4. From protest to participation

This chapter explains how developing countries can build back better from the COVID-19 pandemic through approaches that simultaneously improve development outcomes and strengthen social cohesion. It demonstrates that by harnessing the trust, networks and know-how that constitute social capital and by promoting broad-based participation, countries can escape the traps of low productivity, weak institutions and social vulnerability that not only constrain development but are also key factors behind discontent. The chapter explains that these approaches need to be held together by national development strategies and rely on more experimental approaches to public administration. It concludes by recognising the constraints such approaches will face in the post-pandemic world, notably the weakened state of public finances and higher inequality.

There is no end which the human will despairs of attaining through the combined power of individuals united into a society. (Tocqueville, 1960 [1835][1])

The coronavirus (COVID-19) pandemic is not yet over but there are already widespread calls for countries to “build back better” to meet the challenges they face today and will confront in the future. This chapter explores how this ambition can be realised at a moment when societies are so divided and capacity for collective action so weak. It argues that the project of building back better not only requires effective and widely-supported policies but also demands transformation of the institutional relationships between state, society, the economy and the environment. Indeed, it is not possible to separate one set of tasks from the other: only by identifying new approaches that engage and empower a broad range of citizens is it possible to formulate and implement an appropriate response to these challenges.

This chapter demonstrates how fostering engagement horizontally (across society) and vertically (between society and the state) can address the causes of discontent identified in this report. In so doing, it charts a way out of the development traps of low productivity, weak institutions and social vulnerability through approaches that emphasise the role of citizen participation. The chapter then sets out the importance of devising a collective vision for the future in which everyone can see their role and their route to a better life. It concludes by acknowledging some of the challenges that might impede these approaches, particularly in terms of financing.

The chapter affirms that promoting voice and agency among citizens is essential for reducing inequality and driving development. It envisages approaches to build back better from the ground up but contends this can only be achieved with appropriate and coordinated support across different levels of government. While the mechanisms outlined in this chapter seek to enhance well-being across all dimensions, they place particular emphasis on individuals’ social connections, civil engagement, knowledge and skills.

The first step in locating and strengthening society’s role in the development process is to set aside models predicated on individual economic agents in favour of paradigms that reflect the collective and plural nature of civil society. This entails a shift away from the narrow utilitarianism of Arrow (1951[2]) towards the multi-dimensional empowerment of Sen (1970[3]), whereby economic freedom is meaningless if not accompanied by social and political freedom. This section examines institutional and cultural factors behind development and how these interact to drive transformation. It then explores the concept of social capital as a means of capturing these dynamic interactions and as a basis for a stylised representation of the bonds that connect society and the state.

The simultaneous evolution of culture and institutions

As defined by North, institutions are “humanly devised constraints that structure political, economic and social interaction”, and which can be either formal or informal (1991[4]). “History … is largely a story of institutional evolution in which the historical performance of economies can only be understood as a part of a sequential story. Institutions provide the incentive structure of an economy; as that structure evolves, it shapes the direction of economic change towards growth, stagnation, or decline.”

Acemoglu, Johnson and Robinson explain why economic institutions are such an important factor in determining a society’s development trajectory (2004[5]). They also recognise how the distribution of political power (both de jure and de facto) shapes the evolution of these institutions, reflecting the key role that political institutions play in economic development. They note how the distribution of resources within a society determines the design of political institutions, which raises the question of reverse causality, whereby economic growth affects the development of institutions. Of particular relevance to this report are the lessons they draw from how elites across history have voluntarily ceded some of their power – often to prevent unrest becoming revolution – by creating more inclusive political and economic institutions.

Culture, meanwhile, is a concept with a multitude of definitions not only across various sciences but also within them, reflecting the contestation around the term. A broad definition therefore seems judicious; the report characterises culture as a set of shared attitudes, values, goals and practices that depends on the capacity for learning and transmitting knowledge. Consistent with such a broad definition, culture can affect economic performance through many channels. For example, Weber, in one of the most influential studies of this phenomenon, examines the impact of religion on attitudes towards economic activity (1930 [1905][6]). Another channel is individuals’ propensity (or lack thereof) to trust and support each other and to share resources in addressing collective challenges.

Culture is also central to the framework laid out by Habermas, according to which the evolution of societies is driven by people’s capacity for rational communication, which in turn is fostered by a vibrant public sphere that encourages universal participation in all facets of social life (1981[7]). Amin and Thrift (2004[8]), meanwhile, demonstrate that culture and economy have become inseparable, a point implicitly acknowledged by Bourdieu (1984[9]), who argues that people’s social position and quality of life is determined by their economic, social and cultural capital (Pinxten and Lievens, 2014[10]).

As set out by Bisin and Verdier, institutions and culture are likely to interact and evolve together in fostering the co-operation on which development – and social cohesion – depend (2017[11]). Henrich explains how the cultural and institutional evolution of Western, educated, industrialised, rich and democratic (WEIRD) societies has produced a population that, in psychological terms, is an outlier from the rest of the global population across a number of variables, including individualistic tendencies, morality, capacity for co-operation and style of reasoning (2020[12]). It is possible or even likely that economic or social models that emerge from a WEIRD context will not function elsewhere. Meanwhile, advanced societies that were colonised by European powers in the middle centuries of the last millennium typically suffered a “Reversal of Fortune”, whereby their prosperity diminished significantly once a new set of institutions was imposed on it (Acemoglu, Johnson and Robinson, 2004[5]). For many of these countries, the imposition of economic and political institutions from outside has not stopped with decolonisation, as Chapter 5 discusses.

The relationship between culture and institutions might not always be straightforward. Where generalised trust does not exist in a society, strong institutions might emerge as essential mechanisms to ensure co-operation (Cook, Hardin and Levi, 2005[13]). Nor are the outcomes always positive. However, combining institutions and culture dynamically through the concept of social capital opens a space for elements such as political power and shared values into apparently intractable collective action problems – the vicious cycles (or development traps) – in ways not available to more technical approaches, where such elements are taken as given. Broadening the analytical framework opens up a larger set of possible mechanisms for resolving these issues.

Social capital and the dynamics of social cohesion

Social capital is a cultural phenomenon with important institutional implications and is thus a useful mechanism for articulating the co-evolution of both. The concept of social capital and its application to development economics gained substantially in popularity during the 1990s. While challenges related to definition and measurement have since constrained its evolution, its importance is all too apparent in a world where atomisation and polarisation of societies are hindering collective action. This chapter argues that social capital is fundamental to social cohesion and should be regarded both as a key input and valuable outcome of public policies.

Woolcock and Narayan define social capital as “the norms and networks that enable people to act collectively” (2000[14]). The transformative potential of social capital is possessed by individuals and groups and covers all spheres of life, including social, economic and political. It fosters the tendency to trust both within and between groups, and between civil society and the state. As Fukuyama puts it, “[an] abundant stock of social capital is presumably what produces a dense civil society, which in turn has been almost universally seen as a necessary condition for modern liberal democracy” (1999[15]).

Social capital has the potential to address the two main sources of discontent. As mentioned in Chapter 3, it underpins the relationships that support individuals trying to make their way in modern society and the networks of trust, reciprocity and interdependence that hold societies together. At the same time, numerous studies have shown that social capital is essential for achieving broad-based and sustained improvements in living standards (World Bank, 2001[16]). Although typically omitted from standard economic models, social capital generates the intangible phenomena that underpin development: the trust, relationships, co-operation, organisational skills and know-how essential for problem solving, innovation and expansion. As Dasgupta and Serageldin state, “social capital…draws our attention to those particular institutions serving economic life that might otherwise go unnoted” (1999[17]).

There are important qualifications to make about social capital, starting with inevitable issues of definition and measurement for what is an abstract concept. Trust, participation, and strength of civic institutions often feature in attempts to quantify social capital but there lacks an empirical consensus. Indeed, some argue that the very term “capital” is inaccurate. Even if there were a specific measure, it is impossible to define an appropriate time frame for analysis: social capital evolves as societies evolve.

Social capital can also empower groups that do considerable harm: criminal gangs and the perpetrators of ethnic violence might possess strong social capital (ERIC, IDESO, IDIES, IUDOP, 2004[18]), (Colletta and Cullen, 2000[19]). While some have argued that social capital is a public good, others see it as a mechanism for exclusion: Bourdieu explains how it allows upper social classes to retain their status (1980[20]). Putnam has been criticised for linking the deterioration of democracy in the United States to a decline in social capital due to its focus on the individual (1995[21]). This places the onus on individuals to develop their own social capital by joining an association or becoming more active in the community; the state’s responsibility to reduce economic and social inequality implicitly falls away (Ferragina and Arrigoni, 2017[22]). Another concern is that the term implies a rivalrous relationship with the state, suggesting that its reach into private relations jeopardises – or might be resisted by – the natural functioning of society.

