copy the linklink copied!Czech Republic

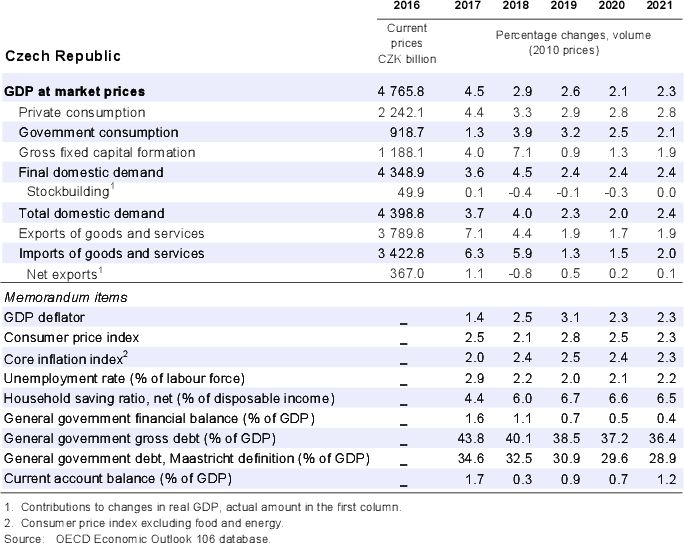

Economic growth is projected to ease to 2–2¼ per cent in 2020-21. Household consumption and government spending will drive growth. Workers will still benefit from high wage growth, while unemployment will remain low. However, the external sector will limit growth as economic activity in the main trading partners is slowing, which will also lead to declining investment growth.

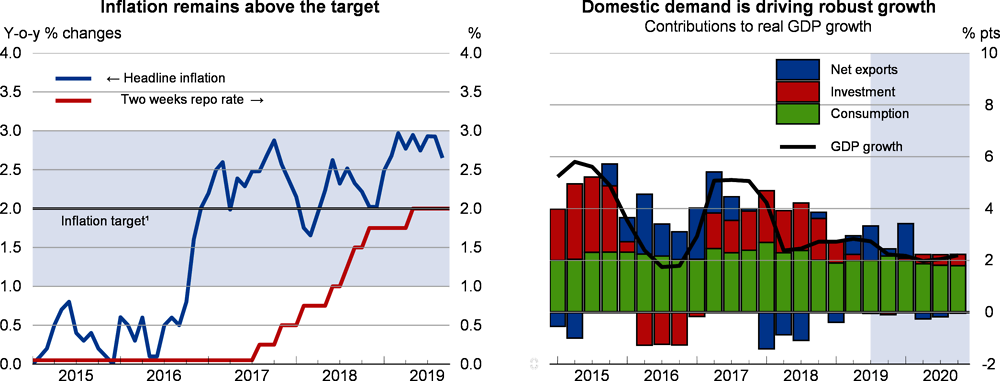

Adjusting monetary policy should continue in 2020 and 2021 as inflation is projected to stay above the 2% target of the central bank. Government spending is increasing, in particular social benefits, thanks to rising revenues. Even so, public debt will continue to decrease. Labour shortages remain the main domestic bottleneck to growth. Accelerating childcare reform to increase women's participation in the labour market and streamlined immigration procedures would help to ease tensions in the labour market.

Robust growth is driven by domestic demand

Government spending and household consumption are driving domestic demand, which is the main engine of growth. The government is increasing spending on social policies while workers are still benefitting from high wage growth fuelled by the very low level of unemployment. The investment rate has fallen sharply this year after the extensive use of EU structural funds last year. It has also declined on the back of the ongoing slowdown in neighbouring countries. Industrial production and new orders have started to decline, indicating the impact of the slowdown in Europe. Exports are declining but less than imports, reflecting a greater diversification of the economy and some upgrading into global value chains.

Policies need to address labour shortages

Inflation is stalling above the 2% target of the central bank though it remains within the tolerance band. Food, energy and services prices are driving inflation while import prices are lower than expected. Currency appreciation is also holding down inflation. As relatively high inflationary pressures are projected to persist and high wage growth set to continue, the central bank will need to further adjust monetary policy to economic conditions, while taking into account euro area monetary policy.

The fiscal stance is mildly expansionary. Government spending is increasing at a rapid pace, leading to a sharp reduction in the government surplus. Spending on health, pensions and disability benefits is on the rise. Social transfers to families with children are increasing. In addition, a paternity leave policy has been introduced. However, policies are still needed to address labour shortages, which is the main domestic bottleneck to growth. Moreover, better planning of the use of EU funds for infrastructure would attenuate the volatility of investment and improve the quality of implementation of infrastructure projects.

The labour market is shifting towards higher-skilled employment. The service sector has expanded and manufacturing has become tightly integrated into global value chains, leading to employment shifting from medium-skilled to higher-skilled jobs. Providing workers with the right skill-set and training to adapt to a changing environment would increase their resilience to automation. More developed vocational training and childcare facilities could help reduce the skill mismatch and augment women’s labour supply.

Robust growth is projected to continue

Growth is projected to remain above 2% over the projection period, driven by household and government spending. Unemployment will remain low, contributing to persistent high growth of wages. The slowdown in neighbouring countries will weigh on export growth.

Risks to inflation are substantial and slightly tilted to the upside. A weaker-than-assumed koruna exchange rate would result in higher inflation and interest rates. However, an unexpected appreciation would imply decreases in imported prices that should help maintain inflation on track. Given its high participation in global value chains, the Czech economy is highly exposed to trade protectionist measures and uncertainties surrounding Brexit.

Metadata, Legal and Rights

https://doi.org/10.1787/9b89401b-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.