2. Peer reviews of the AEOI Standard’s implementation

In addition to monitoring the timeliness of each jurisdiction’s implementation of the AEOI Standard, the Global Forum conducts peer reviews to ensure the implementation is both complete and effective. This includes reviews in relation to the legal frameworks for AEOI and their effectiveness in practice. This chapter provides an overview of the methodology used for the peer reviews and a summary of the findings.

In order to ensure that the implementation of the AEOI Standard is both complete and effective, the Global Forum conducts peer reviews in relation to all of the key areas of the AEOI Standard. These are conducted in accordance with the agreed Terms of Reference for the AEOI reviews, which are contained in Annex C of this report. As set out therein, the Terms of Reference comprise of Core Requirement 1 in relation to the domestic collection of the information, Core Requirement 2 in relation to the international exchange of the information and Core Requirement 3 in relation to confidentiality and data safeguards.

Properly implementing the AEOI Standard requires various legal, technical and operational aspects to be put in place and for them to operate effectively in practice. The Global Forum has therefore designed and conducted a range of peer review processes specifically suited to assess each area of the requirements. The processes are as follows:

Assessments of confidentiality and data safeguards frameworks: The information exchanged, which includes sensitive information identifying taxpayers and their international investments, must be properly safeguarded and used only for the purpose for which it was exchanged (or subsequently authorised). The Global Forum therefore conducts reviews of the legal and operational arrangements jurisdictions have in place, before they commence exchanging information. Assistance is given where needed. The Global Forum again reviews the arrangements in place once exchanges are underway, to ensure the requirements are met on an ongoing basis. Due to their confidential nature, the results of these assessments are not published. The Global Forum also has a mechanism to react to breaches of confidentiality or the safeguarding of data.

Reviews of the domestic and international legal frameworks in place: The AEOI Standard requires complete domestic and international legal frameworks to be in place. Domestically, Financial Institutions must be required to conduct the prescribed due diligence and reporting requirements. Internationally, jurisdictions must have a legal basis in place to exchange the information, in the required manner, with all of their Interested Appropriate Partners. The Global Forum therefore conducts peer reviews of the international legal frameworks in place to ensure they are complete and therefore provide a sound basis for the effective operation of the AEOI Standard.

Reviews of the effectiveness of the implementation of the AEOI Standard in practice: In addition to having complete legal frameworks, jurisdictions must ensure that they operate effectively in practice. The Global Forum therefore also reviews each jurisdiction’s implementation of the AEOI Standard in practice, including the frameworks and activities taken to ensure compliance by Financial Institutions and the functioning of the exchanges in practice.

The Global Forum conducts these reviews in stages, mirroring the timings of the implementation process. This ensures that issues are identified early, supporting the effectiveness of the AEOI Standard even during the implementation process. Further details on the staging of the various reviews (the “Staged Approach”) are available in Annex A.

Further details in relation to the assessment of confidentiality and data safeguards can be found in the Confidentiality and Information Security Management Toolkit.1 With respect to the other reviews, further details on their scope, the process and the outputs can be found below.

A key early step in the implementation process is putting in place complete legal frameworks that are in accordance with the AEOI Standard and the commitments made. The Global Forum therefore reviews the frameworks in place early in the implementation process to allow any issues to be promptly addressed.

What is reviewed

The AEOI Terms of Reference group the requirements with respect to the legal frameworks into two Core Requirements. These are set out below:

Core Requirement 1: Jurisdictions should have a domestic legislative framework in place that requires all Reporting Financial Institutions to conduct the due diligence and reporting procedures in the AEOI Standard, and that provides for the effective implementation of the AEOI Standard as set out therein.

Core Requirement 2: Jurisdictions should have exchange relationships in effect with all Interested Appropriate Partners as committed to and that provide for the exchange of information in accordance with the Model CAA.

Each Core Requirement is split into detailed Sub-Requirements, which are contained in Annex C.

How it is reviewed

For each of the review processes in relation to the AEOI legal frameworks, the following steps are conducted:

The Global Forum Secretariat conducts an initial in-depth analysis of the legal texts and drafts proposed recommendations where issues are identified.

The analysis and draft recommendations are sent to all AEOI Peers2 for input, which is included as appropriate.

The analysis and proposed recommendations are sent to the AEOI Peer Review Group (APRG) for approval.

The approved analysis and recommendations are submitted to all AEOI Peers for adoption.

Details specific to each peer review process of the legal frameworks are set out below.