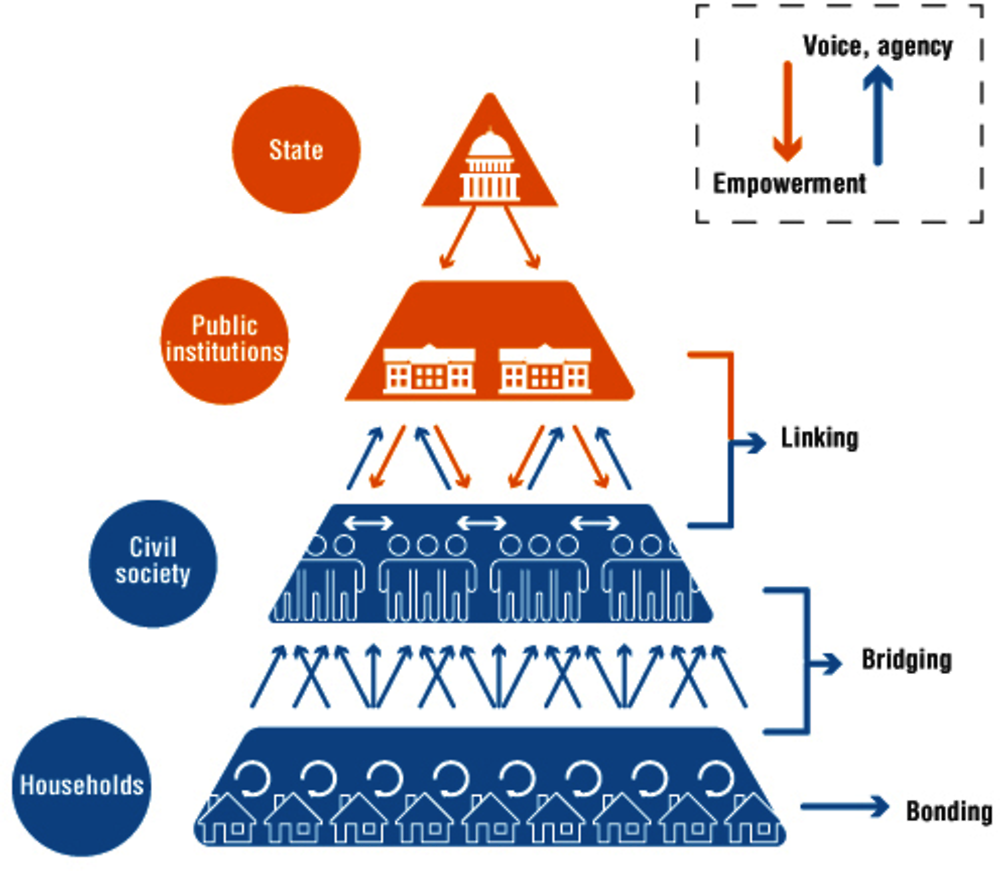

This chapter employs the framework described by the World Bank, according to which social capital can be bonding, bridging or linking (2001[16]). Bonding capital captures an individual’s close ties with their immediate network of family or local community, while bridging capital brings an individual (or group) into contact with other groups. They are thus brought into civil society: associational life predicated on active engagement across a plurality of shared interests that forms the “third sector” of society, distinct from big business and the state. Linking capital allows civil society to interact with power as articulated by the state.

Interactions at the meso level are particularly important for addressing discontent and are thus of central concern to this report. Secondary institutions serve as interlocutors between the individual and the state, allowing the grievances of a particular constituency to be expressed to an institution empowered to address them. Where these interlocutors interact regularly with the state, sudden outbursts of discontent are less likely to occur, and there is greater likelihood of addressing the more structural causes of discontent.

The state has a critical role to play in fostering and harnessing social capital. As Woolcock and Narayan contend, “[the] state is the actor best able to facilitate enduring alliances across the boundaries of class, ethnicity, race, gender, politics, and religion” (2000[14]). This chapter explains how these alliances can be mobilised through participatory processes to strengthen governance, vitalise political processes and generate innovation in public and private spheres. Such processes address the decline in institutional trust identified this report by facilitating productive interactions between state and civil society and by improving development outcomes.

These forms of social capital are represented in Figure 4.1, a simple pyramidal representation of society and state that captures the micro, meso and macro levels on which social capital operates and the various flows of social capital. These levels are not exclusive: at a basic level, an individual might be part of a household, fulfil an active role in civil society and be employed by a public institution. Nonetheless, this stylised model, on which this chapter builds, demonstrates the role each level plays in social, economic and political life, and the mechanics of inclusion and exclusion. The upward arrows from bridging and linking social capital convey agency and voice; the downward arrows from public institutions indicate the capacity of the state to empower. Sideways arrows between institutions demonstrate co-operation. It should be noted, however, that the pyramid could be rotated to reflect that the state’s power ultimately flows from its citizens, as per Rousseau (1762[23]).

The size of the uppermost pyramid – the state – can vary, although it does not do so in this chapter. Such variation would depict the amount of space in which civil society can operate rather than ‘the size of government’ in an economic sense. A large state may be understood as constraining the space available to civil society by restricting freedom of association, peaceful assembly and expression – elements often linked to the health of a democracy itself, as discussed in Chapter 2. CIVICUS reports that the space for civil society had been narrowing in many countries in recent years and that this trend accelerated during the COVID-19 pandemic (2020[24]). However, it also finds that 2019 was a year of extensive civil society mobilisation across the world around a number of national and global challenges, which was able to achieve real change.

Individual households and small communities within a society along the bottom of the triangle (usually) possess bonding capital. Bridging capital allows individuals from these units to interact with secondary institutions – a highly diverse array of larger groups ranging from small firms and labour unions to churches and sport clubs. Individuals can belong to any number of associations, and these associations can interact with each other to create the “dense network” mentioned above. Above the secondary institutions are public institutions, such as the board of education that interacts with a parent-teacher association or the chamber of commerce that works with local businesses. These are examples of complementary linking, as shown by the arrows running in both directions. The importance of horizontal as well as vertical flows within this model requires a broad understanding of the social contract (Box 4.1).

The stylised depiction of society in Figure 4.1, with its interrelations, mutual dependencies and complex reciprocities between society and the state and between members of society themselves, evokes the concept of the social contract. Instances of discontent are often characterised as a vertical rupture of the social contract, a form of rebellion by one or more parts of society against a state that is perceived as failing in its obligations. As this chapter makes clear, the social contract is more complex than that.

In the 2012 edition of Perspectives on Global Development, the Organisation for Economic Co-operation and Development (OECD) explored the role of the social contract in development with reference to the relationship between citizens and the state (2011[25]). This report uses the concept of social capital to expand the paradigm in four ways, to make the case that the role of the state is not so much to fix society’s problems as to partner with society to devise solutions.

First, it emphasises the importance of intermediaries between the state and citizens in maintaining the social contract. This reflects the fact that a citizen’s attitude towards the state is influenced on a daily basis by their local-level interactions with public institutions. Moreover, it acknowledges the importance of the collective: that the report contends that citizens gain a voice not as individuals but as part of a civil society that represents their interests, promotes reciprocity and generates feelings of solidarity.

Second, the chapter places an emphasis on horizontal linkages as well as vertical. The bonds of recognition, reciprocity and mutual empowerment are not confined to state-society relations but also exist between citizens, institutions and places in civil society. Although its specific articulation will differ greatly from place to place and culture to culture, the social contract is defined both by the state’s obligations to society (and vice-versa) and by citizens’ obligations to each other (Shafik, 2021[26]). Trust between people is thus as important to the social contract as trust in government.

Third, this chapter recognises that a social contract is often based on a political settlement articulated in a written constitution, which codifies the rights of citizens and the obligations of the state to those citizens. The chapter contends that a national development strategy complements a constitution by locating each citizen within this project, supporting the realisation of socioeconomic rights enshrined therein and fostering ongoing deliberations about this strategy.

Last, the approaches outlined in this chapter imply that civil society and the state share responsibility for safeguarding societal well-being. The constitutions of a number of countries codify the duties a citizen must fulfil, as does Article 29 of the Universal Declaration of Human Rights: “[everyone] has duties to the community in which alone the free and full development of his personality is possible” (UN, 1948[27]). However, these duties are usually confined to obeying laws, paying taxes and defence of a country (UN, 2018[28]). This report asks citizens to engage more actively in the project of building more inclusive and prosperous societies but recognises the need for governments to support their efforts.

