create an incentive for evasion while multiple lower rates may lead to revenue loss due to misclassifications. Exemption of certain sectors of activity may create distortions and incentives for avoidance, which require additional administrative capacities that cannot be used for the efficient collection of VAT. Inefficient tax administration, burdensome administrative requirements and complex VAT mechanisms may reduce taxpayer compliance levels.

These potentially influencing factors can be divided in two main categories:

Those resulting from policy decisions, mainly affecting the tax base or the coverage of the standard rate (i.e. reduced VAT rates and exemptions – “policy gap”), and

Those related to the efficiency of the tax collection and compliance levels (“compliance gap”).

The VRR is a combination of the result of policy decisions and the “compliance gap”. Analysis to further break down the composition of the VRR can be carried out. One method to decompose the VRR into its policy and compliance components consists in using tax expenditure data from VAT preferential regimes (i.e. the revenue cost of a system’s departure from the application of the standard VAT rate to the entire theoretical tax base) to estimate the “policy gap”. The remaining difference between 1 and a given country’s VRR then provide an estimate of the “compliance gap by” deduction. However, given the number of other factors that may influence the VRR, such figures should be used with caution.

Another method is to calculate the “compliance gap” (or “VAT gap”), i.e. the difference between tax collected and the tax that should be collected if all consumers and businesses fully complied with a given jurisdiction’s VAT rules. This method is employed for the annual VAT Gap estimates in the European Union where the VAT Gap is defined as the difference between the amount of VAT actually collected and the theoretical tax liability according to tax law (VAT Total Tax Liability VTTL). (Institute for Advanced Studies, 2015[18]). (CASE – Center for Social and Economic Research, 2020[19]). The VAT Gap is estimated using a “top-down” approach that applies a jurisdiction’s respective VAT rates to the relevant components of consumption (including final consumption of households; final consumption of government and non-profit institutions, intermediate consumption for partially exempt businesses; expenditure on housing, country-specific, adjustments, etc.). Australia uses a similar method (Australian Taxation Office, 2020[20]). The International Monetary Fund RA-GAP framework (Eric Hutton, 2017[21]) uses national accounts data to calculate the potential VAT base per economic sector. It calculates the potential VAT revenues for a given VAT system by applying its current tax schedule (exemptions, zero-rates, reduced rates) to that VAT base. Potential VAT revenues under the reference policy are calculated by applying the current standard VAT rate to the base. The VAT gap is calculated by comparing actual VAT revenue with potential revenues under the current policy and the reference policy.

2.8.1. VAT revenue losses from fraud and non-compliance remain significant

Reducing the revenue losses from VAT non-compliance remains a key challenge and a priority for countries around the world. Many tax administrations carry out research to estimate their country’s VAT compliance gap, i.e. the revenue loss from VAT fraud, non-compliance and bankruptcies. The VAT Gap in the European Union (EU) was estimated at EUR 140 billion for the 28 EU Member States for 2018 in the latest VAT Gap report (CASE – Center for Social and Economic Research, 2020[19]). Although it remains very high, the EU Commission observed that this VAT Gap has improved marginally in recent years in both relative and nominal terms. In relative terms, the EU-wide VAT Gap fell to 11% of the VAT total tax liability (VTTL) in 2018, from 12.3% in 2016 and 14.3% in 2014. In nominal terms, the overall EU VAT Gap slightly decreased by almost EUR 1 billion to EUR 140.04 billion in 2018, slowing down from a decrease of EUR 2.9 billion in 2017. However, figures for 2020 forecast a reversal of this trend, with a potential loss of EUR 164 billion in 2020 due to the effects of the coronavirus pandemic on the economy.

The smallest VAT Gaps in the EU were observed in Sweden (0.7 percent), Croatia (3.5 percent), and Finland (3.6 percent); the largest in Romania (33.8 percent), Greece (30.1 percent), and Lithuania (25.9 percent). The United Kingdom estimated its VAT Gap at GBP 10.0 billion in 2018-19, i.e. 7.0% of the estimated net VTTL (HMRC, 2020[22]), declining from 13.3 billion and 9.6% of the VTTL in 2017-18. A number of other OECD countries provide public estimates of their VAT gap. In Australia the GST gap is estimated at AUD 5.8 billion or 8.1% of VTTL (Australian Taxation Office, 2020[20])); in Canada, the multi‐year average GST/HST gap for 2000‐2014 is estimated at 5.6% VTTL (CRA, 2016[23]). In Latin America, the VAT gaps showed a wide diversity in 2017 (CEPAL, 2020[24]) but OECD countries in this region had a relatively low VAT gap compared to others, i.e. 21.4% in Chile, 23.6% in Colombia and 16.4% in Mexico (compared to e.g. 45.3% in Panama and 43.8 in the Dominican Republic).