Peer reviews in relation to Core Requirement 1

Core Requirement 1 in the AEOI Terms of Reference refer to the detailed due diligence and reporting procedures that Financial Institutions must follow. These are standardised procedures to ensure that Financial Institutions report the correct information on Financial Accounts and their Account Holders to the tax authority in a uniform manner. It is therefore crucial that each jurisdiction properly reflects these requirements in its domestic legislative framework. The specific elements reviewed are as follows:

The due diligence and reporting rules: This involves a review of how each jurisdiction has: (i) defined the scope of Reporting Financial Institutions, (ii) defined the scope of the Financial Accounts that must be reviewed, (iii) implemented the detailed due diligence procedures that must be applied to identify Reportable Accounts, and (iv) defined the information that must be reported. If a jurisdiction relies on non-AEOI legislation that defines “beneficial owners” in order to identify Controlling Persons with respect to the AEOI Standard, this is also reviewed.

Jurisdiction-specific Non-Reporting Financial Institutions and Excluded Accounts: This consists of a specific review of each entry to ensure that the Non-Reporting Financial Institutions and Excluded Accounts provided for by each jurisdiction meet the requirements of the AEOI Standard and pose a low-risk of use for tax evasion purposes.

The framework to enforce the requirements: This includes, amongst other aspects, a review of the provisions that jurisdictions have in place to: (i) prevent the circumvention of the AEOI Standard, (ii) to require Reporting Financial Institutions to maintain appropriate records; and (iii) to enforce the requirements and address non-compliance. Where the provisions relied upon are included in non-AEOI legal frameworks, these are also reviewed to the extent they are relevant for the implementation of the requirements of the AEOI Standard.

Peer reviews in relation to Core Requirement 2

Core Requirement 2 in the AEOI Terms of Reference contains requirements with respect to both the contents of the international agreements used to exchange the information and the scope of the networks of exchange relationships. These requirements are therefore also essential to ensure the effective operation of the AEOI Standard, based on a level playing field. The particular processes conducted are as follows:

The contents of the exchange agreements: The contents of the exchange agreements put in place are reviewed to ensure their provisions are in accordance with the requirements.

Ensuring exchange networks are complete: It is ensured that each jurisdiction’s exchange network includes all of its Interested Appropriate Partners (i.e. the jurisdictions interested in receiving information from a jurisdiction and that meet the expected standards in relation to confidentiality and data safeguards). The process includes facilitating jurisdictions in putting agreements in place, which can be escalated into a peer review mechanism that jurisdictions can trigger if they become concerned about delays with respect to the putting in place of a particular agreement.

Having complete legal frameworks is not sufficient to ensure that the AEOI Standard is effective and delivers the potential benefits it has to offer. It must also be ensured that the requirements are being implemented effectively in practice. The Global Forum therefore carries out initial peer reviews, early in the implementation process, to assess the effectiveness in practice of each jurisdiction’s implementation of the AEOI Standard.

What is reviewed

Similarly to the legal frameworks, the AEOI Terms of Reference group the requirements with respect to effectiveness in practice into the same two Core Requirements. These are set out below:

Core Requirement 1: Jurisdictions should ensure that in practice Reporting Financial Institutions correctly implement the due diligence and reporting procedures, which includes a requirement for jurisdictions to have in place an administrative framework to ensure the effective implementation of the AEOI Standard.

Core Requirement 2: Jurisdictions should exchange the information effectively in practice, in a timely manner, including by sorting, preparing, validating and transmitting it in accordance with the AEOI Standard.

Each Core Requirement is again split into detailed Sub-Requirements, as set out in Annex C.

How it is reviewed

For the initial reviews of effectiveness in practice, the following procedures are followed:

Each jurisdiction provides a detailed description of the operational frameworks they have implemented to ensure the effective implementation of the AEOI Standard by Financial Institutions, including information on the strategy adopted and details of the compliance activities undertaken, the outcomes achieved and any follow-up actions undertaken.

All AEOI Peers are also invited to provide detailed input in relation to their experiences of the exchanges in practice with each of their exchange partners, including the timeliness and technical aspects, as well as any issues experienced when trying to utilise the information received. Input is also provided on the level of co-operation experienced with each exchange partner when looking to address any such issues that arise.

The AEOI Assessment Panel, comprised of 13 experts from AEOI Peer jurisdictions, conducts a desk-based exercise to analyse the information provided and other relevant information, such as that found in the public domain. It follows up with each jurisdiction and its exchange partners with respect to any omissions or uncertainties. Once a complete view of the situation is established, the AEOI Assessment Panel finalises its analysis and prepares a short report on each jurisdiction.