Introducing a stylised model of the economy, state and civil society

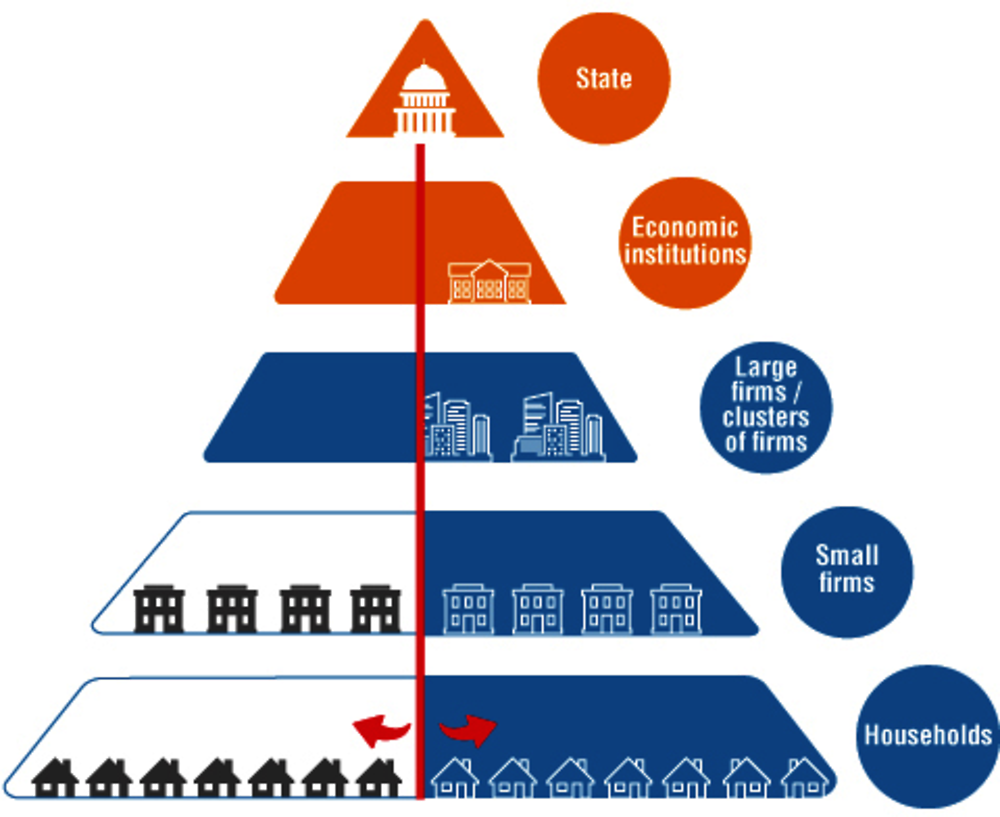

This chapter uses the stylised societal framework introduced in the previous section to address the challenges outlined in Chapters 2 and 3. To do so, the framework first adds an additional layer of institutions: the large firms, or clusters of firms, that are displayed above the small firms in a stylised version of an economy with full employment (Figure 4.2). Small firms are considered part of civil society, rooted as they are in a community, both spatially and culturally. The larger firms, including multinational enterprises are not; these firms might be expected to cluster in particular locations (normally major cities) and have weak links to a particular community. The representation reflects these differences in proximity to households, which are now ranged along the bottom of the pyramid left to right according to income, with the lowest income households at the far left.

The public institutions depicted in Figure 4.1 are replaced by economic institutions in Figure 4.2. These institutions include the agencies established to promote economic development through the provision of infrastructure, direct support for enterprises, research and development activities or higher education as well as a stable macroeconomic framework and the rights and regulations that govern the conduct of firms. These are “promotive institutions”. Economic institutions also incorporate regulations designed to protect workers and the environment from the potential excesses of economic life, which the chapter terms “protective institutions”. These include laws governing maximum working hours or minimum wages, the freedom to form trade unions and social security systems.

Polanyi considered these promotive and protective institutions as constituting a “double movement” (2001 [1944][29]). Capitalist states facilitate the free functioning of the market economy while responding to the demands of society for protection from the associated adverse social and environmental consequences. In this way, the economy remains embedded within social relations despite pursuing its own logic. When protective institutions weaken, the economy becomes disembedded from society; instead, “social relations are embedded in the economy”, and social institutions are divided into the economic and the political (with the latter unable to affect the former). In an idea with powerful resonance today, Polanyi considered that citizens would find intolerable a situation whereby they are unable to exercise control over the economy while having no choice but to participate in it, even on terms that violate their notions of justice or dignity.

Civil society has a critical role to play both as a counterweight to the state and in protecting the individual from the state. However, civil society is also a locus for contestation and dominance, with its own hierarchy. It contains elites, disaffected middle classes and different factions of the precariat, and it produces political parties of opposing ideologies. These elements are the lifeblood of politics but where political systems are dysfunctional, civil society can be captured by powerful sectoral interests that undermine Polanyi’s second movement.

Gramsci recognised the hierarchies within civil society, which he saw to be both economic-political and cultural and ideational (Brighenti, 2016[30]). In spite of its plurality, he argued that civil society in democratic societies tends to be locked into a set of power relations directed by a specific way of thinking; this tendency not only allows inequality to reproduce itself but also prevents the emergence and adoption of new ideas even when the existing paradigm is increasingly discredited. In this context, an innovative political project gains traction through its currency with people’s everyday realities rather than through a revolution directed at the state. Radical change must be fostered by the democratic institutions within civil society.

Polanyi recognised that economic development is a partnership between public and private institutions (2001 [1944][29]). As this model illustrates, firms would not be able to operate, much less thrive, without the support of public institutions. Virtuous circles of reciprocity can develop between firms and economic institutions. While firms benefit from economic institutions, the institutions (and the state more broadly) benefit from engagement with firms: by monitoring the performance of firms, public institutions gain a better understanding of the economy, which in turn allows them to optimise their involvement in the future. Meanwhile, successful firms generate higher revenues for the government through taxes on their profits.

The links between firms, other secondary institutions and households are critical for embedding the economy. These links are not solely commercial: at an individual level, the status conferred by a certain profession or position might greatly enhance an individual’s standing in the wider community. Labour unions and employee organisations might be highly active in non-professional activities: the exalted Indian Railways cricket team leaps to mind. The links between firms and the community create a space for overview of the economy (at least at a local level) and thus an allocation of responsibility to individual actors for any damage they might inflict on society or the environment.

A key feature of this stylised model is its universality: all firms are in the formal economy and everyone is employed. The economy generates public revenues, which in turn finance further investment in the economy and the provision of high-quality public services. Social security is largely financed through contributions by workers and their employers but sufficient public funds exist to redistribute resources to vulnerable groups outside the labour market through a range of social services. Moreover, a citizenry with extensive social capital generates a dense civil society, which is in close contact with the state, thus strengthening social cohesion and collective action. In the sections that follow, the model illustrates how this virtuous circle breaks down in contexts of social, economic and political fragmentation and polarisation.

This section builds on the stylised model developed in this chapter to address the three development traps mentioned in Chapter 2 related to low productivity, weak public institutions and the vulnerability of citizens. In each case, it outlines approaches that enhance individual well-being across multiple dimensions while improving economic outcomes for society as a whole, at the same time as they foster social cohesion and strengthen the bonds between society and the state.

The productivity trap: Linking traditional and modern firms in industrial districts

Chapter 2 explains the productivity trap facing developing countries in terms of undiversified economies with low levels of productivity and large informal sectors. Many developing economies rely on exports from primary sectors with low levels of sophistication (such as mining or agriculture) and are unable to support the growth of micro, small and medium-sized enterprises (MSMEs), even though these account for the vast majority of firms. In Latin America, for example, MSMEs account for 99.5% of firms (with firms at the micro level alone accounting for 88.4%) and 61.0% of employment but only 24.5% of production (OECD/CAF/ECLAC/EU, 2019[31]).