Losses of VAT revenue from non-compliance can result from a number of factors. In addition to “traditional” VAT avoidance (i.e. arrangements intended to reduce the tax liability that could be strictly legal but in contradiction with the intent of the law) and evasion (illegal arrangements where liability to tax is ignored or hidden) VAT systems have often been the target of organised criminal attacks. This organised and criminal VAT fraud has been shown to have connections with other criminal activities such as terrorism and money laundering in a number of cases (EUROPOL, 2020[25]).

The most common type of organised VAT fraud is the “missing trader” or “carousel” fraud. It arises when a business makes a purchase without paying VAT (typically a transaction for which tax self-assessment applies), then collects VAT on an onward supply and disappears without remitting the VAT collected. Originally, the fraud involved primarily high-value goods that can easily be moved across borders, such as computer chips and cell phones - but it expanded to services that can be bought and sold like goods. Organised VAT fraud in CO2 emission trading, for instance, caused billions of Euros of VAT revenue losses in a range of countries. Energy markets are also vulnerable to organised VAT fraud. European energy regulators, energy trading firms and gas and electricity operators notably warned EU authorities about the serious impact of VAT carrousel fraud on the functioning of European gas and electricity markets (Europex – Association of European Energy Exchanges, 2018[26]). They reported signs of "a major penetration of the gas and electricity markets by VAT fraudsters”. Research in the past also showed that certain accounting software products contained hidden tools (zappers) for the manipulation of VAT receipts (OECD, 2013[27]). The digitalisation of the economy creates new challenges for VAT regimes in addressing fraud and non-compliance, notably in light of the exponential growth of cross-border e-commerce (OECD, 2015[28]).

Tax authorities are developing, and implementing, a growing variety of responses to the increasingly complex challenge of protecting important VAT revenues against VAT fraud and non-compliance. The following sections look in slightly more detail at three categories of responses that can be observed among OECD countries: changes in VAT collection mechanisms; reinforcement in taxpayer’s reporting obligations and data analysis; and international administrative cooperation and exchange of information.

2.8.2. Changes in the VAT collection methods: domestic reverse charge and split payment

Domestic reverse charge (see Annex Table 2.A.12)

In a standard VAT regime, the VAT is collected from suppliers through a staged process whereby the supplier collects the VAT from its customer and remits it to the authorities after having deducted any recoverable input VAT (see Chapter 1). Under a reverse charge mechanism, the liability for remitting the VAT to the tax authorities is shifted from the supplier to its business customer (i.e. in B2B transactions). Shifting the VAT liability from the supplier to the customer removes the possibility for dishonest suppliers to disappear with VAT that they collected from their customers without remitting it to the tax authorities, which is for example typical for so-called “missing trader” fraud. Nor can businesses claim the deduction or refunds of VAT that they have not paid (e.g. VAT on false invoices) or that has not been remitted to the tax authorities, which it typical for “carrousel fraud” schemes.

OECD countries that are using the domestic reverse charge mechanism have typically limited its application to economic sectors that are particularly vulnerable to such organised fraud schemes. It is particularly used to counteract missing trader and carousel fraud in sectors such as trade in mobile phones; integrated circuit devices; game consoles; tablet PCs and laptops; cereals and industrial crops; raw and semi-finished metals; gas and electricity; and telecom services.

No OECD country operates a more generalised reverse charge regime for the collection of all VAT on domestic transactions between businesses. Although this would reduce the risks of specific fraud types, as described above, it would also have several drawbacks including new burdens for businesses and tax administrations and growing risks of other types of fraud at the retail level (e.g. sales suppression, misuse of VAT identification numbers). One concern is that it would effectively transform the VAT into a retail sales tax, with the concentration of all revenue risks at the stage of the final sale or at a limited number of points, with the inherent weaknesses of such a system.

In the EU, Member States can apply a domestic reverse charge mechanism to a determined list of supplies, on an optional and temporary basis. EU Member States have also been allowed since 2013 to apply a domestic reverse charge to any kind of supply in case of sudden and massive VAT fraud.