The reports are provided to each jurisdiction for comment before they are submitted to the APRG for discussion and approval. They are then sent to all AEOI Peers for adoption.

Statistics in relation to the operational activities to ensure compliance domestically and in relation to the various aspects of the exchanges in practice play an important role in the assessment, including through benchmarking certain key areas across all jurisdictions. In this regard, it should be noted that the statistics used are based on the disclosure and interpretation of each jurisdiction. Therefore, especially with respect to certain aspects of the domestic compliance frameworks, the statistics are shaped by the framework implemented by individual jurisdictions and may therefore not always be directly comparable. They are nevertheless useful indicators when considered alongside the other information available and have been collected in both 2021 and 2022.

The first draft reports were produced during 2021, following the process set out above, after which the process was repeated to produce the final reports in 2022. The detailed results of these initial peer reviews are included in this report for the first time.

Details specific to each part of the peer review process in relation to effectiveness in practice are set out below.

Peer reviews in relation to Core Requirement 1

The AEOI Terms of Reference refer to jurisdictions ensuring that, in practice, Reporting Financial Institutions are effectively implementing the detailed due diligence and reporting procedures specified in the AEOI Standard. Various specific elements in relation to the required framework are set out, such as various components of the administrative compliance framework that must be put in place, some of which are referred to below.

Having an effective administrative framework to ensure compliance: Various components of each jurisdiction’s compliance framework are assessed in detail. Each jurisdiction is therefore asked for details of, amongst other things: (i) the compliance strategy it has in place, including whether it is based on a risk assessment specific to their jurisdiction and that takes into account a range of relevant and information sources, (ii) the procedures the jurisdiction has to ensure that Reporting Financial Institutions are reporting information as required, including to identify incorrect non-reporting and to follow-up to ensure compliance, (iii) the verification procedures implemented to ensure that the information being reported is complete and accurate, including analysis of the information reported, detail of the desk-based and onsite reviews conducted, and (iv) the enforcement activities carried out, including the application of penalties as appropriate. A jurisdiction’s exchange partners are also asked for any issues with respect to compliance by Financial Institutions that they might have identified when using the data received.

International collaboration to ensure effectiveness: There are provisions in the AEOI Standard for collaboration between exchange partners to address errors or non-compliance by Reporting Financial Institutions identified by exchange partners. Feedback is therefore also obtained from each jurisdiction’s exchange partners on how effective the cooperation has been in practice.

Where deficiencies or areas for improvement are identified, recommendations are made.

Peer reviews in relation to Core Requirement 2

The AEOI Terms of Reference also contain requirements in relation to the processing of the information reported by Reporting Financial Institutions and its subsequent transmission to exchange partners. Some of the key elements are below.

Preparing and validating the information: Once reported by Reporting Financial Institutions, the information must be sorted, prepared and validated in accordance with the technical requirements set out in the AEOI Standard (e.g. the Common Reporting Standard User Guide and XML Schema). Each jurisdiction’s exchange partners are therefore asked about any errors that might have been experienced when trying to utilise the information received. The causes of the issues are identified, including to establish whether there are deficiencies in the sending jurisdiction’s systems to process the information reported.

Using secure channels to exchange the information: It is of vital importance that the information is kept safe while it is being transmitted. This is ensured through the use of the CTS which utilises industry leading security standards and which is used by all jurisdictions. This requirement has therefore always been found to be met in practice.

Timeliness in the exchanges and follow-up: The timeliness of the exchanges is also reviewed, including the timeliness of any response to follow-up from a jurisdictions’ partners and the provision of additional or amended information as necessary. Again, feedback on these issues is obtained from each jurisdiction’s exchange partners.

Where deficiencies or areas for improvement are identified, recommendations are made.

Once the analysis has been completed, the AEOI Assessment Panel prepares draft reports on each jurisdiction. These include the general context, the analysis and findings and conclusions and recommendations. The reports have a section on the AEOI legal frameworks, along with determinations on the extent to which each jurisdiction has the legal frameworks in place, and a section on the initial reviews in relation to effectiveness in practice, including ratings on whether the jurisdiction appears to be on track. Further details in relation to the determinations and ratings are set out below.

The draft reports are shared with the jurisdictions for comments before being submitted to the APRG for approval and AEOI Peers for adoption before publication. This report contains the reports as adopted by AEOI Peers.