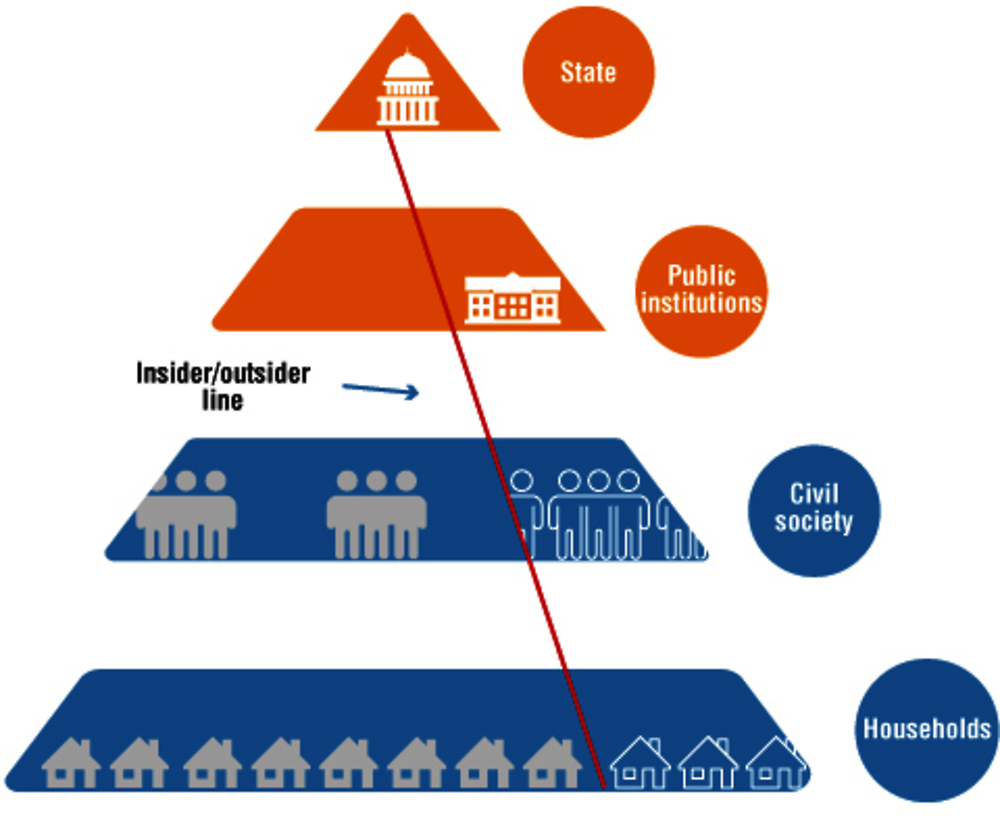

While there are numerous facets to the productivity trap, this chapter focuses on the small size and low productivity of firms. Returning to the stylised model, Figure 4.3 depicts an economy operating some distance from its potential. It introduces a dividing line (henceforth, the “red line”) between what might be considered in crude terms as the modern, productive or efficient part of the economy on the right and the untransformed, unproductive or informal part of the economy on the left. The institutions either side of the red line operate within the same society; there are no cultural or legal impediments to firms or households crossing from one side to the other. However, the differences in the institutional landscape on each side indicate that the firms on the left-hand side are poorly linked to each other and to large firms, and they have little or no role or voice in the productive or formal economy.

In this stylised model, only firms and workers on the right-hand side of the dividing line are covered by promotive and protective institutions. There are no large firms operating in the left-hand triangle, but small firms operate on both sides (and, one assumes, interact in this space). The red line represents the barriers that informal firms (which we expect account for the majority of enterprises on the left-hand side) face in seeking to join the formal sector or to integrate themselves in the value chains of large firms. These barriers might be related to finance, skills or competitiveness, but they might also pertain to the broader economic context. Households working for firms on the left-hand side are shaded in grey on the understanding that their status is closely linked to that of their livelihood.

The red line reflects policy choices that have benefited certain groups at the expense of others or have set the economy on a particular path. These choices might have been made many years ago, notably in the case of former colonies whose economies were engineered to fulfil a particular need for the benefit of a colonial power. This is particularly the case with extractive colonial models (Acemoglu, Johnson and Robinson, 2004[5]). However, the choices might also reflect the power and interests of particular domestic groups that influence policy making today. Most notable in this context are the links between economic development and state formation mentioned earlier: the capitalist state and those who exercise power within this state are often invested in a particular model that grants them financial resources and political control. These structural dynamics hardwire inequality into an economic system and economic policy, and they prevent mechanisms of supply and demand from equalising firms and individuals.

The ranging of households at the bottom of the triangle by income is imperfect. People working in the informal economy can earn large sums of money, while productive firms (small and large) require workers at various income levels, who might be fully covered by protective institutions as a result. However, in aggregate, it seems reasonable to assume that the precariat discussed in Chapter 1, trapped in unproductive activities and highly vulnerable across a number of dimensions, are to the left of the line. This is a source of discontent for them and a waste of human resources for society as a whole.

This divided model recalls the dualist theories of economic development. In broad terms, these distinguish between traditional and modern sectors of a developing economy, as well as between the primary and secondary labour markets associated with these sectors. Many theorists expect that, over time, economic forces, particularly technology, will destroy the traditional sector, leaving in place a homogenised modern economy. Berger and Piore contest this interpretation, demonstrating not only that traditional firms co-exist with modern firms but also that modern firms support the traditional sector (as happens in France and Italy, for example) (1980[32]). Moreover, traditional firms might even be able to expand and thrive.

In explaining this phenomenon, Berger and Piore (1980[32]) and Brusco and Sabel (1981[33]) demonstrate how small firms might prosper in a modernising economy. They argue that traditional firms might diffuse the products of the larger firms, large firms might contract with traditional firms to deal with fluctuations in demand and traditional firms might be better suited to certain tasks. They also show that cultural factors might generate strong social support for traditional enterprises, which incentivises governments to support the traditional sector through subsidies or trade protection for political gain. Rather than be left behind by large firms, traditional firms can exploit their role vis-à-vis the modern sector to innovate and expand.

The divided model can also capture geographical disparities in productivity, with less productive regions on the left-hand side and more productive on the right. This permits the exploration of territorial approaches to development, notably those originating from the district model outlined by Marshall, which focuses on the capacity of local areas to generate productivity gains endogenously (1879[34]). “Each man profits by the ideas of his neighbours: he is stimulated by contact with those who are interested in his own pursuit to make new experiments; and each successful invention, whether it be a new machine, a new process, or a new way of organizing the business is likely when once started to spread and to be improved upon”. Becattini (2017[35]) and Brusco (1982[36]) explain how small firms might expand under a Marshallian approach in which they co-operate with other small firms on product upgrading and innovation; as a result, they become competitive with large, vertically integrated firms.

Social capital allows traditional firms to organise themselves differently to large firms. Under a Marshallian logic, small firms can coexist with large firms based not on their efficiency or their market power but on the relationships they generate with other small firms, with large firms and with society as a whole. These relationships are based on trust and goodwill, cultural factors generated by repeated interactions and reciprocity that reduce transaction costs. As Lin and Nugent argue, transaction costs – including the direct costs of obtaining information, negotiating contracts and communicating with partners, and the indirect costs of monitoring these arrangements – play a key role in shaping institutions (1995[37]).

The decentralised, bottom-up approaches to industrial development outlined here contrast with the centralised top-down archetype of industrial policy. They build not only on the mutually advantageous relationships that small firms can foster both each other and with large firms but also on the cultural ties that embed smaller firms within a given community. This rootedness is a source of political power that firms can exploit to gain support from the economic institutions of the state. In this way, the gap Polanyi identified between the political and economic spheres is narrowed, allowing civil society greater influence.

These approaches involve each level of the stylised model in a dynamic set of interactions whose parameters are established partly by the market, partly by society and partly by the political system, in other words, a symbiosis of culture and institutions. As Marshall puts it, “the secrets of industry are in the air”, to be captured through “conviviality” and “face-to-face” interactions (1879[34]). The rise of teleworking during the COVID-19 pandemic might have implications in this regard.

Echoing Marshall’s argument, Andrews finds patents declined significantly in counties in the United States where prohibition laws passed from 1917-19 forced the closure of bars and other drinking establishments, an ountcome he attributes to a tendency for informal interactions outside the workplace to facilitate invention by encouraging collaboration and the sharing of ideas (2019[38]). The author finds that patent numbers in these counties recovered after three years as people reconfigured their social networks and that these new configurations were reflected in changes in the technological classes of the patents. Meanwhile, Box 4.2 explains how another facet of social capital – the “know-how” located within networks – can be just as important as knowledge.