Annex Table 2.A.12 shows that the use of domestic reverse charge as a means of combatting VAT fraud is widely used in the 23 OECD countries that are EU Member States, in particular for the supply of CO2 emission certificates (all except Estonia, Poland, Latvia and Lithuania); scrap materials and waste (all except Belgium, Luxembourg Poland, and the United Kingdom); and construction work (all except Estonia, Luxembourg, Poland and the United Kingdom). The domestic reverse charge is also applied by many EU countries to the supply of gold (14 countries); electronic devices such as laptops, chips, mobile phones etc. (11 countries) and the supply of gas and electricity to taxable dealers (10 countries). Also other OECD countries use a domestic reverse mechanism albeit to a much lesser extent i.e. Canada (supplies of real property by non-residents and some supplies between provinces); Chile (supplies of rice, construction works, waste and certain plants and animals); Israel (metal debris); Mexico (waste, some supplies made by individuals); New Zealand (supplies of land incorrectly zero rated); Norway (supply of CO2 emission allowances and investment gold) and Turkey (some supplies made by non-taxable persons). More than half of the OECD countries (19 out of 36) apply the reverse-charge to supplies in the construction sector.

Domestic reverse-charge has not been implemented in Colombia, Iceland, Japan, Korea, and Switzerland. Poland replaced its domestic reverse charge arrangements with a mandatory split payment mechanism in November 2019 (applicable only to the supplies that were previously subject to the domestic reverse charge; see also the section below).

The split payment mechanism (see Annex Table 2.A.12)

Another means of reducing the vulnerability of VAT regimes to fraud and non-compliance is through the implementation of a so-called split payment (or withholding) mechanism. Under such a mechanism, the supplier charges the VAT on its domestic supplies to the customer according to normal rules, but the VAT paid by the customer (or part of it) is either directly remitted to the tax authorities (“withholding scheme”) or deposited on the supplier’s special VAT account (“split payment”) rather than to the supplier. The supplier can generally use the amounts deposited in its special VAT account under a split payment regime only to pay VAT either to the tax administration or to another supplier (and to this supplier’s VAT account only). Poland, which operates such a split payment regime (see previous section), has extended the possible use of amounts on special VAT accounts to pay certain other public levies.

A split-payment or withholding regime has a similar fraud-prevention effect as a domestic reverse-charge mechanism in that it removes the possibility for a supplier to collect the VAT without remitting it to the tax authorities. Among the drawbacks of these regimes are the added complexity (incl. the requirement for suppliers to determine for each transaction whether or not it is in the scope of the regime) and the cash-flow impact for businesses, which can be significant particularly under a withholding regime as businesses receive no/less output VAT against which they can offset deductible input-VAT (and this could result in a perennial excess-input VAT position). Some have observed that split-payment mechanisms may not prevent more complex missing trader frauds (Bartosz Gryziak, 2020[29]). Annex Table 2.A.12 shows that such a regime has been implemented in only five OECD countries and these are all targeted at specific sectors or types of supplies.

In Poland, a mandatory split payment mechanism applies to business-to-business (B2B) supplies of a defined list of goods and services that are considered to be sensitive to fraud (such as scrap metal, of CO2 emission allowances, mobile phones, tablets, construction services etc. which were previously subject to a domestic reverse charge), if the invoiced gross amount exceeds PLN 15 000. Upon decision of the customer, an optional split payment mechanism can be applied to B2B supplies that are not covered by the mandatory split payment.

Italy requires public authorities or government bodies, public owned companies and companies listed on the Italian Stock Market to remit the VAT on their purchases of goods and services directly to the tax authorities instead of to their suppliers. Under this withholding regime, suppliers are entitled to faster refunds of excess input VAT credits. Korea applies a withholding regime for the supplies of gold, copper and scrap gold and iron. In the Czech Republic, such a system is only optional for customers that wish to avoid possible joint and several liability for the supplier’s unpaid taxes. Turkey operates a partial withholding regime whereby customers are required to withhold a percentage of the VAT charged to them by suppliers and remit it directly to the tax authorities for supplies in certain sectors, such as construction, scrap metal, glass, plastic and paper, advisory and audit services, some repair services etc. Australia requires recipients of new residential property suppliers to effectively withhold GST from payment to the supplier and they are instead obliged to remit the full amount of the GST to the tax authority which is reconciled against taxable amounts of GST required to be reported for these supplies by the supplier.