Determinations on the AEOI legal frameworks

The determinations on the AEOI legal frameworks are made with respect to each Core Requirement overall. They are either: “In Place”, “In Place But Needs Improvement” or “Not In Place”, with the determination for each Core Requirement and the overall determination taking into account all relevant factors (i.e. it is not a mechanical exercise). Further details on how to interpret each of these determinations, along with an indication of the relevant considerations, are set out in Table 2.1 below.

Ratings following the initial reviews of effectiveness in practice

The ratings issued following the initial review of the effectiveness in practice of AEOI implementation are also made with respect to each Core Requirement and overall. They are either: “On Track”, “Partially Compliant” or “Non-Compliant”, with the rating for each Core Requirement and the overall rating taking into account all relevant factors (i.e. it is not a mechanical exercise). The terminology for the ratings reflects the fact that these are initial reviews and that the frameworks to ensure effectiveness in practice are not yet fully mature. For these reasons the effectiveness ratings are issued separately to the determinations with respect to the AEOI legal frameworks (which are relatively mature), although legal gaps with a direct influence on the framework to ensure the effective implementation of the requirements by Financial Institutions are taken into account. Further details on how to interpret each of these ratings, along with an indication of the relevant considerations, are set out in Table 2.2 below.

A summary of the determinations and ratings can be found in Table 2.3. Before that, a horizontal summary of the progress made and the key issues identified is provided.

With respect to the AEOI legal frameworks, compliance is high and improving

The results

The AEOI legal frameworks are generally complete, with a high level of compliance identified. Furthermore, any remaining issues continue to be addressed. Since the publication of last year’s AEOI peer review report, 15 jurisdictions have requested a reassessment of their legal framework to reflect the actions that they have taken to address the recommendations made. Consequently a further 85 recommendations have been addressed. This means that, to date, 74 jurisdictions have brought amendments into effect to address the recommendations made, resulting in 584 recommendations being addressed in total. This includes 105 jurisdiction-specific exclusions being removed as they were found to insufficiently meet the requirements.

As a result of the reassessments conducted during 2022, one jurisdiction (Sint Maarten) achieved an upgrade of its determinations in relation to CR1 and its overall determination from “Not In Place” to “In Place But Needs Improvement”. Its determination in relation to CR2 was upgraded from “Not In Place” to “In Place”. Furthermore, six jurisdictions (the British Virgin Islands, the Faroe Islands, Germany, Mexico, Monaco and the Netherlands) achieved an upgrade both to their determination in relation to CR1 and their overall determination, from “In Place But Needs Improvement” to “In Place”. Finally, three jurisdictions (Grenada, Macau (China) and Romania) achieved an upgrade in their determinations, in relation to CR1 and their overall determination, from “Not In Place” to “In Place”. These amendments are reflected in this report. The remaining jurisdictions successfully addressed some recommendations, although the determinations remained unchanged (Argentina, Barbados, Costa Rica, Hungary and Uruguay).

This report also includes new reviews in relation to four jurisdictions that committed to commence exchanges from 2020 (New Caledonia, Nigeria, Oman and Peru), all of which received a determination of “In Place” for CR2 and three of which received a determination of “In Place But Needs Improvement” for CR1 (Nigeria, Oman and Peru) and one of which received a determination of “In Place” for CR1 (New Caledonia). Their determinations for CR1 were also mirrored in their overall determinations.