Sen’s capabilities approach mentioned at the start of this chapter has an analogue in the development of firms. Capabilities in the context of firms can be defined as competences or process-related knowledge, “embodied in various collective, shared or aggregate forms of knowledge at the levels of enterprises, the labour force, economies and societies” that “define the feasible patterns and processes of productive transformation” (Nübler, 2014[39]).

Capabilities allow the use of, but are distinct from, productive capacities or endowments, such as capital, labour and infrastructure. Capabilities can be considered as the combination of options for productive transformation, given by the existing structure of the economy, and the competences that allow an economy or a firm to exercise an option and create new economic activities. Options and competences are complementary and both need to be developed simultaneously (Nübler, 2014[39]).

Delving deeper into the types of knowledge that constitute capabilities, it is important to distinguish between conceptual and procedural knowledge (also termed know-how or tacit knowledge). Conceptual knowledge can be considered as the understanding of principles and concepts, rules and models. Procedural knowledge refers to knowing how to do something in actuality. Although harder to articulate than conceptual knowledge, procedural knowledge is necessary at the individual, firm and economy level, and it takes on new forms at each level.

The complexity of creating and passing on procedural knowledge increases with the size of the group, as does the required amount of procedural knowledge. A sports team just needs to have the knowledge to perform as a team in a match. A firm must have the routines to organise itself (from top management to workforce) to produce a product and develop new products. A citizenry requires procedural knowledge for a vast array of interactions, from basics such as family and neighbourhood relations to politics and collaboration for common statehood.

Competences must be shared or mastered by a large proportion of the group or population to become fully effective. Trust in transactions is a good example. Only if a large majority of members of a society share a common conception of the roles and duties involved in a transaction (such as delivery of a product against the promise to pay in the future) can this transaction be undertaken. Where only a minority shares this trust, such transactions will be more difficult to undertake, as they would require establishing a common understanding of duties, as well as reliable, objective control mechanisms. The number of transactions possible would be limited in this setting.

The increasing complexity of creating and passing on competences as groups get larger increases the difficulty of copying or learning competences from other groups. In terms of practical policy advice, the knowledge and process concept of capabilities emphasises combinations of formal training, inviting advanced foreign firms to invest in a country in order to learn from their operations, and targeted programmes for building the necessary competences.

The state has a key role to play in these processes. Mapping a country’s economic capabilities alongside its endowments and industrial capacity, discussing a strategy with a broad array of stakeholders from public and private sectors in collaborative processes, and learning from the experiences of other countries are strong foundations for unleashing an economy’s potential to expand and diversify. This principle underpins the OECD’s Production Transformation Policy Review, which emphasises peer learning and consensus building as first steps in developing an industrial strategy, which in turn is the basis for an inclusive development strategy for society as a whole (Primi, 2016[40]).

In this example, a benign combination of institutional and cultural factors and policy choices can shift the red line leftwards to make the productive economy more inclusive. The example also demonstrates that it is not possible to move the line leftwards by applying pressure at a single point; rather, initiatives must push in a co-ordinated fashion along its length. From the perspective of the government, policies to promote the development of MSMEs must be aligned from the micro to the macro level, from exchange rates to local infrastructure, for example.

The model assumes that all individuals have full and equal access to the state insofar as they enjoy equal rights as regards voting and citizenship. This is represented by the pendulum pivoting at the bottom of the inner green triangle rather than the top. However, it does not imply equal access to public institutions or an adequate equitable provision of services, as the next section discusses.

The institutional trap: Improving tax morale and making schools work

The institutional trap is a key ingredient of today’s discontent. It is premised on the growing expectations of emerging middle classes, whose members aspire to a better life for themselves and their children and, as a result, demand better public services, in particular education and health. Middle-class status means that these individuals might be paying tax on their income for the first time and are thus even more sensitive to the quality of the services they are financing. If they are not satisfied, they lose the incentive to pay tax; lower tax revenues imply lower-quality services, and a vicious circle develops that can result in civil unrest.

Recent work on tax morale finds evidence of this vicious cycle in some countries but not others. The OECD shows tax morale to be higher in the OECD and Latin America than in Africa and Eastern Europe (2019[41]). However, the situation seems to be improving in Africa and deteriorating in Latin America. The proportion of people who strongly agreed that the government has the right to make people pay taxes rose sharply in Africa between 2005 and 2015: by the end of this period, only one-quarter of the population disagreed with this government right, although there is evidence that the upwards trajectory stalled or even reversed subsequently (Isbell and Olan’g, 2021[42]). In Latin America, the proportion of individuals who believed that it is justifiable to cheat on one’s taxes rose between 2011 and 2015; by the latter year, less than half of respondents thought that it was never justifiable to do so (OECD, 2019[41]).

The OECD identifies clear trends among the varying attitudes to taxation (2019[41]). More educated individuals view paying taxes more positively; women generally have higher tax morale (although not in Africa); older people are less likely to justify cheating on taxes; and people who claim a faith or religious identity are more in favour of paying taxes. Institutional factors also matter: individuals who believe that they are living in a meritocratic society have significantly higher tax morale, as do people who trust the government, support redistribution or consider democracy to be the best form of government. These results are complemented by the work of Andriani et al. on the cultural factors behind tax morale (2021[43]). Based on the evolution of tax morale in 48 countries over 30 years, they find that political inequality (what they term “power distance”) and a lack of transparency in government operations tend to interact with people’s deeply held values to reduce the likelihood of tax compliance.

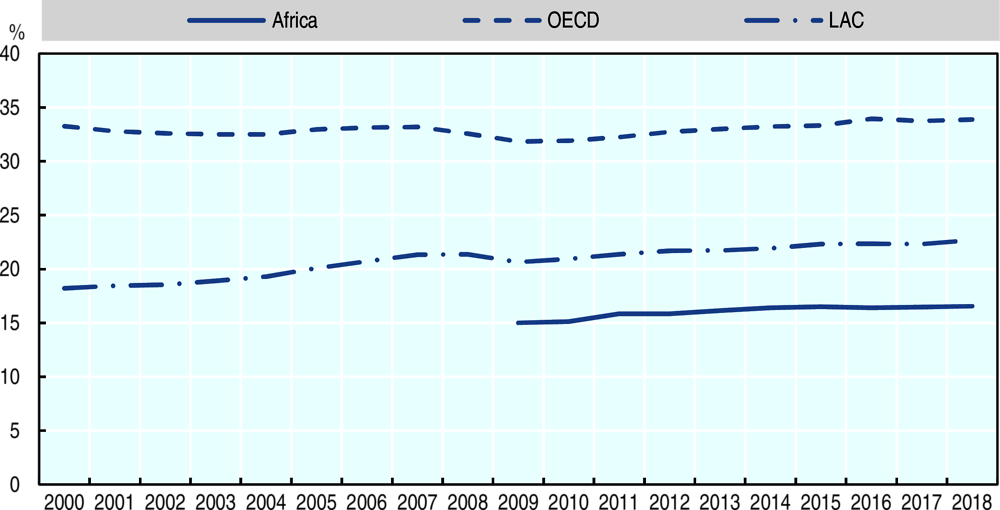

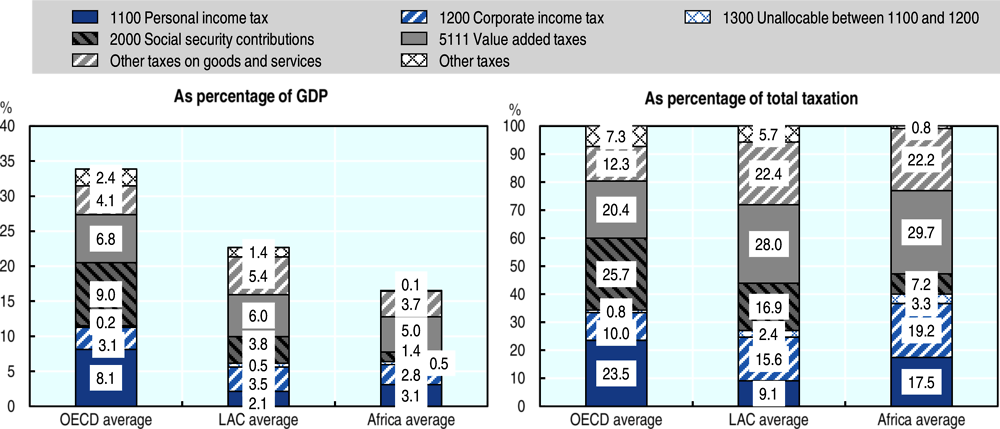

Developing countries can ill-afford weak tax compliance. Figure 4.4 demonstrates the financial constraints many developing countries face relative to OECD economies when attempting to satisfy the demands of a growing middle class. Harmonised tax data for more than 100 countries shows how much these revenues vary across countries and regions (OECD, 2021[44]). The average tax-to-gross domestic product (GDP) ratio for OECD economies in 2018 was 34.3%; in Latin America and the Caribbean (LAC), it was 23.1%, and in Africa, it was 16.5%. These averages mask significant within-region variation. LAC’s tax-to-GDP ratios ranged from 13.2% in Dominican Republic and Guatemala to 42.3% in Cuba. In Africa, they ranged from 6.3% in Equatorial Guinea and Nigeria to 32.4% in the Seychelles (OECD, AUC and ATAF, 2020[45]). A regional average for the Asia Pacific region is not available, but average tax-to-GDP ratios ranged from 11.9% in Indonesia to 35.4% in Nauru (OECD, 2020[46]). Over the period 2009-18, the gap between the Africa and LAC averages and the OECD average hardly narrowed.