Colombia, Chile and Mexico operate a withholding requirement as a fallback for the collection of VAT on inbound business-to-consumer (B2C) supplies of services and intangibles by foreign vendors. Where the foreign supplier of such B2C services and intangibles does not register to account for the VAT in the country, payment providers that facilitate the payment for these supplies (credit and debit cards; payment wallets; and banks) are required to withhold VAT on the payment for these supplies and remit it to the tax authorities.

2.8.3. Collecting transaction data from the taxpayers

Many OECD countries have used technology to enhance the reporting of tax relevant data to tax authorities. After a generalisation of mandatory e-filing of VAT returns (OECD, 2015[30]), many OECD countries have introduced or consider introducing a requirement for taxpayers to provide transaction data to tax authorities, sometimes in real time. These measures typically require detailed information to be provided in an electronic format at individual taxable transaction level. This information can include invoicing information and accounting data or any other information that allows tax authorities to monitor supplies made and/or received by individual taxpayers.

Annex Table 2.A.11 shows that most OECD countries have implemented transaction information reporting obligations since 2000, except Belgium, Canada, Finland, Iceland and Japan. Amongst the countries that have implemented transaction information reporting obligations, nineteen impose a specific format for such reporting (Chile, Colombia, Czech Republic, France, Greece, Israel, Italy, Korea, Lithuania, Luxembourg, Mexico, Netherlands, Norway, Poland Portugal, Slovak Republic, Slovenia, Spain and Turkey). Eight of them use (a variation of) the Standard Audit File for Tax (SAF-T) format developed by the OECD Forum on Tax Administration (OECD, 2005[31]). This involves the use of accounting software to create an electronic file (the SAF-T) containing tax-relevant accounting data. The SAF-T format enables the transfer of these data from the taxpayer to the tax authorities in a standardised electronic format.

Half of the countries requiring electronic transaction reporting (16 out of 31) require the systematic transmission of such information to the tax administration (Chile, Colombia, Czech Republic, Estonia, Greece, Hungary, Israel, Italy, Korea, Lithuania, Mexico, Poland, Portugal, Slovak Republic, Spain and Turkey) and eight of these require this transmission to happen in (near) real time (Chile, Colombia, Hungary, Italy, Korea, Mexico, Spain and Turkey).

Countries are also increasingly concerned with the monitoring of transactions in cash in the business-to-consumer (B2C) environment and more than one third of OECD countries (16 out of 36) have implemented requirements for suppliers to use electronic cash registers (Austria, Belgium, Czech Republic, France, Greece, Hungary, Israel, Italy, Korea, Latvia, Lithuania, Norway, Poland, Slovak Republic, Slovenia, and Sweden). Six of these countries require the systematic transmission of data to the tax administration (Austria, Greece, Israel, Korea, Slovak Republic and Slovenia, in (near) real time for Korea, Slovak Republic and Slovenia.

The volume of information collected by tax administrations has increased dramatically in recent years. In order for countries to take advantage of the opportunities that such data collection provides, countries and their taxpayers need to have confidence in the security and confidentiality of the information gathered by tax administrations. Facing the risks of inappropriate disclosure of information whether intentionally or by accident (e.g. hacking of tax administration databases), countries must ensure that both the legal framework and appropriate data protection systems are in place (OECD, 2012[32]).

2.8.4. International administrative cooperation

There is also a growing recognition that effective strategies to tackle VAT fraud and evasion would benefit from the enhanced international administrative co-operation. Governments increasingly recognise that information exchange and administrative co-operation play a significant role in combatting international VAT fraud and ensuring effective tax collection, not least in the context of the digitalisation of the economy (OECD, 2015[28]); (Court Auditors, 2015[33]). This need was also recognised in the 2015 OECD Report on Tax Challenges Arising from Digitalisation (OECD, 2015[34]) and the OECD is developing work in this context.

A number of instruments already exist that provide the legal foundation for the international administrative co-operation in the area of VAT. These include the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (OECD/Council of Europe, 2011[35]), the bilateral treaties implementing the current Articles 26 and 27 of the OECD and UN Model Tax Conventions, and Tax Information Exchange Agreements (TIEAs) based on the OECD Model. Regional agreements also provide legal base for such co-operation. These include EU Regulation No 904/2010, the Nordic Mutual Assistance Convention on Mutual Administrative Assistance in Tax Matters, the CIAT Model Agreement on the Exchange of Tax Information, and the African Tax Administration Forum Agreement on Mutual Assistance in Tax Matters.