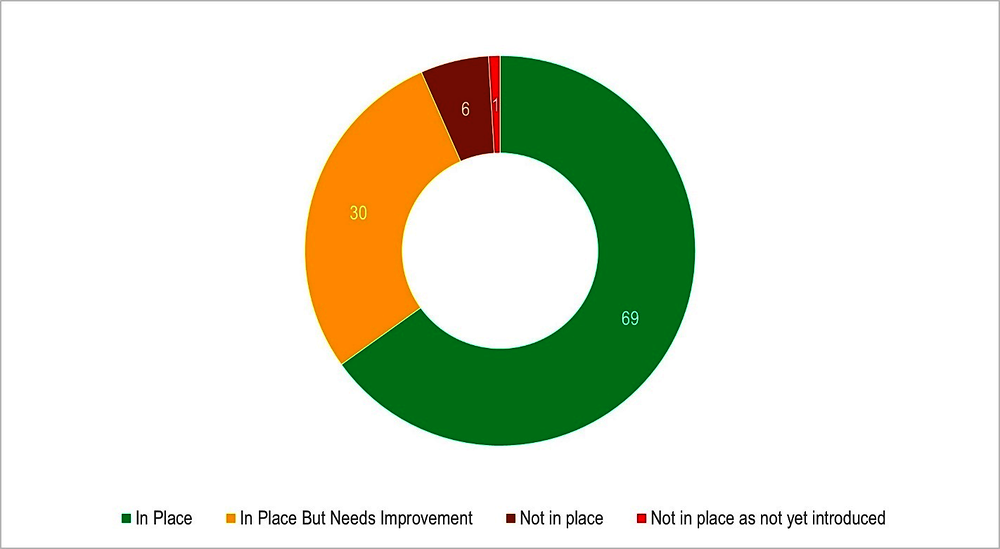

Overall, therefore, there continues to be a very high level of compliance in relation to the legal frameworks put in place to implement the AEOI Standard. Of the over 100 jurisdictions committed to commencing exchanges by 2020, virtually all of them (105, or 99% have an international legal framework that is fully in accordance with the AEOI Terms of Reference. The Global Forum has therefore issued them with a determination of “In Place” for CR2. Furthermore, the majority of jurisdictions (69, or 65%) have domestic legislative frameworks that are also fully in accordance with the AEOI Terms of Reference. The Global Forum has therefore issued these jurisdictions with a determination of “In Place” for CR1. 69, or 65% jurisdictions therefore received an overall determination of “In Place”.

By far the next largest group of jurisdictions 30 (or 28%) are those for which the Global Forum issued a determination of “In Place” for CR2 and “In Place But Needs Improvement” for CR1. Their peer review reports include one or more recommendations to amend their domestic legislative framework in order for it to be fully consistent with the AEOI Terms of Reference. Consequently, 30 (or 28%) jurisdictions received an overall determination of “In Place But Needs Improvement”. In total, 99 (or 93%) of the jurisdictions now have domestic and international legal frameworks that are fully or substantially in place, up from 89% in 2021. This demonstrates a generally high level of compliance with the Terms of Reference.

Following the actions taken, 93% of the jurisdictions have now been determined to have domestic and international legal frameworks that are fully or substantially in accordance with the AEOI Terms of Reference

Of the remaining jurisdictions, six have implemented a domestic legislative framework which contains many of the requirements, but that includes significant deficiencies. The remaining one jurisdiction (Trinidad and Tobago) has not yet implemented a domestic legal framework. Seven jurisdictions have therefore received an overall determination of “Not In Place”. Figure 2.1 summarises the distribution of the peer review results.

Common issues identified

While there remains a generally high level of compliance with the requirements, there are some commonalities in relation to the issues where recommendations remain. They most commonly relate to the following:

The largest category of remaining recommendations are jurisdiction-specific Non-Reporting Financial Institutions and Excluded Accounts that are not in accordance with to the requirements of the AEOI Standard.

Perhaps of even greater significance is the next largest category of recommendations, which relate to issues found with respect to the legislative provisions to enforce the requirements. This includes gaps in the powers to address avoidance of the due diligence and reporting requirements, the ability to impose sanctions on Account Holders and Controlling Persons for submitting false self-certifications and having record-keeping obligations that cover the full scope of the records required to be kept under the AEOI Standard. Their significance is reflected by the fact that all of the jurisdictions with legal frameworks that have been determined to be “Not In Place” have multiple recommendations with respect to their enforcement frameworks.

Several more specific recommendations have also been made in cases where jurisdictions have summarised the detailed definitions in the AEOI Standard with the omission of relevant details that are needed to ensure their full and proper operation.

The Global Forum continues to work with the jurisdictions concerned to assist them in addressing the issues where recommendations have been made. It is also developing processes to continue to monitor the implementation of the AEOI Standard in relation to these issues, as well as to obtain a deeper level of assurance with respect to the implementation of the AEOI Standard in practice (see Next steps below).

With respect to the effectiveness in practice of AEOI, the situation is generally progressing in line with expectations, but it must remain a key area of focus

This report contains, for the first time, the initial analysis, conclusions and ratings in relation to the effectiveness in practice of the implementation of the AEOI Standard for 99 jurisdictions that committed to commence exchanges in 2017 or 2018.

The results

As mentioned previously, the results in this report are from the initial reviews, conducted in parallel to the implementation of the AEOI Standard by jurisdictions. Significant advancements therefore continue to be made. Overall, the picture is a positive one with a large majority of jurisdictions being found to be on track with their implementation. Furthermore, where issues have been identified (including during the review process, which included draft assessments in 2021, that were finalised in 2022), in the majority of cases they have been promptly addressed.