These trends demonstrate the fiscal challenge facing governments in developing countries as they look to improve public services. Assuming that the majority of tax revenues (especially from taxes on income and profits) are generated by the productive part of the economy to the right of the red line in Figure 4.3, it follows that the smaller the right-hand triangle, the lower these revenues are likely to be and the less they can afford to spend on services for the wider population. Unless a country follows an inclusive development path – one that expands the tax base by increasing the number of firms and individuals operating in the productive part of the economy – the government might well lack the financing required to expand and improve public services at a rate that satisfies the population. This is compounded by the challenge of sustaining the quality of services while scaling them up: intuitively, it takes one or more generations of quality schooling to produce a nationwide supply of good teachers and doctors. Citizens’ expectations might not tolerate such a lag

Charting a way out of the institutional trap requires a deeper understanding – and harnessing – of the role secondary institutions can play in getting the most out of public spending, especially in constrained fiscal contexts. While tax morale partly reflects an individual’s attitude towards the state (in particular, whether they feel they are getting out of the fiscal system what they put in), improving tax morale and strengthening public services depends in large part on the intermediary institutions located between citizens and the state.

Middle-class taxpayers unhappy with the quality of their children’s education, for example, must choose between two courses of action when faced with poor public services: they can continue to use services while pushing for improvement or they can go to the private sector for their health and education needs. These two responses might have very different impacts on the long-term prospects of the service in question, as outlined by Hirschman, who characterises them as a choice between “exit” and “voice” (1972[47]). If the parents send their children to private school, this will do nothing to improve the quality of public provision; however, if they use their voice to express dissatisfaction with a school, they might achieve something. Assuming these are relatively well-off individuals who are likely to be endowed with significant social capital, both in the sense that they have the capacity to influence various groups and in terms of the tacit knowledge that they possess which might help the school to address some of the challenges it faces.

The question for the government is how to give voice to these parents. A parent-teacher association establishes a two-way dialogue between individuals and a public institution through which complaints can be aired and discussed. A governing board comprising parents and other members of the community can oversee a school’s performance. An education board or local department of education can liaise with these institutions to ensure higher-level involvement and, where necessary, remedial action. These are examples of bridging and linking social capital.

Two factors are important here: opportunities for voice and the power to effect change. Both are critical to the participatory approaches to public services that are increasingly recognised as prerequisite for their effectiveness. Rosanvallon argues that this trend reflects changes in the nature of democratic systems, where “the inability of electoral/representative politics to keep its promises (has) led to the development of indirect forms of democracy” (2008[48]). Citizens are represented (and are exercising) power beyond the ballot box through their capacity for oversight (surveillance), prevention (capacity to protest) and judgment (power to take the government to court). Through these mechanisms, civil society serves as custodian for public goods, ensuring both their quality and their broad accessibility.

The three dimensions of counter-democracy – and the institutions that underpin them – need to be operational simultaneously if governments are to be held to account. They also need to operate across the economic, social and environmental spheres to ensure a broad range of rights is protected. Voice without power is merely consultation, and where consultation does not lead to change, citizens are likely to lose interest in or even resent the process. Mechanisms by which citizens can provide feedback about the quality of public services are a more complex case: their voice is an important source of accountability for public officials and has the power to improve public services, but it positions citizens as consumers of public services rather than giving them an active role in improving matters. On the other hand, participatory budgeting has the potential to improve public services and institutionalises the power of citizens (Box 4.3).

Without the power to effect change, it is unlikely the parents in this example will keep their children in the public system unless compelled to do so. This compulsion might take two forms. The first is societal: it might be culturally frowned upon to opt out of public schools because it is incumbent on everyone to support the system. These cultural factors exercise great influence over people’s behaviour, and (although not discussed here) they are closely linked to social capital. The second mechanism is to exclude rival service providers. This is not easy to do in a market economy but can nonetheless be critical to the sustainability of a public system. Many health systems, for example, have clear rules about which services can be provided by the private and public sectors. Security is another example where this might be necessary: if private security services expand beyond a certain degree, the state no longer has a monopoly on law and order provision or even the use of violence.

Keeping these parents engaged with the school and empowering them to improve its performance has the potential to create a virtuous circle. Not only do they continue to attend and continue to pay taxes because of this improvement, but other parents are more likely to do so as well. The resultant increase in revenues allows further improvements in quality, alleviating the discontent that poor public services often generate. All the while, children at the school receive better teaching and emerge as more productive members of society.

This has the potential to move the red line to the left but, as mentioned above, only if it is accompanied by other interventions higher up. No matter how well-taught children might be, if there is no chance of them finding productive employment once they leave school, the economic returns on education will be minimal and the incentive to enrol children similarly low. In this way, escaping the institutional trap is conditional on progress in escaping the productivity trap.

The institutional trap can compound the productivity trap. Where economic activity is relatively concentrated and the government is thus reliant on a relatively small number of firms to finance public services, these firms enjoy significant bargaining power which they can use to lobby against attempts to regulate or diversify the economy. At the very least, this influence can generate a degree of risk aversion in governments; at worst, it can prompt governments to introduce policies that empower incumbents and increase barriers to entry.

This examination of the institutional trap prompts two final points about the purpose of education that are germane for this report. First, education is a key route to freedom at an individual level, provided that it challenges structural power dynamics (Freire, 1970[49]); at a societal level, it can serve as a mechanism for generating what Unger calls a “social imagination” to craft alternative visions of the future beyond prevailing, unsustainable models (2009[50]). Both Freire and Unger recognise the importance of education in encouraging critical thought, problem solving, co-operation and dialogue rather than a top-down flow of information if education is to achieve its transformational potential. Second (and relatedly), education has the capacity to inculcate a sense of civic responsibility that has the potential not only to enhance social cohesion but also to generate the level of citizen engagement essential for the more participatory approaches to democracy discussed in this chapter (OECD, 2017[51]).

Ho perduto la possibilità di vedere l'alto Sole...non per ciò che ho fatto, ma per ciò che non ho fatto. (Dante Alighieri, 1472[52])

Participatory processes aspire to “democratise democracy” (Pateman, 2012[53]). They are a continuous project by which individuals can participate in decision making in their daily lives and interact with authority structures in a way that reflects their individual capacities and characteristics. Individuals learn to participate over time and shape processes accordingly, while authority structures adapt to accommodate these processes. They provide opportunities for citizens to express their voice, empower communities to improve lives and transform public institutions, and generate trust between communities and institutions.

The most successful example of participatory democracy is participatory budgeting, a mechanism that first emerged in the Brazilian city of Porto Alegre in 1988 (shortly after the restoration of democracy in Brazil) and subsequently spread throughout the country, across Latin America and then globally. Today, it is an increasingly common component of democratic life in advanced economies. However, there is wide variation in how participatory budgeting is practised; in many cases, it falls far short of the goal of democratising democracy and becomes an exercise in consultation or deliberation that involves no transfer of power.

The Porto Alegre model has three layers (Group, 2008[54]). At its foundation are two sets of neighbourhood assemblies set up across the city in which all citizens are able to participate. In one set, citizens debate and vote on budget priorities and elect representatives to the layers higher-up. In the other “thematic” assemblies, citizens discuss citywide policies, such as health, education or transport.

The second layer consists of Regional Budget Forums and Thematic Budget Forums for each of the city’s 16 districts, where elected representatives discuss the investment priorities identified by the neighbourhood assemblies in the presence of citizens wishing to attend. These forums each choose two councillors to participate in the Municipal Budget Council, which decides how to allocate the city’s annual investment budget, monitors implementation of these decisions and makes decisions around the subsequent year’s process.

According to the World Bank, some 20% of Porto Alegre’s population have participated in the budget process (2008[54]). A large proportion of participants in the assemblies are in poverty (although the extreme poor have found it difficult to participate), and these individuals account for a significant proportion of the representatives elected to higher levels. Indigenous groups that are otherwise marginalised from political processes also participate. Women have been active participants and (after disappointing results initially) now account for a proportionate number of elected representatives, although women with caregiving responsibilities are under-represented.

Participatory budgeting is equalising in two critical dimensions: in addition to distributing power across citizens, it also redistributes resources. In Porto Alegre and other Brazilian cities, participatory budgeting has been shown to direct funding to poor regions and to projects that communities in these areas expect to be most transformative (Marquetti, Schonerwald da Silva and Campbell, 2012[55]). The practice has been found to improve living standards over a range of dimensions in the short and medium term, reducing poverty and improving access to potable water and sanitation.

Cabannes finds that participatory budgeting globally is associated with significant improvements in public service provision, with increased community involvement enhancing the implementation and maintenance of investment projects, thus making them more cost effective (2015[56]). The study also suggests that participatory budgeting increases municipal revenues by making citizens more likely to pay taxes, and finds that participatory processes also generate additional “off-budget” resources through unpaid work by communities and co-contributions by local enterprises. The emancipatory impact of participatory budgeting is harder to quantify but could nonetheless be an integral part of the social change that the practice has been shown to generate (Célérier and Cuenca Botey, 2015[57]).

As noted above, certain characteristics are necessary for participatory budget processes to be transformative rather than entrench pre-existing structures or political dynamics. Involvement should be a right, universally accessible to all citizens. The resources over which these processes have discretion should be large enough to achieve visible change in local communities and in citizens’ power to allocate these resources meaningful. Mechanisms must be allowed to evolve in ways not controlled by the central authority. Where there is no meaningful transmission of power to citizens, participatory processes might improve transparency and make local administrations more accountable, but they are unlikely to reduce inequalities (Herzberg, Sintomer and Allegretti, 2013[58]).

The world-wide diffusion of participatory budgeting shows that the practice is not reliant on a specific political system or particular political orientation. The approach is increasingly common in the People’s Republic of China and South Korea, while the Indian state of Kerala was one of the first adopters in Asia in the mid-1990s. In Africa, participatory budgeting is most widespread in francophone West Africa, particularly Burkina Faso, Cameroon (which received extensive support from Brazilian and international non-governmental organisations) and Senegal. It has achieved less traction in other parts of Africa for a number of reasons, including the limited resources available in municipal budgets, entrenched power structures, weak capacity among citizens to engage and, in some cases, state- or local-level fragility (Herzberg, Sintomer and Allegretti, 2013[58]).

Pateman takes a mixed view of the spread of participatory budgeting around the world and the local variants that have emerged, finding evidence of “an expansion of participation and an extension of citizenship, but not the beginnings of democratization and the creation of a participatory society” (2012[53]). Yet to say that the practice has, in many places, fallen short of its transformative ideal risks overlooking the fact that it is a relatively recent innovation. It is not unreasonable to hope that a sustained impulse for civic engagement, combined with experience in implementation and evidence of impact, will intensify support for participatory budgeting and make it work better. Refinements will generate greater trust, and technological advances might make participation easier, ultimately engendering a culture of participation among citizens and public institutions alike.

The social vulnerability trap: The case for universal social protection

The social vulnerability trap articulates the reality of citizens who are classified as middle class in terms of their income but whose status is fragile. Individuals caught in the social vulnerability trap are typically in informal, low-quality, low-paying jobs without social protection coverage. They find it difficult to accumulate the savings required to invest either in themselves (through further training) or in an enterprise and are highly susceptible to income shocks, which can push them back into poverty. Their mobility is limited; although they might change jobs relatively often, they will usually move from one informal job to another. These citizens have been hit especially hard by the COVID-19 pandemic. This vulnerable population is located along the bottom of the left-hand triangle of this chapter’s stylised model but is unlikely to be at the far left, where individuals who remain in poverty are located.

This chapter explores the social vulnerability trap through the lens of social protection – the broad set of policies and programmes designed to alleviate poverty and protect individuals and their households from risks over the entire course of their life. As of May 2021, 222 countries and territories had scaled up social protection provision in response to the COVID-19 pandemic, underlining its importance as an economic and social stabiliser in times of crisis (Gentilini et al., 2021[59]). Social protection also has a key role to play in helping countries to recover from the pandemic in the short term and to build back better in the long term. Consistent with the approaches to the other development traps outlined in this chapter, enhancing social protection simultaneously achieves better outcomes for individuals while also strengthening social cohesion and reinforcing the social contract.

Demonstrating the importance of social protection to social cohesion, Alik-Lagrange et al. explain that social protection affect relations between society and the state through three channels: the redistributive, the contractual and the reconstitutive (2021[60]). The redistributive channel captures what governments provide to citizens, the contractual channel reflects what citizens expect from the government and how they perceive the state’s authority, and the reconstitutive channel captures how states and citizens see themselves and each other. The authors explain how these channels are affected by the design of social protection programmes as well as by their financing modalities, and they emphasise that the interactions between programme and context have a significant impact on an intervention’s effectiveness.

Social protection not only provides the income support required to get people out of or stop them falling into poverty; it is also a critical means of enhancing social inclusion and social cohesion. As Babajanian and Hagen-Zanker explain, social protection establishes legal rights for citizens, can improve human capabilities or human capital, and can enable poor and vulnerable people to strengthen their assets, all of which promote their inclusion in different facets of daily life (2012[61]). In the case of social cohesion, Babajanian argues that social protection can “improve intergroup solidarity, tackle discrimination and stigma, reduce or prevent social conflicts, and achieve greater stability” (2012[62]).

De Milliano et al. demonstrate how these positive impacts of social protection come together Ghana’s Livelihood Empowerment Against Poverty (LEAP) 1000, a cash transfer programme for pregnant women and mothers of young children living in poverty (2021[63]). The authors find that women participating in LEAP 1000 were more likely to receive social support than a control group and no less likely to receive financial support. Moreover, the study finds that LEAP 1000 beneficiaries were more likely to participate in community groups and that their access to financial markets, such as borrowing money or contributing to local savings schemes, had improved. These findings rebut the theory that social protection programmes weaken social support networks by “crowding out” the informal support of friends and neighbours; rather, the authors find evidence that social protection “crowds in” community support.

The COVID-19 pandemic has demonstrated the importance of universal provision of social protection, as articulated by Sustainable Development Goal 1.3. However, as Chapter 1 shows, that less than 50% of the world’s population has access to one social protection programme, with coverage in Africa, the Arab States and Asia Pacific typically far below this level. Coverage among vulnerable middle-class members (especially those of working age) on whom this chapter focuses is often particularly low: because they are not considered to be among the extreme poor and typically do not fall within a vulnerable group (such as the elderly or people with disabilities), they are unlikely to be eligible for a tax-financed social assistance programme. At the same time, their informal status and irregular income means that they are unlikely to be covered by a social insurance arrangement. They therefore form part of what can be termed the “missing middle” of social protection coverage.

Viewed in narrow, technical terms, the missing middle phenomenon is an intractable problem. Governments in developing countries typically generate a much lower level of tax revenues than advanced economies and thus, it is assumed, are unable to expand social assistance. Meanwhile, efforts to expand social insurance arrangements to workers on low and irregular salaries raise concerns that contributions will increase the cost of labour and thus undermine efforts to increase formalisation in the economy (OECD/IDB/CIAT, 2016[64]). Various options have been attempted to combine social assistance and social insurance through partial public subsidies (which translate into lower contribution or tax rates). These have had limited success in increasing coverage, for example in the case of combined contributions in Latin American pension systems (Bosch, Melguizo and Pagés, 2013[65]). In other cases, the subsidies have cost the fiscus more than expected, as is the case with Indonesia’s Jaminan Kesehatan Nasional health insurance scheme, which has nonetheless achieved rapid success in improving coverage across the informal economy and moving towards universal health coverage more broadly (OECD, 2019[66]).