As a consequence, at the present time almost two thirds (65 or, 66%) of the jurisdictions that committed to commence exchanges in 2017 or 2018 have been rated as “On Track” with respect to their frameworks and activities to ensure the effectiveness of the AEOI Standard in practice. They have therefore been found to have developed complete administrative compliance frameworks to ensure that Financial Institutions effectively implement their due diligence and reporting obligations, which they are also implementing, and they are successfully conducting the exchanges in practice, addressing any issues as they emerge. A further 15 of jurisdictions have been found to have credible frameworks and plans in place and are generally successfully exchanging the information in accordance with the technical requirements but need to further implement their plans. These jurisdictions have therefore been rated as “Partially Compliant”. It is expected that the implementation in many of these jurisdictions will generally become much more mature in the near future, based on the plans they have in place. Finally, 19 jurisdictions have been found to have fundamental deficiencies in their frameworks (i.e. they are not yet fully developed) and have therefore been found to be “Non-Compliant”, five of which are constrained due to their lack of enforcement powers in their legislative frameworks. So, while the exchanges are taking place each year, they do not yet have complete operational frameworks to verify that Financial Institutions are effectively complying with all of the due diligence and reporting requirements.

More generally, the rate of improvement and the increasing maturity in implementation continues at pace. Over the last two years around three-quarters of jurisdictions have seen improvements in their ability to match the information received based on the increase in quality of the information being sent, a similar number have seen improvements in the collection of Tax Identification Numbers, as well as reductions in the numbers of undocumented accounts reported. Furthermore, the rate of the collection and exchange of dates of birth is close to 100%. As regards the exchanges themselves, delays in the exchanges are relatively rare and two-thirds of jurisdiction showed improvements in the preparation of the files, resulting in fewer rejections being experienced.

Figure 2.2 summarises the distribution of the peer review results.

Common issues identified

While around two thirds of jurisdictions were found to be “On Track” with their implementation, amongst the other jurisdictions, several common issues were identified.

The most significant issues identified relate to jurisdictions that have been delayed in putting in place a complete and credible operational plan to ensure compliance with the requirements by Financial Institutions. In many cases some activities had been conducted to ensure all Financial Institutions are reporting information (e.g. by cross checking relevant lists of regulated entities), but there has been limited activities to ensure that the information being reported is complete and accurate. In general, these jurisdictions understood the deficiencies identified and seemed intent on addressing them. In general, it is therefore not expected that these issues will persist, although jurisdictions with constraints in their legal frameworks to enforce the requirements will generally take longer.

In terms of less severe issues, there is another group of jurisdictions that have credible plans in place but that have only very recently started implementing them. For example, the level of checks to ensure that the information being reported is complete and accurate might not yet be very mature, such as being limited to analysing the information but not yet carrying out compliance activities in relation to specific Financial Institutions. For these jurisdictions, as they already have credible plans in place, it is expected they will often quickly show improvements.

With respect to the exchanges in practice, the level of implementation has been very high and improving. The issues identified often related to the transition to the new version of the Common Reporting Standard Schema that occurred during 2021. Jurisdictions have nevertheless generally been proactive in looking to resolve issues where they emerge.

Jurisdiction-specific conclusions

Table 2.3 contains a summary of the determinations made with respect to legal frameworks introduced by each jurisdiction to implement the AEOI Standard and the ratings made following the initial review of the effectiveness of their implementation in practice. Further details on the analysis and reasons for the determinations for each jurisdiction can be found in Chapter 3.

Next steps

The methodology and timeline for the initial peer reviews in relation to the effectiveness in practice of the implementation of the AEOI Standard was designed to allow issues to be identified early, even during the implementation process. This recognised that the operation of the AEOI Standard was not yet fully mature.

Therefore, having completed the initial reviews in relation to the effectiveness in practice of the implementation of the AEOI Standard, the Global Forum is already developing its approach to its future reviews. In this regard it is expected that a deeper level of assurance would be sought as to the effectiveness in practice of the implementation of the AEOI Standard, including strengthened expectations and deeper verification methods, particularly in relation to ensuring the effective implementation of the requirements by Financial Institutions.

Notes

← 1. OECD (2020), Confidentiality and Information Security Management Toolkit, www.oecd.org/tax/transparency/documents/confidentiality-ism-toolkit_en.pdf.

← 2. All jurisdictions committed to implementing the AEOI Standard and that have passed domestic legislation to that effect.

A peer review group of the Global Forum consisting of 33 members which replaced the former AEOI Group (www.oecd.org/tax/transparency/documents/aprg-members.pdf).