Informality is the common denominator in the missing middle problem. It is a constraint to social insurance coverage (which is typically predicated on formal labour relations) and it restricts the size of the tax base, thereby limiting the potential for domestic resource mobilisation that can finance non-contributory social assistance. It is not just the lack of visibility of the informal labour force that constrains policies to expand social protection to this group; its heterogeneity is also a major challenge. For example, not all workers in the informal economy have low and irregular incomes; they are often able to contribute something. They are often in some form of regular employment relationship (as part of a formal enterprise’s supply chain, for example), and there is therefore an employer who could contribute to their income security. Moreover, an informal worker might still be covered by social insurance through a member of their household. Better understanding these specificities is an important first step towards understanding the social realities of informality (OECD/ILO, 2019[67]).

A universal approach to social protection is the best and only solution to the missing middle problem and to the social vulnerability trap more broadly. As explained by Packard et al., social protection systems that are not adapted to high levels of informality in developing countries or to the changing nature of work in advanced economies render vulnerable a large portion of the workforce and greatly constrain risk-sharing across the population (2019[68]). The authors call for a major expansion of social assistance beyond poverty targeting (moving coverage ‘up’ the income distribution) to protect vulnerable workers from falling into poverty when large-scale risks materialise. This should be co-ordinated with an expansion of social insurance arrangements ‘down’ the income distribution that shares risk and financing responsibilities fairly between individuals, employers (where a labour relationship exists) and the state. At the same time, expansion of well-regulated and flexible voluntary savings and insurance arrangements for workers at all income levels would respond to the fluidity and diversity of people’s employment activities, as well as the associated income variability (Packard et al., 2019[68]).

The push for universal social protection in developing countries must overcome certain preconceptions. The first is that a country’s income level determines whether it can scale up social protection. European countries introduced universal social pensions at an early stage of their development, when their per capita incomes were equivalent to the level in Latin America in the 1980s and 1990s, and tax revenues as a percentage of GDP were far lower than they are today. South Korea committed to universal health coverage at an early point in its economic development. As Mkandawire states, “[social] policies have served not only as an instrument of development, but also as a guarantee that the development process will ensure, contemporaneously, the wide range of ‘ends’ of development and nation-building” (2005[69]). This process can also work in reverse: Kyrgyzstan has sustained universal pension coverage since the collapse of the Soviet Union, despite a massive economic contraction (OECD, 2018[70]).

The second preconception is that the Global South has always been playing catch up on social protection towards an idealised vision of the European-style welfare state. In fact, as Wehr, Leubolt and Schaffar point out, “a considerable number of states in the Global South, especially in parts of Asia and Latin America, developed modern welfare state policies and structures at the same time or even earlier than most of the European countries” (2015[71]). In developing countries across Africa, Asia and Latin America, especially those that pursued import substitution policies, social security was an important part of the social contract and the project of state building, albeit one that benefited a relatively small constituency that tended to be urban, middle class and politically powerful (Mesa-Lago, 1978[72]), (OECD, 2020[73]). Oscillations between authoritarianism and democracy also played their part, as “welfare state policies were used to alleviate the tensions brought about by (dependent) capitalist development and the growing demands of democratic inclusion and participation” (Wehr, Leubolt and Schaffar, 2015[71]).

The third preconception is that developing countries are obliged to channel scarce resources to those most in need. This targeted approach creates a stratified system whereby coverage for formal-sector workers is universal while those outside the formal sector have low coverage and inadequate benefit levels. In reality, universalism was the guiding principle of welfare policies in developing and advanced economies alike in the 1960s and 1970s, but “since the 1980s, the balance has radically tilted in favour of targeting” in both sets of countries (Mkandawire, 2005[69]). In the case of developing countries, the debt crises of the 1980s and 1990s, and the structural adjustment policies imposed subsequently, cemented this ideological shift. It should be noted, however, that many developing countries have retained universal subsidies for staple goods, in particular food and fuel; attempts to remove these subsidies can lead to unrest (Box 4.4).

Proponents of targeting point to the efficiency – and fairness – of directing benefits to individuals who need them most. This argument appears all the more compelling in countries that generate low fiscal revenues or where inequality is high. However, such arguments disregard the challenges inherent to targeting: people move in and out of poverty (especially in urban areas), the poorest people are often those that governments find it hardest to reach, income-based measures of poverty are unreliable, and multi-dimensional indicators are complicated to administer without necessarily generating better results (Brown, Ravallion and van de Walle, 2016[74]).

Targeting also risks undoing the potential gains to social inclusion and social cohesion. Identifying a group as sufficiently poor to warrant government handouts might result in their being resented or stigmatised. Gassmann, Martorano and Waidler show that receipt of social targeted assistance benefits in Kyrgyzstan is associated with lower levels of subjective well-being among young people, who have grown up in a market economy, but not among older citizens, who recall universal social protection provision under Soviet rule (2021[75]). Targeting can also generate divisions between recipients and non-recipients that result in tensions between groups and diminish social capital (Adato, 2000[76]). Community-based approaches can address concerns related to the accuracy of targeting (McCord, 2013[77]); however, as Endris et al. show in the case of Ethiopia, securing the legitimacy of a targeted programme requires embedding it in broader sets of community arrangements (2020[78]). Meanwhile, effective grievance and accountability mechanisms are essential for improving performance and safeguarding the relationship between the state and society (Alik-Lagrange et al., 2021[60]).

Applying conditionalities (such as school attendance or visiting medical facilities) to receipt of social assistance benefits is another mechanism for enhancing the impact of social assistance that has a mixed record, including in terms of strengthening social cohesion and relations between society and the state. Alik-Lagrange et al argue that much depends on programme design, emphasising the importance of aligning conditionalities to people’s rights and expectations, ensuring these conditions are feasible (the services must be accessible in the first place, for example) and that recipients are not punished for non-compliance (2021[60]).

The importance of the latter point is borne out by Heinrich and Knowles, who show that the behaviour of recipients of the Kenya Cash Transfer Programme for Orphans and Vulnerable Children was the same whether benefit receipt was conditional or beneficiaries were simply informed of the desired outcomes but compliance was not monitored (2020[79]). Indeed, the authors showed the punitive conditionalities produced undesirable and regressive outcomes. It is also often the case that the task of adhering to conditionalities falls upon women, thereby reinforcing gender inequalities (Jones and Holmes, 2011[80]).

The cost of universal social protection means it is a long-term objective, especially for low-income countries, which often have large gaps in social protection provision. The COVID-19 pandemic has increased this cost through its impact on incomes and employment. Durán Valverde et al. calculate that developing countries would need to spend an additional 3.8% of GDP per year on average to close the financing gap for the establishment of social protection floors (including health protection) (2020[81]). For upper-middle-income countries, this cost falls to 3.1% of their GDP; for low-income countries, it rises to 15.9% of their GDP – the sum total of their tax revenues as calculated by Akitoby et al (2019[82]).

For developing countries, increasing financing for social protection is inseparable from the broader objective of domestic resource mobilisation. Scaling up social insurance has an obvious role to play in this regard, in spite of the complexities. For low-income countries, however, external support is indispensable, even though this confronts the challenge of social legitimacy: as Devereux and White find, “programmes that emerge out of domestic political agendas and respond to local conceptualisations and prioritisations of need are more likely to “succeed” in terms of their coverage, fiscal sustainability, political institutionalisation and impacts” (2007[83]).

For most developing countries, establishing universal protection systems will take time. A social protection strategy that takes account of the needs of the population today and into the future is essential; so too is a corresponding financing strategy that demonstrates how to sustainably scale up social protection while also promoting shock responsiveness (OECD, 2018[84]). To ensure that the resultant social protection system not only reduces vulnerability but also strengthens social cohesion and reinforces the social contract, both exercises should be based on social dialogues with an array of actors in government, business and civil society (ILO, 2021[85]).

By including the voices of vulnerable members of society, such processes generate a broad-based consensus around the design of social protection systems and individual programmes that strengthens their legitimacy. They also reinforce social protection’s capacity to empower individuals and communities as a means of reducing inequality ex ante. As Lothian and Unger argue, “[the] most important form of redistribution is not retrospective and compensatory redistribution through tax-and-transfer; it is the reshaping of economic and educational arrangements to broaden opportunity and enhance capabilities” (2012[86]).

While most developing countries lack universal social protection programmes, many subsidise the cost of basic goods, particularly food and fuel, for the population as a whole. They do so either by controlling the price through government procurement processes or by exempting these products from taxation. These subsidies can become extremely costly for the fiscus when the price of these products rises, as happened in 2008-09 (IMF, 2008[87]). They can also encourage overconsumption of certain products that runs against the environmental priorities of the government. However, as Chapter 2 notes, policies to remove or scale back these subsidies are often a cause of large-scale popular unrest. With a particular focus on fuel subsidies, the stylised model helps explain why.